Credit Is The Lifeline

Credit conditions, Non-farm data and U.S macro

Hey guys,

It’s September 1st.

So you know what that means…

The macro guide for traders is now live and ready!

I must say, piecing this together was one heck of a journey.

Time. Energy. Planning.

But it’s here.

I’m certain you will gain a tonne of value from this. Even if it’s just one new thing you learn that helps connect the dot, that’s a win.

Here’s the link to access the guide.

As always I aim to present you with new concepts and frameworks for analysing macro, and in the process, provide the most value per word.

Today I want to explore the recent NFP print and dig a bit deeper into the credit picture when looking at the private and public sector.

Credit, The Economic Accelerator

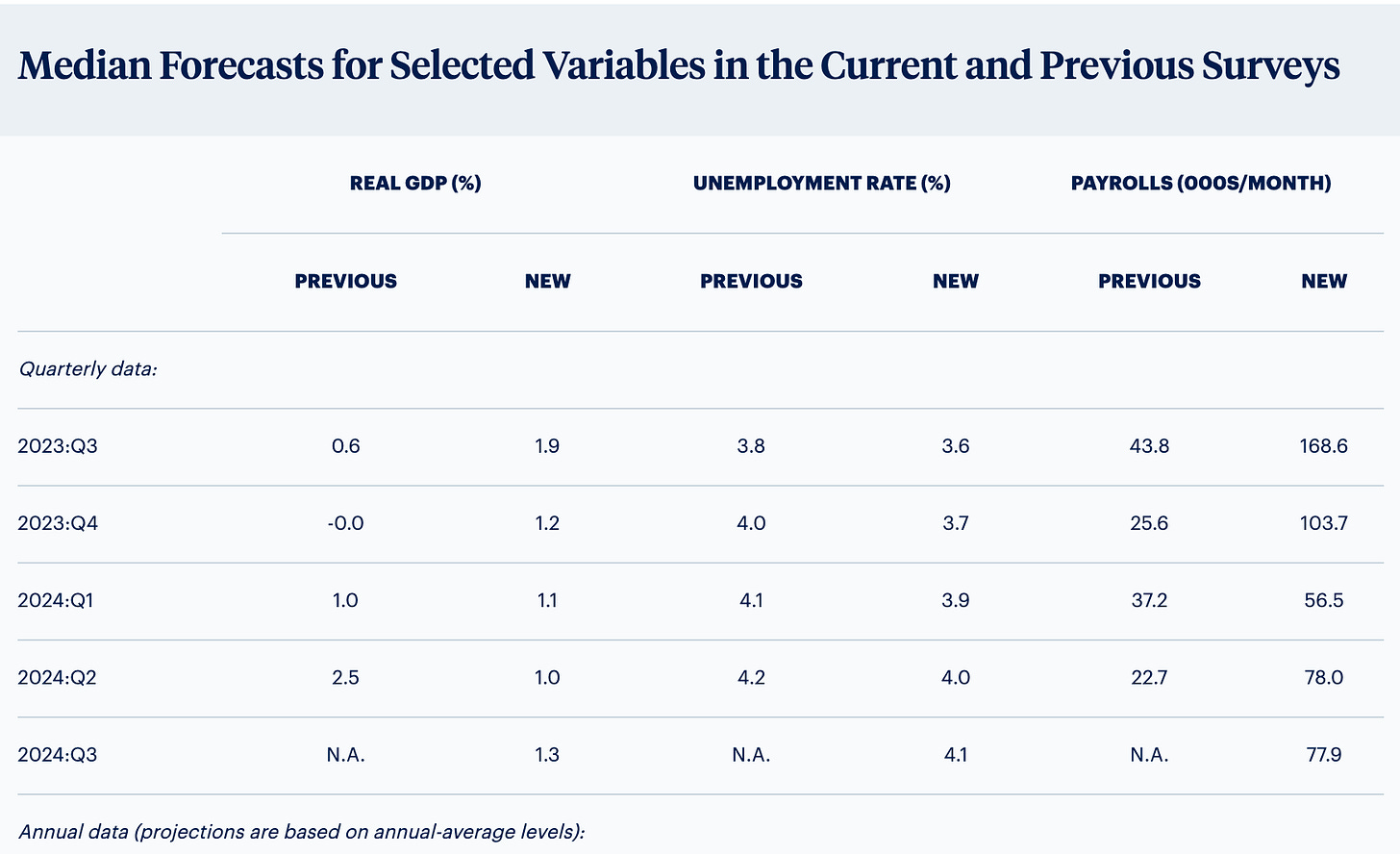

Nonfarm Payroll came out at 187k vs 170k estimate, with private ADP employment data showing a moderate lower than expected 177k new jobs added vs expectations of 195k. The underlying unemployment figure rose to 3.8% from 3.5%, something the Fed should find solace in despite inflation still being above their target.

