Economic Health Check: China's Opportunities

Dealing into China's Trajectory & Economic Interplays

Hey guys,

The markets for summer have been volatile, no time for rest.

I’ve been really reading into global macro in the current conditions and China’s optimism has caught my eye, as I explained in my report a couple weeks back.

Knowing the conditions within G4 currencies can really branch out into actionable trade ideas.

The global rate cutting cycle is also well underway.

Let’s begin!

Macro Watch

A complete unwind of the Dollar’s H1 gains is fully underway, led by monetary policy expectations, which is no surprise as it’s been the main driver of currency prices since global interest rate hikes late 2021/early 2022.

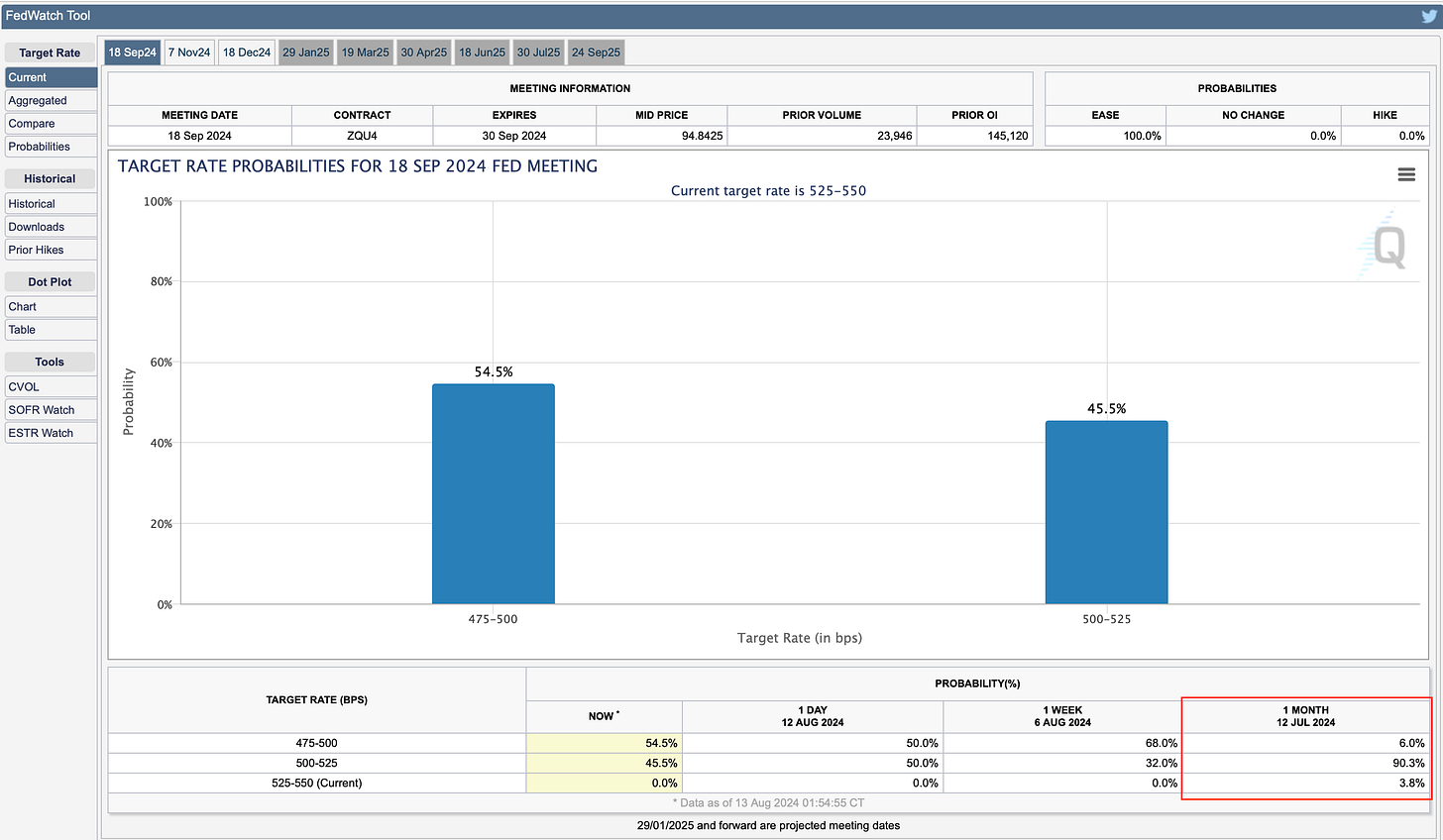

Just one month ago, the market had almost fully priced in a 25bps interest rate cut from the Federal Reserve in their September meeting. Fast-forward to now, we’re looking at expectations of a 50bps cut in September after an unexpected 20bps jump in the US unemployment rate to 4.3%, pushing the US economy into a potential ‘red zone’.

At the time of publication, the probability of a 50bps rate cut at the September FOMC meeting is already 54.5%. A further 25bps cut at the November meeting is priced at 51.3%, and an extra 25bps cut at the December meeting priced in at 42.9%. The market is already pricing in 3 cuts totally 100bps this year, taking the key US interest rate down to 4.5% and suggesting that the Fed are late with rate cuts.

However, the Fed’s Daly (a voter) said none of the labor market indicators she looks at are flashing red right now but she is monitoring them carefully and said the Fed is prepared to act as it gets more information.

Market mover

The UK’s labor market followed the footsteps of the US’ labor market on Tuesday 13th August, when the unemployment rate unexpectedly dropped by 30bps to 4.2%.

