Disinflation, Rate Cuts and The Bond Market

Looking beneath the hood of the Treasury market to get an understanding of what investors are pricing in for the rate trajectory.

Hey crew,

It’s been a good week.

I spent some time reading yesterday.

It wasn’t the usual global macro or financial book, something different.

I find that I perform best when I have mental clarity.

Seems pretty obvious right?

To drown out the million-and-one things simultaneously trying to get your attention.

Most fail. Most give in. Scroll, scroll, scroll…

In a world full of distraction create an environment only you can enter. Leave your untamed thoughts at the door.

Welcome to the zone.

Anyways, the bond market has been telling us a lot about the Fed’s rate trajectory and inflation expectations, so let’s dive into how we can interpret what the front end is telling us about future rates.

Disinflation’s The New Inflation

The best way to judge the current inflation theme in the U.S.

Headline CPI is now at 3.0%, and Core CPI is below 5.0% and slowly declining. This is an environment known as disinflation, where the pace at which goods and services are increasing slows down. Take note, this is different from deflation where the cost of goods and services declines.

The Minneapolis Fed have a market-based probability tool which shows the probability of things such as:

the probability of CPI above 3% over the next 5 years

the probability of a 3% or greater increase in the SPX (S&P500) over the next 12 months

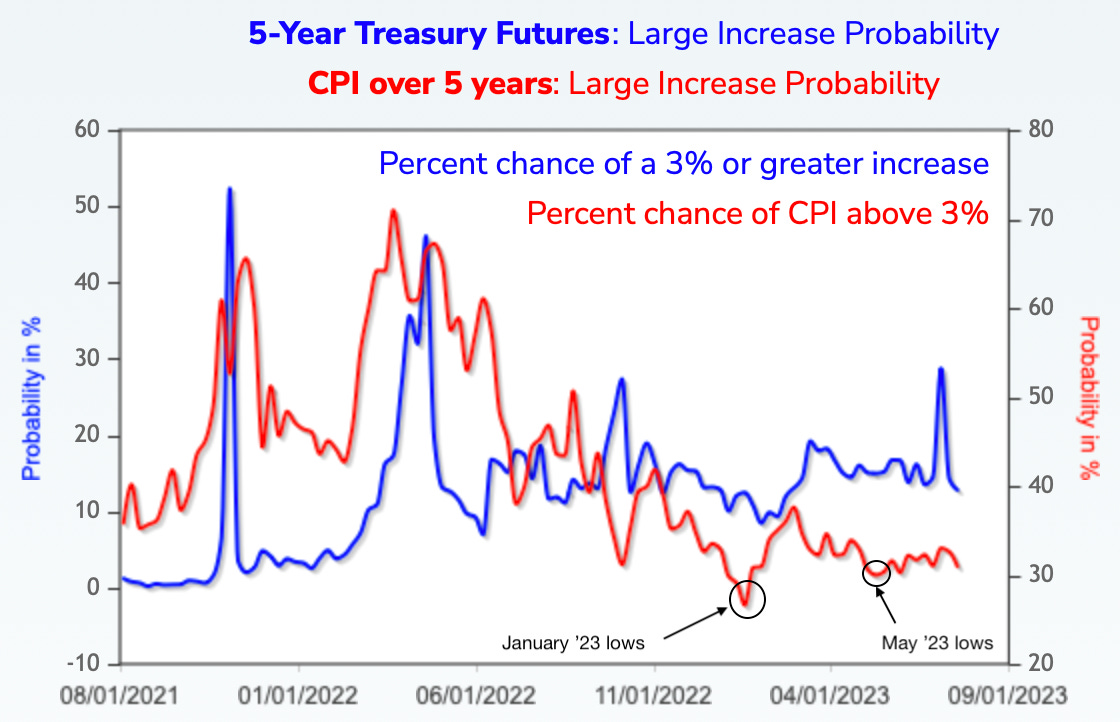

For this purpose, I’d like us to look at the probability of CPI peaking above 3% over the next 5 years and the probability of a large increase in 5-year Treasury Futures.

