Elections Through a Macro Perspective

It's All a Volatility Play.

Hey crew,

Election season is in full cycle here in the UK.

The polls opened yesterday, and surprising to most the pound held steady.

We’ll get into the details later in this report, as for now, let’s get a quick snapshot of the universe.

Macro Snapshot

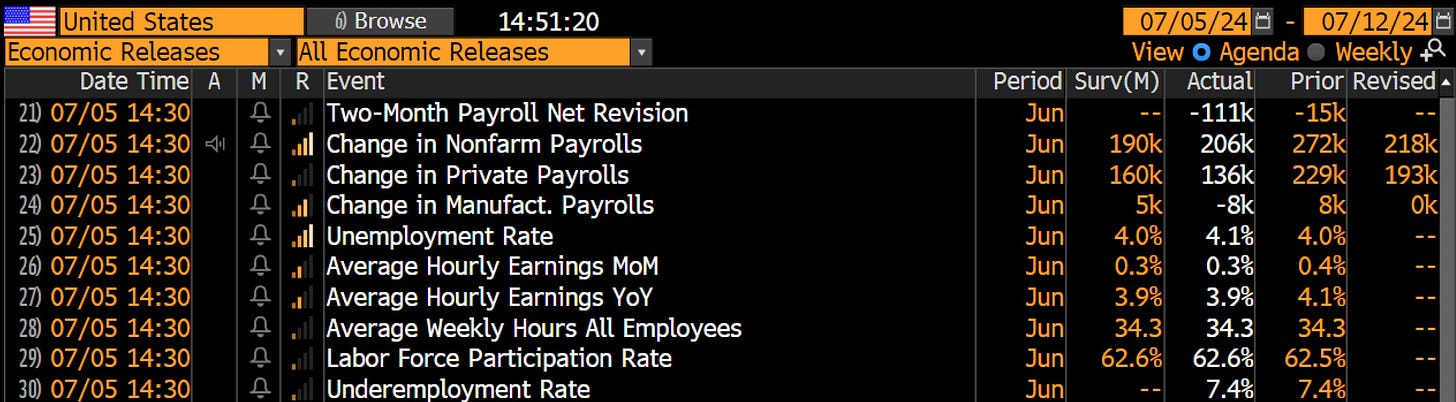

It’s non farm payroll day.

The US added 206k jobs in June vs a consensus 190k. As always, there were downward revisions to payroll data for April and May, subtracting 110k jobs vs previously reported. Average hourly earnings were in line with surveys so no surprise there, we did see an uptick in the unemployment rate to 4.1%.

The overall trend shows that the labour market is still cooling. Meaning, all eyes on the Fed this July as there’s both reason to hold and or reason to cut rates.

As we stand, markets are positioned well to absorb either of the two scenarios— I would be in the camp to see rates come down slightly to give the dollar some relief from it’s dominant H1 performance.

Thought of the Week

Since central banks have shifted the way global markets perform and taken away left tail risks in global macro— what legacy trades have to be left behind?

A thought I had earlier this week after rummaging through some market chatter.

We can all agree, markets aren’t the same.

Money managers are paid to take VaR (Value added Risks), but if there’s minimal value add in some regions as there are in Asian markets, then you end up taking on unjustified risks.

This is the issue affecting many shops running different strategies in Hong Kong right now. There’s simply too little value to justify taking on current levels of risk in markets.

This is something I’ll delve into deeper, as it’s affecting more than just Hong Kong funds.

Chart of the Week

Bets of a Fed cut in September have risen to 70%.

With signs of weakening in the labour market and jobless claims ticking higher it makes a very compelling case for the Fed to cut rates by 25bps at the September meeting.

Cue the dollar weakeness.

Making Sense of Elections: A Macro Perspective

Politics and elections are two topics that have dominated 2024 so far. From elections in EM to elections here in the UK and in the West.

While elections are not as fun as FOMC press conferences their potential impact on markets demand close observation and understanding for us macro traders.

Just like my beginner friendly primer on Treasury auctions last week—

the world of elections impacts markets in ways difficult to comprehend; so it’s essential to understand why markets react the way they do and uncover the turbulence behind elections.

When you think of elections the first thing that should come to mind is “How will the market react to this politician/policy/party?”

As someone who loves a good carry trade I’ve kept my eyes on a basket of EM currencies throughout this year, notably the Mexican Peso and Brazillian Real. On June 2nd, Mexico held their presidential elections which resulted in Claudia Sheinbaum, of the Morena party taking a majority victory in the elections.