The US economy has proven itself resilient, in the face of the greatest tightening cycle in history. The labor market is still tight despite a 0.3% increase in unemployment, real wages adjusted for inflation are positive, real growth is steady with the Federal Reserve Bank of Philadelphia foresting real GDP to grow at an annual rate of 1.9% in Q3 on a YoY basis.

Although the current picture may look good for the US, remember these data points are all backward looking snapshots on

their economy. Credit is the driving force of growth, be that leverage in the form of private sector household loans, corporate debt but also public debt in the form of fiscal deficits. Let’s take a look at corporations first.

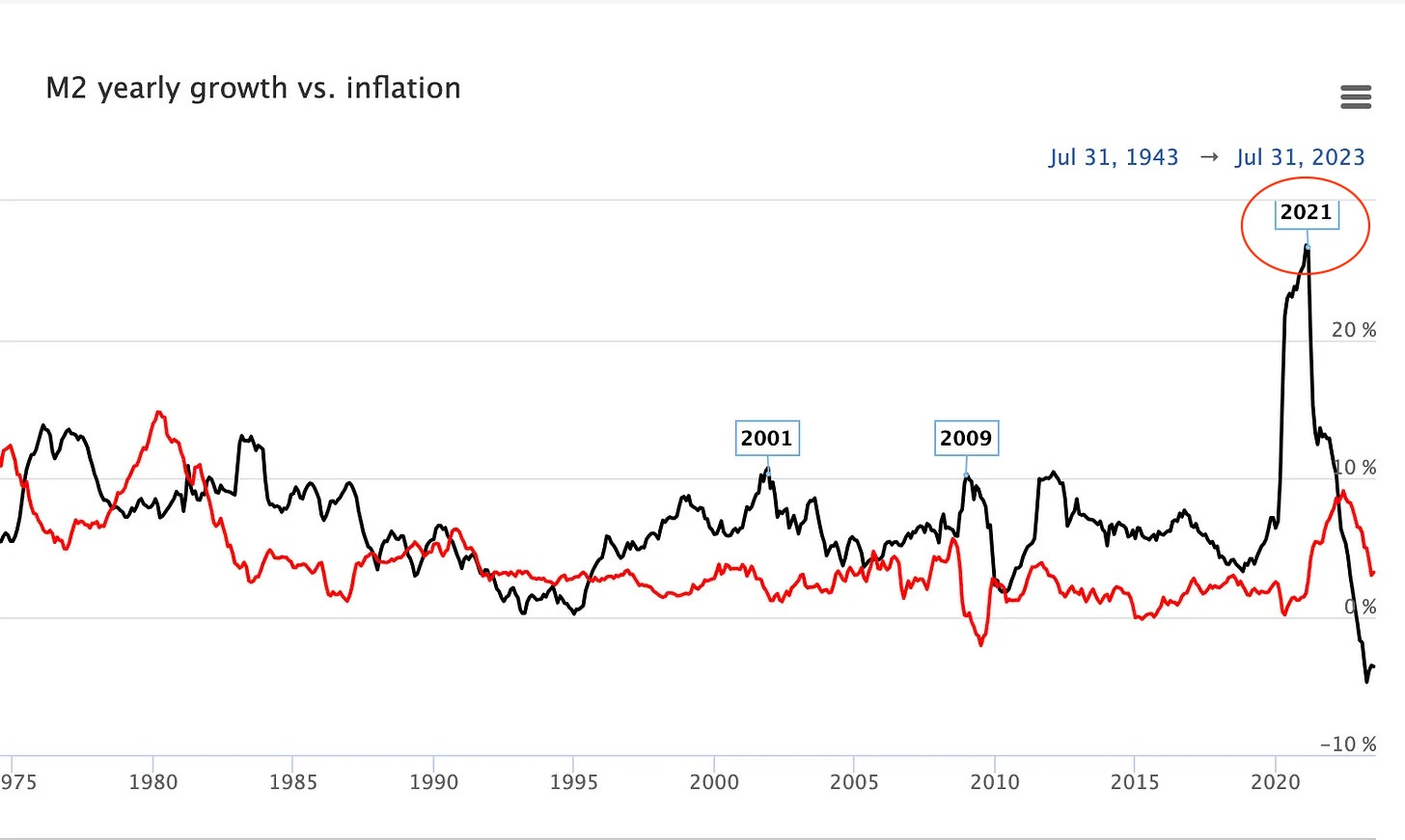

The black line represents inflation M2 (money supply) YoY growth the red is inflation. During 2021, the M2 growth was 26%! For those who access ‘The Macro Guide For Traders’ I explain why that number is so significant. Now remember, interest rates were still at 0.00% in response to the Covid crash.

