Emerging Market Currencies in Focus & China's Most Recent Stimulus

Diving Into the Opportunities Inside Emerging Market Currencies and New Emphasis on China's Stimulus

Hey guys

We have now made all paid reports available to everyone, so check out our Substack home page to find all the reports you were missing out on!

For the guys who paid, you had access to the real-time data we were releasing at that point, so please don’t feel hard done by.

Joe, who has now signed on to a multi-billion pound L/S Equity Hedge Fund, was the predominant writer of those reports, so please give credit to him for all the value you find inside!

Let’s get into this week’s report.

Macro watch

China is back in the spotlight, for good reasons this time.

The highly anticipated stimulus package has now been put into place by Governor Pan Gongsheng. The measures from the People’s Bank of China aim to stimulate their stagnating economic environment. The move comes after a series of disappointing data has increased expectations in recent months that the world's second largest economy will miss its own 5% growth target this year.

There is multiple parts of the stimulus package:

The reserve-repo (RRR) has been cut by 50bp, freeing up around 1 trillion Yuan. There are also signals that the RRR may be cut further by the end of the year.

Mortgage rate cuts for existing loans will be put into place, averaging c.50bp ($5.3trn) cut on those loans.

Lowering minimum down payments on all types of homes to 15%, which will aid China’s crisis-hit property market.

A swap programme sized at an initial 500 billion Yuan, allowing institutional investors to tap central bank financing for stock purchases. The second provides up to 300 billion Yuan in cheap PBoC loans to commercial banks to help them fund other entities’ share purchases and buybacks, unleashing around 800 billion Yuan of initial liquidity support.

The stimulus gave the offshore Chinese Yuan a boost.

The Chinese equity market index, Hang Seng index, followed its domestic currency in the bullish move, up c.15.4% this week as optimism sparked in China. Iron ore, seen as a key benchmark for the Chinese property sector, also see some gains throughout the week, up c.10.9%.

The PBOC has thrown the kitchen sink at its sluggish economy and unloved equity market. Short-term interest rates and reserve requirements are now at their lowest level since 2020. The timing of the move by Beijing suggests that they felt more comfortable unleashing the ‘Big stimulus’ after the Fed started its rate-cutting cycle. The question for investors is what does this mean for broader markets? Will the China stimulus trade be the best trade of Q4? The initial reaction has centred on Chinese equities, and the stimulus package is designed to boost the domestic economy, hence the blistering rally in Chinese and HK shares. The move from China is a positive to global sentiment.

