Central Bank Fiasco

Rates Roulette & FX Market Frenzy

Good morning crew!

This week sets the stage for what could be the most volatile central bank convergence of 2025: the Fed, BoE, and BoJ all convene within a 72-hour window. When the world’s most influential monetary authorities line up back-to-back it sets the stage for volatility across the ccy markets.

So grab your morning coffee (or tea), let’s walk through our thought process heading into these major risk events.

The Federal Reserve

Market participants are heading into this announcement squarely focused on how Chairman Powell communicates the Committee’s assessment of both sides of the Fed’s dual mandate, price stability (inflation) & maximum employment (labour market).

What do we know so far?

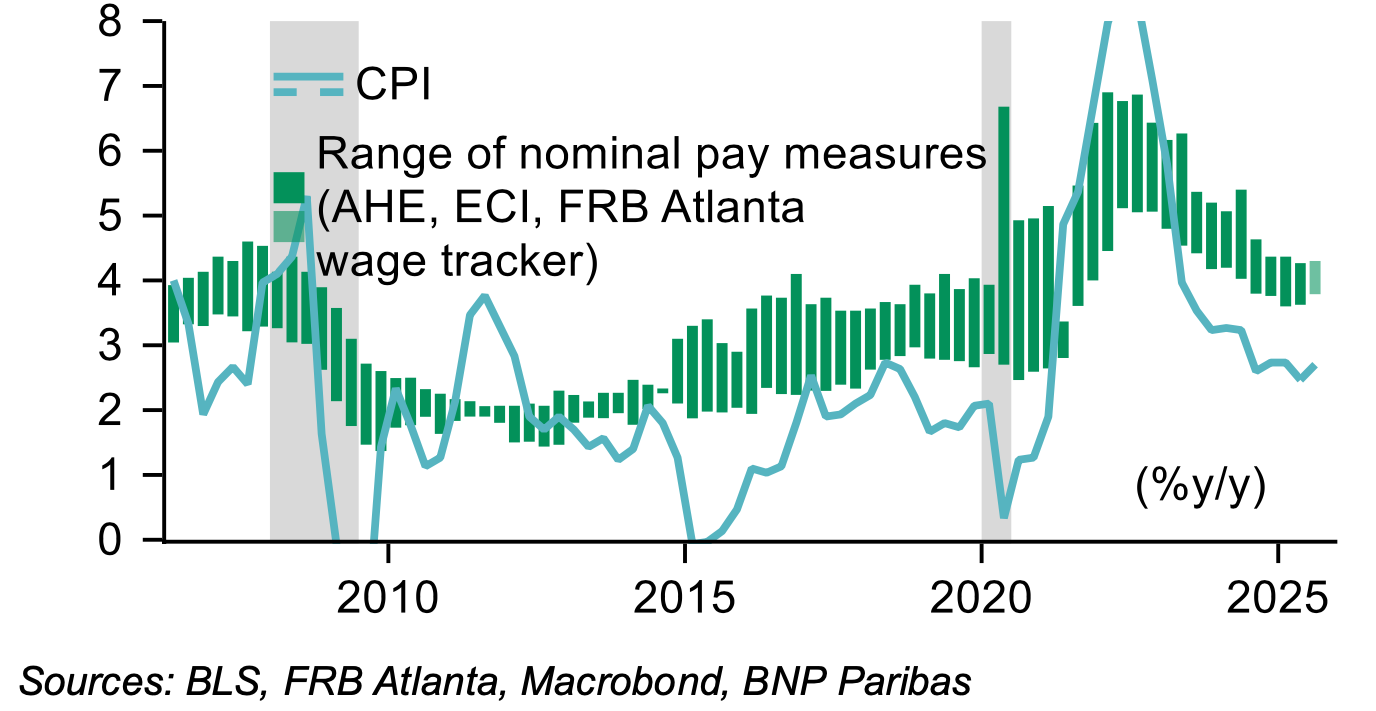

It was a heavy past week of macro flows for the greenback, which to be fair largely dominated the price action across G10 FX. Labour data continues to validate markets’ reasoning of rate cuts heading into the September meeting, while core CPI, though printing slightly above consensus, is projected to show limited follow-through into the Fed’s preferred gauge, PCE. Fixation on the accuracy of the latter is in the back seat momentarily.

The bottom line is the overshoot hasn’t materially undermined the case for easing.

Despite softer prints in last week’s PPI, unemployment claims & UMich sentiment, losses in the dollar have remained within its established trading range with the dollar index finishing the week 0.27% in the red.

