Currency Trading Primer: Part 1

Cracking the Code of Currency Trading With a Primer

Hey guys,

I introduced our newest member of MMH just a couple of weeks ago, Emmanuel.

He has written this currency primer, which is very useful as I know many of our readers are concentrated towards FX and rates.

I’m sure he’d really appreciate some feedback so please drop some in the comments!

Without further adieu, let’s get into it!

Currency Primer Pt.1

When rate differentials aren’t offering clear signals, FX quickly becomes the most complex asset class to navigate. In today’s macro landscape riddled with trade tensions and geopolitical landmines—idiosyncratic moves causing capital flight are no longer just noise; they’re central to the game.

Unlike equities, which can sometimes be propped up by inflated sentiment, FX is still the market's sharpest diagnostic tool for global stress. That’s not opinion—it’s fact.

This report is designed to shine a light on the most liquid market in the world, breaking down the core macro drivers into executable trade ideas. Whether you’re just getting started or already deep in the weeds, there’s something here for you, clear enough for beginners, but packed with the nuance professionals will appreciate.

POV—FX Market

Rate Differentials: Relative Return vs. Relative Credibility

Perceived strength in a country’s macroeconomic trajectory relative to others sets the baseline for yield expectations — or more precisely, how markets interpret those expectations. In this context, interest rate differentials matter, but even more so, it’s the forward-adjusted yield, derived from key indicators like inflation and growth forecast, that anchors FX movements.

This is responsible for trends across FX, centred around the question ‘where can investors earn higher‘

When one central bank is hiking to fight inflation while another is cutting rates due to slowing growth, monetary policy divergence emerges. Naturally, hot money flows toward higher-yielding assets

But it’s not as simple as “Fed hikes, BoE cuts, buy USD, short GBP.”

In reality, the FX market prices in anticipated yield spreads, primarily through instruments like STIRs and the OIS curve, which encapsulate not just current rates, but forward-looking views on policy, economic health, and central bank credibility. These tools reflect how markets digest macro data and guidance from policymakers

Currently markets see a reduction in the EFFR by 1.00% at the end of 2025, so despite rates currently at 4.33% the dollar has declined c10.% (now c.-8%) YTD.

This is FX so by definition, it's a relative game. Every position is a stance on two economies. When you go long a currency pair, you're not just betting on one country’s strength — you’re betting on its outperformance versus another.

So yeah, you might be bearish on the dollar in isolation. But if you're pairing it against a currency facing even bigger headwinds, USD might still be the better buy. That’s the nuance. FX isn’t about absolute views, it’s about who looks less fragile in a shaky world.

Take the Nigerian Naira (NGN) as a case in point. The Monetary Policy Rate (MPR) in Nigeria sits at a hefty 27.5%, while the U.S. Federal Reserve is at 4.33%. Yet, despite the massive rate differential, the USD/NGN has surged by 250% over the past two years. So, what’s going on here?

It’s not just about yields. It’s about structural shifts — the type of policy changes that can flip the script entirely. The Central Bank of Nigeria (CBN) has been making moves, like unifying multiple exchange rate windows into a single rate, and even taking steps toward a free-floating currency (more on this nuance later). This kind of shift shows that when structural changes come into play, they can completely overshadow traditional rate-based expectations.

My point: hot money doesn’t just chase yields but also capital preservation. That means

• Macro stability

• Policy clarity

• Credible institutions (especially the central bank)

• Most importantly, positive real yields (inflation-adjusted)

Therefore, yields of 27.5% mean nothing if real is negative.

Real Yields = Nominal Interest Rate - Inflation

Real Yields = 27.5% - 32.5%

Total Real Yield = (5.0%) or -5.0%

Now, here’s a side note — the inflation figures underpinning that rate narrative are from December, before Nigeria rolled out its updated approach to calculating CPI. The country recently rebased its inflation methodology, shifting the reference year from 2009 to 2024. That matters — a lot.

Why? In FX, perception drives positioning and blurred signals and political compromise like this make it harder to commit capital with conviction.

Honourable mentions, you can’t talk about currency instability without tipping your hat to the familiar names, Turkey and Argentina. Both serve as textbook cases of what happens when central bank independence gets compromised. Think erratic policy, politically driven rate moves, and in Argentina’s case, full-blown sovereign default. It’s a masterclass in how not to anchor a currency. And this isn’t just an emerging markets story.

