Decoding Jay Powell.

Unraveling the Fed's Pivot, Market Reactions, and the Art of Analysing Central Bank Speeches

Hey crew,

It’s been one heck of a workflow the past 48hrs.

Jay Powell set off fireworks at his FOMC press conference on Wednesday so we will be reviewing the extent of his dovish tonality, the market’s reaction and future expectations and how to decipher dovish from hawkish speeches.

The Fed Pivot Delivered.

Wednesday marked the widely anticipated Fed pivot, Jay Powell and the FOMC held rates at 5.50%, in continuation of QT, but delivered a message which sent asset markets spiralling.

After a thorough examination of the press conference transcript and the SEP paper, it is evident that the Fed has undergone a significant shift in its stance. Instead of prioritizing concerns about persistent inflation and potential risks, the Fed now prioritizes avoiding falling behind the curve and "overdoing" policy tightening.

There was one sentence which stuck out on page one from Powell:

“We will make decisions about the extent of any additional policy firming and how long policy will remain restrictive based on the totality of incoming data”

Chair Powell

The word “any” in this context signifies that the Fed has acknowledged that this is the end of the tightening cycle, and that “any additional policy firming” would only be considered in response to unforeseen economic developments. This marked a departure from previous opening statements by Chair Jay Powell, who had avoided making such a definitive statement. The inclusion of the phrase 'any additional policy firming' further reinforces the market's expectations of the Fed having reached its terminal rates.

How to differentiate the tone of CB speeches

Decoding Jay Powell's press conferences, particularly his language and choice of words, is crucial for understanding the Federal Reserve's monetary policy stance. The quote from Jay Powell made its first appearance in Wednesday’s FOMC press conference. In previous press conferences, such as the November 1st FOMC meeting, Jay Powell's tone was relatively neutral and data-dependent, emphasising the uncertainties in the economy rather than signalling a clear path for future rate cuts or hikes. Here’s an extract from the November press conference to illustrate this neutral tone.

The frequency of specific words used by Fed Chair Jay Powell can provide valuable insights into the central bank's stance on monetary policy. In the November 1st FOMC press conference, the word 'uncertainty' was mentioned five times, while the word 'monitor' or 'monitoring' appeared five times as well. In contrast, the December FOMC transcript only contained one occurrence of 'uncertainty' and one mention of 'monitor' or 'monitoring.

These changes in word usage suggest a shift towards a more dovish approach from the Fed, evident in the language of the opening remarks by Chair Powell.

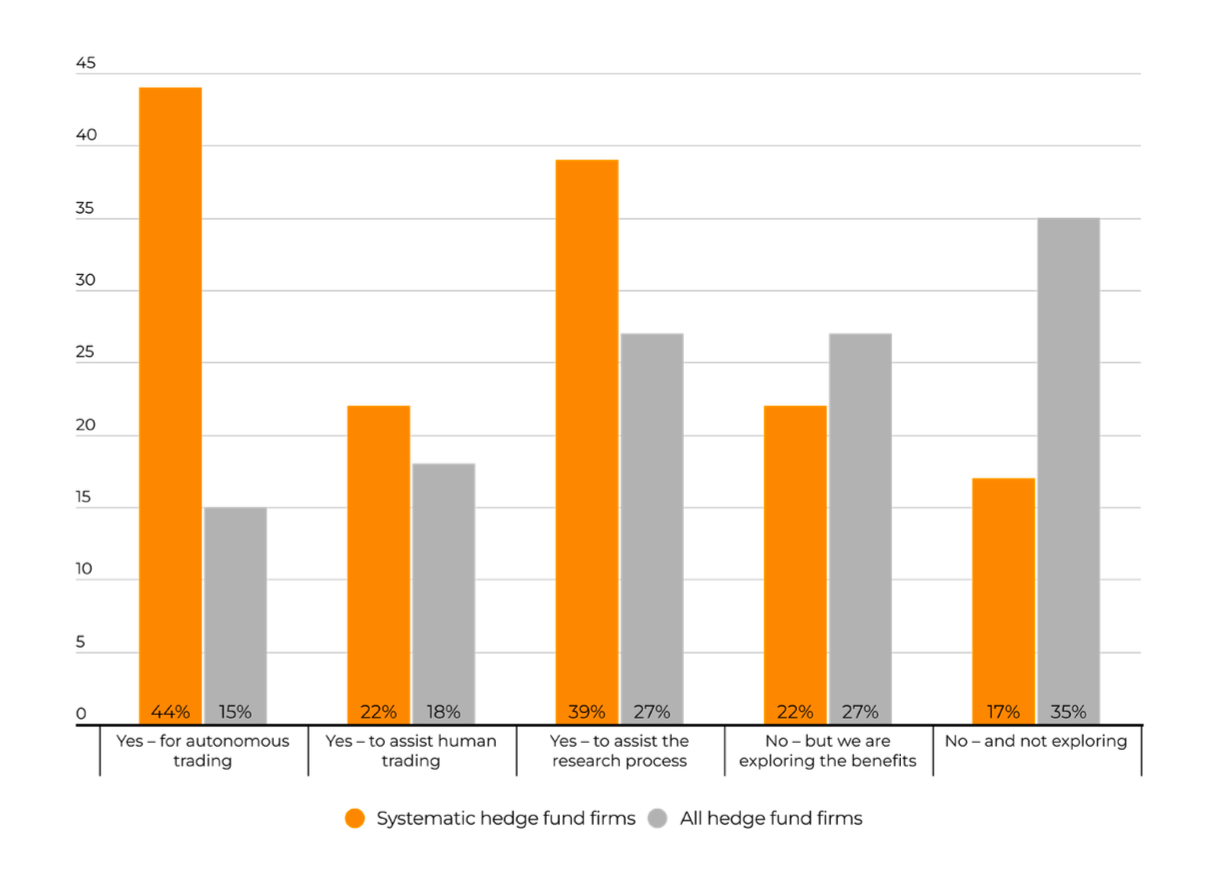

Hedge funds leverage the use of AI to quickly review and compare statements as well as analyse more signals deeper than the central banker’s choice of words to accurately decide investment implications.

