Central Bank: Sterilised Currency Intervention

Exploring the mechanism behind sterilised and unsterilised intervention in currency markets.

Hey guys,

I hope you’re good.

It’s H2.

Meaning that if you haven’t gotten what’s yours to take this year there’s no better time to get it than now.

Be resourceful and strategic.

Enough about life, let’s talk about central bank policy. Particularly, sterilised and unsterilised currency intervention.

Currency Intervention Broken Down

In its simplest form, currency intervention is the act of a central bank or monetary authority buying or selling its domestic currency with the intent to affect its exchange rate.

Now before I get into the different types of currency intervention, it’s important to understand the reasons why a central bank may choose to use this policy tool. One of the more popular reasons behind currency intervention is to stabilise a currency within the FX markets. Globally there are a few central banks that utilise both sterilised and unsterilised intervention to stabilise their respective currencies, countries like China are known to artificially manipulate their currency for a few main reasons which I’ll dive into. So let’s dive into the different forms of intervention with case studies.

Sterilised Intervention

Sterilised intervention is the process of a central bank buying and selling a country’s currency via foreign exchange reserves. When a central bank wants to strengthen its currency, it sells the foreign currencies it has on reserve and purchases its domestic currency on the FX market. You’re probably thinking, what makes this ‘sterilised’ isn’t this just a normal form of intervention? Here’s the answer. You see when the central bank sells its reserve of foreign currencies to purchase the domestic currency, the monetary base of the central bank and country increases as a result of the central bank running intervention.

During a sterilised intervention, the monetary base of the central bank increases, so to offset the increase in the monetary base, the central bank engages in open market operations, and sells securities (usually gov bonds), in order to eliminate the increase in monetary base. This process of rebalancing the monetary base is the ‘sterilisation’ process of the intervention. The reason a central bank would want to offset the increase is that if the monetary base isn’t sterilised this can result in an increase in money supply, increased liquidity and a decrease in short-term interest rates. MB represents the total amount of money in circulation, plus the reserves held at the central bank.

Remember, all the central bank wants to do in this scenario is strengthen its currency, not create more liquidity in the form of reserves or money supply which has inflationary pressures on the economy.

The formula for the monetary base also referred to as ‘high powered money’ is:

MB = C (Currency) + R (Reserves)

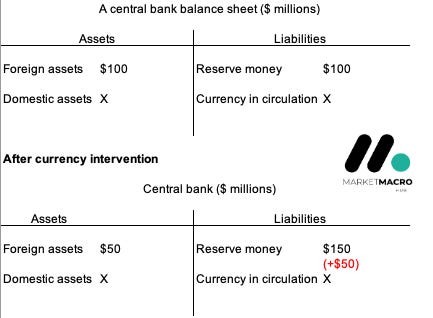

Here’s an example for you:

Let’s say central bank A has $100m in foreign currency reserves and wishes to strengthen its currency, so it sells $50m in foreign currency reserves on the foreign exchange market. As a result, central bank A’s currency appreciates by 4%.

Essentially, what has happened is that the central bank has increased its monetary base by $50m. It’s simply because the central bank has exchanged $50m worth of Dollars in this example for its domestic currency.