Even in the U.S., when the Trump administration flirted with challenging the Fed’s autonomy and amplifying trade wars, we saw pressure build on capital outflows — a subtle, but telling, warning shot at the dollar’s reserve status. Markets may tolerate volatility, but they punish coercion. Always have.

So I hope you understand the picture by now, the quality of policy execution, governance and longer-term macro credibility also play a role in FX.

Anyways, let’s move on…

Market Theme—The Flagship of the Carry

This right here is the heartbeat of foreign exchange. The strategy that gives interest rate differentials (IDRs) their punch. At its core, it’s as straightforward as it gets: borrow (go short) in a low-yielding currency, and invest (go long) in one offering a higher return.

In essence, you’re capturing the “carry” — earning the spread between the two rates.

Carry began to regain serious momentum in early 2022 right as major economies werecrawling out of the post-pandemic slump but found themselves grappling with an inflation hangover. That sparked a global hiking cycle across much of the G4… well, except Japan. The BoJ held the line, and the yen underwent what was effectively a structural devaluation — though unpacking that deserves its own deep dive.

Naturally, rate divergence became the playground. Enter the classic “yen carry.” With Japan sticking near-zero rates, traders turned the yen into the go-to funding currency, using it to finance positions in higher-yielding G4 assets. Some even reached further afield — LATAM currencies, with their historically embedded inflation premiums, offered even juicier returns. More risk, more reward.

Carry Trade Yield = MXN 10Y note - JPY 10Y note

Carry Trade Yield = 1125Bps - 50Bps

Total Carry = 1075Bps / 10.75%

As the example above shows, take something like converting JPY to MXN, you’re borrowing in Yen and parking that capital in Peso notes. That nets you a yield spread of roughly 10.75%. Adding to that when the MXN/JPY pair stays stable… or better yet, appreciates c.70%.

In that case, you’re stacking gains on two fronts: the interest rate differential and the currency move. More yen weakness? Even more upside. That’s the essence of a well-executed carry trade, when macro alignment turns yield into capital appreciation.

However, with every strategy comes its inherent risk, as this one is no different.

The carry trade thrives in calm seas. It’s a bet on low volatility, policy stability, and predictable flows. But when the macro tide turns, those calm seas get choppy, fast. Risk-off regimes hit high-yielders hardest. EM currencies get dumped, capital races back into havens like U.S. Treasuries, JPY & CHF and if positioning is crowded, the unwind is brutal.

To summarise, when VIX pops the Carry drops

Equity investors aren’t exempt from currency risk. Consider a UK-based investor seeking exposure in Japanese equities, this requires converting GBP to JPY, effectively going long the yen. While the return profile on Japanese equities might look compelling, the FX leg quietly becomes a key driver of realized performance.

Understanding central bank rate direction trajectory and forward guidance is also important.

For instance, the BoJ historic pivot away from yield curve control and negative interest rates in 2024 caught many off guard. Investors who were long Japanese assets but unhedged on currency saw potential equity gains wiped out by a strengthening yen when converting back to GBP. Contrast this with the beginning of the hiking cycle in 2022.

At that time, the yen was weak, and hedging currency risk against the expected rate hikes from the BoE would have led to a much more favourable outcome. The same investment scenario, but with hedging in place, would have resulted in greater returns when converting back to GBP, thanks to the positive impact of a falling yen.

This is where a bit forward pricing complicates the math. To hedge FX risk, investors use forward contracts. But those aren’t priced at spot, they're set by IDR's.

Refresher: Forwards are agreements to exchange one currency for another at a predetermined future data and exchange rate.

Investors chasing high-growth equities in countries like Brazil, where local interest rates sit in double digits, face forward curves that make FX hedging prohibitively expensive. Either they accept the currency volatility, or they give up much of the upside to mitigate it. This puts carry traders at a crossroads: either accept the FX risk and run the position unhedged, or hedge and give up the rate advantage. In either case, the myth of “risk-free yield” disappears fast once you factor in cross-asset dynamics and forward pricing realities.

