Currency Plays: Cable Shorts, Yuan Shorts

Capitalising on Weak Yuan and Pound through Targeted Trades Backed by Macro Trends and Data

Hey crew,

Glad to be back.

It’s been a hectic but very fruitful start to the new year.

The macro universe is large in swing, geopolitics driving the headwinds of markets as well.

As I’ve said in previous reports, I want to make my research actionable and truly educational for you all.

So, today I’ll be sharing two key currency plays. The reasons and the macro data behind my cable short idea and my Yuan shorts.

Without further adieu, enjoy:

Bloodbath In Chinese Markets

Positioning: Underweight

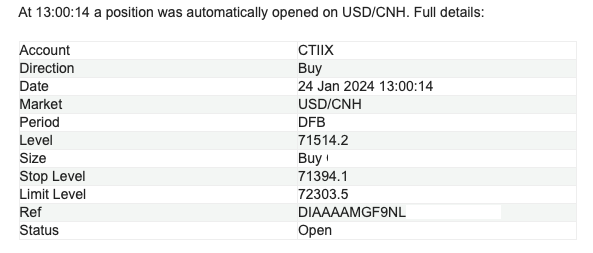

Earlier this week I opened a long position on USD/CNH.

For a multitude of reasons, many of which I shared in my last report covering China and its current economic challenges.

To give you a clear and concise view of why I shorted the Chinese Yuan here’s my thought process.

No demand for Chinese assets

Strong capital markets with consistent returns are typically a magnet for foreign investors, attracting them to buy the currency for outsized gains. However, this hasn't been the case for China since 2018, where the Hang Seng Index has declined by over 40%, dampening investor appetite and contributing to the Yuan's depreciation

Since the trade war commenced China’s equity market the Hang Seng Index has declined by more than 40%. China’s crackdown on the public sector during 2021-2023 also contributed heavily to investors withdrawing capital and domestic businesses moving abroad to destinations such as Singapore. Clear capital outflows.

Weak Growth Data & Deflationary Fears Mounting

Although clocking in at 5.2%, Chinese GDP came in lower than analysts expected which escalates concerns that even with all the fiscal aid and support packages China’s economy failed to meet expectations. The question arises, what happens when this unprecedented level of support ends?

The Chinese government are planning to support its domestic equity markets with a $288bn support package amid the large selling seen on the Asian stock index. The prospect of further fiscal spending has sown doubt among both retail and institutional investors, with concerns about its long-term impact on the sentiment around Chinese equities making them hesitant to commit with a long-term perspective.

As discussed in my report last week, China’s deflationary environment presents a unique challenge to the PBOC. Traditional monetary policy tools aren’t working or stimulating markets. This brings me to point no.3.