The reason there is significance behind this unemployment reading is because there’s divergence between economic conditions and monetary policy, how is the unemployment rate dropping while the monetary policy is so tight? Contradictory.

(Word this better) Extra employment does often lead to larger economic output and can fuel wage inflation. The last thing the Bank of England need is even stickier inflation, in my last report I spoke about the central bank needing to be careful when addressing inflation due to the sticky nature of services inflation (which increased by 6% YoY in June).

Although I don’t see this one data point being a game changer for the monetary policy path, it could definitely be a start of many challenges to come for the BoE. Now, just to clear things up as I know some were confused about the divergence between the unemployment rate and claimant count. They can diverge because they are two completely different readings.

Unemployment rate - The percentage of the labor force actively seeking employment but unable to find a job.

Claimant count - The number of people claiming unemployment-related benefits.

The chart above is exactly why this event is in the market mover section this week, the US is really struggling to gain any traction against the other G3 currencies due to the cooling data.

China’s Extremes

The real estate sector in China has historically been a significant driver of China's economy, contributing to between 25% to 30% of its GDP. However, this figure can be misleading as it only captures the direct impact. When considering the broader economic implications, including related industries like construction, materials, and finance, the overall influence of the housing market on China's economy is estimated to be significantly higher, potentially reaching up to 40% or more.

So for China to perform well, their housing market must be in great order.

The large issues in China’s housing market range from a multitude of things, the main reasons are below.