0.25% reduction in EFFR is already a done deal. The case now, so, is markets finding confidence in bidding a more aggressive 50bps move. Given the stickiness of inflation, a half-point cut looks very unlikely. It would be surprising and quite frankly reckless in our view if that was to materialise considering the cautionary methodology adopted by JP in his speech at JH along with monetary policy framework now centered on a 2% target as opposed to compensating for decades of NZIRP. A cut of that size would, in our opinion, signal strong underlying weakness from the Committee which in turn could prompt a sell-off in risk assets.

We view the most dovish feasible outcome as a 25bps reduction paired with guidance skewed to further easing, a “25bp dovish cut.”

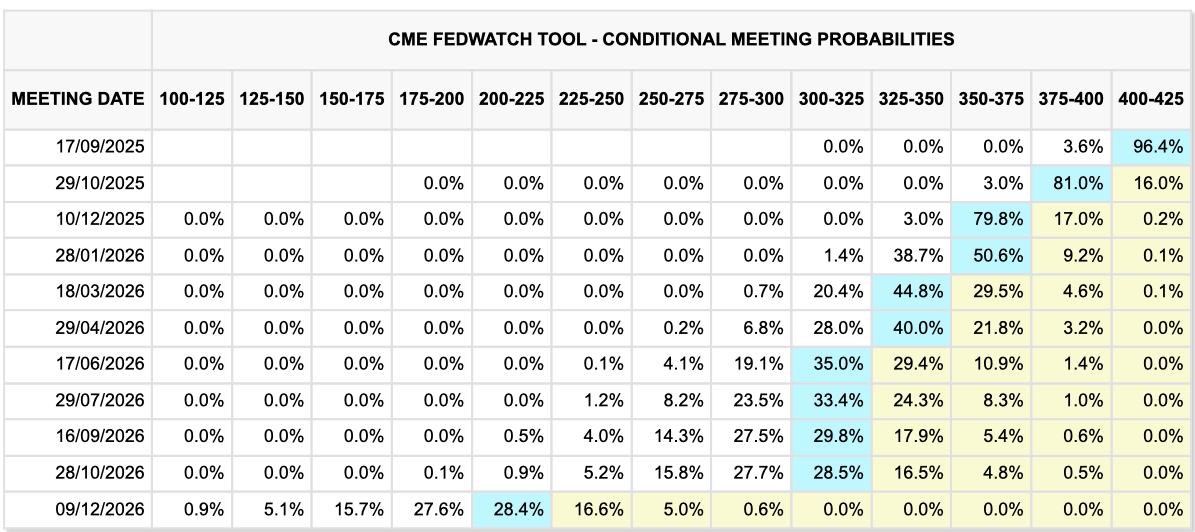

The labour market slack has encouraged markets to price in quarter-point cuts at each meeting through year-end. That should make this announcement itself relatively uneventful. The signal to watch will come through the updated SEP and how JP ‘defends’ it.

Will the $ smile again?

The year is 2090 and we are still hearing tales of the dollar losing its reserve status. If I had a dollar for every time that phrase was used, I’d probably be sitting on a larger reserve position than most EM central banks. Okay guys, seriously, despite this downturn, the greenback remains unrivalled, underpinned by deep capital debt markets, rule of law, and the absence of a credible alternative.

Sorry (not sorry) if I upset the EUR/BRICs enthusiasts.

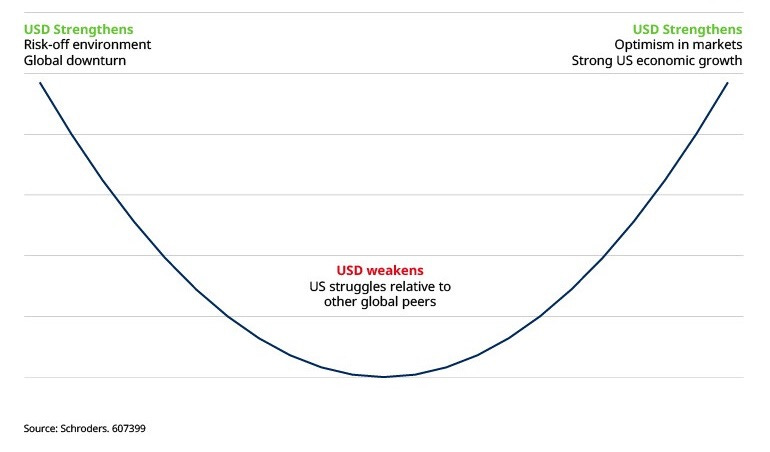

Okay moving on. The dollar smile theory tells us the greenback thrives at the extremes, in deep stress (as a safe haven) or in robust US outperformance, while it typically softens in the middle ground of modest growth and policy convergence. For much of this year, the USD has been stuck in that middle zone.

