Endgame.

A heavy week of central bank activity; analysing the FOMC meeting and implications on markets & FX.

Hey guys,

You guessed it.

Workflow playlist rolling in the back.

Deep in thought as I review what has not only been an intense year thus far with the launch of the Four Foundations of Macro FX but also the launch of MMH Pro.

I want to say a huge thank you to all MMH Pro subscribers for the interaction in Discord and support, I want to extend thanks to all free MMH subscribers as well for your readership.

It makes my work fulfilling. Believe me.

Anyways, FOMC was on Wednesday, and there are some fine details I’m going to uncover for you.

As always, lend me your attention:

The Beginning of The End

Attention to detail.

That’s a lesson which forever keeps me up at night looking into the granular.

The Fed hiked rates to 5.25% Wednesday evening.

When looking beneath the surface, you would have realised that the Fed removed an important statement from their May press release.

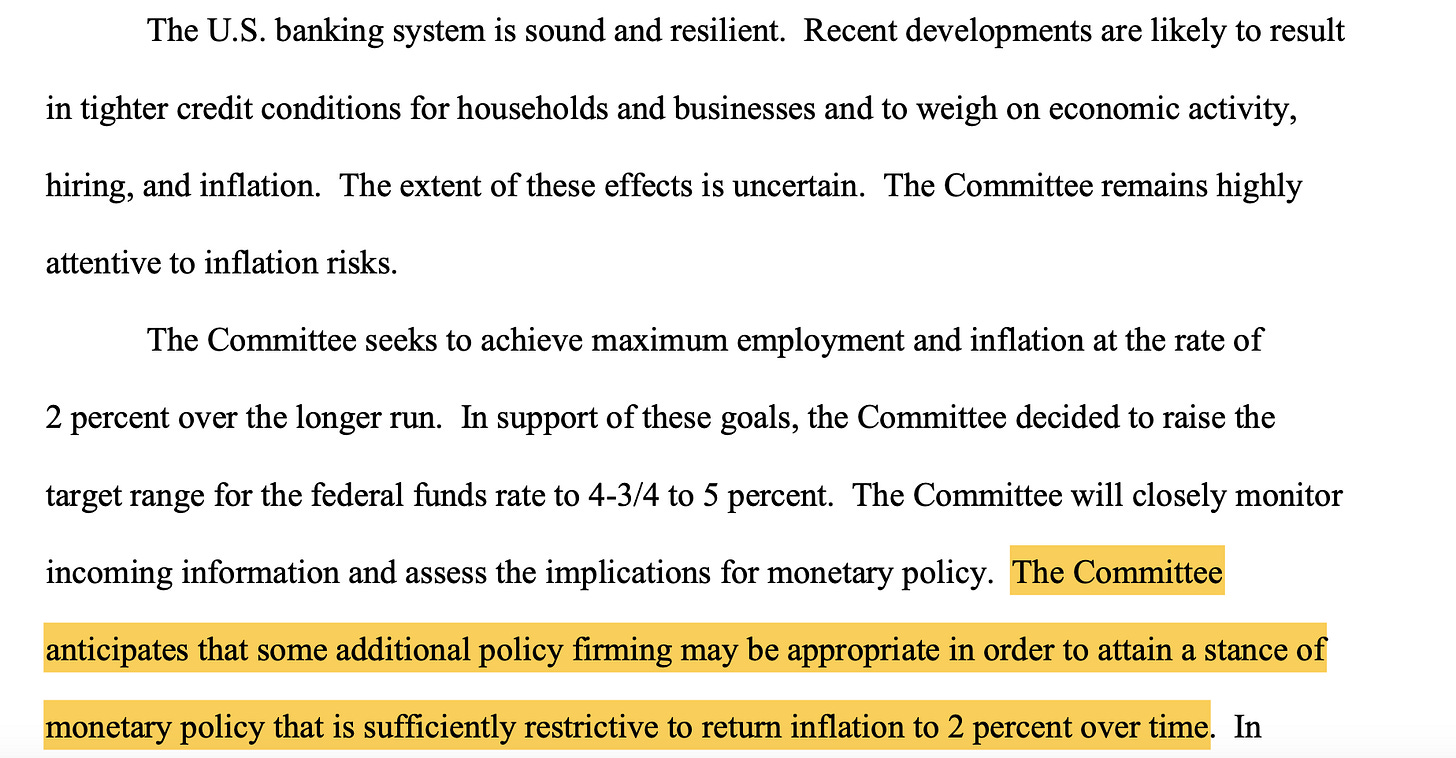

This was taken from the March press release

Vs the dovish and soft language from Wednesday below:

One sentence. That’s all the confirmation we needed to confirm a pause for the Fed and for this to be what I expect to be the last hike of this tightening cycle that we have been on since March 2022.

I’ll dive into what this means for markets with a focus on FX, but before I do it’s important to look at why Jay Powell is confident that this is the appropriate time to hold rates. What alarm bells are ringing within the US economy right now?

The Banking Crisis

CRE loan defaults (commercial real estate)

Credit & liquidity tightening

We’ll start with point number 1. I recently watched an interview with Nick Timiraos, Chief Economist at The Wall St Journal, also known as the “Fed Whisperer” and he said that the SVB collapse could be viewed in a similar light as an earthquake. And that comment makes so much sense, the below line chart will provide some clarity.

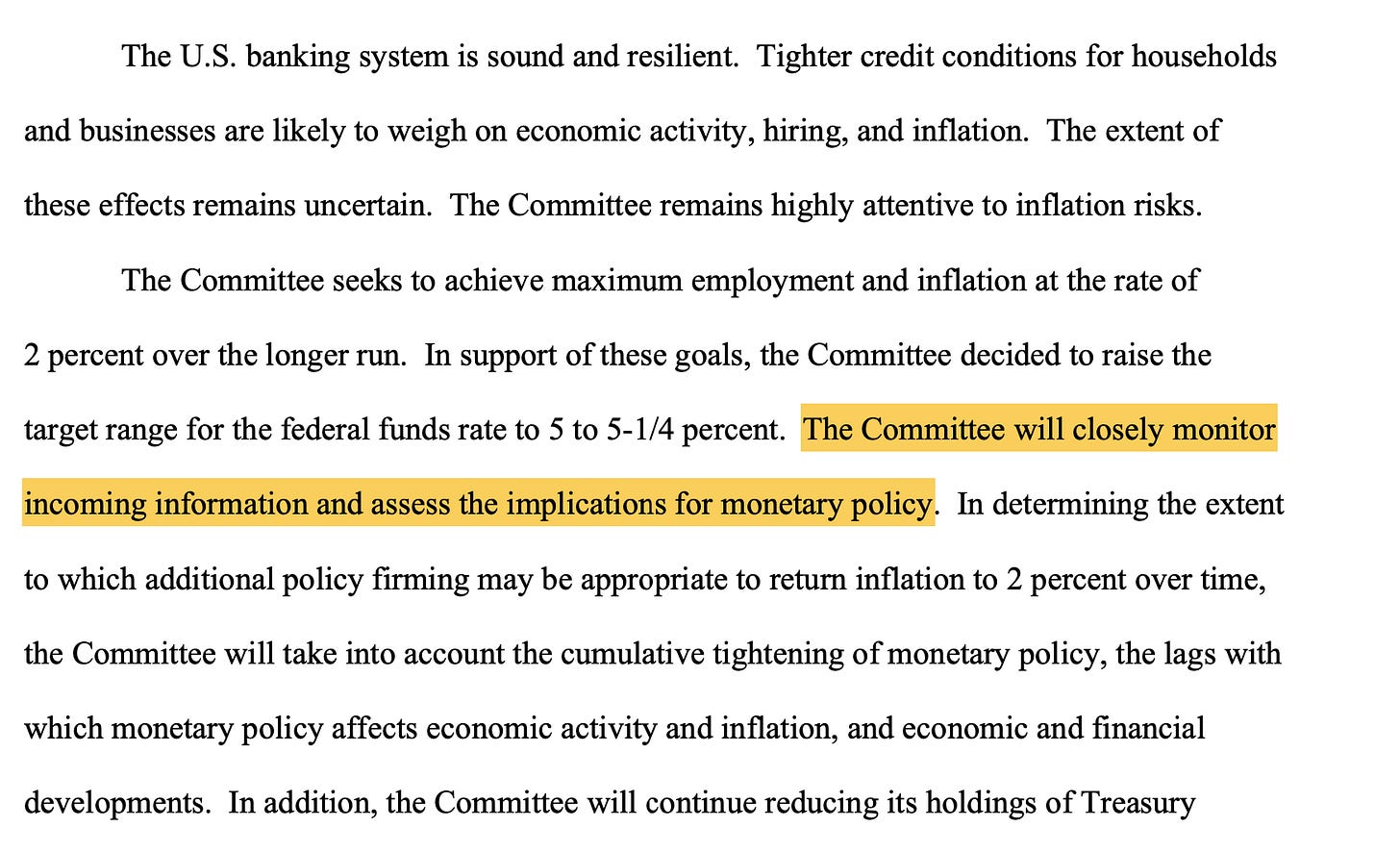

The OFR financial stress index is a daily snapshot of stress within U.S financial markets. Variables like yield spreads, interest rates, credit, and funding all compromise to make this visual chart.

This index looks at systematic financial stress, anything that may disrupt the normal functioning of financial markets such as C-19, the GFC in 2007, and of course the dot-com crisis in 2001. Now you can see that leading up to the Fed’s hiking cycle in March 2022, the financial stress index rose to just below 2.5 and remained elevated up until October 2022 when financial conditions in the U.S but also globally weakened due to a multitude of reasons such as the UK gilt market crash, U.S bond volatility dropping and towards December, hints of a China re-opening.

The current macro climate where rates are 5.25%, with many banks still holding onto uncrystallised bond losses, poses a contagion risk which could result in more banks collapsing and rushing to raise capital just like Pacific West, a California-based bank focused on providing business banking and treasury management to SME’s, recently done.