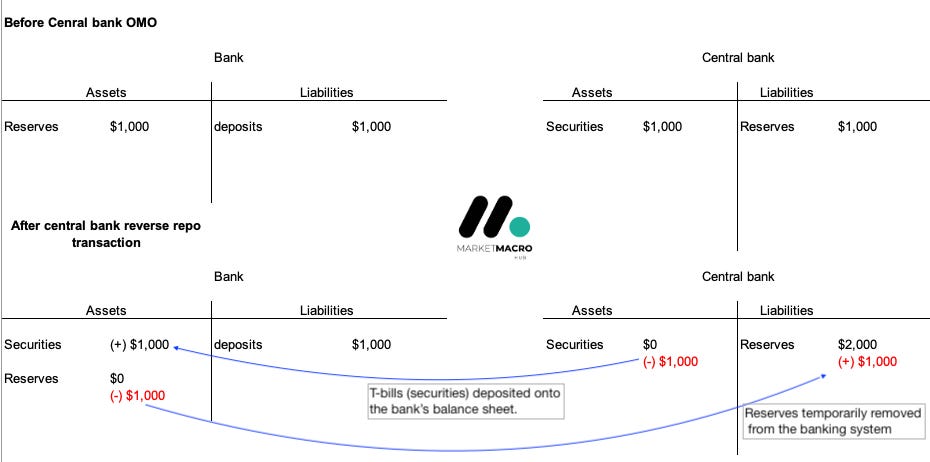

So, in order to offset the $50m increase in the central bank’s monetary base, the central bank engages in open market operations by selling government bonds which reduces the money supply. If that didn’t make sense, don’t worry, I’ll explain further. Following my lesson last week, it’s important to understand that higher bank reserves mean a higher monetary base, which results in a greater money supply within the economy. It’s worth noting reserves are assets for commercial banks but liabilities for the central bank since the commercial bank deposits its reserves at the central bank, hence reserve money being on the liability side.

So when the central bank sells government bonds the exchange that happens on the balance sheet is simply commercial bank reserves in exchange for central bank securities. Here’s a visual to help digest the information.

As you can see, the flow of reserves goes from the commercial balance sheet to the central bank, extraction of reserves from the banking system, draining the increase in the monetary base and reserves. That process now offsets the increase in the monetary base.

Unsterilised Intervention

As you can imagine, unsterilised is easier to get your head around than sterilised intervention. During an unsterilised intervention, the central bank purchases or sells its country’s currency, but this time there's no equal transaction in the OMO to offset the monetary difference.

Hence, this form of intervention becomes a great tool to influence both the supply of money and short-term interest rates. If the BoE wanted to reduce the money supply and weaken its currency it would sell the pound and purchase foreign currencies. In this process, pounds are being taken out of circulation resulting in a reduction in money supply which can lead to higher short-term interest rates.

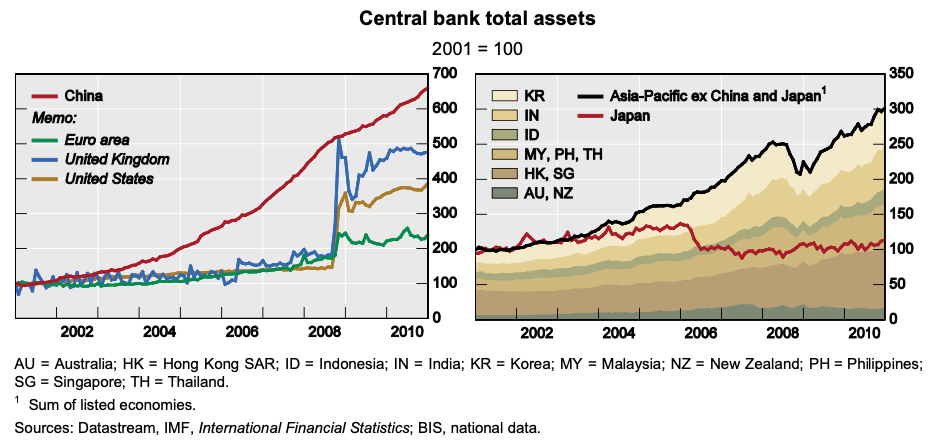

Expansion of Asian central bank balance sheets

Since 2001, China amongst many Asian currencies, have amassed a large amount of foreign exchange reserves due to a continuous inflow of capital and commitment to maintain a fixed rate against the dollar and now move to a crawling peg exchange.

*Crawling peg - a currency exchange strategy that allows the value of a currency to fluctuate within a narrow band with the intervention of the central bank to periodically adjust the band to reflect changes in economic conditions or even monetary policy.

The chart above shows data from 2001, which was just after the Asian financial crisis of 1997-98, where a number of East and Southeastern Asian currencies experienced large losses and spikes in volatility driven by fears that a number of Asian currencies were overvalued due to their peg against the dollar causing them to be artificially strong because of the USD factor.

As a result that caused policymakers in Asia to revisit their currency strategy and come to the realisation that having a fixed exchange rate was extremely difficult to defend in times of large vol and foreign capital flow.