Tariff uncertainty

Fight from WH targeting Fed independence

Rollback on fiscal austerity causing reassessment of US debt

A JH dovish Fed pivot on weak payrolls

…have all wighed heavily.

When we try to map the future path for the US the call is centered around the next leg of the regime change. Away from the politics, although it’s worth noting the court’s decision siding with Gov Cook which has supported our view, the US macro backdrop looks firmer than the prevailing bearish consensus implies. Despite the worrisome figures from headliners the UR rate has only edged up to 4.3% underscoring that structural balance as labour supply shocks, from immigration constraints to tariff frictions, are limiting downside slack while wage growth remains elevated.

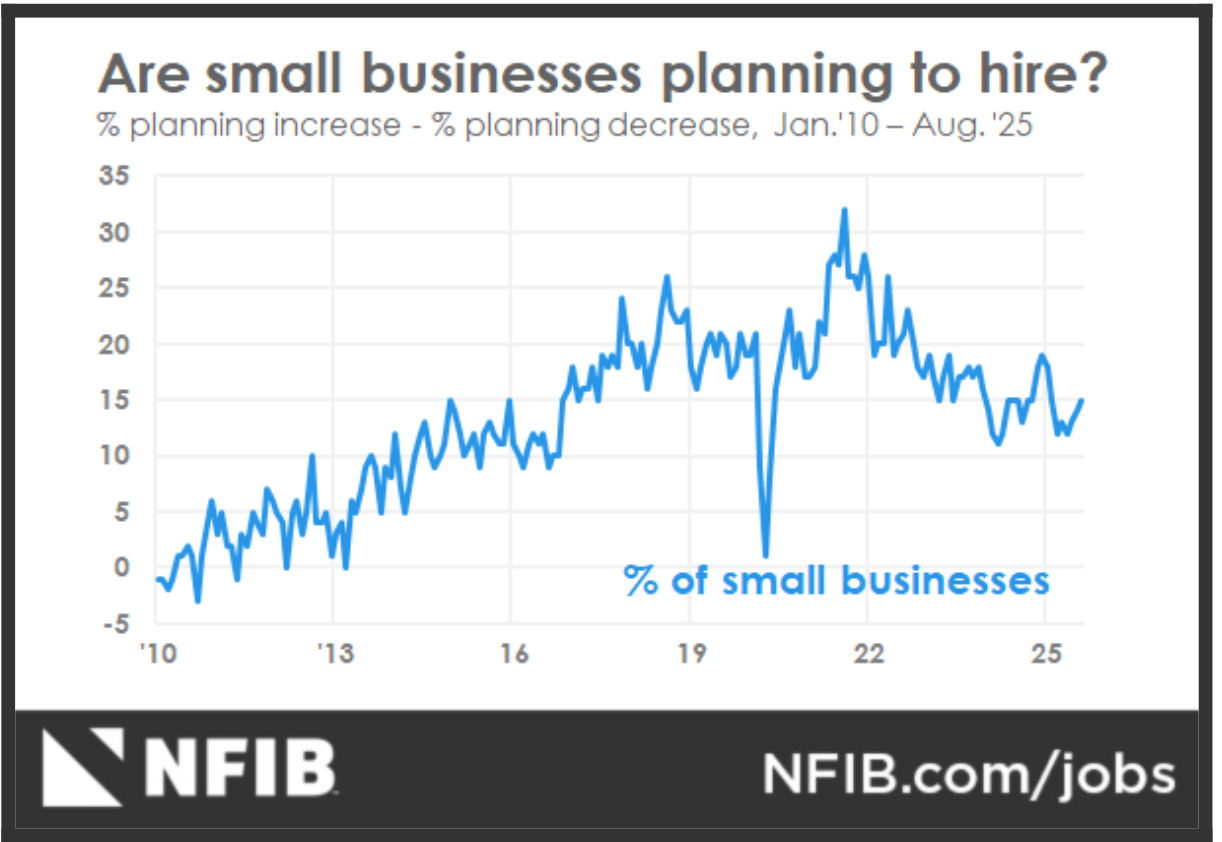

In the midst of this, NFIB surveys are beginning to show expansionary momentum in hiring. What markets see as a “deteriorating” labour market may instead be a transition toward stability, not collapse.