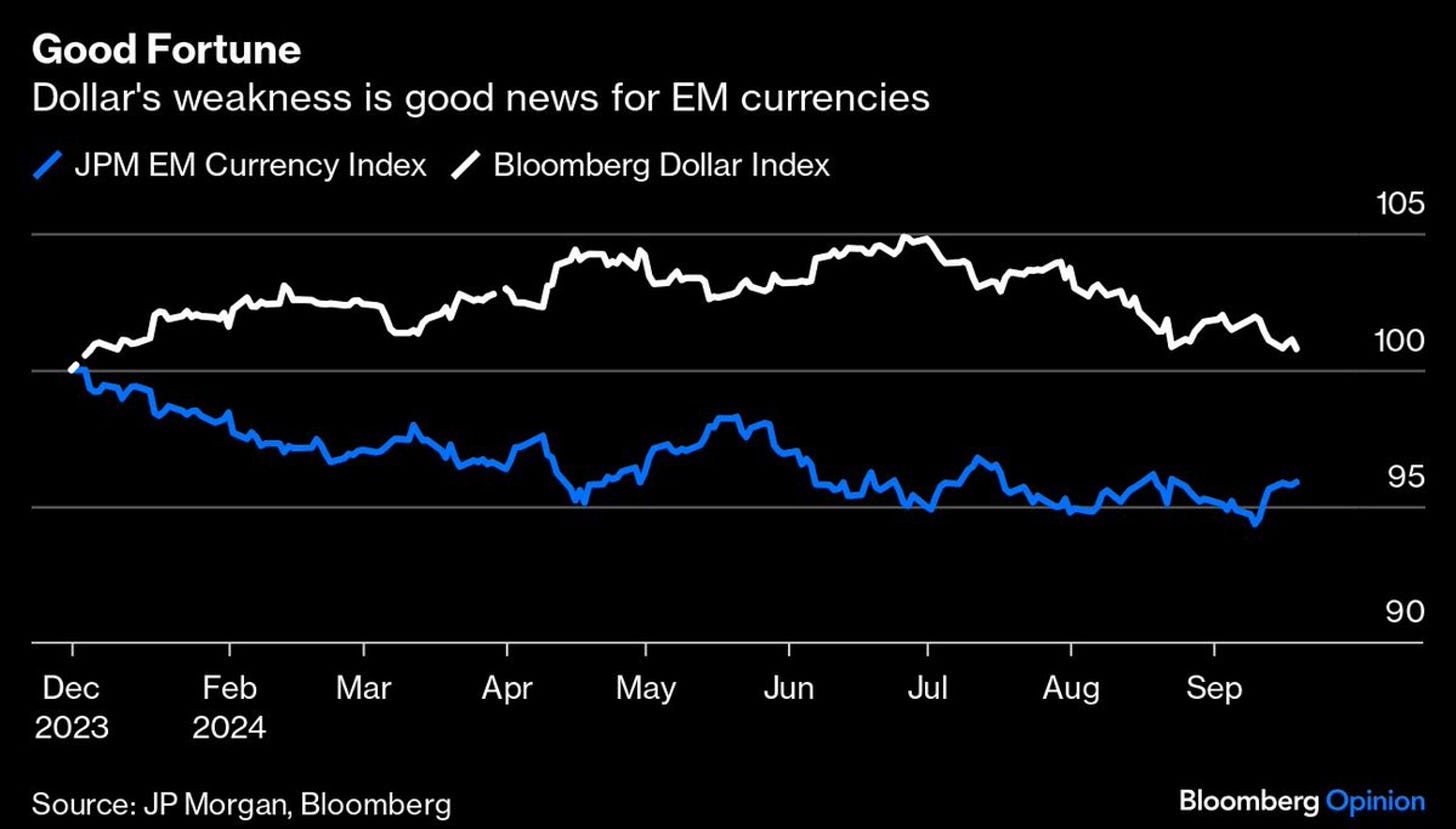

China’s stimulus also lifted EM currencies, due to the strong relation between the two in the commodities market. EM currencies like Brazil, Russia and South Africa are heavily reliant on the export of commodities, so for as long as China’s economy is growing, exports demand will be sufficient for EM growth.

China is also considering recapitalising its largest state-owned banks with up to 1 trillion yuan. This is another step in the economic stimulus plan announced earlier this week. The recapitalisation aims to increase the banks' capacity to support the struggling economy.

Market mover

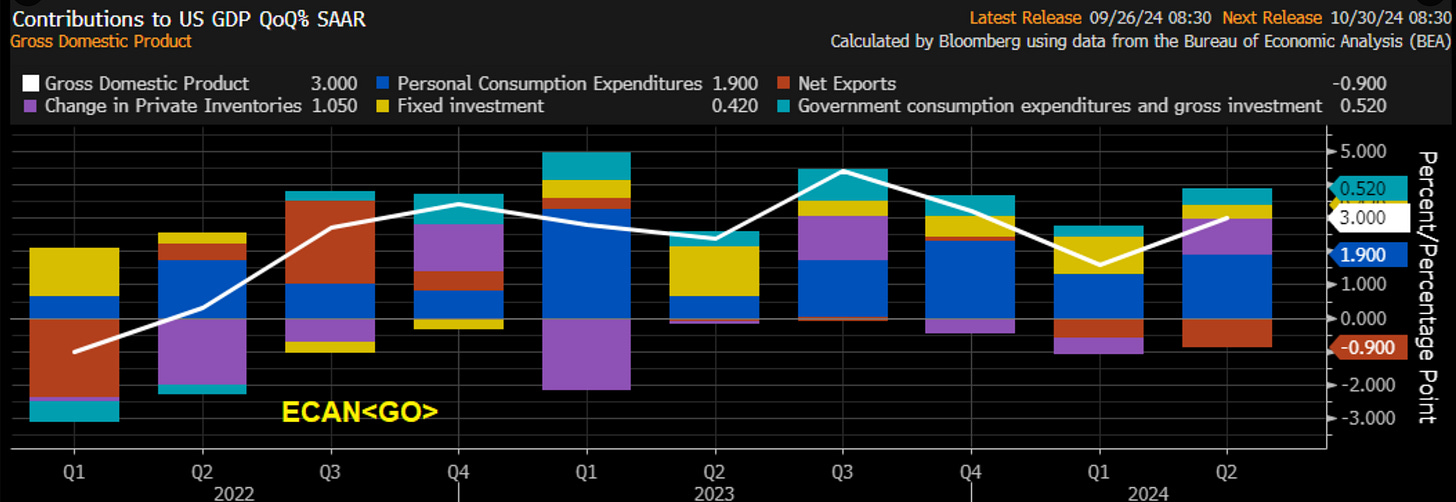

The US GDP proved yet again that the rate cutting cycle can happen at a faster pace, supporting the 50bp from the Fed last week. Up from Q2’s reading of 1.6%, the US’ unrevised GDP was up 3% in Q3.

