Dealing With Tariffs & Geopolitical Issues: Cross-Asset Macro Framework

Tensions, Tariffs and New Headwinds

Hey everyone,

This week’s note is a bit different, it’s a joint report from both of us.

We’ve been digging into the U.S. geopolitical and tariff framework, unpacking how trade policy, reshoring, and strategic supply chains are quietly reshaping the global cycle.

Let’s get into it.

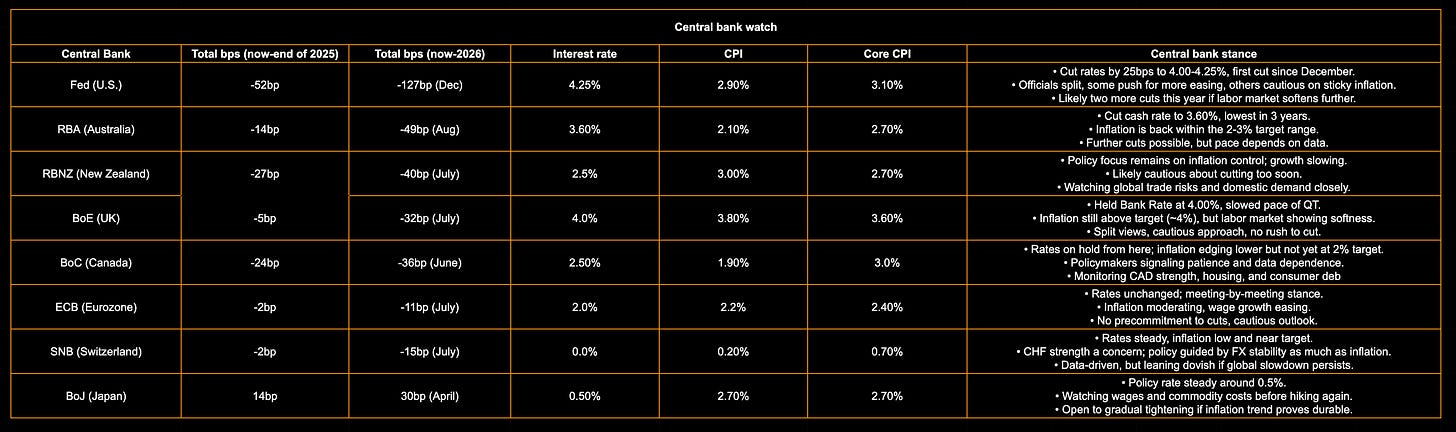

Central bank tracker

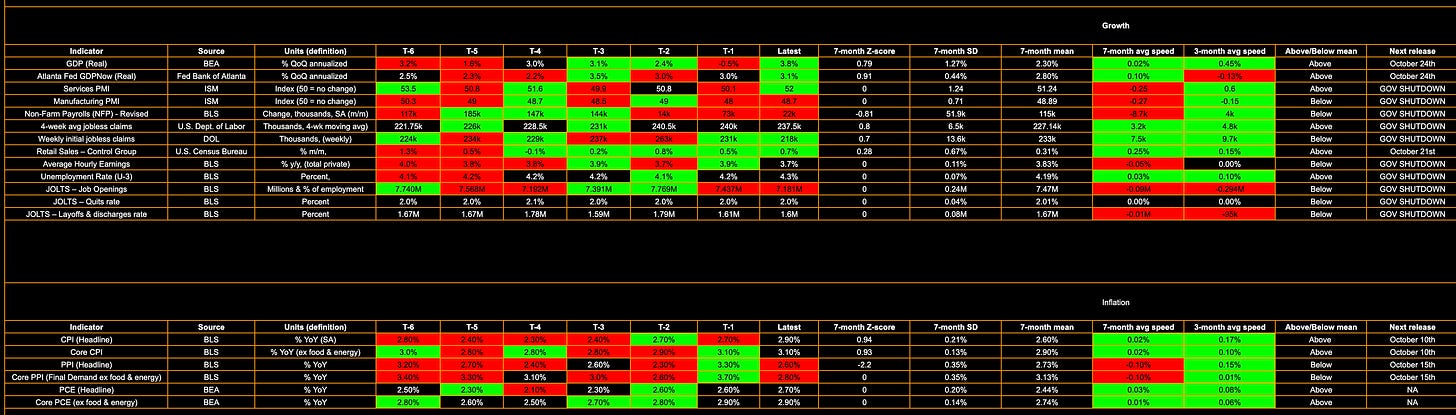

U.S. data tracker

(once again not updated due to U.S. gov shutdown)

Dealing with tariffs & geopilitical issues

We’ve spoken a lot on how inflation and growth are, and will transmit into the economy as Fed continue to allow cuts to be priced into the OIS in the face of a strong data. Risk has rallied, but recently so have bonds.

Trading rates

There’s some cause for concern if risk assets continue to sell off as they have over the past couple of weeks. Although markets have only marginally moved lower since the selloff two Fridays ago, triggered by Trump’s announcement of new tariffs on China, which reignited geopolitical fears, the price action remains fragile.

