Commodities, The Global Super Power

Reviewing OPEC+ cuts and where commodities fit in the global spectrum of markets

Hey crew,

“You can’t skip the reps.”

Something that’s been on my mind for the past week, relentlessly.

No matter which way you look at it, you have to get the reps in.

Especially when you don’t feel like it.

Tired, unmotivated, distracted.

What you do in these situations defines who you are more than anything.

So make a decision to do what you need to regardless of how you feel.

Alright.

I’ve been wanting to do this report for a while now, so here it is. I’ll be exploring what’s been happening in the commodity landscape and exploring why OPEC cuts aren’t as significant as you think.

So without further adieu, lend me your attention:

Are Commodities The Next Play?

Why OPEC Cuts Mean Nothing

As you all know I’ve been pretty vocal of my short view on USOIL.

Predicated on weak commodity demand stemming from China, the largest commodity consumer in the world, weak Chinese economic rebound, which we’ve seen and of course, global macro conditions materially weakening as global growth slows.

As always, in regard to Oil, OPEC+ countries have a say in the supply/demand dynamics, but the truth is production cuts aren’t necessarily bullish for oil. prices. So let me explain.

On April 2nd, Saudi Arabia and OPEC+ oil producers announced oil production cuts of around 1.16 million bpd. This cut brought the total volume of OPEC+ cuts to 3.66 million bpd which is equal to 3.7% of global demand according to Reuters calculation.

As you can see analysts were calling for Oil to “jump $10 a barrel”, so let’s see what Crude Oil really did.