As a small insight, the Morena party in Mexico has been the ruling party since 2018—so markets weren’t scared because of a new party, but because of the additional power the Morena party has gained in its recent selections.

The fear is with the landslide victory, the Morena party, may enact constitutional changes, nullifying the checks and balances system which prevents the government from abusing its power.

So, in Layman’s term, the market fears that the Mexican government may embark on aggressive policies (fiscal, regulatory etc) without the need to compromise since they have majority. Uncertainty.

Uncertainty = volatility = losses in high beta ccy

Simply put, the easiest way to observe elections is through volatility indexes.

So it’s all a volatility play? Yes, for the most part.

Election uncertainty can manifest through increased volatility in currency, bond, and equity markets. Analysing every presidential candidate's detailed positions is a resource-intensive endeavour. Instead, markets primarily focus on how candidates plan to address critical issues like national debt, deficit levels, economic growth, taxation, and foreign policy. Since the government controls fiscal policy, any proposed legislation or policy that generates market unease will be swiftly reflected in bond yields. *Cue Liz Truss*

We can see the similarities with the snap elections in France and what effect that had on all three major markets, bonds, FX and equities.

The week after President Emmanuel Macron announced a snap election this was the performance of a basket of currencies against the Euro. All currency pairs gaining, some +2% in a matter of days after the announcement on June 9th.

Equities in France sold off c.7% after the announcement.

The catalyst this time? You guessed it. Uncertainty and fear.

The French elections weren’t due for another two years, so after Macron announced elections the surprise in markets resulted in a flee from French denominated assets, including the debt and ccy.

The second part is dependent on who presents the most market friendly policy.

This in it’s own could take a full report, but to sum it up. The market will forever and always be the judge and exchequer of policies. Take Liz Truss, before her tax cuts had time to land the bond market came to a verdict, which was to oust her, her mini budget, and her cabinet members out of parliament.

So rest assured nothing gets past the eyes of the market.

The Labour party here in the UK won the general election by a landslide margin. Keir Starmer is set to become the new PM of the UK, you’ll notice however, zero reaction in currency or equity markets. If anything the pound has caught a bid prior and post the election day/result.

This is the opposite end of what we described earlier. Political stability is what markets are reacting to.

The market largely anticipated a Labour Party victory; consequently, following yesterday's polls, confidence in a politically stable UK was reflected across equities and FX.

In any election campaign or season, the primary question to consider is: "Based on the probability and outcome predictions, will this election campaign bring political stability or instability to the markets?" From this starting point, one can delve into the individual party manifestos to better understand the proposals from each party.

US Election Prediction Markets

Prediction markets like PredictIt, PolyMarket and Kalshi are essentially real-time polls. Through these platforms people are able to bet on the outcome of specific events, such as “will the Fed hike 25bps or cut at the July meeting?” or “will Biden step down as the Dems nominee?”.

While this is not a new market, it’s still a new concept for many. However, when you realise that what we, as macro traders, do is make predictions on specific market movements, the similarities become evident. Take the treasury market, the 2-year note serves as a proxy (broad market bet) of where the Fed policy rate will be over the next two years. The majority of currency plays are simply bets on future implied policy rates of two central banks. The only difference between our markets and PredictIt is that they’re betting on elections & geopolitical events.

