Currency Projections 2024

Highlighting the trends in G7 FX volatility and my FX projections for 2024.

Hey crew,

This report had me banging my head against the wall trying to word my views, we got there in the end ;)

This report will be focused on taking a macro viewpoint on the USD, EUR & JPY detailing my projections with the backing of macroeconomic data.

This report is longer than usual, so take your time going through it.

As always, enjoy:

A Year In Review

In 2023, G7 FX experienced subdued volatility for the most part, with the notable exception of the banking crisis in March, which triggered a sharp spike in volatility across all asset markets. Before delving into the factors underpinning 2023's muted volatility, it’s crucial to understand the key drivers of forex market volatility.

Volatility in Currency Markets

Volatility in FX, like in any other market, is never a good thing, as elevated uncertainty dampens liquidity and increases trading costs, especially for businesses aiming to hedge their FX exposure. Energy companies in Japan, with their substantial reliance on energy imports from the Middle East, are a prime example of this dynamic. Due to the Middle East's dominance in supplying Japan with over 90% of its crude oil, energy companies were confronted with dual headwinds in 2022: soaring energy prices and a yen that depreciated by over 30% over 12 months. This currency depreciation significantly compounded the difficulty of hedging their FX exposure.

Not just companies, but investors too, face the challenge of managing currency exposure. When investing abroad there’s an element of currency risk, which means that elevated FX volatility can impact the return profile of investments, potentially deterring investors from investing in such economies. Moreover, excessive FX volatility can often lead to financial instability and widespread panic.

The Asian financial crisis of 1997 provides a clear example of the consequences of heightened currency volatility under a pegged exchange rate. Many Southeast Asian countries had maintained a fixed exchange rate against the US dollar, which compelled their central banks to align their monetary policies with those of the US Federal Reserve. When the US Federal Reserve raised interest rates in 1997, it triggered a series of events that destabilized the region's economies sending them into a financial crisis.

FX Volatility in 2023

JP Morgan developed the JP Morgan G7 Volatility Index, a broad-based measure of implied volatility for the G7 currencies, this index tells us a lot about the rate of volatility in currency markets right now. For those unfamiliar with the term, implied volatility is a measure of the market’s expectation of future price fluctuations.

From Figure 1 volatility across G7 FX has steadily declined just below the 8% level over 2023. Coming into 2023, the G7 volatility index was elevated, sitting at 11%. Events such as the global central bank tightening cycle, escalation of the war between Russia-Ukraine, with risks of additional interference from Western powers, and rising concern over the stability of the banking sector sent the volatility index back above 11%, but since the banking turmoil volatility has been suppressed. However, the onset of war in the Middle East presents a scenario where volatility could return if the war pulls in neighbouring countries across the Middle East.

Currency Outlook

The Dollar.

House view: Short

In my previous report I noticed my viewpoint on the dollar was rather unclear, and lacking depth, so here’s my outlook for the dollar in the year 2024.

From a macro perspective, the dollar is projected to have another year of economic outperformance when compared to its G7 counterparts.