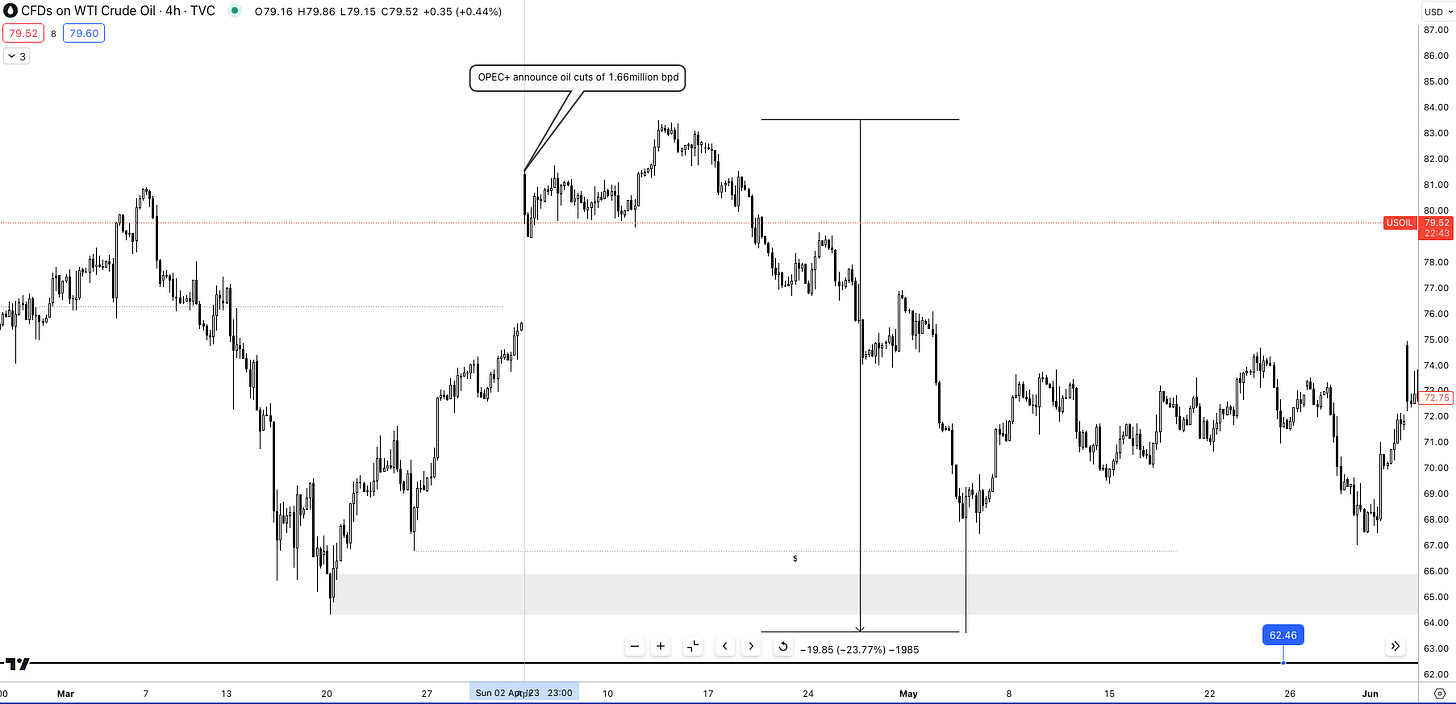

As you can see from my annotations, OPEC+ held their meeting on Sunday (2nd April) the announcement of the cut caused crude to jump 7.8% overnight as a reflex reaction to the surprise cut. But what happened next? Crude prices dropped -23% throughout April, trading in the mid 60’s. There was no $10 per barrel price increase. Note, don’t take analyst price predictions as gospel.

This is no coincidence. Take a look at the most recent oil cut in June ‘23.

On June 4th, OPEC+ countries met together to discuss the current energy market and agree on more cuts. This time Saudi Arabia voluntarily offered to cut production by 1 million bpd, with Russia also agreeing to cut production by 100,000-200,000 bpd. Moscow later in July announced that cuts will step up to 500,000bpd this August.

Similar to April’s cut, crude prices jumped 4% on the announcement but immediately sold off by -8%.

I know what you’re probably thinking. “But why? If OPEC cut production, doesn’t that mean prices should go up because there’s now less oil being supplied to the market”.