The growth trend seen recently in the US is beginning to establish a soft landing scenario, shifting risk sentiment and potentially pushing US equities further into the green. A hard landing is definitely not ruled out, however, building a case to allocate capital to assets based on a recession would be a tough case to create. The continuation of the positive 2s10s yield curve is bolstering consumer sentiment inside the US. As mentioned in previous report, narratives will begin to shift as we close into the final weeks of the election cycle, so these data readings (which would typically cause a certain shift in markets) may cause more muted reactions.

What’s next for EMFX?

Just a quick one, for those who aren’t too familiar with currencies outside of the main focus (G10)…

Emerging market currencies (EMFX) refer to the currencies of economies that are in the process of rapid growth and industrialisation but do not yet have fully developed financial systems like those of advanced economies (like the US Dollar or the Euro).

Examples of key EM currencies:

Brazilian Real (BRL):

Mexican Peso (MXN):

South African Rand (ZAR):

Indian Rupee (INR):

Russian Ruble (RUB):

Turkish Lira (TRY):

The relationship between emerging market currencies and developed market currencies (USD/Euro/GBP) is complex, driven by a range of factors that tie the economic performance, financial stability, and investor sentiment. When central banks inside developed markets, especially the Federal Reserve, raise interest rates, capital tends to flow out of higher-risk emerging markets (seeking higher yields) back into safer developed market assets. This can lead to a depreciation of emerging market currencies.

Many emerging markets are commodity exporters, while developed economies are often consumers of these commodities. Changes in commodity prices, which are typically denominated in developed market currencies (like the U.S. dollar), can affect EM currencies. Global sentiment is a large driver of EM trends too, when there is a risk-on environment investors can allocate extra capital to ‘risker’ EM currencies, while in a global downturn the portfolio management strategies tend to seek safe-haves.

Finally, the Dollar plays a central role in global; trade, so many emerging markets hold large amounts of dollar-denominated debt. This means that when the Dollar strengthens (like 2021), EMFX suffers. In low-interest-rate environments, investors may borrow in developed market currencies (like USD or JPY) to invest in higher-yielding EM currencies. This flow of capital can appreciate EM currencies, but the reversal of the carry trade can cause sudden devaluations.

Investing in emerging market currencies isn’t as simple as it looks on face value.

High inflation is common in some EMs, and it erodes the value of a currency. Central banks in EMs may raise interest rates to combat inflation, which can attract foreign investment and stabilise or strengthen the currency. The Banxico (central bank of Mexico) have their interest rates at 10.75%, with expectations of a 25bp cut at the next central bank meeting. You would think this is a great yield, right? Wrong, unfortunately.

Inflation in Mexico is 4.99%, leaving the real rate at 5.76%, which is still higher than any interest rate offered by developed countries’ central bank. However, the small difference in return doesn’t offer enough ‘premium’ with investing in an emerging currency like the Mexican Peso. EM currencies are more prone to sudden devaluations or currency crises due to factors like political instability, large external debts, or capital flight which is another consideration taken by investors.

Many emerging markets rely on external (foreign) borrowing, often in hard currencies like the USD or Euro. High levels of foreign-denominated debt create a vulnerability to currency depreciation because repayment becomes more expensive as the local currency weakens against foreign currencies.

Ok, so where do the opportunities present themselves in EMFX right now?

Let’s do the maths on this one:

Chinese stimulus = Higher demand for commodities + improved global sentiment

Global interest rate cuts = Risk-on sentiment + lower safe-haven demand

So, that leaves us with this equation:

Chinese stimulus + global interest rate cuts = Emerging markets becoming more attractive for capital allocation.

Naturally, as China sparks larger demand in the commodities market, emerging markets that export these commodities (like Brazil and Russia) will see higher growth (GDP) and therefore become far more attractive to foreign investors. Now, I’m definitely not saying that developed currencies like the USD and GBP will see downturns, definitely not. However, what my theory is, is that emerging currencies will potentially be a place where excess capital/investment is allocated.

Not only are these emerging countries offering a significantly higher yield, but they will begin to offer more stability as their exports rise and profits tumble into growth. Take the MSCI Indonesia index as an example of how sentiment can change in emerging markets as commodity demand rises and global Arte cuts are emphasised at a larger scale.

As any investment does, capital allocation in an emerging currency comes with tail-risks.