Systematic hedge funds as you may know are a type of hedge fund that employs quantitative trading strategies to make investment decisions. Some of the large hedge funds we all know fall under this systematic/quantitative strategy, Man group’s AHL division run by Tim Wong, Ken Griffin’s Citdael quant team and Cliff Asness’s AQR Capital management.

LLMs (Large Language Models) are used to analyse speeches and generate economic projections to turn into macro trading signals; now for the rest of us, this may not be as easy to replicate just yet so picking up trends and patterns in Jay’s language is how to best conclude the result of the outcome.

SEP projections

Powell was extremely constructive of the fact that inflation has significantly declined without the expected looseness in the labor market as previously expected by FOMC members, stating that the “frantic labour shortage” is now “behind us” which alleviates pressure that services inflation will prove sticky as the Fed aim to wind down the last mile of inflation.

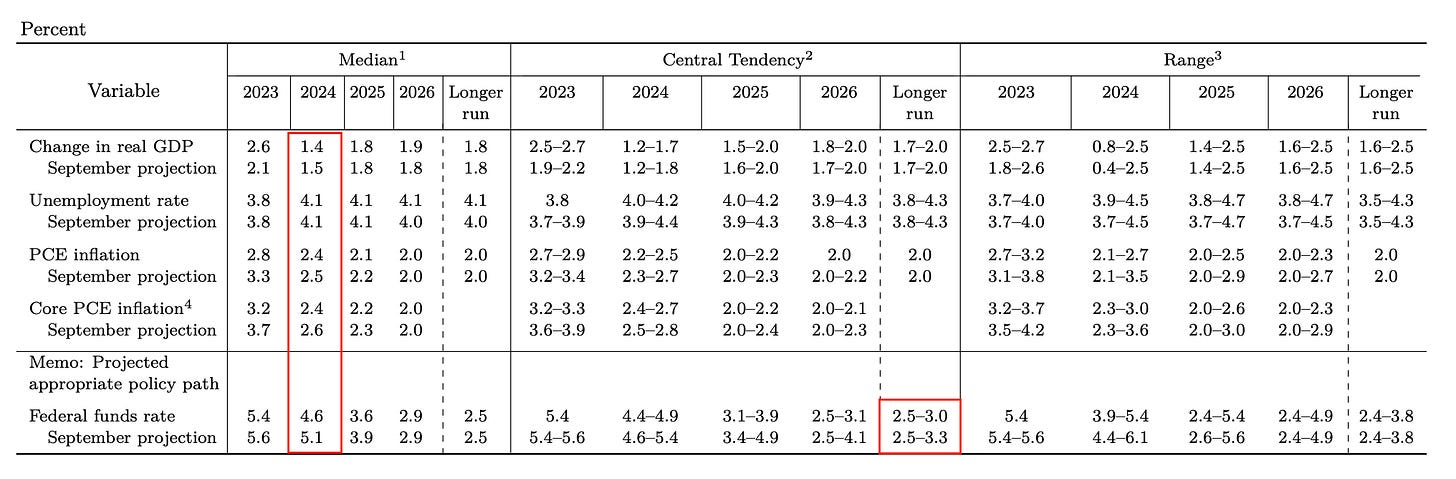

When observing the changes in the SEP projection material, the Fed has shown an uplift in expectations that core PCE will decline to 2.4% for 2024, down from the 2.6% projection in September.

A closer examination of the central tendency reveals a noticeable shift in the Fed’s longer-run, or neutral federal funds rate, which now resides within a narrower range of 2.5% to 3.0%, a significant reduction from September's 2.5% to 3.3%. This lower neutral federal funds rate underscores a notable shift in the FOMC's hawks and doves' perspectives on the interest rate level that would enable the US economy to operate at its full potential.

Market reaction

Both long-end and short-end yields exhibited a significant decline in response to the statement issued during the press conference. The 2-year yield plunged by 40 basis points (bps) in the immediate aftermath, before recouping some of its losses to settle at 4.45%. The 10-year yield also retreated by 25 bps post-press conference. On the long-end, a continued decline in yields is likely to exert downward pressure on term premiums as inflation expectations continue to moderate and converge towards the 2% target.

Rewind 1-month ago and yields across the curve were in GFC territory, +5% on both front-end and long-end yields, but have since retreated in what I expect will be a continued move throughout 2024.

In tandem with falling yields, the dollar plunged as investors shifted their focus to riskier assets in an effort to position their portfolios ahead of future gains.

Financial markets are renowned for their tendency to overreact both positively and negatively to statements and pivotal shifts like this. The increased likelihood of financial markets relaxing policy through liquidity expansion and credit growth further enhances the probability of sustained gains in equities and a broader positive performance leading up to 2024.

This was a brief snapshot of the US Press conference and a primer on identifying the tone of Fed speeches.