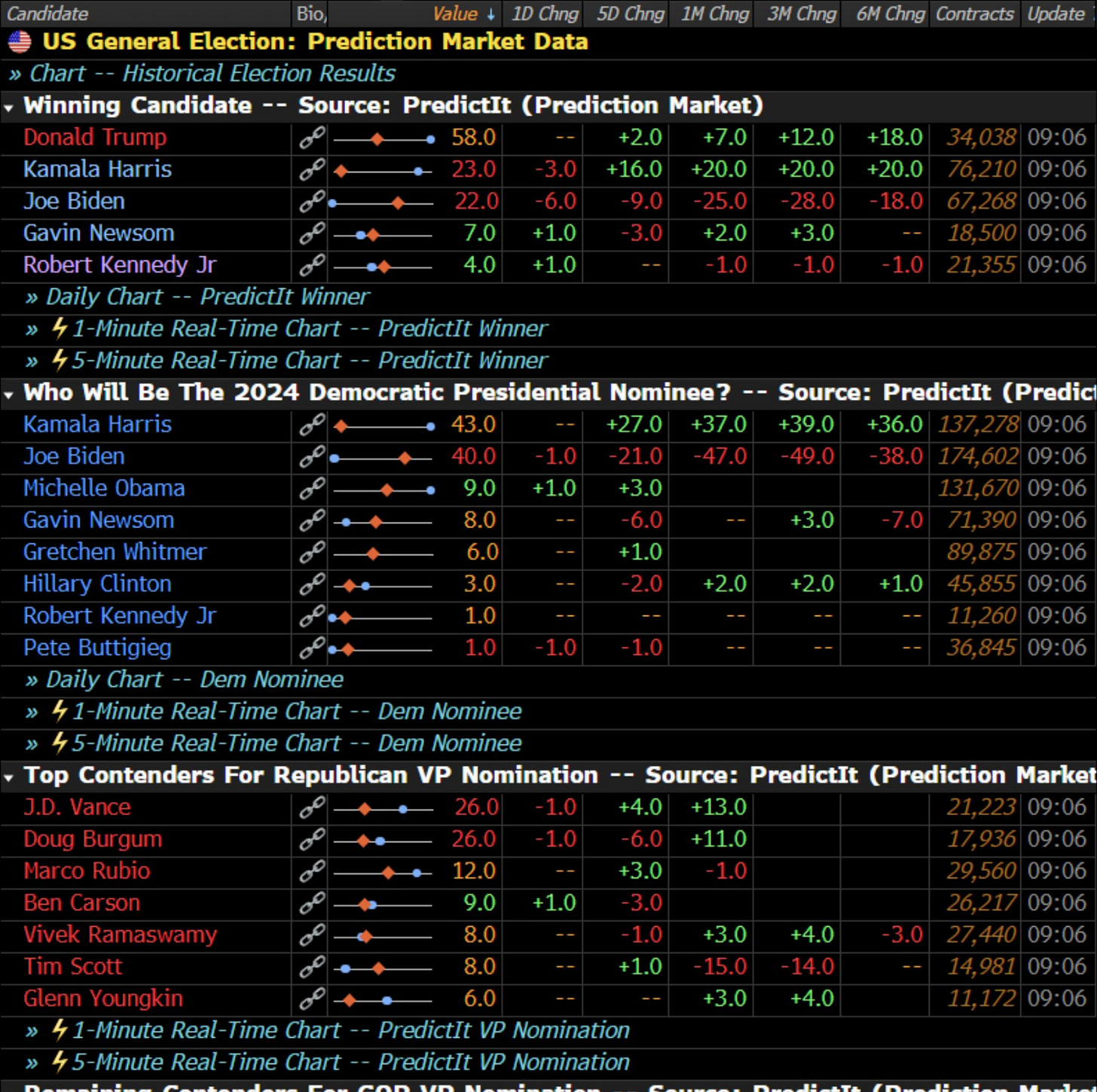

This was the prediction markets earlier this week for who will win the 2024 Democratic Presidential nomination. Leading into July Biden was well ahead of all other nominees, but after an abysmal debate with Trump and rumours of Biden planning to step down from the election race markets have shifted their expectations towards Kamala Harris becoming the frontrunner.

This is the beauty of prediction markets, we’re able to quantify, numerically the possibilities of certain events like a new Democratic nominee occurring and also see the minds, the thoughts of everyone at the same time. Similar to how investors flock to safe haven assets in times of market stress, prediction markets are able to visualise the sentiment of the people for a wider range of events.

Here’s a detailed view of the prediction market (from today, stale data).

After Joe Biden’s nightmare debate we can see how the market have reduced the bets of him becoming the Presidential nominee by 21 points this week whilst Kamal Harris' bets have gone up over 27 points in the same time. Bets on Kamala Harris being the Democratic nominee have now outweighed Biden’s.

In the broader general election Trump is still expected to bring it home.

For us sticking to capital markets, the ebbs and flows of this prediction market have little significance in the immediate on markets. However, as discussed above keeping an eye on our MOVE Index gives us a pulse check on the state and confidence within investors trading US debt.

The MOVE index has resurged back towards April levels, and I expect that as we get closer and closer to the November US election period the jitters and chair switching in the Democratic party will cause the MOVE index to remain relatively elevated above the 2023 year low level.

In conclusion, everything surrounding politics ends up as a binary selection process for us. Stability or instability, and from here the rest is in our hands to decipher how we wish to play it out. The go to decision is to be short high beta assets (ccy, equities etc) in such times— this is something I’ll explore deeper, looking at historical election cycles and market’s reactions. For now, I hope this simplified and opened your understanding to election season.

Thanks for getting to the end of this report.