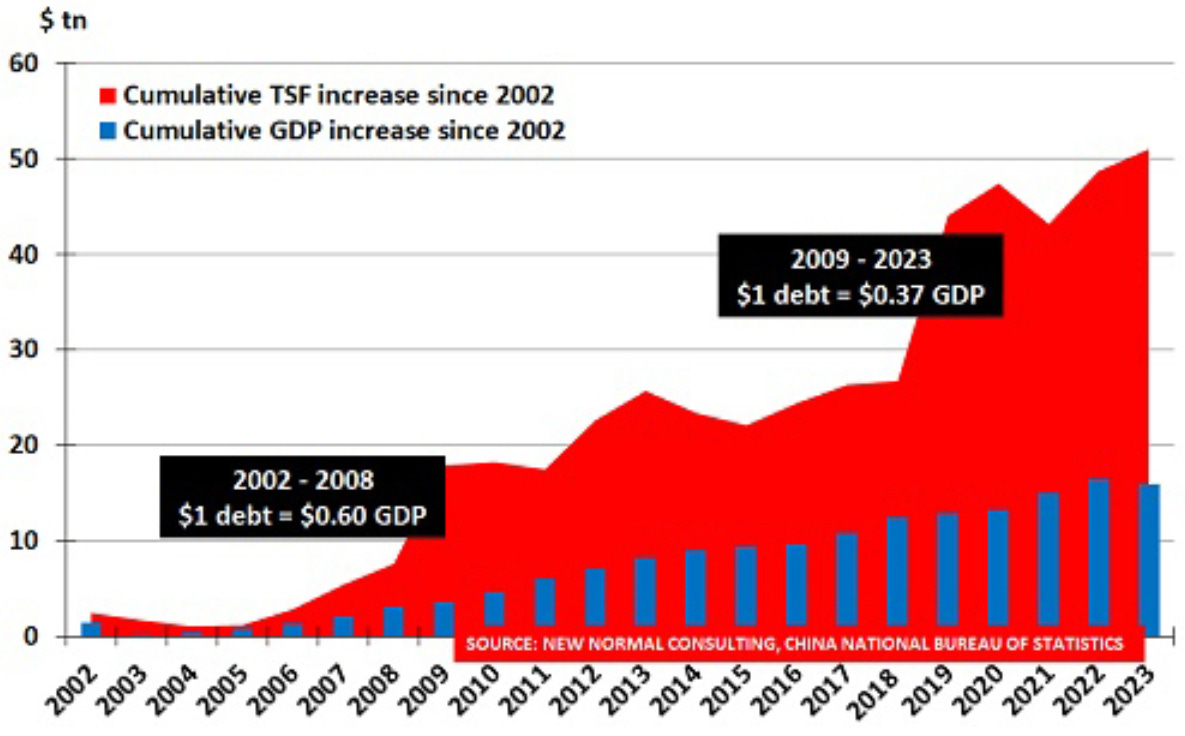

Developer debt - Many property developers in China are heavily indebted, with some on the brink of default or have already defaulted. This has led to concerns about financial contagion. The reason for such debt among developers stems from such excessive leverage which is then hard to repay when the plots don’t sell as fast as anticipated. With the way things are going with China’s global and domestic demand, this debt can linger for many years.

