Easing Into Strength: A Policy Error in the Making

Steepening Pressure: When Cuts Collide With Inflation

Hey guys,

Sometimes the hardest part is just starting, even when the path isn’t clear.

Momentum doesn’t show up on its own - we build it through motion.

Let’s begin.

TLT Trade Update: Riding the Steepener

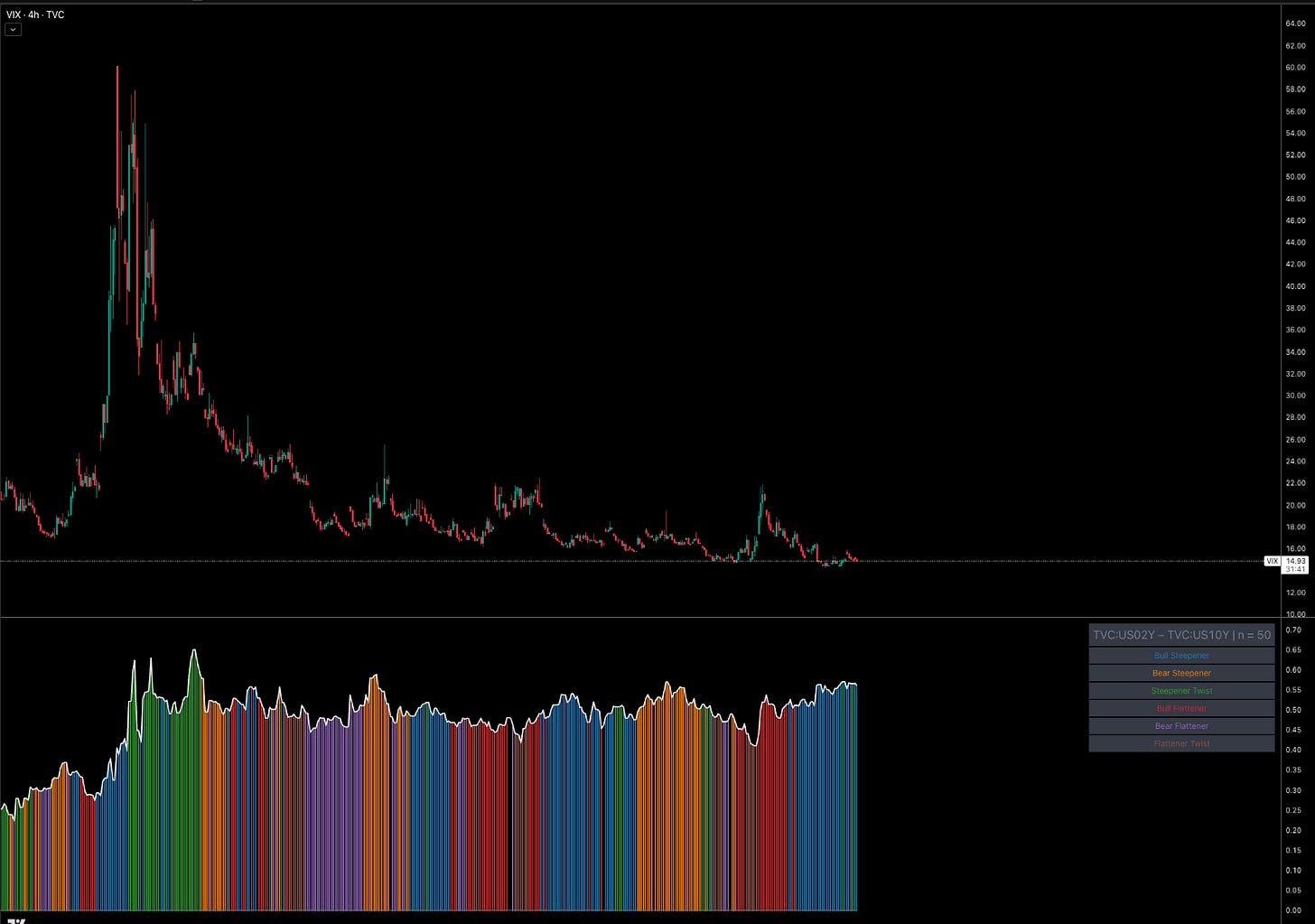

The TLT short I flagged last week has already moved in the money, carried by a clean bull steepening in the 2s10s. I’m leaning into it and adding another 25% of the original size here because the conditions for more curve steepening remain firmly in place. Growth and inflation are too present to stop the long end from bleeding duration, and any step-up in rate-cut rhetoric at Jackson Hole would only accelerate the move. When the Fed cuts into this backdrop, TLT doesn’t drift, it melts.

Growth Still Solid (Labor Is the Wild Card)

Let’s start with growth. The only meaningful tail-risk here is the labor market, and while June data gave us some early signs of cracks, they’re not yet big enough to call regime change. Claims, payrolls and participation need to worsen materially before the “growth is faltering” narrative sticks.

Credit corroborates that story. IG spreads sit comfortably around 50 bp, HY ETFs like HYG are well bid, and beta in credit is subdued. In other words: no stress, no contagion. Unless a geopolitical shock comes out of nowhere, credit markets aren’t waving red flags. Steepening curves are actually supportive for equities, which further adds to the selling pressure on duration.

