Credit: The Next Shoe To drop?

Analysing the knock on effect from the banking crisis and depicting the current macro picture

Hey guys,

Firstly, thank you to all the paid subscribers who’ve joined MMH pro, you would’ve received a separate email inviting you to the private discord. It’s about to be an immersive experience. Join and grow.

It’s the 31st of March.

You know what that means…

The Four Foundations of FX is finally out and ready for you to tear apart all 5 pillars ( decided to add 1 bonus topic).

It’s epic.

So if you’re a technical trader with at least 2+ years of trading experience, wanting to fill the void in your trading and learn more than 90% of traders in less than 90% of the time (4 weeks).

This is for you. Check it out here

As for now, we’re seeing the ripple effects of the banking crisis crack through the U.S economy and restructure the current global macro picture.

Let’s dive in.

As always lend me your attention from here on out.

Liquidity Is Thinning, And That’s Not Good.

Since the peak of the banking crisis triggered by SVB and Signature Bank, I’ve kept a close eye on one of the most sensitive indexes out there to reflect changes in market conditions.

A quick synopsis for the new readers, when this reading is above zero (positive) this has been historically associated with tighter than average financial conditions, while negative values mean financial conditions are looser than average.

Now due to a number of central bank policies, mainly quantitative easing, and a low-interest rate environment, financial conditions have remained loose for soo long that investors, traders and markets adopted this as the new norm. However, as we know, in times of stress when the tide goes out, you find out who’s been swimming naked. That is the banking sector, namely SVB.

But I thought that was all done and over?

No. You see in financial markets contagion risk is one of the biggest factors at play, especially in moments of stress, which is why the Fed had to step in to provide emerging funding for banks and lending institutions even if their collateral were in losses due to higher fed funds rates.

The Fed were able to backstop the banking crisis to a certain degree, but the one thing you can’t control is investor confidence, no matter the size of the Fed's balance sheet.

Let’s take a look at the contagion effect still at play within the banking system.

Since the Fed began QT over a year ago most vulnerable banks lost over $1tr in deposits as you can see by the JPM flows & liquidity doc below. This number was only a mere $500b before SVB, but as soon as the crisis occurred investors picked up the pace and withdrew money out of these smaller banks at a speed not seen before.

To take advantage of the high-yielding money market funds, many of those investors flooded directly there with the rest of the investors taking their deposits to SIBs (Systematically Important Banks), the likes of JPM, Citi Bank, Wells Fargo and Bank of America.

This rapid flee of capital raises immediate issues, mainly a lack of confidence among investors. Here’s why. The problem is, when investors start to sell or lose confidence due to the failure of one bank, they immediately try to witch hunt and figure out who amongst the remaining banks might be underwater, an event which accelerated the demise of Credit Suisse. Billions in dollars of deposits instantly flow out of these smaller banks to money market funds, SIB/institutions which begins to create a liquidity shortage within the economy.

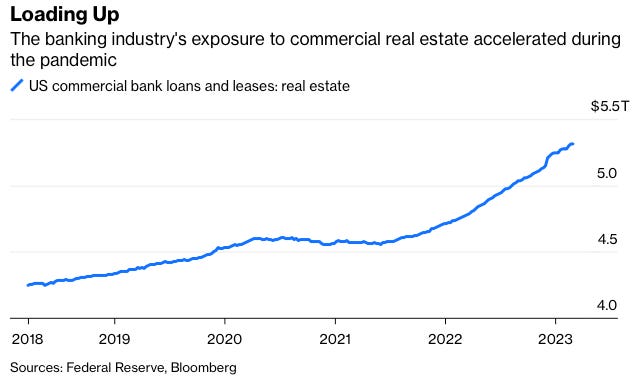

As a result of rates being 5.00% and liquidity drying up in the market, the next shoe to fall looks to be commercial real estate. To make matters worse, the banks that issue these CRE loans (commercial real estate) are not the SIBs, they’re the smaller non-SIBs with less than $250b in assets. CRE loans account for 43% of the total loan book of these smaller banks; things get sticky as deposit outflows soar these bonds on the bank’s portfolio become dead weight adding to the financial stress of these smaller banks. Now the problem arises for these smaller banks when the time comes to refinancing these CRE loans. When these CRE properties were bought pre-pandemic and pre the 450bps Fed hike, there was a clear spread between the rate they paid, and the rate they would charge large corporations, but as rates soared north of 400bps refinancing these loans put banks under extreme tension as their profit margins on these loans get wiped out.