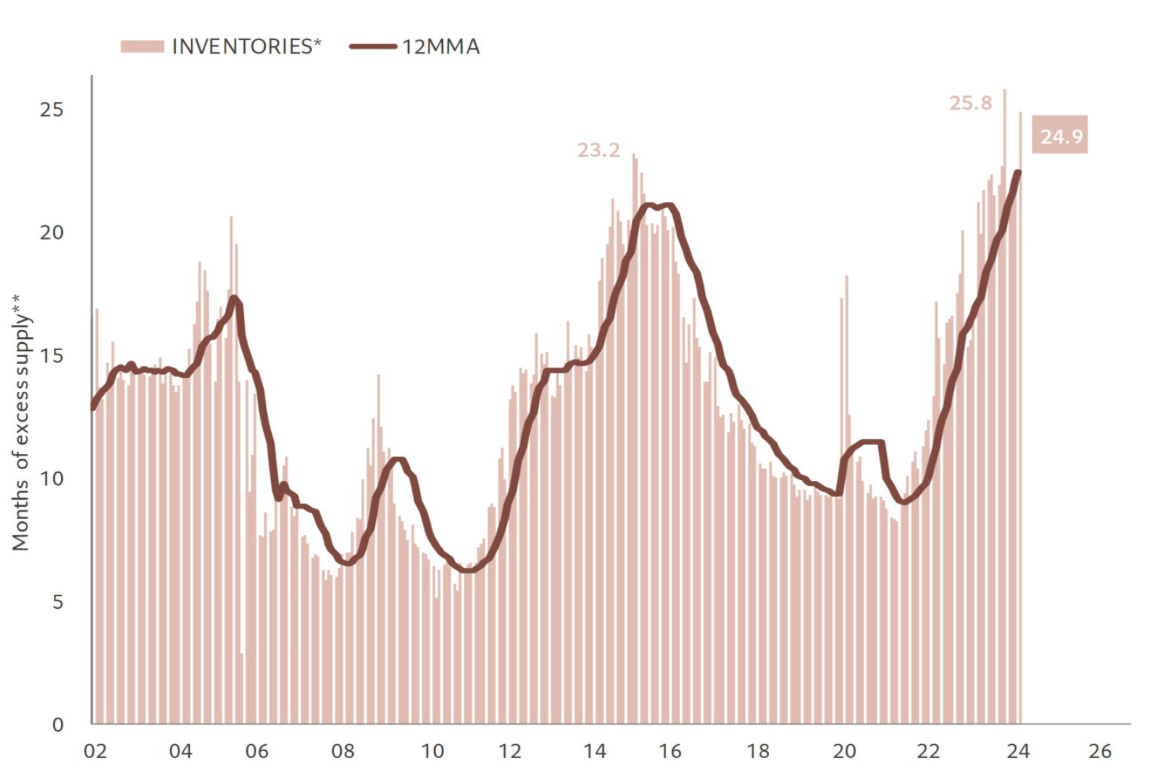

Oversupply - In the rush for developments, many cities built more housing than was needed, leading to oversupply, the oversupply then created ‘ghost cities’ & excess inventory. Also, with already sufficient opportunities in other areas, there is little incentive to move to new areas and people are reluctant to consider it. Another deterrent is the inadequate transportation, schools and other essential services in some of these developments. Urbanisation, which is the process of people moving from rural areas to urban areas, has helped developments within the city but hasn’t entirely solved the problem. This shift will naturally result in an increased population density in urban centres but the danger for the developments will linger.

Government policies - In August 2020, the Three Red Lines policy was introduced by Chinese government. This policy imposed strict financial leverage limits on property developers, restricting their ability to borrow and invest. While aimed at reducing financial risks, it led to a sharp decline in investment and a liquidity crunch for many developers. In the mid 2000’s, housing purchase restrictions were also brought in, implemented in various cities, these restrictions limit the number of properties individuals can own and increase down payment requirements. While effective in cooling down prices, it has also dampened demand.

Weak demand - Not just in the housing market, but across the board in China we have seen a large slowdown in demand. Coincidentally, a large portion of household wealth is tied up in property, and declining property values have reduced consumer spending power which also gives no incentive to move at all. The global economic slowdown and geopolitical tensions have created uncertainty, affecting consumer sentiment and spending.

So with such a weak housing market, does China really have any optimism one may ask?

The People’s Bank of China recently cutting the 1-year Loan Prime Rate by 10bps to 3.35%, economic growth can be stimulated. Typically, FDI will seek the higher interest rate economies, such as the US and UK. As mentioned before, with global interest rates taking a turn, the PBoC won’t be the anomaly to cutting rates, which is a positive because there shouldn’t be dramatic capital outflows from the Chinese Yuan seeking higher rates. Also, with a larger incentive to borrow domestically in China now interest rates are lower, China’s spending draught could see an end. Retail sales (YoY) in China dropped from 10.1% in December to 2% in July, a clear contributor to the lacklustre growth.

Now i’m not saying that the Chinese economy will see a fast turn-around, however, I do believe the turn-around is near.

You may be thinking - “What has US debt got to do with China?”