Before diving into the tailwinds ahead, it’s worth briefly touching on the recent movements in equities and bonds. Trump and Xi have set the tone for another round of trade tensions since October 10th, though these fears eased as both sides signaled a willingness to cooperate rather than escalate.

A key concern, however, will emerge if these positive trade developments persist yet markets still fail to make new ATHs, especially given that we haven’t even retraced the initial selloff yet.

Now, we pair this with the recent bid in bonds, strong moves across both the short and long ends of the curve. While bonds can rally alongside equities for brief periods, those correlations rarely last before sentiment fully shifts in favor of bonds over stocks. I don’t think we’re at that stage yet, but it’s worth watching closely.

Crucially, if ES fails to make a new ATH within the next two weeks, it could add further downside pressure to equities, especially against the backdrop of renewed tariffs and lingering geopolitical headwinds.

I want to touch on the most recent development regarding the U.S. deploying troops in Venezuela. Earlier last week, U.S. special forces conducted night operations off Venezuela’s coast, targeting what they claimed were drug smuggling vessels linked to the Maduro regime. At least one strike reportedly destroyed a boat, resulting in multiple casualties, with several survivors captured by U.S. troops, marking the first confirmed instance of U.S. forces detaining individuals in this new Caribbean campaign.

The White House maintains that the operation is part of a broader anti-narcotics mission, while Venezuela has condemned it as an illegal act and a violation of its sovereignty.

So, what if this escalates? (this is not being spoken about)