Developing a Macro Framework and Possible Trade Setup on EURUSD

Macro Regime

• Europe—modest growth, accommodative CB

• United State—decelerating growth, restrictive CB

OIS Curve Year End

• Fed -100bps priced—Current rate 4.25

• ECB -64 bps priced—Current rate 2.25%

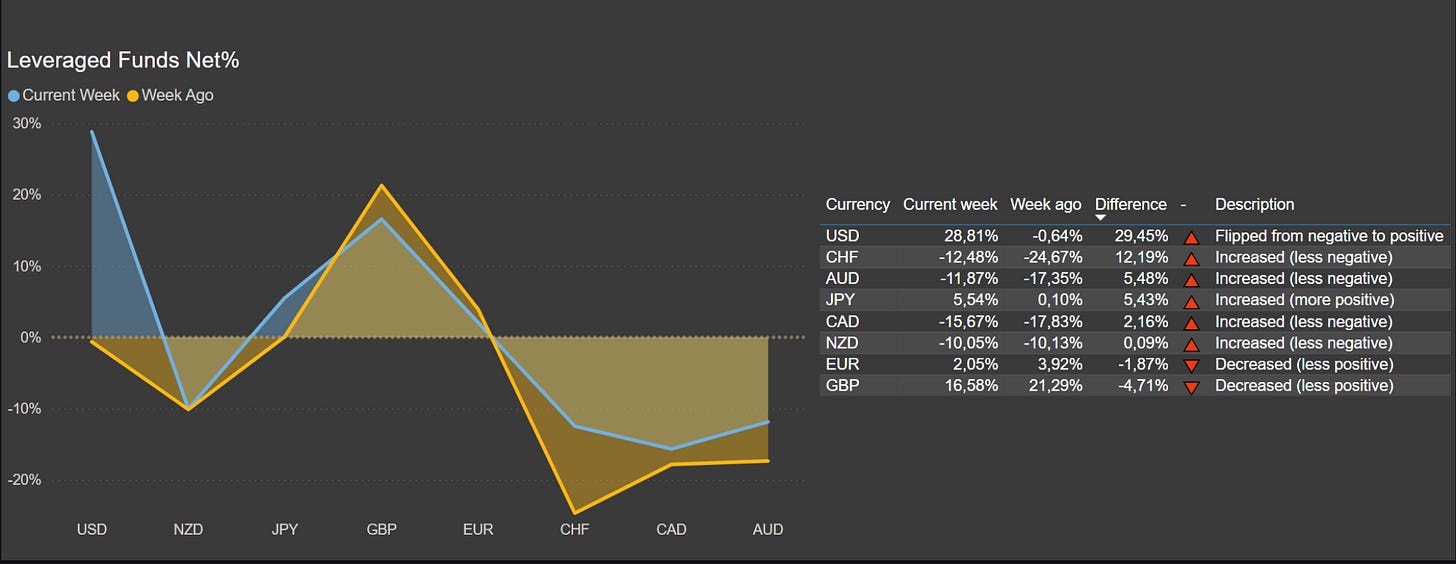

COT Positioning

Recent CFTC data underscores how leveraged funds are positioning amid ongoing trade policy volatility. While overall sentiment remains cautious, allocation has turned more tactical. Focus remains on the EUR and USD: the Greenback has regained momentum, buoyed by unwinding trade tensions following the 90-day pause.

Meanwhile, flows into the Euro previously driven by its role as an alternative reserve have moderated, with allocators trimming exposure after a strong run and weighing possibility of negative growth impact if tariff persist.

Tracking Event Risk

Growth & Inflation — US GDP contracted -0.3% this quarter, down from 2.4%, while core PCE surprised to the upside at 3.5% y/y (prev. 2.6% y/y). The narrative? Growth cooling, inflation heating and this is pre-tariff. Across the euro bloc, GDP prints from France, Germany, and Spain held steady, with the euro area posting a modest beat at 0.4% vs. 0.2% consensus.

Fiscal — A stark policy divergence is emerging. Europe kicked off the year with a clear pivot toward fiscal expansion, channelling capital into AI, infrastructure, and defence. Contrast that with the US, where austerity signs, partly driven by DOGE-linked drag, have started biting in federal job cuts and a visible pullback in government spend, however can’t rule out the impact of potential tax cuts.

Positioning Bias

Long Bias

• The Euro Area continues to outperform on a relative basis.

• In the U.S., current sentiment is shifting to hard data, with tariffs and trade tension amplifying stagflation concerns.

Short Bias• Long consensus is crowded. Expectations are stretched—any walk-back on tariffs or a trade resolution could trigger a sharp unwind and repricing in rates markets.

• U.S. labour data remains resilient, and GDP (ex-inventory) holds modest strength.

• A stronger EUR beginning to weigh on GDP, dampening export competitiveness.

That is a wrap for this week!

Great primer, thanks!