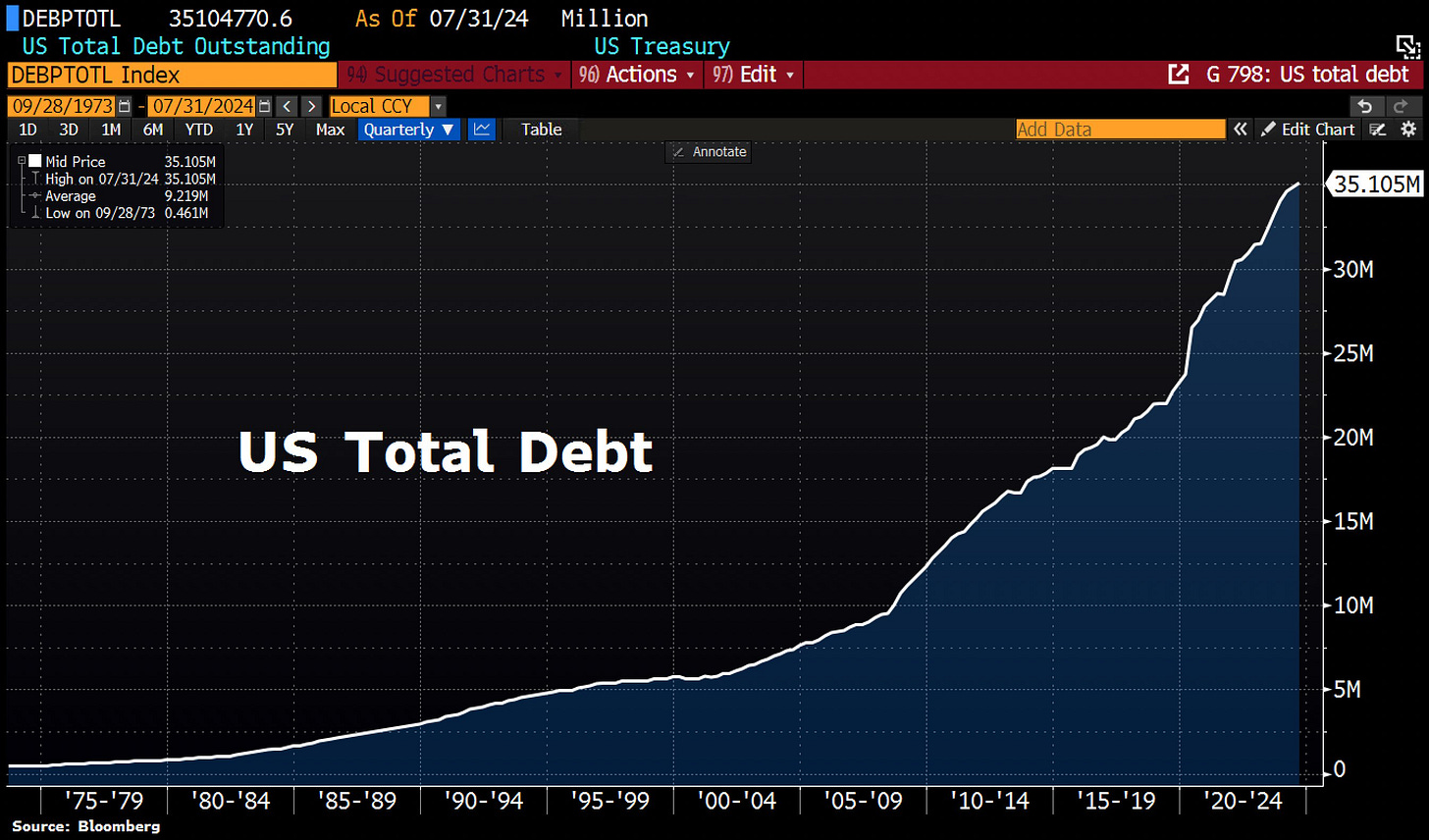

US debt tops $35tn as the federal budget was $1.5tn in the first 10 months of fiscal year 2024. CBO projects a federal budget deficit of $2tn in fiscal year 2024 when adjusted to exclude the efforts of shifts in the timing of certain payments.

So, when investors are allocating capital, there are plenty of factors considered, systemic risk is one of the large considerations. Systemic risk is the risk of a collapse of an entire financial system or market, as opposed to the risk associated with any one individual entity, group, or component of a system. It's essentially the risk that a problem in one part of the financial system can spread to other parts, leading to a widespread crisis. So, if the US continue on such a steep debt trajectory, what can this lead to?

High debt levels can stifle economic growth by diverting resources away from productive investments.

A large debt burden limits the government's ability to respond to economic crises or invest in public goods.

A growing debt-to-GDP ratio can erode confidence in the US dollar, leading to depreciation.

Point number 3 is the most crucial when linking China’s potential optimism with the US economy, the interplay. If there is large enough erosion in the confidence of the US, regardless of the Dollar being a “safe-haven”, China will pick up FDI from the US economic downturn.