The blue line represents 5-year treasury futures with the scale on the LHS, whilst the red line represents the chance of CPI above 3%. Just focusing on CPI over 5 years (line in red), you can see that we are gradually moving towards lows last seen in May ‘23 with all-time lows on the chart being January ‘23.

So currently as we stand, the market believes there’s a 30% chance of U.S CPI printing above 3% over the next 5 years. That’s a fairly high probability that U.S inflation will resurge in the near term.

Let’s take a look at the Fedwatch tool and the UST curve.

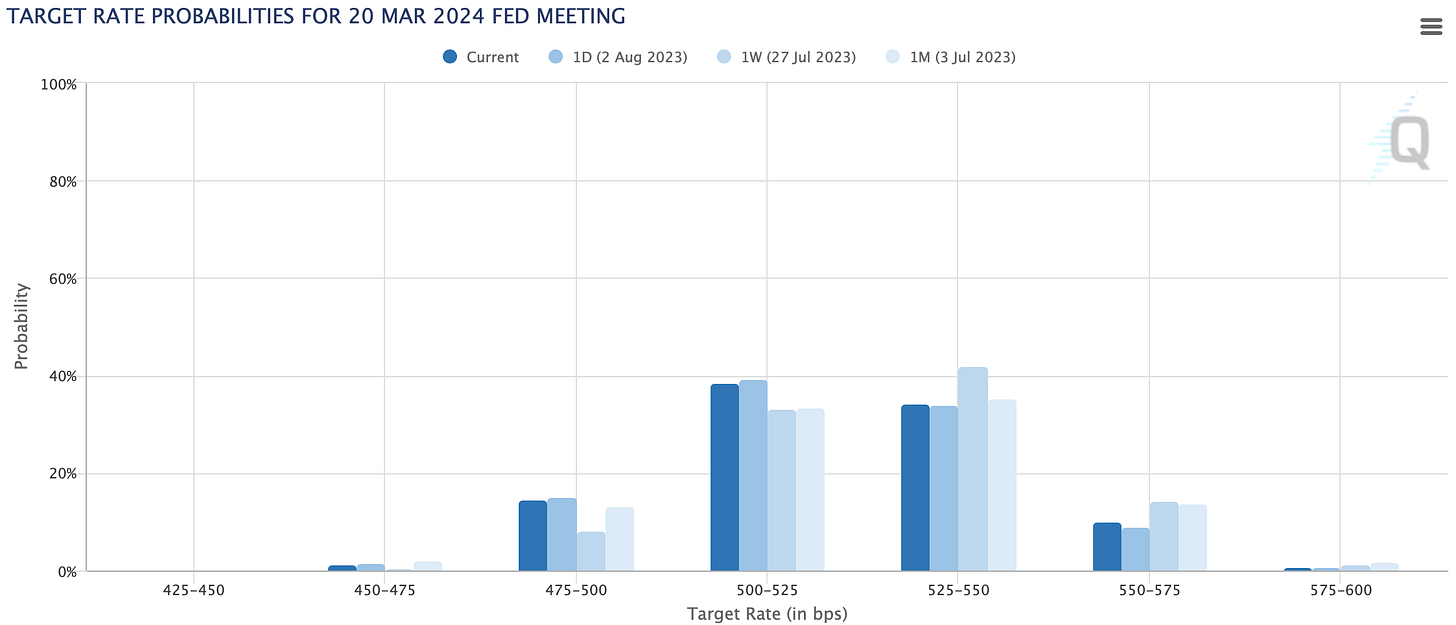

As it stands right now, the market is pricing in a 40% chance of a 25bps cut for the March 2024 meeting shown by the darkest shade of blue. As we go further into the year I expect the current reading, which would be the darkest blue, to continue rising as we see the continued effect of disinflationary pressures.