Banks don’t want to lend

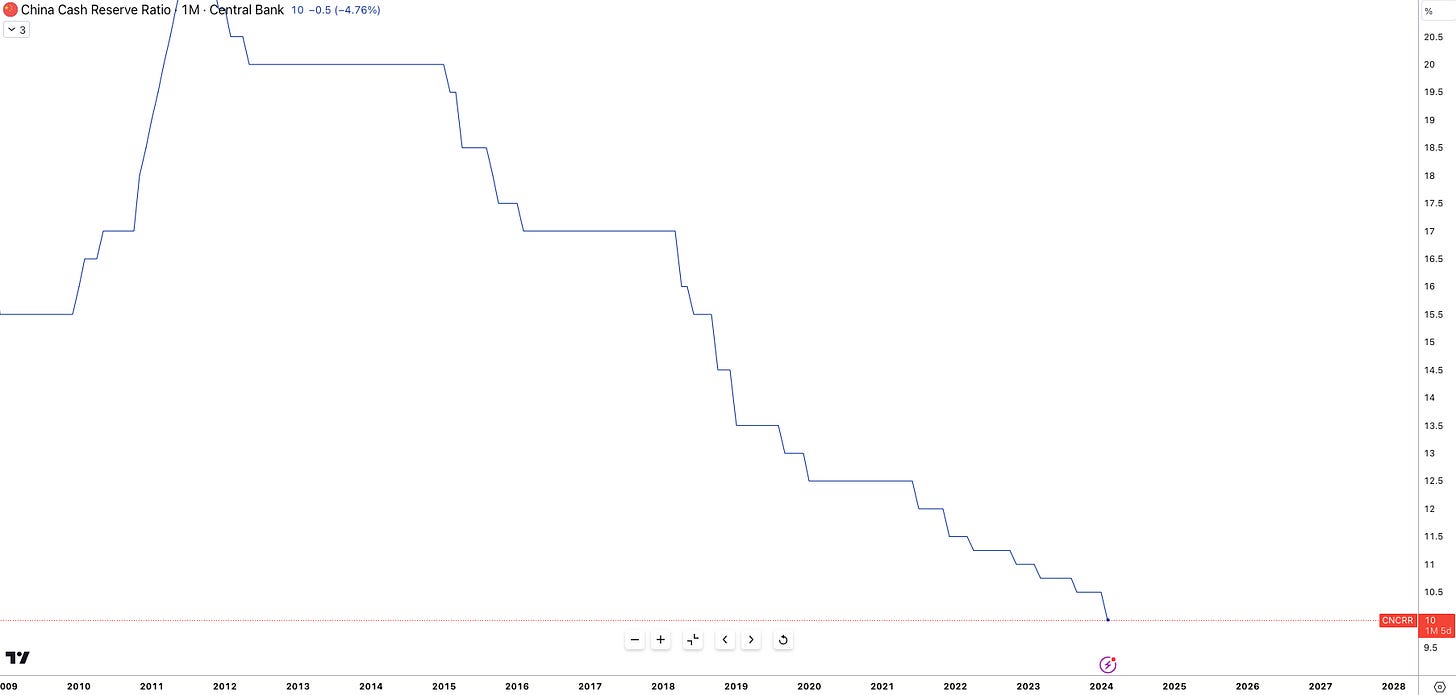

Yesterday, the PBOC’s governor Pan Gongsheng told reporters they will cut the RRR (reserve requirement ratio) for banks on February 5th by 50bps. The RRR determines the amount of cash banks have to keep in reserve for liquidity purposes. Now what’s unusual about this is the size of the RRR cut.

Over the past two 2 years, the PBOC has cut the RRR only 25bps at a time, however, this 50bps cut emphasises the importance of stimulating the economy. The unfortunate fact is that even with the reserve ratio lowered, practically freeing up ¥1 trillion, banks are unwilling to extend credit through the financial system further clogging up the flow of credit due to weak consumer consumption and demand.

Geopolitical risks

The increasingly complex geopolitical landscape, particularly centred around China, presents significant challenges for investors. Firstly, China's strategic rebalancing and stated ambitions towards Taiwan unification have elevated tensions in the region. Any military intervention in or around Taiwan by China would likely trigger significant responses from the United States and its allies, potentially disrupting global trade and financial markets. Secondly, the upcoming US presidential election adds another layer of uncertainty.

While a Biden re-election might maintain the current geopolitical and economic trajectory, a potential Trump victory could introduce significant changes in US foreign policy, further exacerbating risks for China-exposed investments. Therefore, investors need to carefully consider these geopolitical factors and their potential impact on their portfolios, diversifying their holdings and adopting risk management strategies accordingly.

These factors aligned with a study on previous Chinese stimulus rounds (i.e 2015), which is why I am positioned against the Chinese Yuan in the currencies market. Currently, the position is in the money, I will provide a detailed insight into my thinking on our webinar this Saturday at 1 pm.

Why I’m Short Sterling

Trade Idea: Short GBP/USD

Research criteria:

Growth outlook

Individual sector strength

BOE outlook (statements, tone)