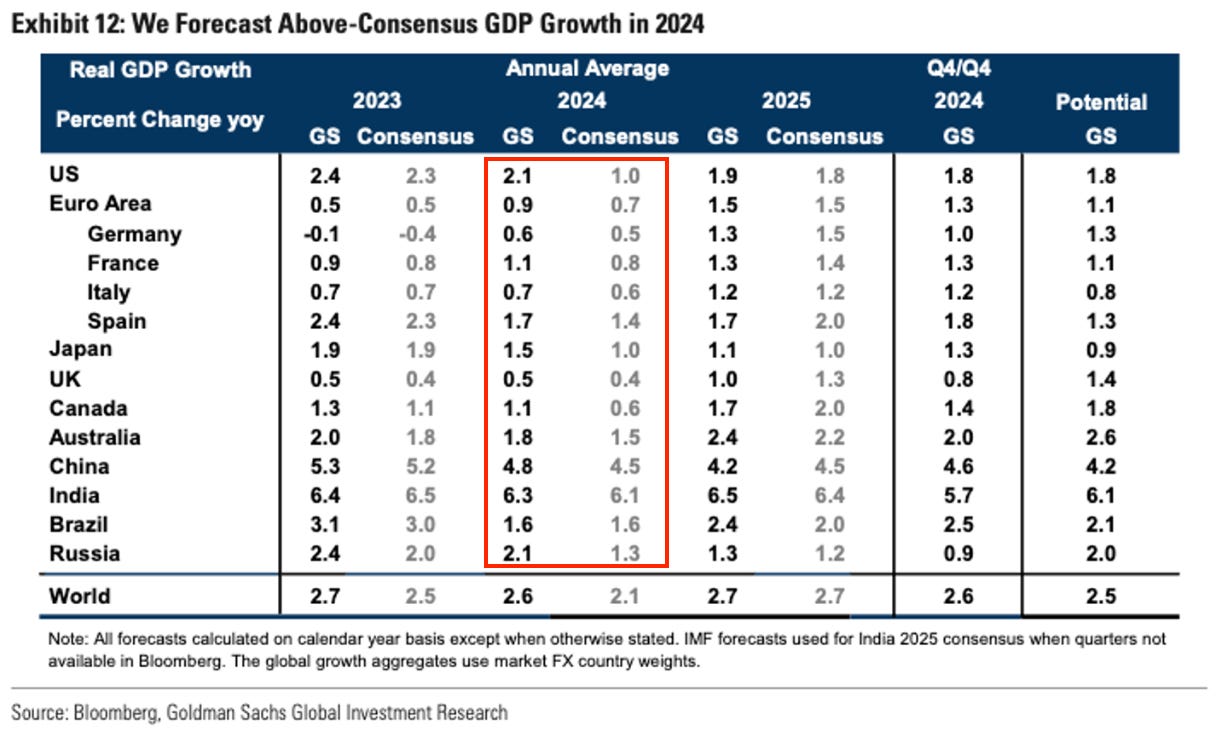

GS forecasts the US to grow 2.1% across 2024, when compared to the Euro Area, UK, Canada and Australia, the US is positioned to be a destination for additional cross-border fund flows. Cross-border fund flows represent the movement of global liquidity, in this case as in any, when US growth is strong, investors expect outsized returns and demand US dollars to invest in US assets resulting in a strong dollar. Although this scenario carries the greatest probability, my view on the dollar is bearish despite the strong growth outlook of the economy.

2024 is the Presidential election year, elections are set to take place in November 2024. Although carrying great significance, out of the 23 different elections that have occurred since the S&P began, 19 of the 23 years provided markets with positive performance.

What does this mean? Politics has a huge impact on markets, but the overriding macroeconomic climate carries greater weight and influence on how investors perceive US asset markets and therefore the performance of the index.

With all current and future facts in play, my consensus view for the Dollar in 2024 is that we will see a broad decline in the index for the first half of the year. Despite strong growth projected for the US, I don’t believe that will be enough to drive a strong and dominant US dollar performance as seen in 2021 & 2022. In the latter (2022) interest rate differentials and an aversion from risk assets drove the Dollar to have an 8% gain over its counterparts, whilst in 2021 several factors such as the robust economic recovery and a swift vaccination rollout compared to G7 member countries drove dollar gains.

I choose to make a view on the first half of the year as I believe any potential economic slack from Europe and the UK may trigger a flight to the dollar.

I believe three themes will be key in my bearish view of the Dollar:

Rising global liquidity levels and lower treasury yields as the Fed cuts rates.

Allocation of capital towards EM countries as risk appetite returns.

A return to sub 2.5% inflation in the US, resulting in further dovish rhetoric from the Fed.

Based on the SEP projection material released yesterday, the Fed has returned to its June projection for the Federal funds rate, now projecting rates to be 4.6% by the year-end. The Fed has also reinstated 50 basis points of rate cuts to its projections. The markets have interpreted this as an extremely dovish signal, evident in the significant decline observed across both front-end and long-end yields

The Euro

House view: Long

My outlook for the Euro is divided between my assessment of the Euro Area economy and my analysis of the currency's performance. The Euro Area has exhibited noteworthy progress throughout 2023, successfully taming inflation from a peak of 8.6% to 2.4% as of November.

The main headwind for the Euro Area remains their ability to stimulate growth, the EU is expected to grow a shallow 0.9% in 2024, still ahead of the UK which is expected to grow 0.5% through 2024. The reliance on the performance and expansion of the Chinese manufacturing and industrial sector have weighed on the European economy. A weak rebound at the start of the year resulted in less export demand for German factory goods. As a brief reminder, China has been Germany’s largest trading partner, just under €300bn were traded between the nations in 2022.

Germany’s manufacturing sector has borne the brunt of economic dependence on China, weighing in on the Euro Area growth forecast for 2024. Germany has the largest share of the European Union’s GDP, contributing 24.6% of the union’s growth.

Contrary to my bearish economic view on the Euro Area, my currency outlook for 2024 is rather optimistic. I expect the Euro to experience positive performance leading up to H2 2024 where I will re-evaluate the landscape for major shifts.

For most this would be a hard bias to hold, I’ll explain why I’m bearish on the economy but bullish on the currency, and it’s for the following reasons.

As the Fed begin to ease, cutting rates, liquidity will begin to rise within the financial system, now both leverage and credit, two lubricants for the financial wheel will also experience a gradual rise as the interest rate environment cools off. As seen in Figure 7, on the 10th of October 2022, now regarded as an inflection point, global liquidity re-entered the financial system, loosening the effects of monetary policy tightening and as a result, the Dollar sold off. The Euro instantly rallied and has since rallied 14% due to the weakness in the Dollar despite inflation being 10.1% as of October 2022. Throughout 2022, the Euro Area has shown no sign of economic strength yet the Euro has managed to hold strong as a result of a relatively muted performance from the Dollar.

The Yen

House view: Short

The story of the BOJ and the MOF is one that many of you reading will be sick and tired of me repeating, so I’ll link a report going over the intricacies for those wanting a reminder below.

The premise of my short view revolves around the hawkish sentiment of the BOJ. While Japan's current inflation rate of 3.3% surpasses the 2% long-term target, Governor Ueda has emphasized the need for inflation to remain consistently above 2% to achieve the central bank's inflation objective. The yen has suffered significant depreciation over the past two years, driven by carry trade strategies exploiting widening interest rate differentials. However, as 2024 approaches, the Bank of Japan (BOJ) stands as the only major central bank poised to raise interest rates, once again positioning itself as an outlier among its global counterparts.

While the timing of any potential BOJ rate cut remains uncertain, it’s evident that the yen will be in a compelling long position heading into 2024, as the prospect of a rate hike and a significant shift in BOJ policy looms large.

Thanks for getting to the end of this detailed report. I hope this was of value to you

Such a depth of knowledge in this report, as per usual.

Thanks Joe!

Excellent read, great work Joe!