As I discussed above, a strong USD often caps emerging market currency gains. In a scenario where the US avoid a hard landing, data remains strong and terminal rate of c.3.00% is reached, US dollar dominance could play a central role in hindering bullish EMFX. A more expensive dollar will surge emerging countries’ debt, subduing any growth. Yes, China’s stimulus and future growth will play a role in emerging g market growth, however, it’s not enough alone to really drive a bullish trend if the dollar is so strong (in my opinion).

Couple this tail-risk with a common issue in EMs, political instability.

Argentina: The country faces political uncertainty, worsened by economic challenges such as inflation and debt, which are fueling social unrest. The upcoming elections (elections = risk) could exacerbate instability.

Venezuela: The ongoing economic crisis and territorial disputes with Guyana over oil-rich regions remain volatile, with potential for escalating conflicts. This instability could have broader regional security implications

Sub-Saharan Africa: Countries such as Sudan, Nigeria, and Ethiopia are grappling with armed conflict, political crises, and governance challenges, which disrupt economic activities

The systematic risk inside of these countries is nothing new, take a look below:

History of risk inside EMFX

1997 Asian Financial Crisis - A brief:

The 1997 Asian Financial Crisis was a severe financial meltdown that began in Thailand and quickly spread across much of East and Southeast Asia. Over-leveraging by businesses and governments, coupled with unsustainable fixed exchange rates that tied local currencies to the US dollar. Weaknesses in banking and financial systems, including excessive lending and poor regulatory oversight, created vulnerabilities. The sudden withdrawal of foreign capital (similar to a bank run, but not exactly) caused liquidity crises in these economies, compounding the problem.

It was marked by sharp currency depreciations, stock market crashes, and a surge in sovereign debt defaults. The crisis began in July 1997 when Thailand floated its currency, the Baht, after failing to defend it against speculative attacks. This led to a massive devaluation.

Contagion risk became a factor and the issues spread through to neighbouring countries like Indonesia, Malaysia, South Korea and the Philippines. Currencies and domestic stocks inside these countries collapsed. The IMF came in with bailouts which partially rescued countries in the list above. GDP’s in EMs contracted (c.10% in some countries), political unrest emerged and millions of jobs were lost. Emerging market countries then began building larger foreign exchange reserves and adopting more flexible exchange rates to prevent such a crisis from occuring again.

Late 1990’s-Early 2000’s Argentine Peso Crisis - A brief:

In 1991, Argentina introduced a currency peg, tying the Argentine peso 1:1 to the US dollar under the "Convertibility Plan." The goal was to curb hyperinflation by stabilising the currency, as Argentina had suffered from chronic inflation in previous decades. The peg initially curbed inflation but larger issues in Argentina persisted. Rising public debt and loss of competitiveness against global trade partners led the economy into a recession in 1998, where investors lost confidence in the peg and this led to large capital outflows. In 2001, a sharp decline in Argentina’s GDP created large social unrest, where the government then defaulted on its $132 billion debt (the largest sovereign debt default of all time).

The Peso lost significant amounts of value, increasing inflation and wiping out savings. The abandonment of the peg allowed the Argentine Peso to float freely. Many EM currencies still tie their currency to DM currencies, which is a tail-risk on a bullish EMFX market.

A list of EM currencies pegged:

1. Hong Kong Dollar (HKD)

Pegged to: US Dollar

Peg Ratio: Approximately 7.8 HKD to 1 USD

2. United Arab Emirates Dirham

Pegged to: US Dollar

Peg Ratio: Approximately 3.67 AED to 1 USD

3. Saudi Riyal

Pegged to: US Dollar

Peg Ratio: Approximately 3.75 SAR to 1 USD

4. Qatari Rial

Pegged to: US Dollar

Peg Ratio: Approximately 3.64 QAR to 1 USD

5. Bahraini Dinar

Pegged to: US Dollar

Peg Ratio: Approximately 0.38 BHD to 1 USD

6. Omani Rial

Pegged to: US Dollar

Peg Ratio: Approximately 0.39 OMR to 1 USD

7. Cabo Verdean Escudo

Pegged to: Euro

Peg Ratio: Approximately 110 CVE to 1 EUR

8. Central African CFA Franc

Pegged to: Euro

Peg Ratio: Approximately 655.96 XAF to 1 EUR

9. West African CFA Franc

Pegged to: Euro

Peg Ratio: Approximately 655.96 XOF to 1 EUR

Once again, that’s a wrap for this week!

Thanks for reading until the end.

Another superb write up Alfie, raising the bar from where Joe left it. 🤝🤝