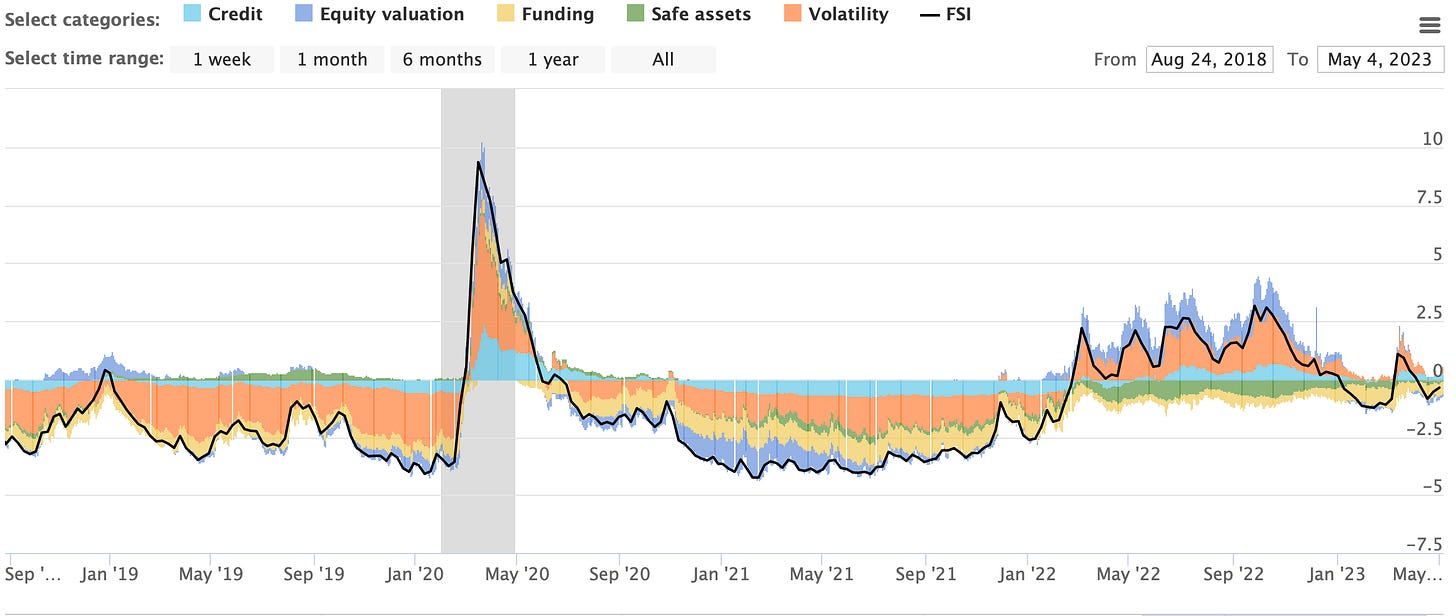

Even after securing a $1.4b asset-backed financing facility in March this year, shares of this bank trading -79.52% YTD.

I review the current turmoil the U.S is in with CRE loan defaults rising in March here:

So for the sake of not repeating myself add this to your reading list this weekend! To show you how interconnected markets are, especially the scenario the U.S currently faces listen to this, the banks that issue CRE loans are smaller banks such as your SVBs, Pacific West Bank and FRBs, roughly 43% of the total loan book of these smaller banks were made up of CRE loans. Refinancing these loans in such a high-rate environment rings alarm bells, especially when these banks were issuing dirt-cheap CRE interest loans.

As a result of high rates, moments of increased bond volatility seen in March, persistent inflation and recession worries lingering as we move towards what I believe is phase 4 of the business and market cycle, being a recessionary environment, credit thinning alongside liquidity is a second order effect which can only be reversed by an influx of M2 (money supply) through QE or Fed cutting. Neither of these is happening this year.

One positive chart.

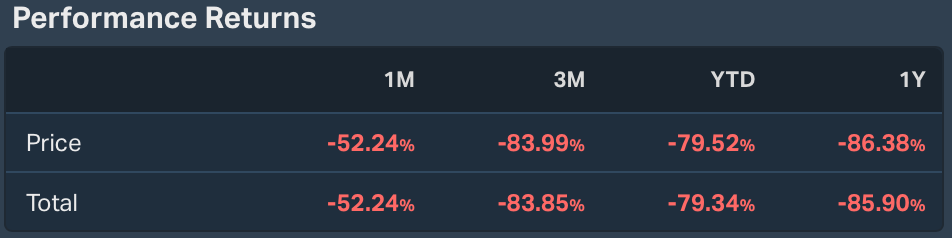

If there’s one solid reason, Jay Powell is in the right to pause here it’s this chart right here. History shows, when looking back at the GFC crisis of 2007 that the Fed have to hike interest rates above the level of core inflation, in order to successfully see inflation return to 2%. As we can see Core CPI is in a sharp decline, with many expectations calling for inflation to fall below the 5% region in the near term giving the Fed more time to observe the economy.