CPI, retail sales, mortgage rates, PMIs, unemployment, wage growth, fiscal

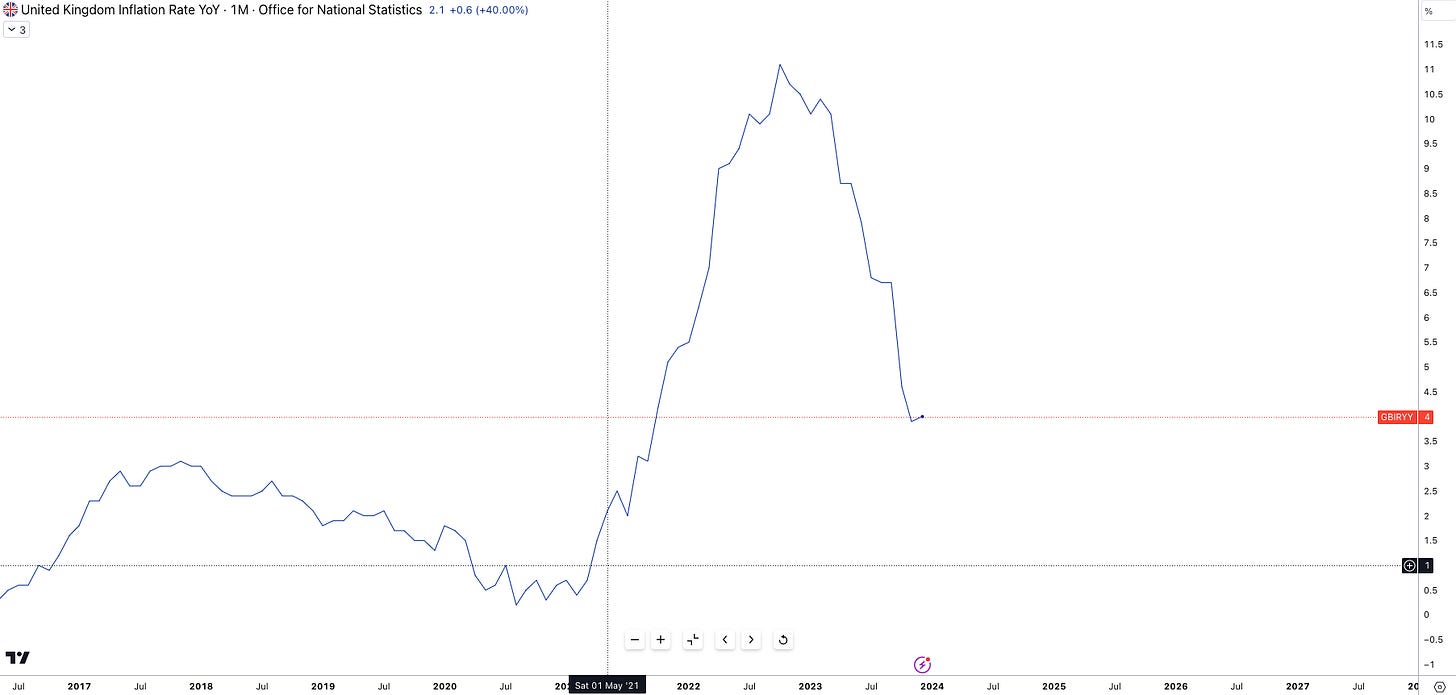

Since the COVID-19 pandemic, the UK economy has faced headwinds in maintaining a steady growth trajectory. Recent challenging political leadership shifts and persistent economic data weaknesses, such as high inflation and sluggish GDP growth, have further pressured the pound. As the Bank of England navigates towards policy normalization, balancing inflation concerns with economic growth becomes increasingly difficult. Sticky inflation figures, for example, highlight the delicate dance the bank faces: pivoting too early could harm the economy, while delayed action could exacerbate inflation and weaken the pound further.