So what did corporations do?

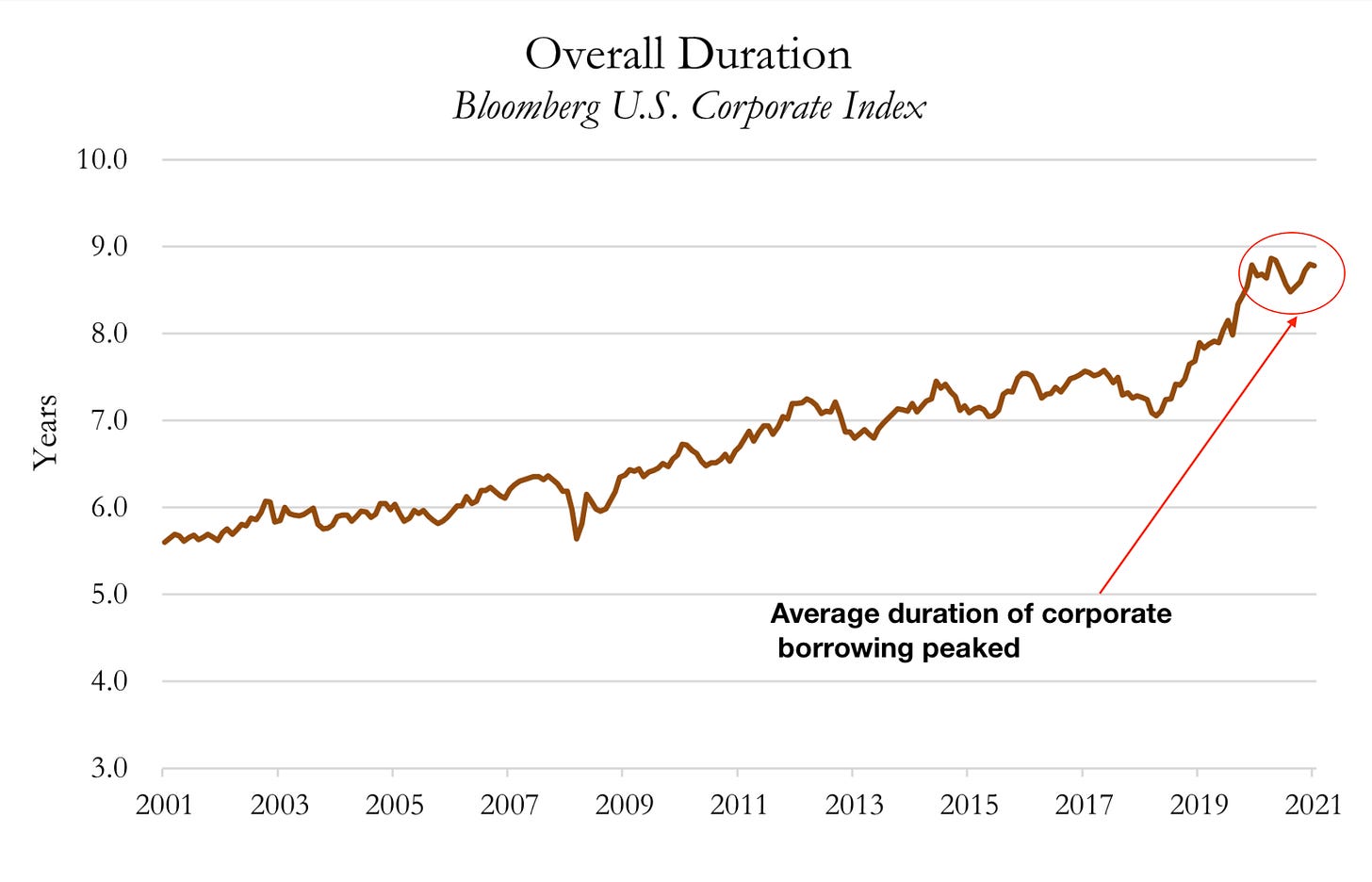

Corporations in the US locked in cheap funding for c.8.5 years! A smart move by such firms now when looking at the recent hiking cycle to secure cheap funding when rates were 0% for roughly 8 years. That right there is the main reason why corporations aren’t feeling the true effects of the rapid hiking cycle.

For households its a similar story, the caveat being that the level of restrictiveness private sector households are experiencing, shown through mortgage rates which are well above 7.50%, is sufficiently putting a lid on future credit consumption.

My concern is simple, credit growth has hit negative territory, something we have not seen since the Great Depression of the 1930’s! The fiscal deficit spending of the US government from 2022-23 is the sole reason the credit crunch hasn't realised yet. The pausing of student debt payments, the inflation reduction act, and many other expansionary deficit plans have actually offset the real effect of the Fed’s quantitative tightening program.