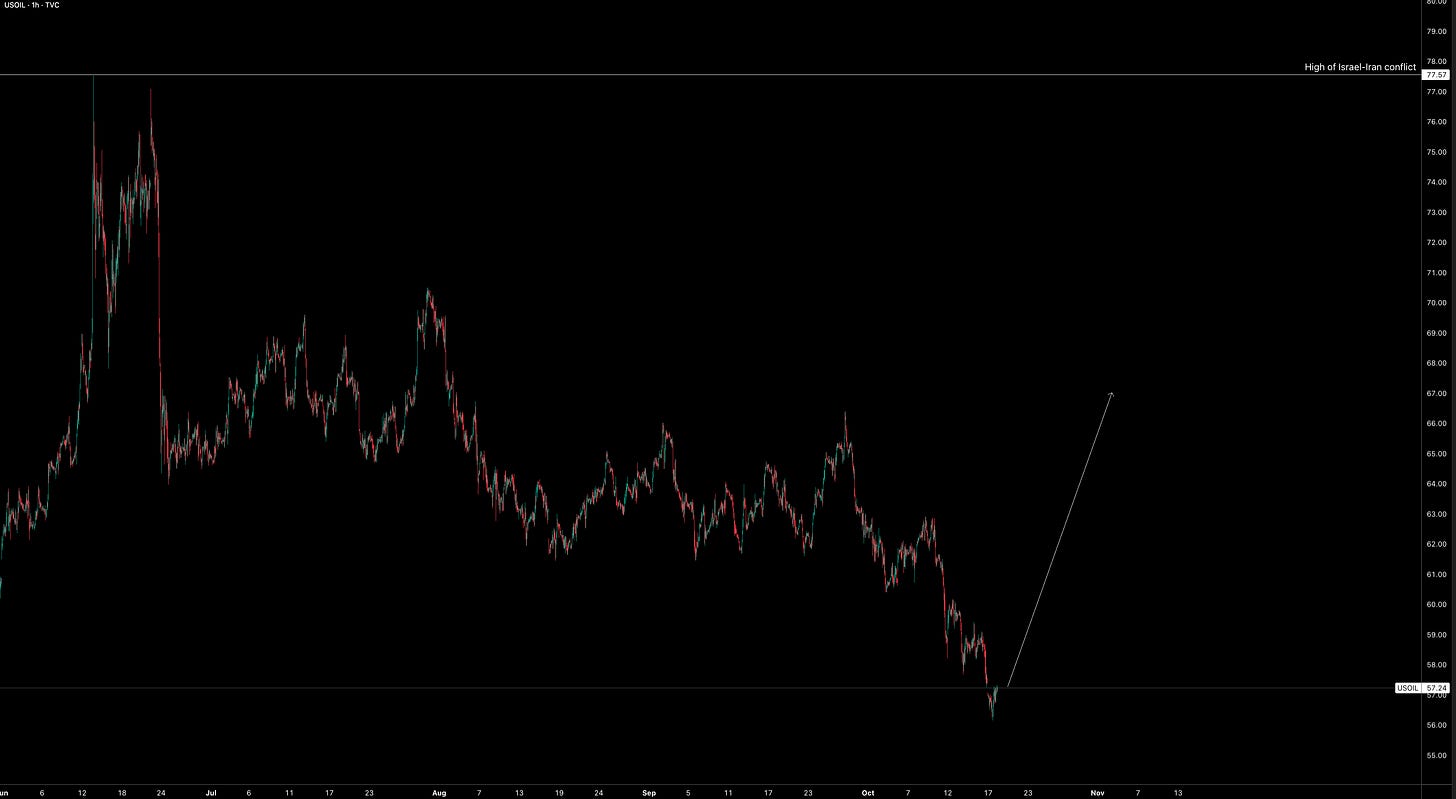

If the U.S.–Venezuela confrontation graduates from maritime strikes and covert ops to a sustained campaign, the first transmission mechanism is energy. Venezuela’s exports are mostly heavy/sour barrels so any disruption or tighter sanctions risk widens heavy vs light spreads (think Maya/WTI, Mars/WTI, WCS/WTI) and fattens U.S. Gulf Coast coker margins (how profitable it is for refinery) as refiners scramble for replacement feedstock. That typically pulls Brent and WTI higher, narrows WTI–Brent when U.S. imports tighten, and inflates diesel cracks given heavy yields. Shipping insurers would re-price Caribbean lanes, lifting freight rates and adding another premium to delivered prices. The idea here is that oil will spike hard as sanctions and disruptions come into place. Taking a look at the chart below, $67 would likely be easy to move past in oil, although I don’t think we’ll reach the highs of the Israel-Iran conflict in oil prices because Iran’s pruction is 3 million barrells per day which is 10x bigger than Venezuala. I think $67 is fair given the way oil reacts to these tyopes of tensions too.

Washington has already conducted multiple lethal strikes on vessels it links to Venezuela and green-lit CIA covert activity, evidence that this is more than signalling.

Second order effects show up in LatAm risk. An escalation is likely EM negative and USD positive. COP/BRL/MXN likely weaken on risk aversion and trade/spillover fears while the Venezuelan bolivar could gap lower on sanction/speculation headlines while EM credit would see CDS widen on fishing/energy disruptions. If the episode broadens or drags on, expect a classic risk-off rotation, U.S. duration bid, dollar firmer, gold up (it just keeps going) as a geopolitical hedge, while high beta equities (airlines, Caribbean tourism, LatAm banks) would underperform. A sharper move would come if Washington hints at land operations or if Caracas secures explicit backing from external powers (lower probability imo), both would raise the geopolitical risk premium across commodities and EM.

Politically, Caracas is already pushing the U.N. for a ruling labelling the strikes illegal. If that campaign gains traction (or civilian casualties mount) compliance and legal risk increases for traders, shippers, and banks handling Venezuelan-adjacent cargoes. That cools liquidity in the gray areas of the crude market and tightens effective supply even without a formal embargo. As I mentioned above, we’re already see that this rally in bonds is beginning to pressure equities as we fail to make new ATHs. If these tensions escalates and there’s further demand then I’d say that equities would be neutral at best (please don’t put me in the category of bears, yet!). I’d expect the white line in the chart below (114’12) would break with ease on an escalation, but I’d be quick to fade this move as soon as tensions de-escalated because the macro regime we’re in is not supporting tp be this long on bonds. The recent moves are already overblown for an enviroment of strong growth & inflaiton in the face of rate cuts in my take. A prime position would be a shprt on bonds AFTER a de-escalation as lomg as inflation & growth data remains at leats at the levels we’ve been

For now, I’m neutral on bonds becuse of macro conditions (inflation/growth/liq) but will be monitoring movements in the U.S.-Venezuela tensions (espeically in oil and bonds). A push to $67 in oil would likely cause less of a move up in bonds (becauise of the inflationary tail-risk) but we’d still likely see the white line break with ease. For now, there’s no positons I’m actively taking as this scenario hasn’t come into play but I will update you guys when I do. We’ve had a large streak of winners from reports released (with a couple losses across Chinese equity ideas too), so be sure to keep your eyes peeled!