Economic Outlook

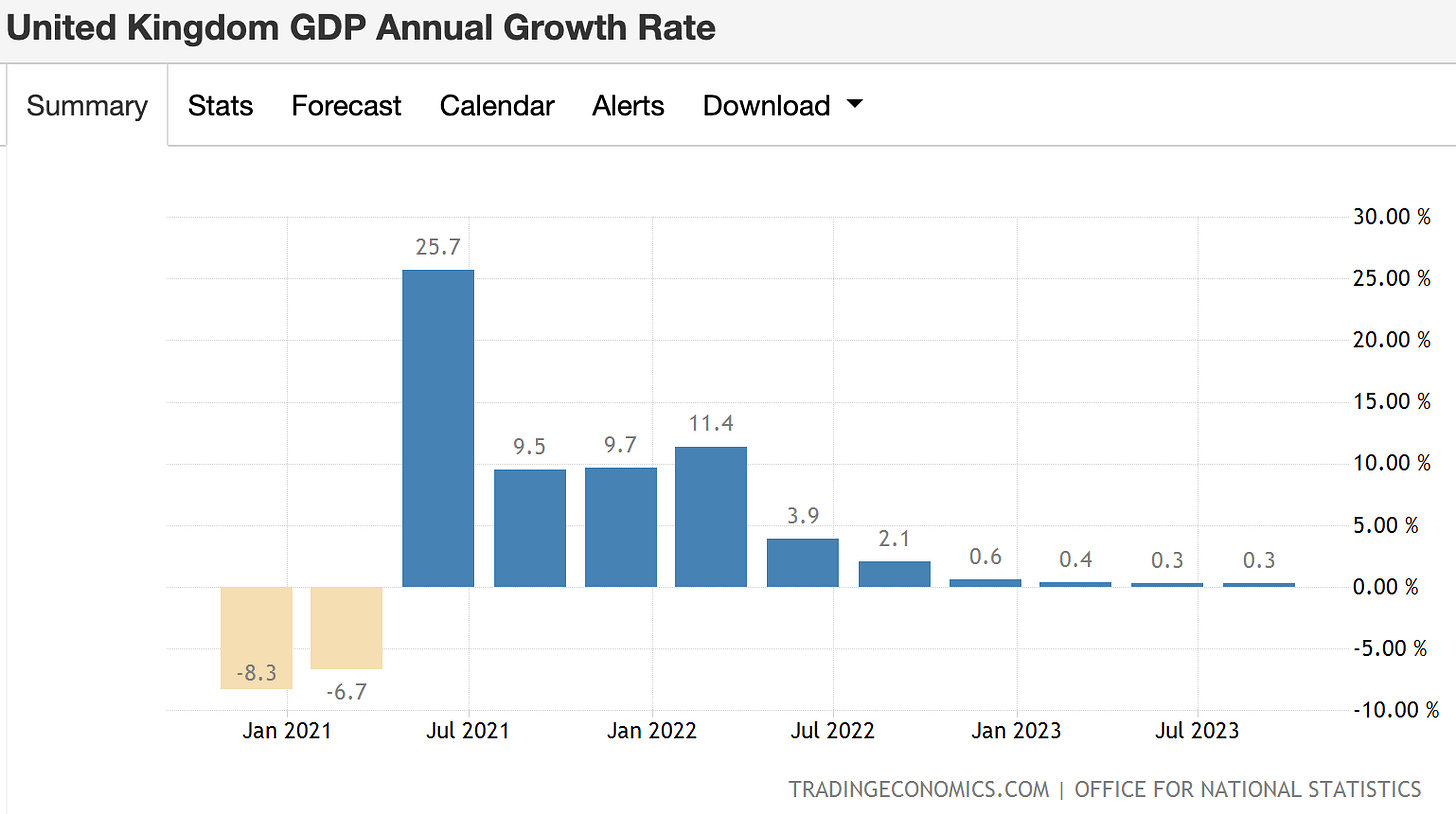

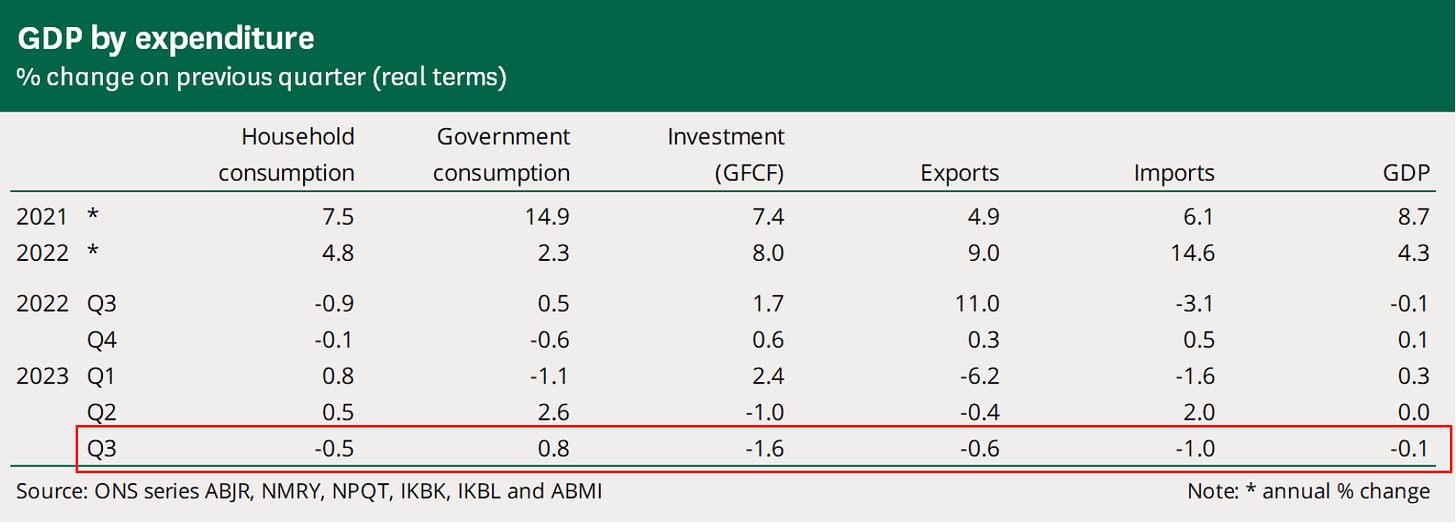

UK GDP grew 0.3% YoY during Q3 of 2023, at the same pace as Q2’s annual growth rate.

The lacklustre growth since Q4 ‘22 has stemmed from a flurry of political instability, irresponsible fiscal policy and an economy whose capital markets just aren’t structured to weather 5.25% interest rates for a long period.

The services sector contributed to over 80% of the UK GDP output in 2022, whilst the manufacturing industry (production sector) accounted for 9.4% of the UK’s GDP output according to the House of Commons Library. Across the UK in 2023 households faced excruciating pain as mortgage payments went up by an average of £490, an amount which erodes most households’ discretionary savings and spending allocation.

The negative turn in real (inflation-adjusted) household savings can be observed in Figure 3. Although nominal household savings paints a picture of a large war chest, when accounting for real household savings the true picture reveals itself. After suffering the worst level of inflation in decades the purchasing power of household savings has been nullified to pre-pandemic levels.