PBOC Currency Strategy

Sterilised intervention is a currency strategy that China use for one main reason:

a cheaper currency makes Chinese goods more attractive on the global trade market

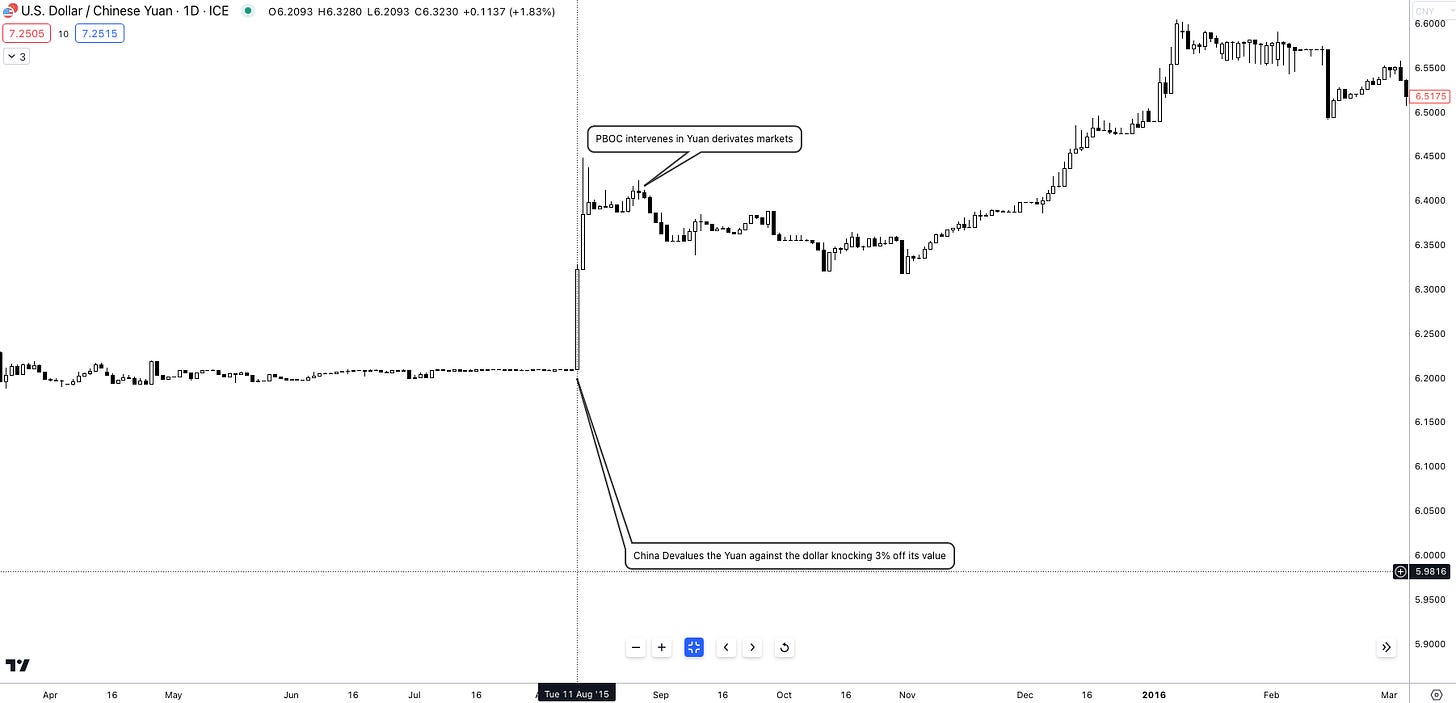

The PBOC sets the daily midpoint for the Yuan every morning, from this midpoint the PBOC allows the Yuan to fluctuate +/- 2% from the midpoint which is called the currency “band” it floats within.

The PBOC has intervened in recent months, dating to June 2023 just over a week ago on the 27th (Tuesday) to defend the CNY from losing too much value against the dollar, but there’s one particular intervention which was a great example of the power of central bank intervention.

In August 2015, the PBOC famously intervened in currency markets to devalue the CNY, resulting in 3% being wiped off its value against the dollar. Now 3% may not sound like a lot due to the age of huge volatility moves we see across markets, but in a currency, 3% is a colossal amount. Of course, this move had ripple effects across global markets, from equities in the U.S to Europe and even Latin America; as you can imagine the net effect on commodities was also bearish with WTI Crude Oil continuing its bearish price action dropping a further 19% after the PBOC intervention to devalue it’s currency.

I hope from this detailed report you’re now able to understand deeper how open market operations lead to currency intervention and what the underlying effects of currency intervention are, both for the domestic currency and also the monetary system within.

That was a detailed yet simplified view of central bank currency intervention.

If you took away any value in this report could you leave a comment, like and let me know your thoughts?

It’s always great hearing your thoughts on such interesting reports.

Until next time ;)

Therefore MoF for BOJ does a sterilised intervention this will value up the yen? And unsterilised is vice versa?