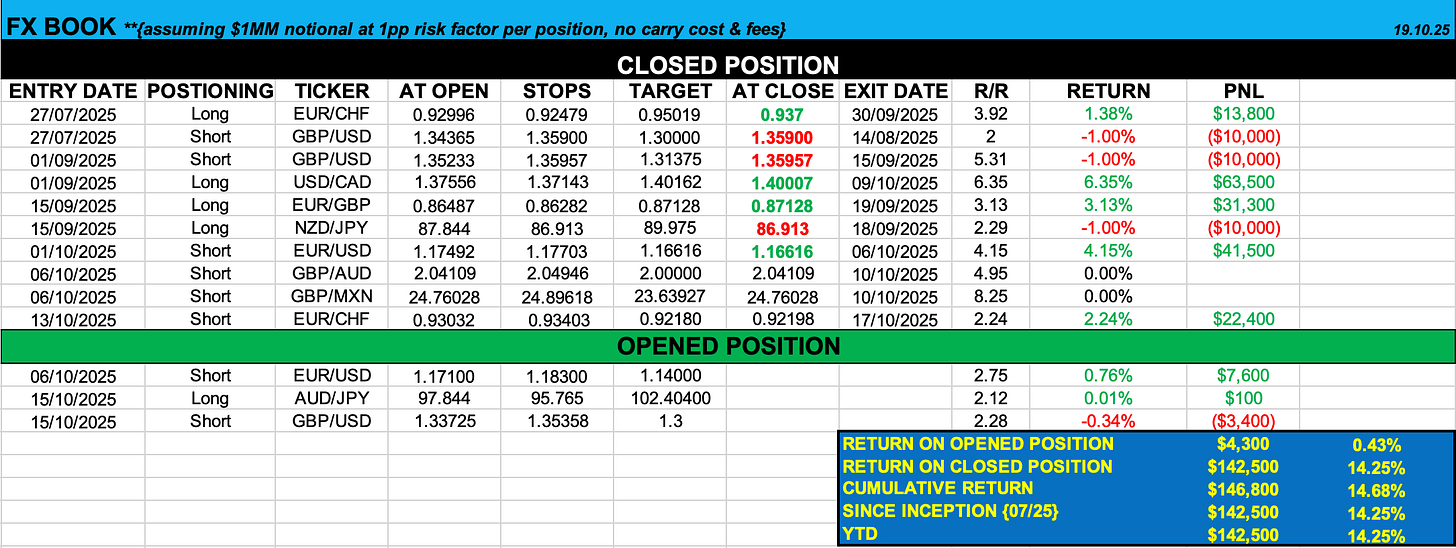

Trading FX

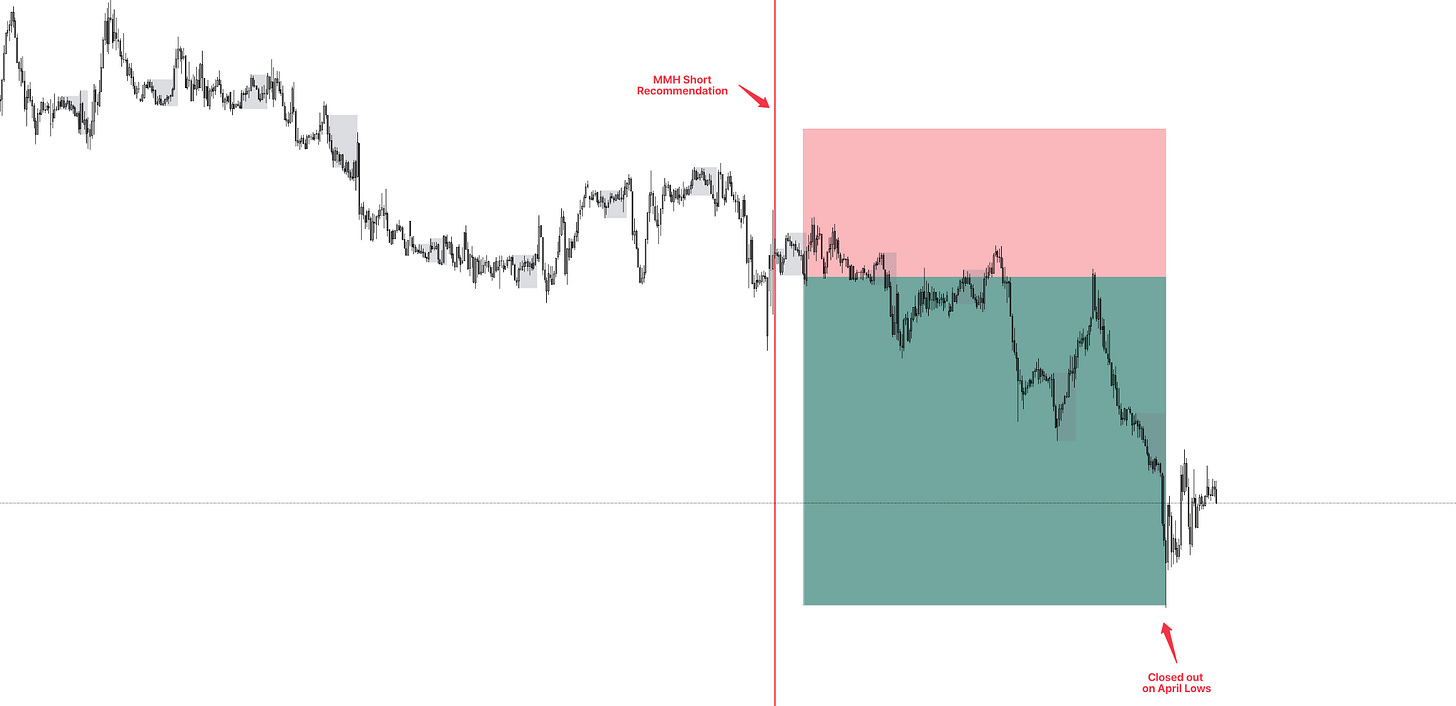

*Since Inception, {7/25}: 14.25% || YTD:14.25%

A quick brain teezer before we proceed.

What do you get when investors are partly worried about the inflationary impulse from tariffs, partly the stagflationary impulse from immigration, and the distortions of an aggressive fiscal stance unanchored by any credible austerity? Layer onto that the slow erosion of confidence in traditional safe havens as both DM and EM CBs diversify away from US and European debt?

Answer: Gold at $4.25k/oz

Translating this to ccyinese: if you are bullish on gold for the plethora of reasons mentioned, you should be buying CHF.