Inflation: The Real Driver

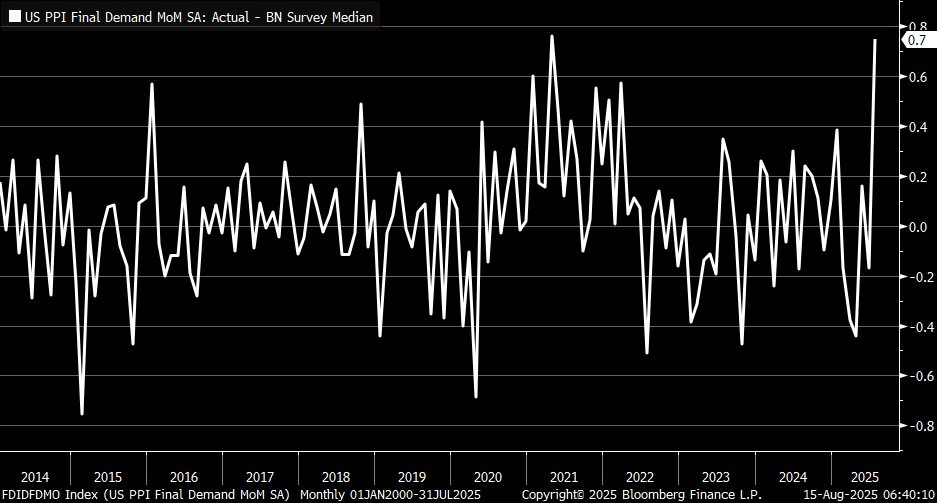

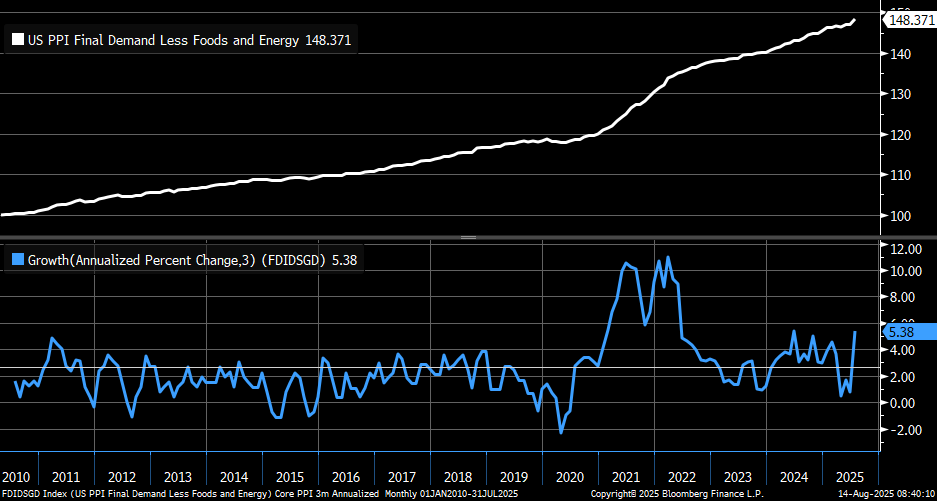

Inflation is where things get interesting. Beyond the noisy headline prints, the structure of inflation is stubborn. PPI is climbing, and the 3-month momentum in CPI/Core CPI is running about +10–12 bps MoM—call it ~120–140 bps annualised. Sure, those numbers are exaggerated on an annualised basis, but the point remains: in what’s supposed to be a “restrictive” policy setting, inflation momentum shouldn’t look this hot.

Markets keep treating inflation as if it’s cyclical noise, but it’s increasingly structural. Energy, goods and services are they’re all pushing upward. And in this regime, liquidity transmission matters more than spurious correlations between CPI and equities. Liquidity is abundant, and that’s what’s pushing ARKK, the Russell, and cyclicals higher. The Fed is still injecting fuel into the fire, whether intentionally or not.

Policy: The Fed Is Cornered

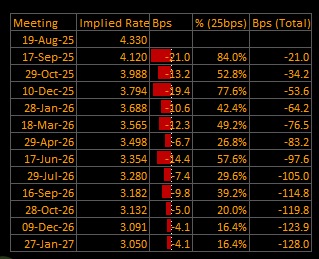

September’s 25 bp cut is all but priced, roughly 21 bp implied, 84% probability. Beyond that, OIS markets are pricing 128 bp of easing through January 2027, with a terminal rate near 3.05%. That’s a dovish curve.

Here’s the problem: cutting into strong growth and sticky inflation risks inflating asset prices to unsustainable levels. We’ve seen this movie before, 1994 (tightening into strength), 2013 (taper tantrum), and 2021 H2 (reflation trade). Each time, duration got punished while equities and credit absorbed the shock. This time, the Fed risks easing into strength, which could make the bond selloff even uglier. Chart below from Capital Flows:

Markets: Positioning and Plumbing

2s10s: Bull steepening intact; TLT shorts working.

Equities: Liquidity bid, risk appetite strong; Russell and ARKK leading.