The result? Credit crunch.

Banks significantly stop issuing new lines of credit to businesses; money stops circulating and defaults start to arise. This is already underway and has started at the top, earlier this month Blackrock defaulted on a $562 million bond backed by a portfolio of Finnish offices. In the past few weeks, there’s been billions of dollars in defaults across the U.S commercial landscape particularly in San Francisco, New York and Boston.

Since mid-2021 real estate loans have grown $725b to 5.3tr, up 16% according to Bloomberg.

Post the SVB blowout, the Fed stepped in with their new BTFP (Bank Term Funding Program) and ramped up their discount window facility. I mentioned in my previous article how banks borrowed $153b from the discount window after the SVB failure.

For those of you who don’t know what the discount window is, let me quickly explain:

The discount window is a borrowing facility enabled by the Federal Reserve to support the banking system in times of stress. This facility allows banks to borrow cash for up to a period of 90 days and post up collateral for these loans with the central bank (a collateralised loan). It’s called the ‘discount’ window because the Fed lends the bank less cash than what the collateral, usually a government bond or MBS is worth, which acts as the interest charge for this form of borrowing.

Now what’s different about this discount window is that the bonds smaller banks and larger banks were posting up as collateral were underwater (in a loss) or in actual bond terms trading below face value. But, in order to prevent a contagion risk and an out wide recession, the Fed decided to treat these bonds as if they were trading at face value, a small e.g:

Bank A: holding onto US10Y bond issued at $100, but now trading at $82

Fed: We’ll pretend this bond is trading at $100 without that loss of $18 and provide you with a loan for up to 90 days.

So the Fed has soaked up the unrealised losses of these banks, but we already knew that, the question is, what do markets have to say?

MOVE Index, The Dollar & The Regime Trade

Last week we took a dive into this index here, called the MOVE index.

This index here shows the volatility within the bond market. As we know, bond market volatility is extremely bad for bonds, especially for holders of those bonds. As we can see volatility spiked through Covid highs and just below the GFC crisis. The good takeaway is the huge rejection from these highs, showing bond market volatility is declining consistently. This should generally lead to higher yields in the short term across the curve as investors shake off worries from a deepening crisis.

It’s worth noting that although all we’re hearing and seeing in the news is a ‘banking crisis’ and the possibility of a recession, the Nasdaq is up 20%+ and SPX 6% YTD, worth mentioning BTC is trading up north of 60% YTD.

I’ll be covering different regime trades to trade in different macro environments for MMH pro subscribers starting next week.

Following on from last week’s report, the dollar and US10Y have a positive correlation, as yields on the 10Y start to rise the dollar also sees some uplift.

With a turbulent end to the quarter, it’s a positive sign to see yields recovering from the huge sell-off two weeks prior. For the dollar, my expectation is for the greenback to remain relatively soft and continue it’s bearish p.a as investors’ fears of a full-blown out crisis reduce; until we start seeing some large defaults in the CRE space it seems as if investors won’t go full risk-off mode and continue to remain net long on risk assets.

And that’s a wrap!

Guys, it’s been one heck of a journey.

13 weeks, 100+ hours and months of planning prior to bring forth the macro guide.

Can’t thank you guys enough for the comments, shares, and feedback, it’s all been overwhelming, you’re the real MVP reading this. I’ll continue providing value as always for free subscribers, but MMH pro subscribers we’re taking this to a new level.

Check out the launch here

please where do I get this ‘The Four Foundations of FX’ u recommended in your MACRO GUILD please I will so much appreciate . Want to know more about Macro analysis my goal for the year . ur help will be greatly appreciated