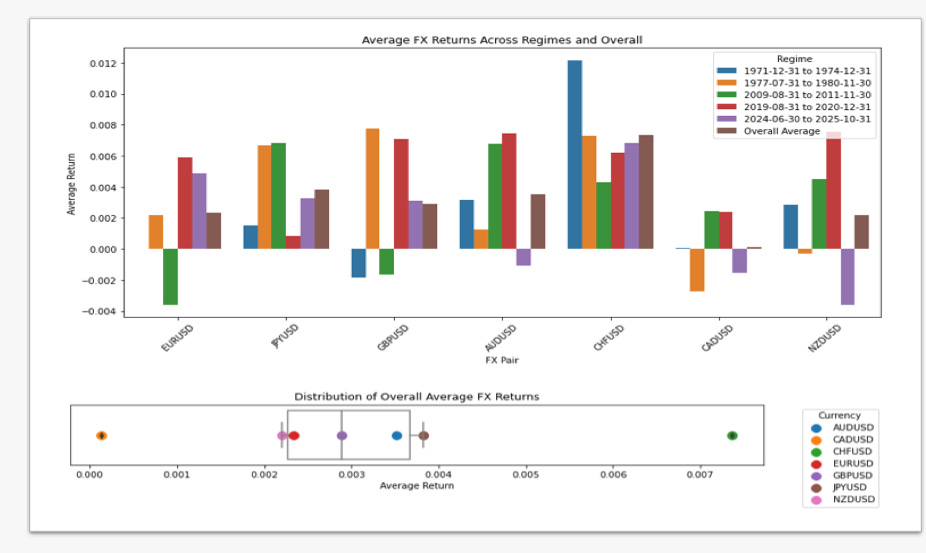

The chart above precisely points this out. During periods where gold trades parabolic, the Swiss franc has been the best performer, a relationship that speaks to the franc’s role as a quasi-gold proxy in the FX complex, benefiting from its debt profile, the lowest among its G10 peers.

Last week’s trade setup on Spot EUR/CHF

Okay, moving on…

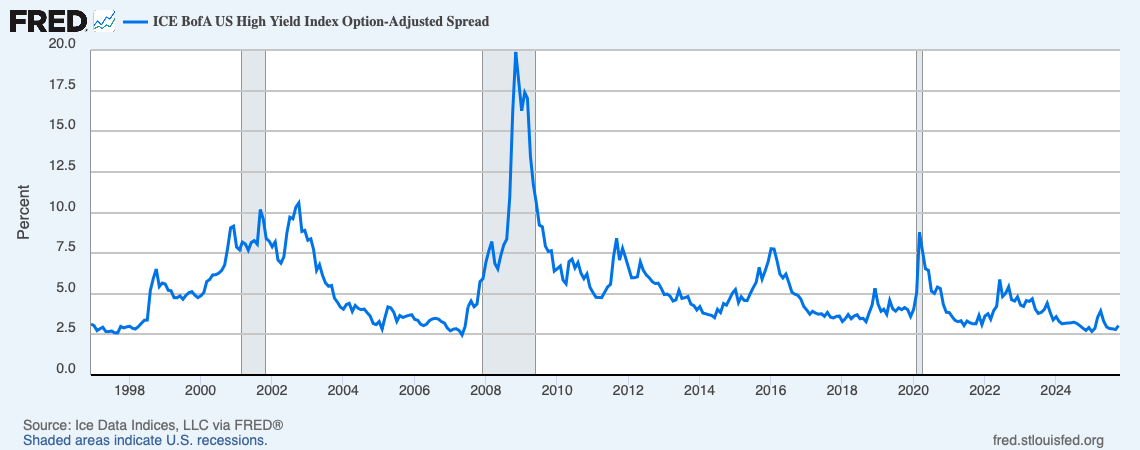

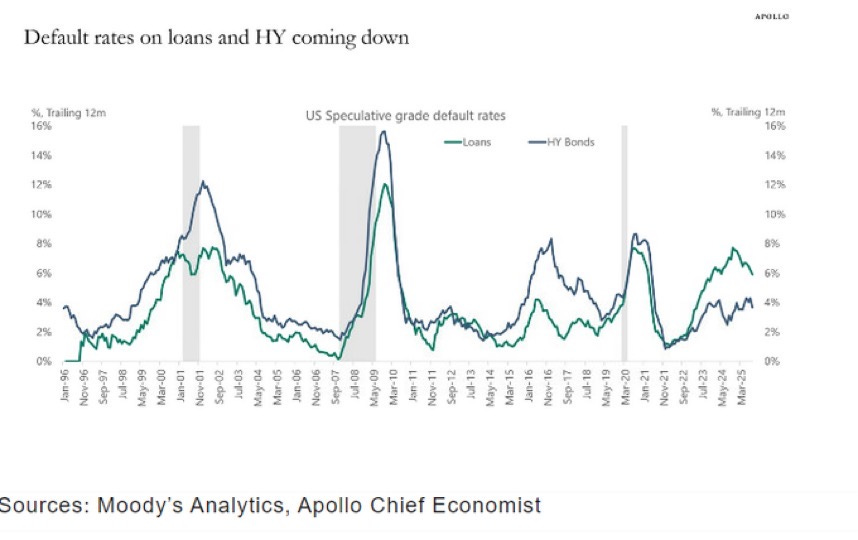

Markets are in a weird place. On one hand, regional banking stress is resurfacing just as the major financial institutions post record earnings and report stronger credit sentiment. A closer look suggests the regional turmoil is more idiosyncratic, reminiscent of the ‘23 SVB episode, rather than systemic. Several top-tier regional lenders reported solid balance sheets this past week also, reinforcing the notion that the issue lies with a few isolated names rather than the broader sector.