Credit: IG - 50 bp, HY tight, no stress.

Volatility: VIX at “calm waters” levels, compressing risk premium and leaving duration vulnerable.

Bonds: ZN/ZT mean-reverting post-NFP spike, but long duration still under pressure.

P/E ratios? The wrong debate. Multiples are regime-dependent, 22.5x might be stretched in one regime and perfectly fair in another. Growth, inflation, and liquidity drive equities, not static valuation anchors.

Risks and Invalidators

The TLT short still has a clean setup, but here’s what could break it:

A sharp labor market deterioration (payrolls, claims).

Downside inflation surprise (CPI/PPI roll over).

Fed skipping the September cut or pivoting hawkish.

Geopolitical flare-up (energy shock, shipping disruption).

As of now, none of these look imminent, VIX supports that.

Tail-Risk Scenario Analysis (outside of what’s layed out above)

CPI/Labor miss (soft): 2s10s bull flattens, breakevens compress, equities rotate into growth, gold higher - TLT squeezes up (temporary P&L drawdown).

Fed skips September cut (low prob): Bear flattener, USD up, equities chop - TLT rebound short squeeze, profit taking chance.

Oil to $100 (low prob): Bear steepener, breakevens rip, energy leads, gold rips - TLT collapses.

Term premium repricing: Curve bear steepens, equities derate, IG spreads widen modestly - TLT sharply lower.

Bottom Line

The setup is still asymmetric: growth resilient, inflation sticky, liquidity abundant, Fed easing bias intact. All of this argues for more curve steepening and more pain for long duration. That’s why I’m adding +25% to the TLT short here.

Invalidation sits with labor or inflation rolling over. Until then, the bias is clear: more steepening, more duration pain, more pressure on TLT.

As always, have a great week!