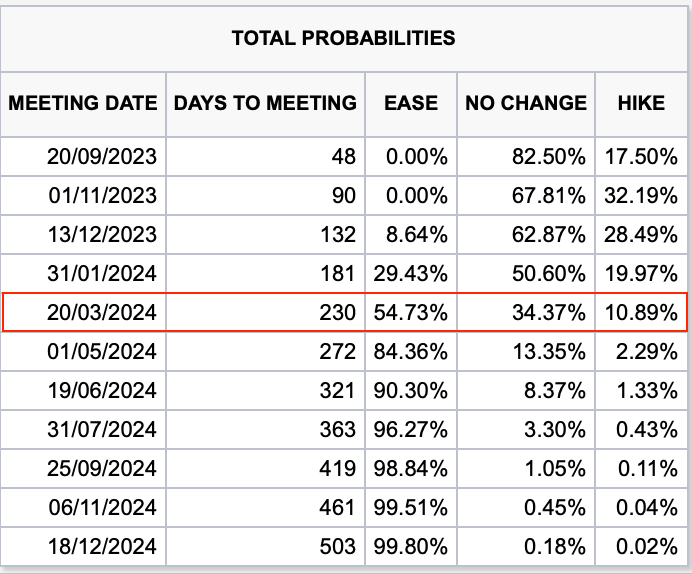

This table might be easier to show exactly what the market is expecting.

Now many traders would look at this and think this is the beginning of Fed easing, maybe even the start of QE, or think that’s when the Fed see a recession happening, but I don’t think that’s the case so let me explain.

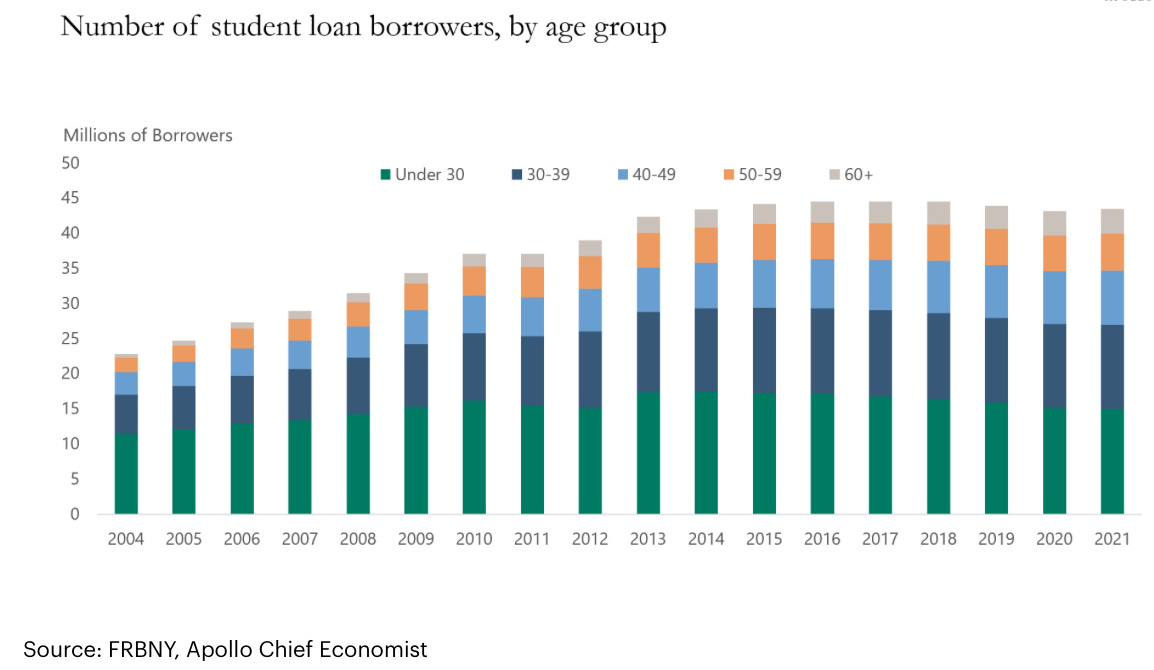

The U.S has proven its resilience throughout 2023, so much so that a soft landing is a probable scenario. We know from the recent Q2 GDP print, that real GDP is strong, 2.60%, but set to decline moderately as we go deeper into Q3 & Q4, to add on, a significant contraction in retail sales is also expected as 45 million U.S consumers who had their student loan repayments paused in 2020 by Trump will now have to continue making monthly payments of roughly $200 towards student debt.