What credit risk?

The broader “weirdness” lies in how markets are digesting policy risk. Investors appear comfortable pricing deeper rate cuts under a JP-led committee, less under a potential Trump-led appointee come May of next year, even as concerns grow about the Fed’s institutional independence. Paradoxically, that optimism remains anchored to the Fed’s September forward guidance and aided by the low coverage of key macro data in the midst of this shutdown as we question the state of the labor market and worry less about the inflationary timeline from tariffs.

Near term downside risk vs Longer term macro normalisation

For us, it’s almost as if the market is selectively hearing what it wants to hear. The result is a form of policy schizophrenia, a market both fearful of the worst outcome unfolding and yet mirroring the front-run easing and trading its perceived benefits.

So, which is it?

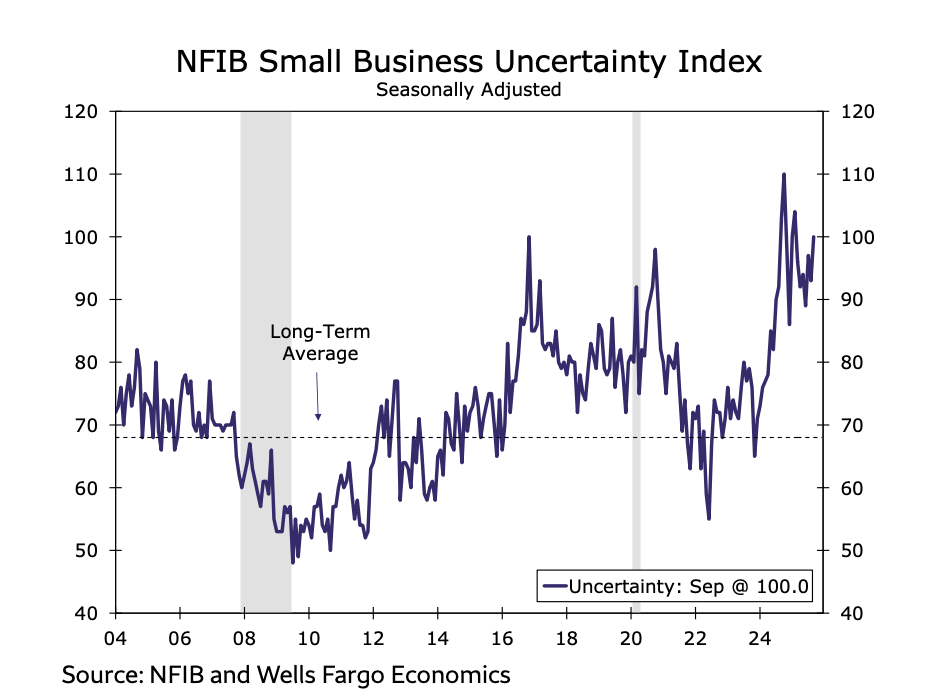

The recent price action across FX has now opened a new can of worries for markets, one that is different from past months. Markets in the past were able to conveniently price such extremes and at the same time forecast a soft landing. With the new external shocks introduced over the past few weeks, near-term growth risk looks to be the newest underpriced left tail to this baseline view.

I’ve always had a disdain for when my university professor lectured us on the Efficient Market Hypothesis. Maybe the cynicism comes from thousands of hours logged on charts or because the theory itself assumes away the very forces that make markets what they are: emotions, positioning, and liquidity. Outside having a broader scope, and maybe for chart junkies such as myself, it’s easy to spot the day-to-day price action in markets as it navigates between various narratives, overreactions, and policy distortions. Plenty of inefficiencies there, so to speak.