The unwind of the carry

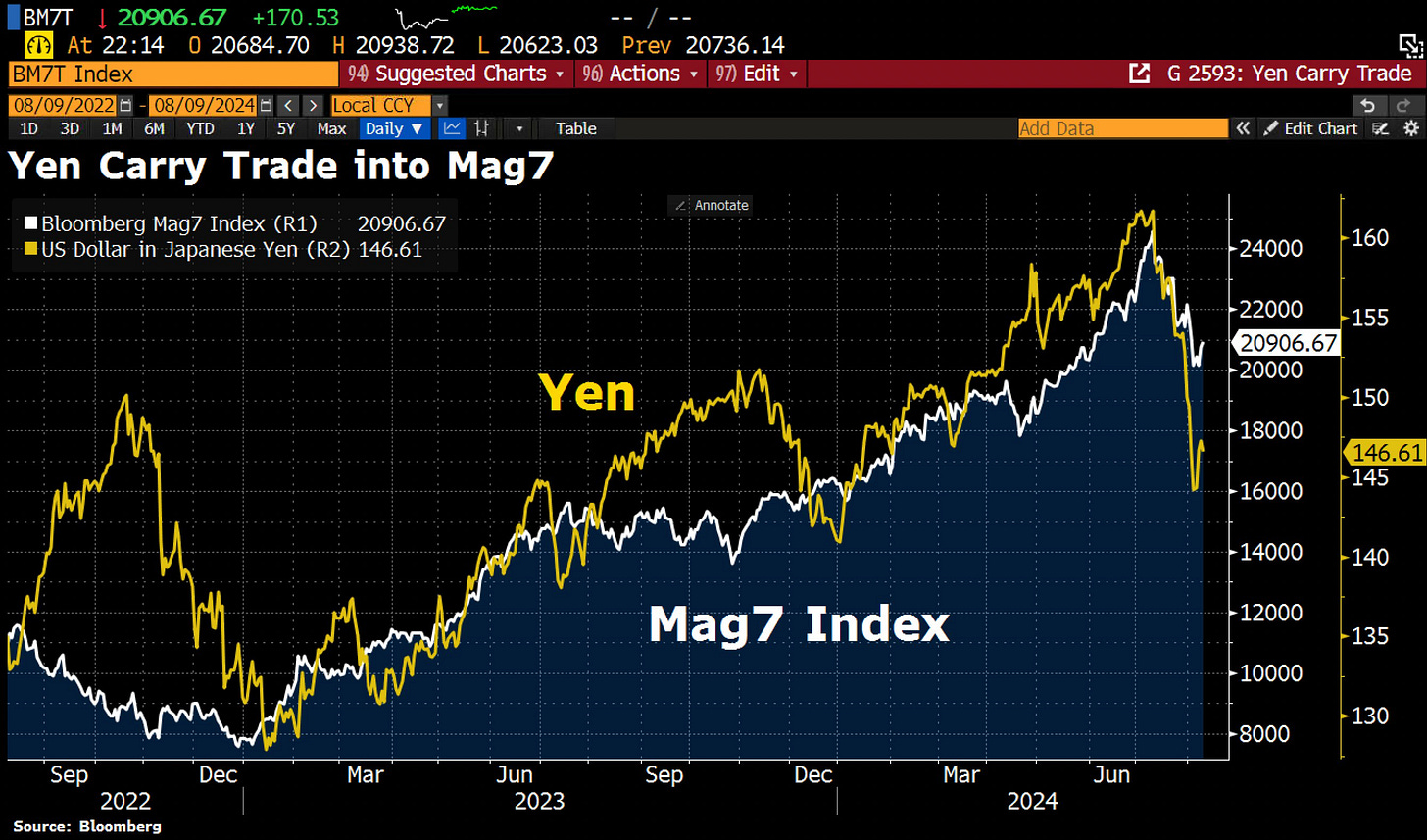

The carry trade has been dominant since the beginning of 2021. However, recent Japanese optimism a change in the BoJ’s monetary policy has unwound the gains made earlier in the year. The USD/JPY is down nearly 10% since the beginning of July.

What does this change in behaviour mean for markets?

Capital seeks investment elsewhere. For years, investors have borrowed in Yen and invested elsewhere, but now it’s mote expensive to borrow the Yen, those investments will be reallocated/closed.