That wipes out $9bn from consumer spending every single month. Credit to Torsten Sløk for bringing this to everyone’s attention.

Just like that, $9bn monthly or $100bn annually will be wiped away from consumer spending this coming October, which will only put additional downward pressure on retail sales and other consumer-sensitive parts of the U.S economy.

So, we can expect U.S economic data to drag into the final quarter alongside CPI. Now remember, if the Fed can avoid a recession as a whole they will do just that, so what I see the Fed doing is cutting rates to avoid the possibility of a recession whilst maintaining a sufficient level of restrictiveness within the economy to subdue any inflationary risks.

Whenever you hear of the ‘front-end’ or ‘short-end’, just know that this is about what you see right in front of you, the UST yield curve (U.S Treasury).

The front end refers to the shorter-dated maturities on the curve, so any bond with a maturity of 4-5 years or less. Looking at the yield curve the front end is elevated due to the hiking cycle, but as we begin to look out towards the medium to long end you can see how drastically rates are expected to decline in response to this hiking cycle.

So with cuts practically being priced into the market I expect we will see lower yields across the US 2Y which will allow the downward pressure on the dollar to continue mounting with lower real yields available.

4.600% on the 2Y is a structural low made in July, which we can expect to see over the coming months.

Right now, yields present both an extremely safe allocation but also positive real returns when accounting for inflation, especially across the front end!

The question is always where are we headed, I can’t say we’re headed for merrier times within markets hence why my view for equities and other risk assets would be that they’ll start to lose steam in their performance and drag due to the lagging effect this tightening cycle has on financial markets.

The future expected Fed Funds rate tells us one thing, the Fed will cut from 2024, but it won’t be the massive easing cycle everyone expects unless something within the economy does break.

4.00% rates by December 2024 is still significantly tight, yes, that’s a 150bps cut from where we are, but once again still restrictive enough for both the private sector and the public sector.

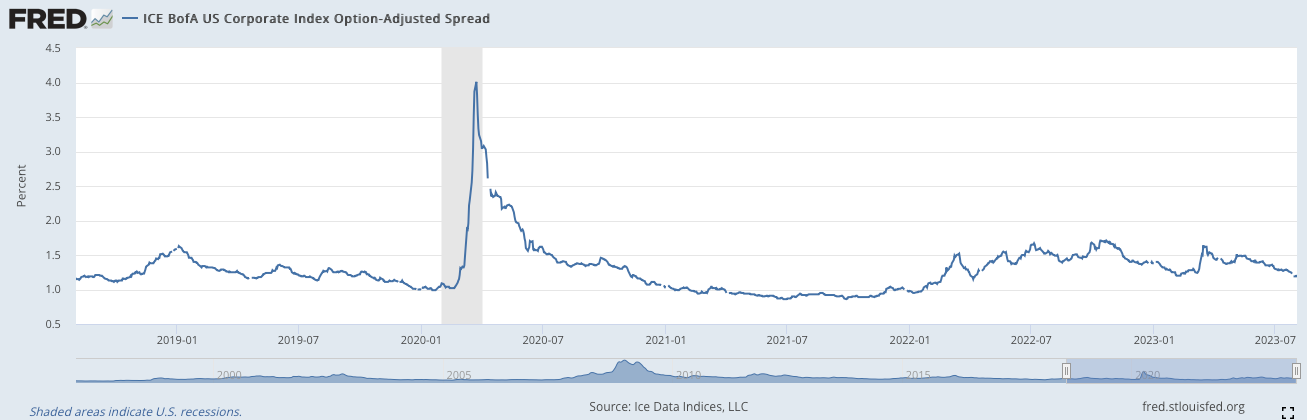

Once again just looking at the private sector you have corporations and households/individuals

As you can see conditions for corporations are slightly elevated but I believe to really put the inflation tale to bed further restrictiveness for corporates would seal the deal.

That’s a wrap for today everyone.

I felt it was important to touch upon the bond market and the probabilities markets have set out for the Fed Funds rate moving forward.

The next MMHPro live webinar is in the works.

I’ll update you, but as a request, I’d like to hear when you’d like the next one in the comments!

Until next time

Weekly zooms on a Tuesday would be great