Scenario I

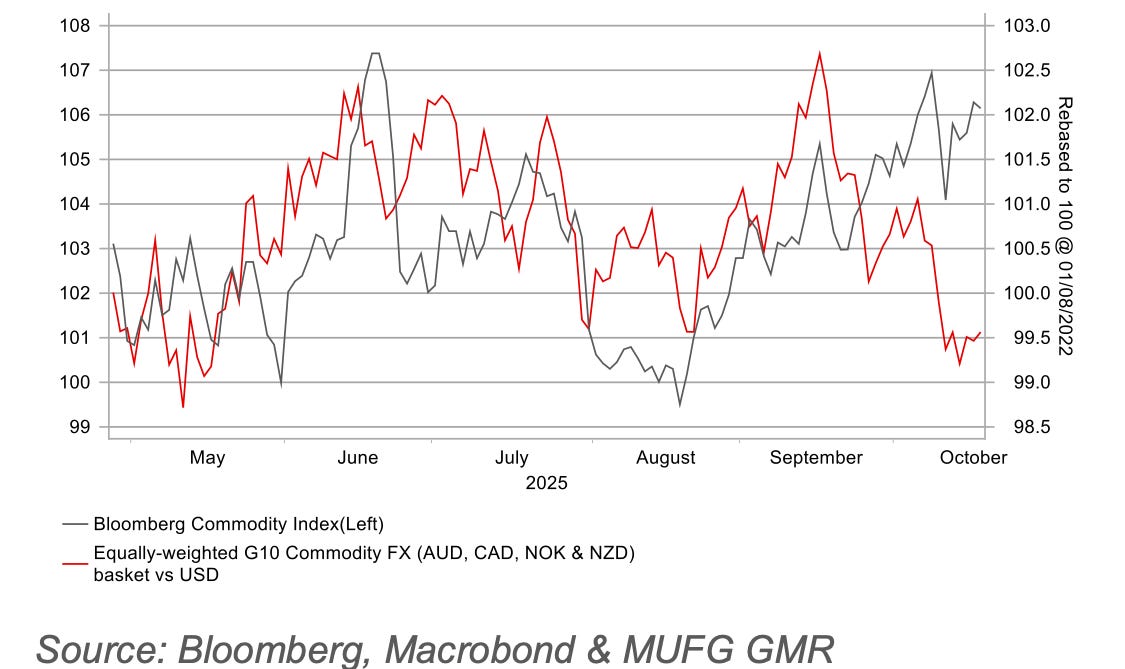

Sorry to digress. Where were we? Right, near-term risk. This was clear as day in last week’s price action: USD lost its gains against broader G10 but remained firm as the usual pro-cyclicals traded defensively against the greenback. The high yielders, alternatives, and safe havens (GBP, EUR, JPY, CHF) gained while the pro-cyclical beta (AUD, CAD, NZD) sold off.

In the near term, we believe FX will trade closely to the US/China tariff developments, feeding into that growth drag. The shutdown doesn’t help matters, although we are somewhat skeptical of how much more dovish investors can turn given the lack of data and the political charade going on elsewhere (Europe and Japan).

Keep it simple. In this scenario, own CHF, JPY. Sell AUD, CAD, and NZD. Selling commodity-linked ccy should provide some upside. Layered on top of that, the domestic macro backdrop of both antipodes has turned a bit sour. The RBA might be contested to follow suit with its neighbor RBNZ following the upside surprise in its recent employment figures last week (4.5% vs. exp. 4.3%) with -19.5 bps already priced in for the November 4th meeting. It’s unclear if this would be met with any pushback. For one, despite the UR headline miss, other metrics such as employment figures rose by 14.9k for the month, although a miss in expectations, has now turned positive compared to the previous month along side up shoot in business confidence keeping broader outlook scope optimistic as its economy still battles risk of an inflation reacceleration particularly in the services sector.

Scenario II (base case)

Against this backdrop, we continue to see asymmetric opportunities that could remain attractive if the narrative pivots back toward the underlying macro framework defining the current regime.

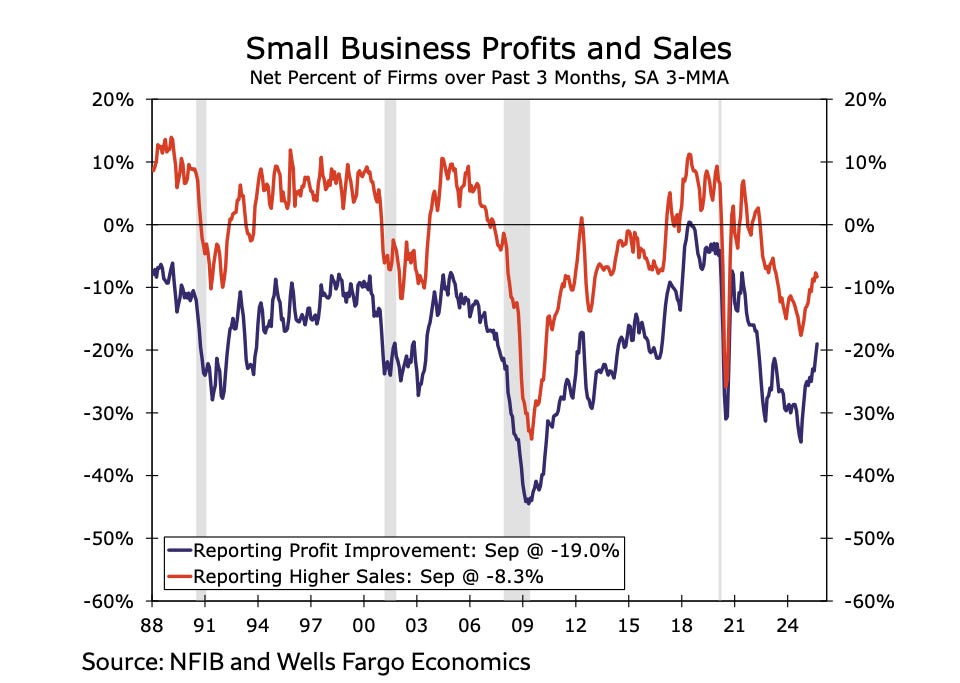

The latest Fed Beige Book painted an economy that’s mixed at worst and optimistic at best. Activity across most districts was described as “little changed,” with stable employment and resilient spending among higher-income consumers offsetting softer demand at the lower end. Wage growth has cooled, but firms remain reluctant to cut staff, suggesting labor markets are easing rather than cracking. Price pressures linger from tariffs and supply disruptions, yet not enough to reignite broad inflation fears.

