Economic Disfunction

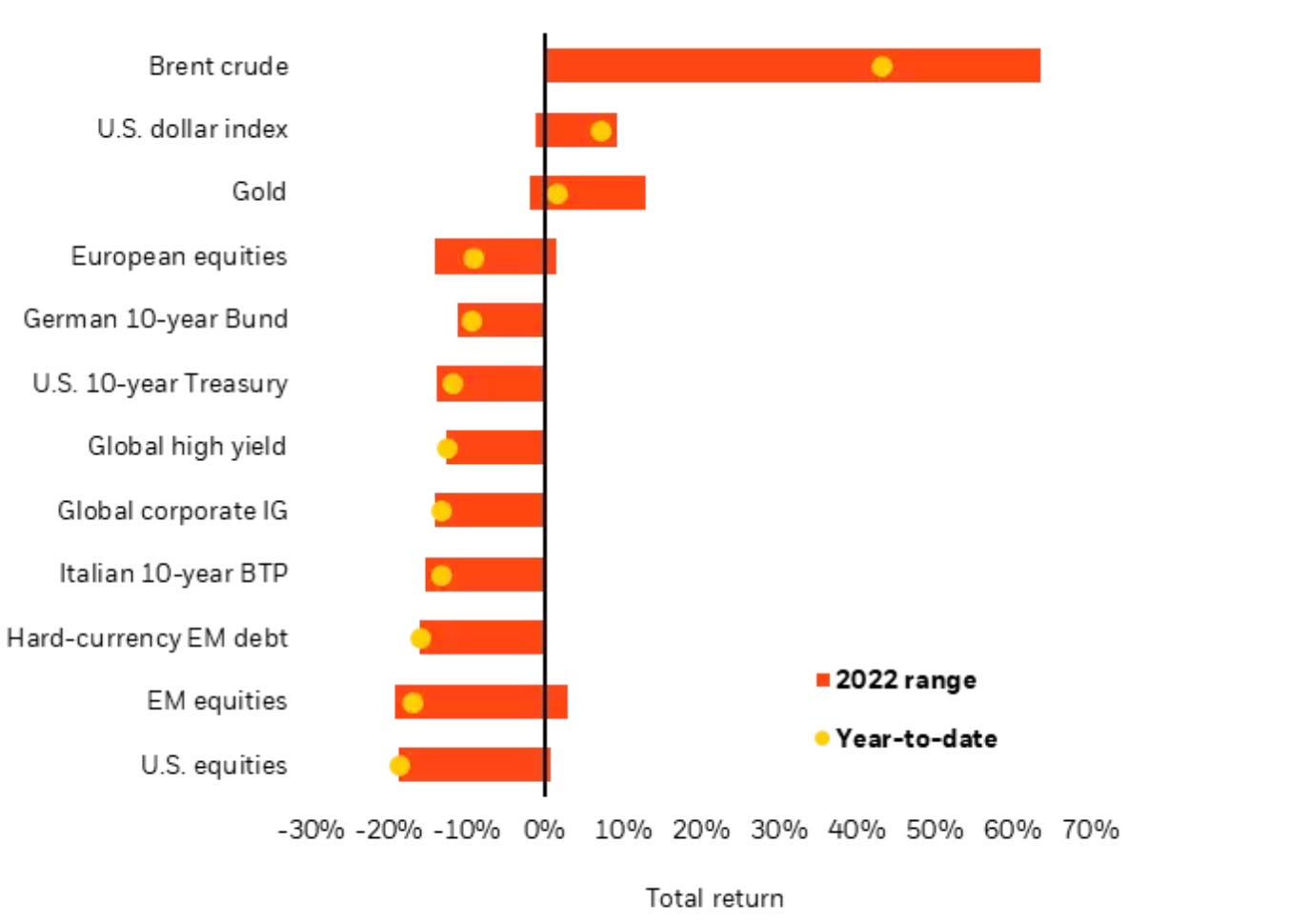

YTD returns by asset class

U.S home sales paint a gloomy picture

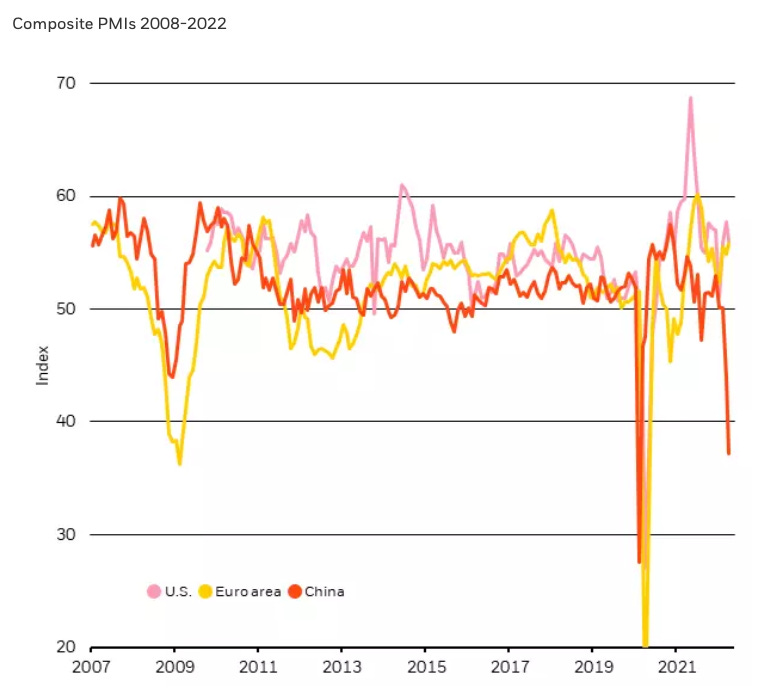

China's slowdown set to ripple through global markets

Where’s the alpha?

According to figure 1, you guessed right, commodities.

In a year proclaimed to be the year of “normalisation” in equity markets we’re seeing even more losses than expected. Yesterday U.S equities closed higher yet the economic environment is unchanged, so there’s no real joy in a recovery day as such.

European equities have also suffered the test of time with investors juggling an ongoing war, stagflation and unprecedented inflation levels; the last place you would want to have your portfolio invested in is European equities if you have access to other markets.

Unsurprisingly we’re seeing bonds yield negative returns in this inflationary environment. Whilst the yield on a Treasury note may be around 2-3% inflation now eats into the real rate of return; so now you have an instrument yielding -5% or more as inflation soars. It wouldn’t take a genius to do the math on that, now on the topic of bonds, the Fed plans to initiate its quantitative tightening process from June 1st.

Looking back at figure 1, this is the market currently re-pricing itself based on expectations of Fed policy and market conditions. Once tapering kicks in the markets will be sucked dry of capital leaving inefficiencies that will become evident as the process continues. The first point of focus will be the MBS market (mortgage-backed securities). With the Fed being one of the largest players in the MBS market it’s hard to imagine another institution filling the place of the Fed once they begin offloading their max of $35B in MBS securities per month. So for the wider bond market, corporate IG (investment grade) to be exact, widening credit spreads only makes it more difficult to issue debt and fund operations.

Worst Housing Market In U.S

A few weeks back I saw this chart but never thought much of it.

Take a look at 1978 and take a look at 2022. The % has dropped to its lowest in history. Are we in a worse off real estate market than in 2008? Personally, I don’t think so. However, the market is by no means in a good position, earlier this week we had data for new home sales come out.

The overall consensus was 750k expectations with the actual figure coming in at 591k. A massive disappointment, now the housing market can be a very difficult one to navigate but consistent data points like this start to paint a very bleak outlook for the market. Thursday brought us even more negative news:

China Slowdown To Ripple Across U.S & EU

As I love saying time and time again, China's economy is a leading indicator of where the U.S but majorly the world will go in terms of synchronised growth and contraction.

Every time there has been a drastic decline in PMI led by China we see both economies follow suit sooner than later. So, right now the Fed is having to make the trade-off between choking off growth through further rate increases or living within a supply-driven economy. Growth in China has plunged as lockdown measures add to an already broken supply chain so over the next few readings this is expected to filter through the wider economy particularly the U.S and Europe.

Thanks for getting to this point! The past few days have been hectic however I like taking more time to go in a bit deeper on things…

Let me know your thoughts

Appreciate you