So for the reasons listed above, that’s enough conviction for Jay Powell to hold rates, tight enough to see inflation return to 2% but also tight enough to cause more pain in rate-sensitive sectors.

The Dollar & US 2yr

As it stands, the dollar is just above a pivotal price point of 100.820, from a macro perspective, all conviction lines up for a short mid to long term, I’m personally leaning towards a soft dollar throughout Q2.

The 2y and the dollar have a strong positive correlation, if you didn’t know, government yields like the 2s and the 10s (US10y) impact the strength of the USD, when yields rise expect to see the dollar follow through, as the yield on a government bond is an indication of where investors expect interest rates to be in 2 or 10years.

As of right now, the 2y dropped below the analysis I shared with you on the 21st of April

Vs today

With NFP numbers coming out extremely bullish for the U.S economy the 2y has risen sharply in anticipation that rates may have to be higher or held longer at the current rate with such tightness in the labour market making it hard to argue to cut.

Remember, right now the labour wages are the stickiest part of the Core CPI and PCE readings, so average hourly earnings increasing 4.4% YoY adds another difficult complex to the already complicated inflation tale.

That’s enough for today, I hope you enjoyed this piece!

That’s one way to end the week.

Hot NFP data doesn’t get much better!

I’m back with you guys next week— so be on the lookout