We can see the realisation of this through credit spreads between corporations and the risk free treasury. With the current pace of deficit spending unsustainable within the US, the next 3-4 quarters truly will start to show the effects of this tightening cycle.

Today we saw the first glimpse of what could be a loosening in the US labor market.

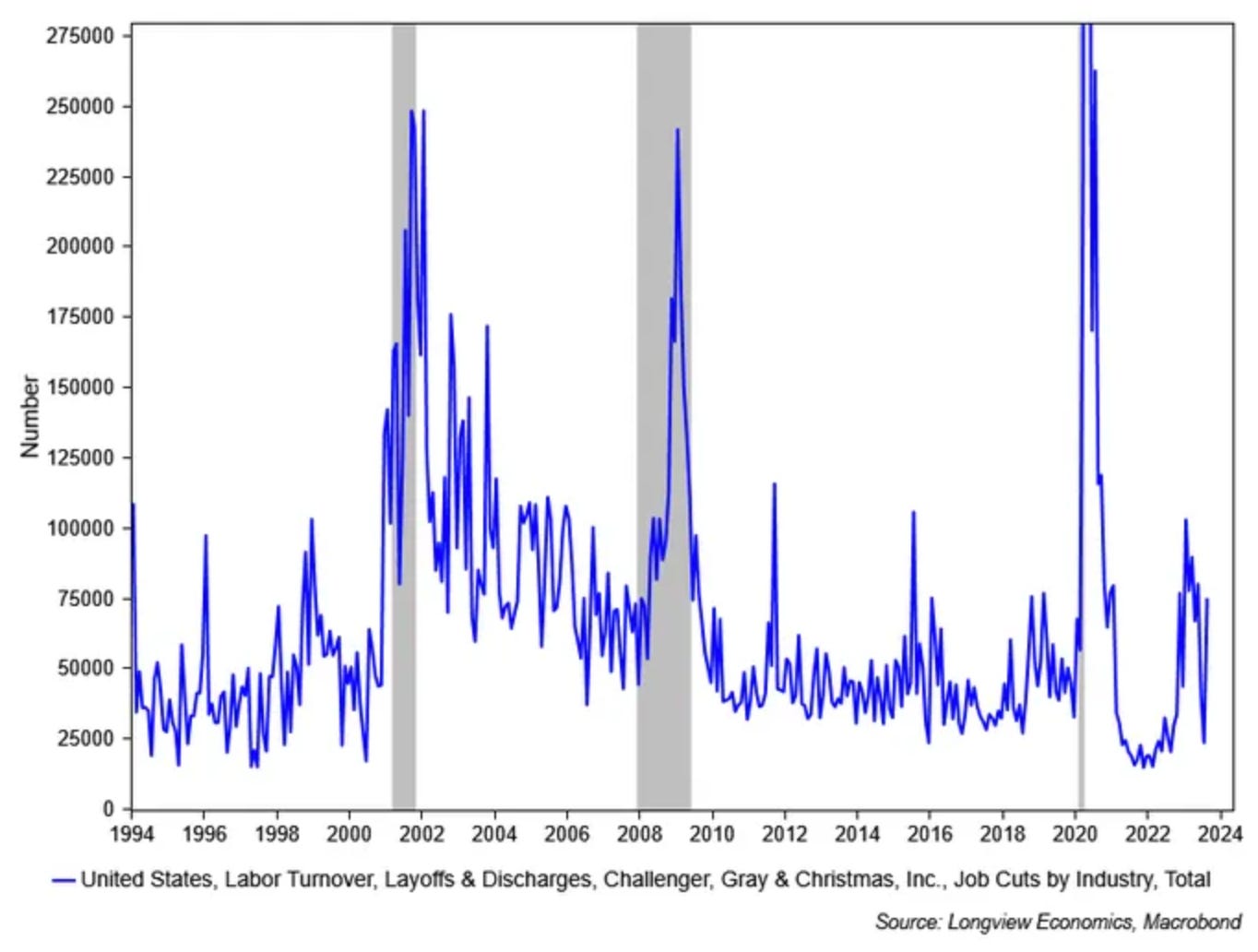

Unemployment rose to 3.8%, and we’ve seen a spike in layoffs as companies facing refinancing challenges and budget restrains resolve to cutting labor costs.

The labor market has shrugged off the rapid rise in inflation due to the reasons mentioned above, however, with the private sector set to experience further tightening this year as students resume debt payments, rates remain sufficiently higher and liquidity is removed from markets resulting in higher credit spreads and borrowing costs we could easily see the unemployment figure rise above the 4.0% over the next coming 2-3 quarters.

Guys that’s it for today!

I know you guys have been eager for the macro guide so I thought I’d keep this one shorter than usual, so I hope to hear your feedback from it!

Great analysis