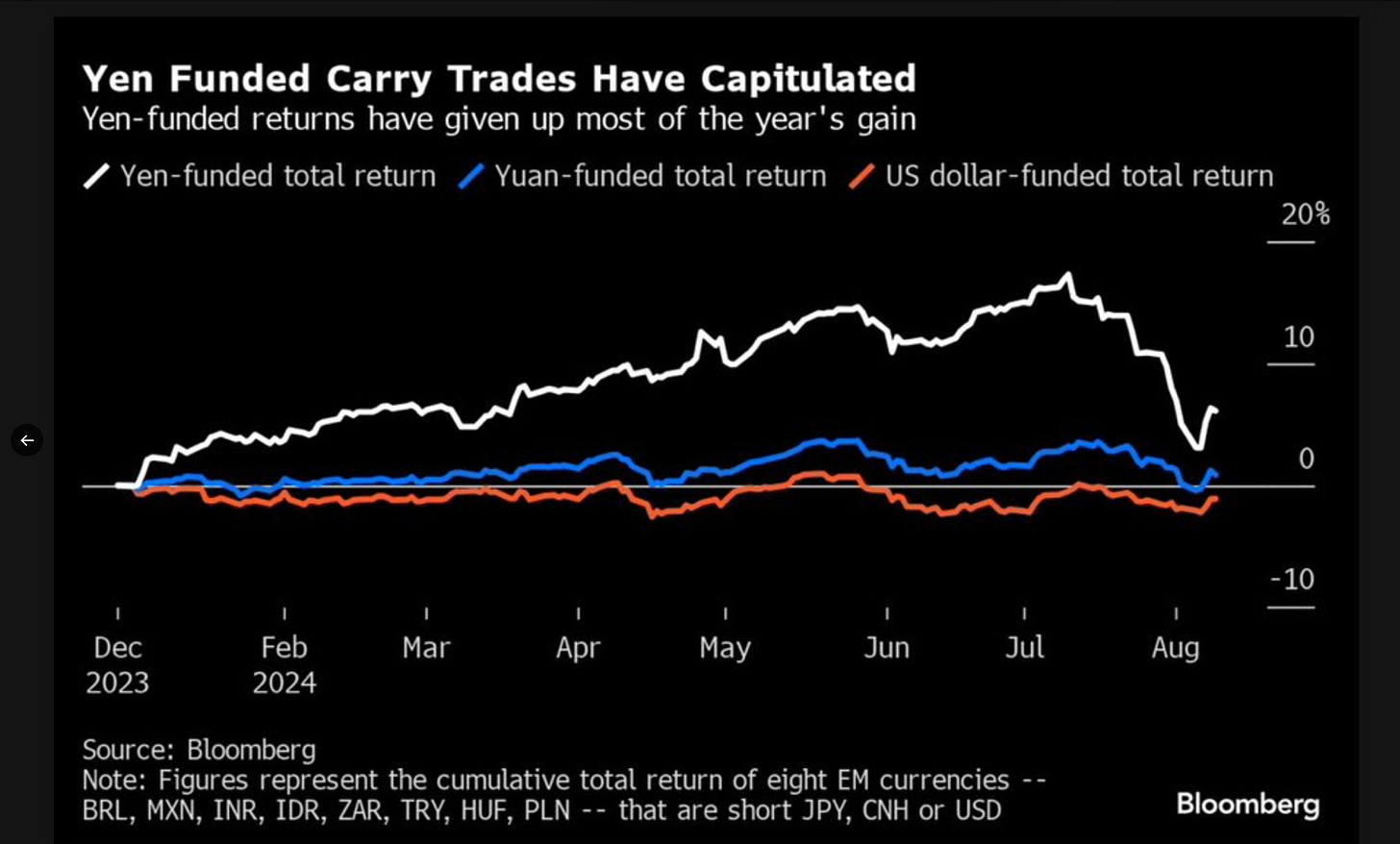

Figure 7 clearly represents investors are pulling the plug on some of their Yen borrowing which also means pulling there plug on those investments. That now gives clarification to me that the equity sell-off was dominated by the unwind of the carry trade

The Mag7 refers to a group of the most influential tech companies in the US stock market, stocks that would’ve been heavily invested in with capital from Japan. Now, as the carry trade further unwinds and the BoJ’s monetary policy gets tighter, equities could see a further sell-off and reallocation into economies like China (for the reasons explained above) could be the play.

That’s it for this week… As always, I’d love to hear your thoughts!

A sea of interconnected webs 🕸️