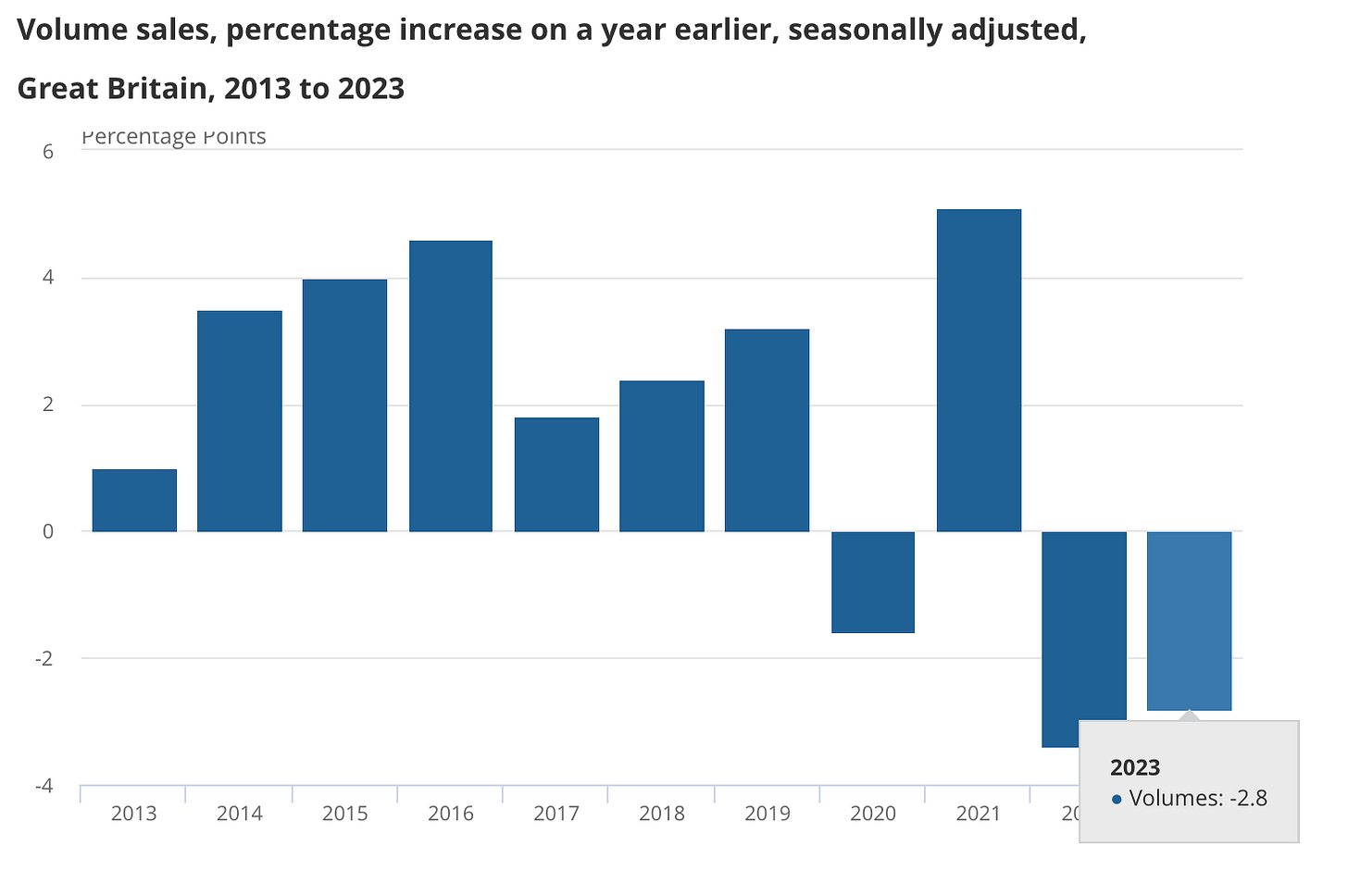

The driving wheel of UK GDP is consumer consumption; retail sales for the UK released on the 19th of January contracted 3.2% MoM (Dec) vs the expected 0.5 contraction 2.6% worse than expected. Core retail sales followed a similar pattern contracted by 3.3% over a time period where Christmas holidays are expected to incentivise consumers to spend more. YoY retail sales contracted 2.4% over December vs a 1.1% expected expansion as seen in Figure 3. This was the second consecutive YoY decline in retail sales for the UK.

Data for GDP by expenditure shows that households retracted in consumption over Q3, most likely driven by the persistent increase in inflation & the downward pressure on household savings as discussed earlier.

Inflation data for the UK shows further struggles ahead for the BOE. Rate cuts are anticipated for the BOE but with headline CPI at 4.0% up from November’s 3.9% print and Core CPI at 5.1%, the same as November, finding an excuse to cut rates for the central bank is becoming increasingly difficult. Over the last reading alcohol and tobacco contributed most to the reading.

The surge in the annual inflation rate was primarily driven by the recent increase in tobacco duty, implemented after the autumn statement outlined higher taxes. Tobacco prices spiked by 4.1% month-on-month from November to December, compared to a 0.3% rise in the same period last year, resulting in a significant annual increase of 16.0%. This comes amid continued concerns about inflationary pressures, with the current RPI inflation figure standing at 5.2%. Additionally, the ongoing conflict in the Red Sea poses potential disruptions to shipping routes, particularly for crude oil supplies, which could add further upward pressure on European inflation in the coming months as vessels are forced to travel around Africa avoiding the Suez Canal.

When analysing the UK economy there’s little reason to be confident in a resurgence in growth and strength; the upcoming elections later this year further reaffirms my point. Discussions of potential tax cuts within certain political circles ahead of the elections could lead to looser fiscal conditions which I’m betting on leading to a weaker pound. While this tax cut might attract voters, it also raises concerns about its impact on the UK economy and the pound's stability.

When observing price action, the pound has been consolidating sidewards, with no directional move. Once the price does break out of this level of consolidation I will look to enter my short play on the pound.

That’s it for today, I hope you were able to take away actionable insights from this report. If so, let me know!

Always bring the Heat !