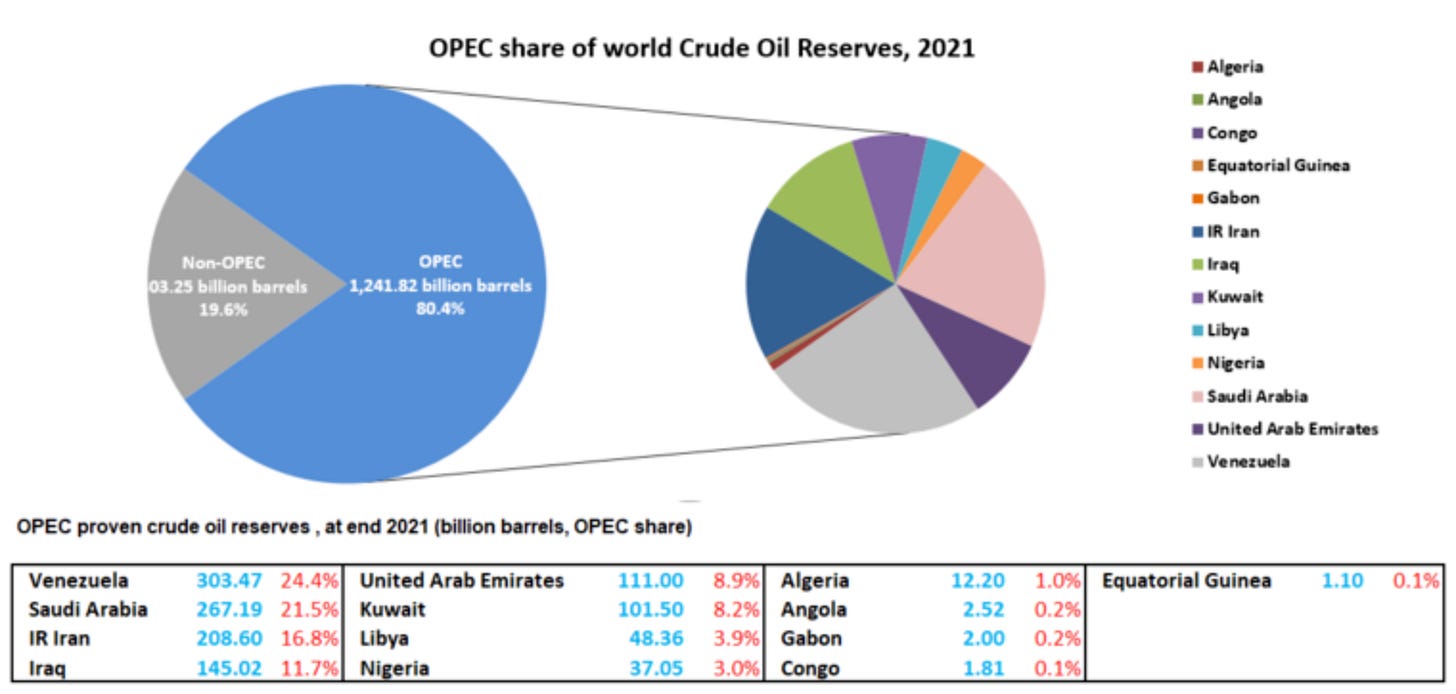

Not exactly, and the reason why is due to this one thing called spare capacity.

This is the volume of production that can be brought on within 30 days and sustained for at least 90 days. When OPEC announces production cuts, that oil is not being brought to the market, nor used, so that cut in production actually adds and replenishes the spare capacity available. Think of oil production cuts as increasing oil reserves hence adding further stability to oil markets and prices. This is precisely why OPEC cuts are usually bearish or neutral for crude prices, never bullish. Simply because the market knows that if there is an increased need, or demand for Oil, OPEC has enough spare capacity to meet the market’s demand.

Making sense now?

“But why then does the market jump on the announcement”, you make ask. Simple, upon the announcement some speculators are bound to panic buy out of their short positions temporarily, propping up the price but as you can see the short-term fear is simply a knee-jerk reaction to OPEC cuts.

So, in the current macro regime, in order for oil to enter a bull market or a prolonged period of higher prices, we would need to see OPEC reverse the production cuts, see the oil demand from China increase and see spare capacity run dry across OPEC+ main producers Saudi. It’s only once spare capacity has been drained then we see massive panic and oil prices rally hard.

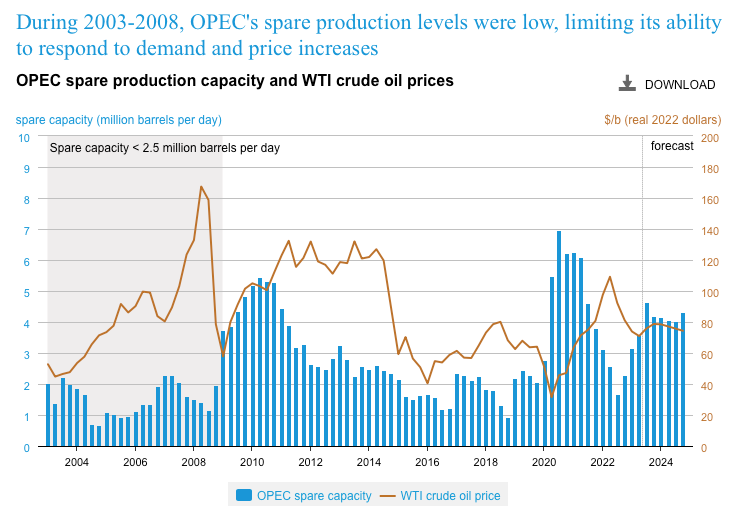

Here’s a perfect example.

Spare capacity during 2003-2008 was running extremely low during a recession which is an environment of heightened market volatility, and as you can see WTI crude prices (RHS) peaked past $160/b. OPEC’s spare capacity was stretched to its limit which resulted in the drastic price movement.

Commodities, The Backbone of Global Advancement

As many of you will already know from previous reports, commodity markets are a great indicator of global growth. When growth is picking up and advancing we always tend to see commodities play a crucial role in the physical advancement, which results in a commodity rally.