It’s the same cocktail mix we saw at the start of the year. the fight between soft data survey and hard data print

The EUR staged a recovery last week. The combination of the US credit story and French PM Lecornu avoiding a vote of no confidence oust helped investors lean back on the relative IRD spread, causing EUR/USD to trade higher.

Despite the recent uptick in EUR/USD, we make an argument for limited scope for sustained upside.

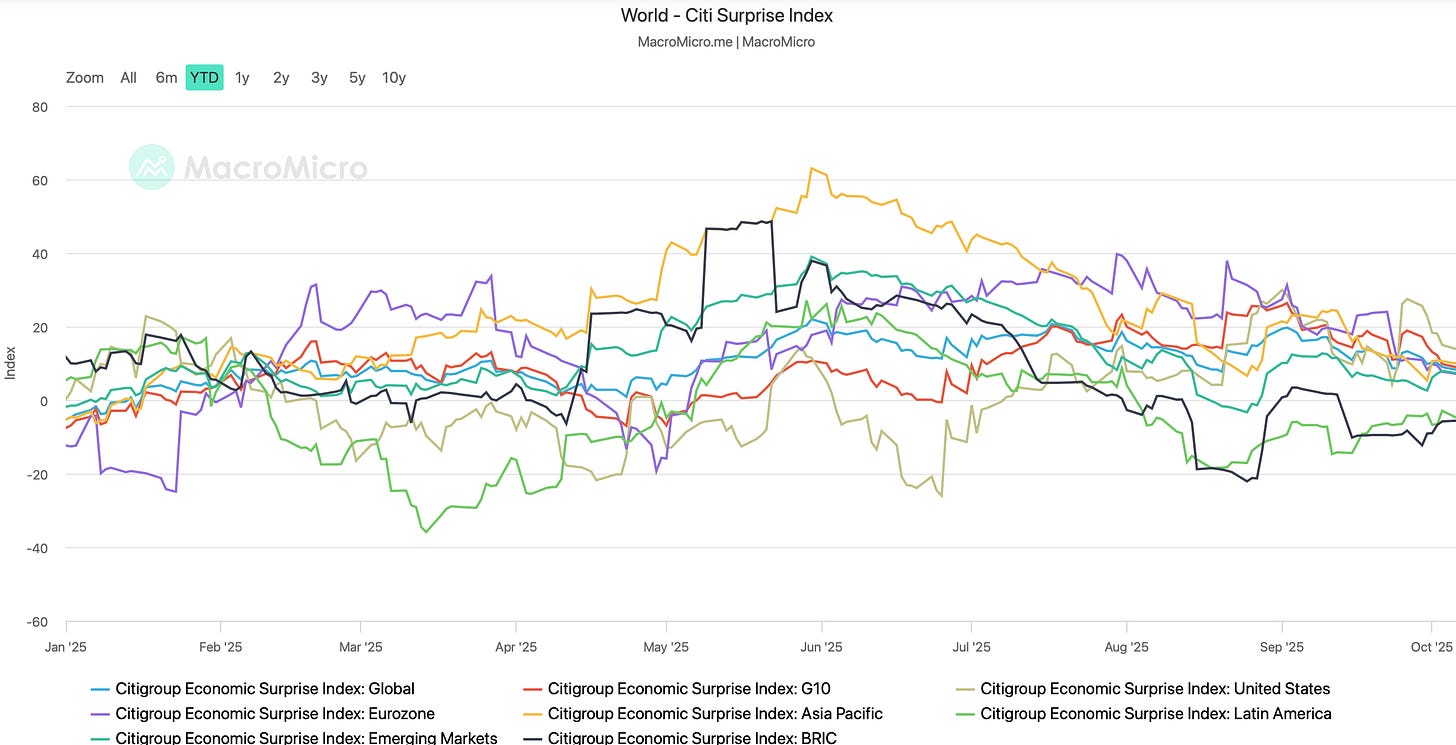

The Citi Economic Surprise Index showed that data momentum in the Eurozone has slipped decisively, edging into contractionary territory, a fate sadly suffered across the bloc and broader DM economies compared to the US, which, while softer, remains in positive surprise territory, reinforcing the view that its economy continues to outpace its peers.

The play is simple. The more time passes without clear downside risks materializing in the US, whether from the labor market or fresh shocks, the more investors are likely to unwind excessive easing expectations and shift focus back to growth resilience. In that scenario, good data becomes bad news for dovish bets: rates should reprice higher and the dollar, in turn, should strengthen.

Trade recommendation

Long EURGBP || BUY 0.86814 || SL 0.86552 || TP 0.873

Long AUDUSD || BUY 0.65 || SL 0.644 || TP 0.67

MMH!