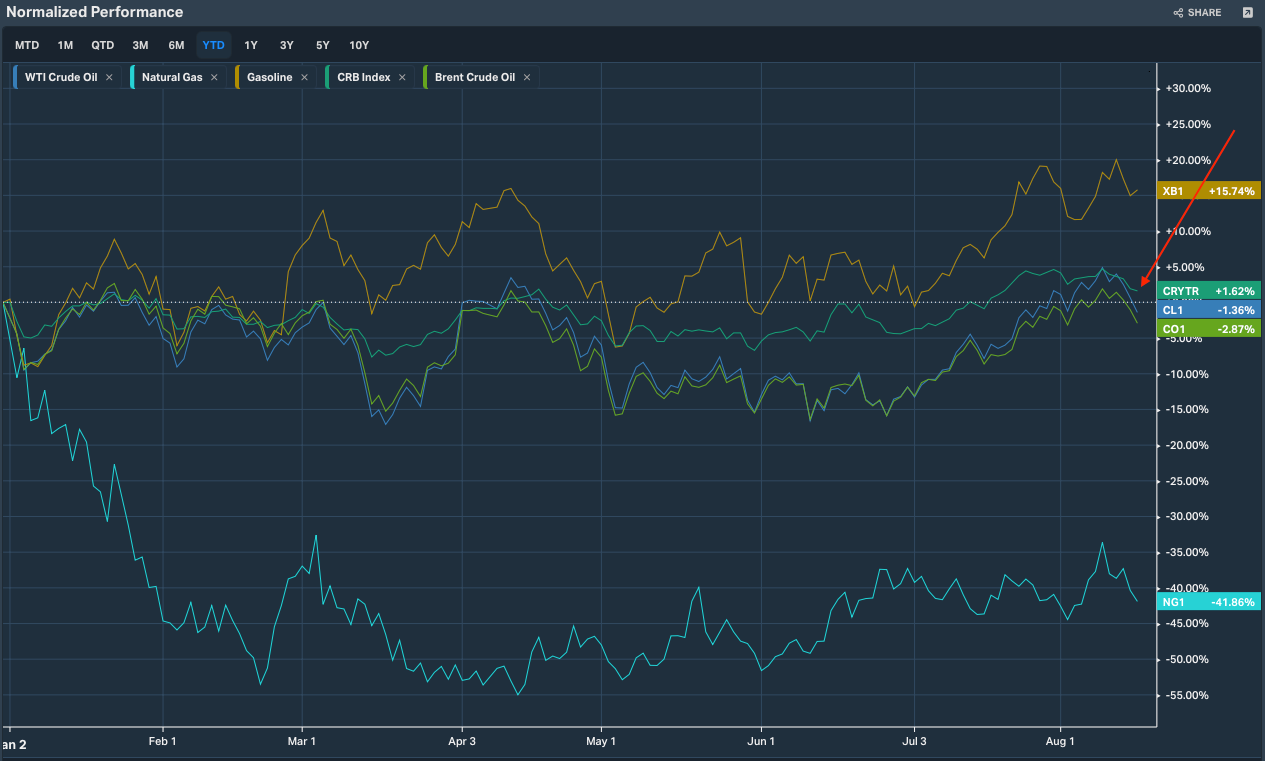

The CRB Index is composed of 19 different commodities from agricultural, to precious metals, industry metals and energy. This is basically the SPX but for commodities, so whenever you want to quickly aggregate and understand what is going on within the commodity landscape this is your index to check out.

Why is that important?

It’s very easy for us to misjudge market dynamics or narratives, and make inaccurate biases such as, “commodity markets in a bull rally” based on insufficient evidence like the recent gasoline and oil rally. This is a common error many macro traders make, assuming an overall market is rallying in synchrony not knowing that the moves are idiosyncratic. The CRB index will allow you to have an overall index to help determine what regime or part of the macrocycle we’re in.

Looking forward the question remains, what is set to drive demand for commodities?

There are two macro points, one which we’ve discussed, being global growth mainly driven by China, but the second one which isn’t discussed as widely is the increase in the standard of living in emerging markets. As EM countries like China, India, Brazil and many others not only continue growing and increasing their share of global GDP but get richer, the domestic spending on infrastructure will soar through the roof.

Consumer consumption will inevitably rise for such EM countries supporting the advancement of their countries and also the global demand levels for commodities.

Guys that’s it for today.

I hope you were able to learn a new concept about the world of commodities.

In the meantime, I noticed the discord’s super quiet, so let’s get active. Don’t be afraid to post ideas or share your mind, it’s the only way you’ll grow!

If you enjoyed it, be sure to let me know.