Adopting this narrative, the Fed is easing into a reflationary environment, which would lead markets to reprice rate expectations (signals policy normalisation over emergency easing). As such, the implications for the dollar shift meaningfully. The sluggish price action in the dollar this past week encourages our view of the de-dollarisation trend as overblown and now fading.

Meanwhile, outside the US, growth profiles were propped up by temporary distortions, notably, front-loaded exports from Europe and Asia into the US ahead of tariffs. As those flows normalise, GDP prints abroad will lose some shine just as US data stabilises. Put differently, the dollar has overshot to the downside. If we assume no imminent US recession (still a dollar positive), the Fed’s upcoming cuts into a still-resilient macro picture are more likely to mark the bottom of the smile. From there, the dollar can climb again not on fear, but on a reassertion of US strength relative to a slowing world.

We expect the USD to stabilise in the near term into year-end, with broad-based recovery through 2026.

The smile, it seems, is about to return!

Bank of Egland: damned if you do & damned if you dont

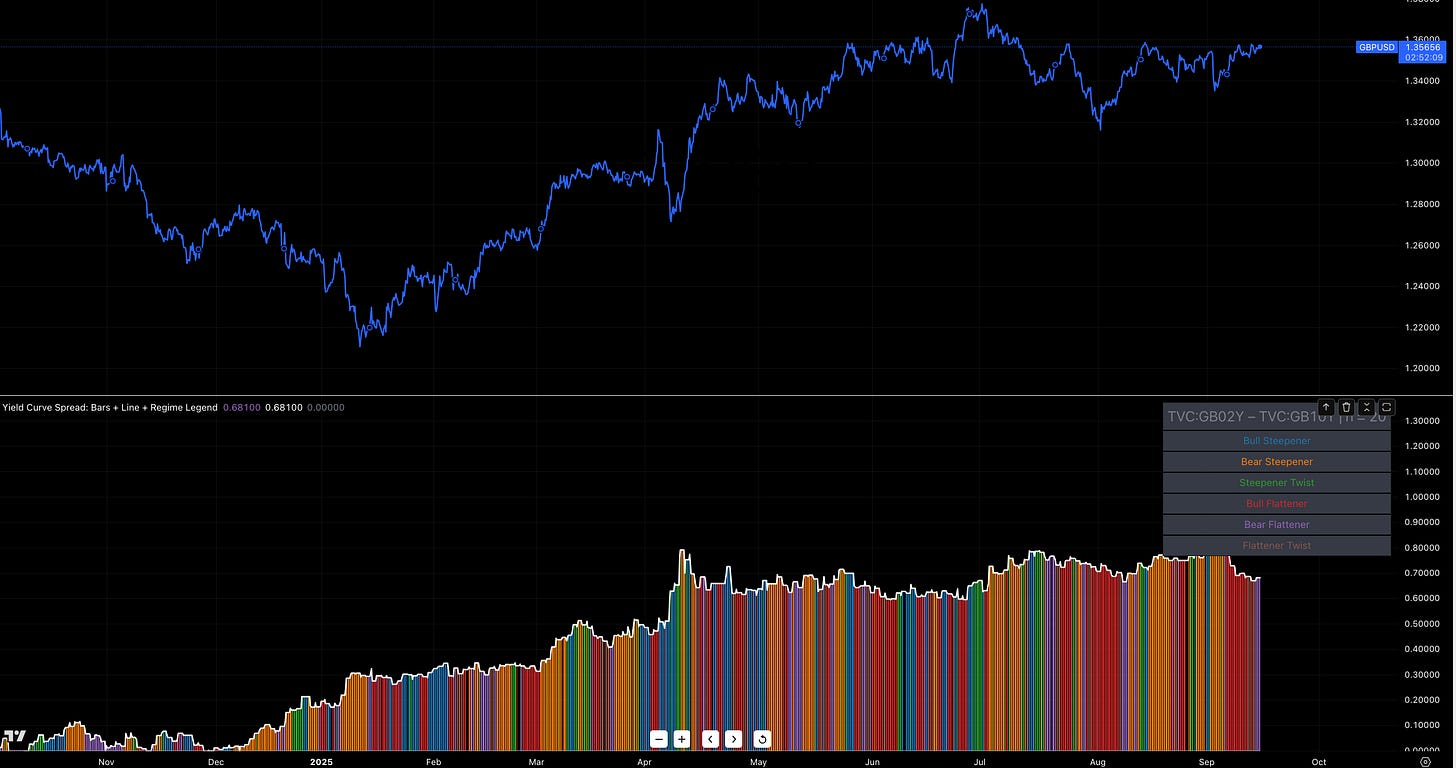

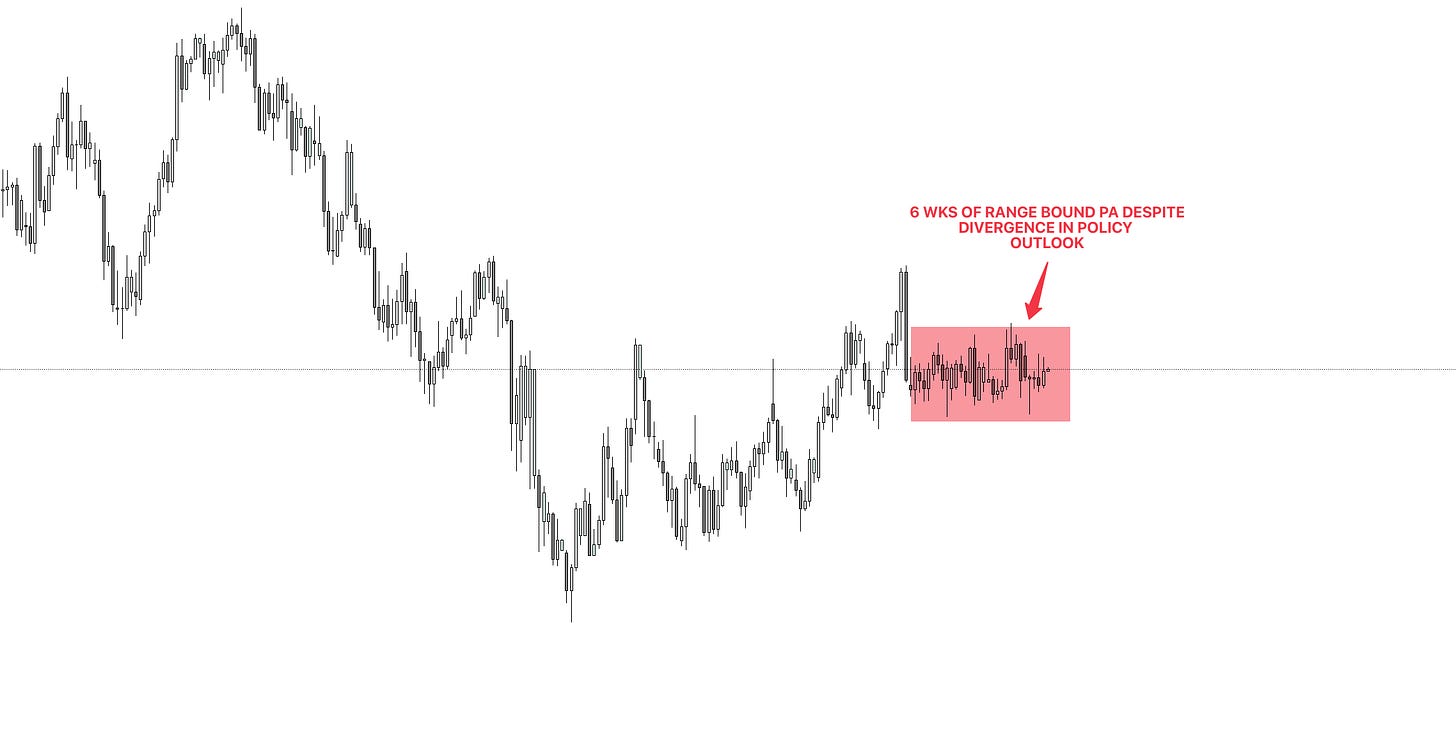

Less than 1% probability of a rate cut going into the meeting as the Committee is expected to keep its policy rate unchanged as the economy continues to grapple with a sticky inflation outlook. Frustrating as last week’s price action on the GBP/USD was, our bearish view for the cable is still very much intact, strengthened even. The bid caught has little to do with domestic macro and at large courtesy of global flows, particularly that of the US easing narrative repricing IRD spreads.

The headwinds to the pound, in our view, continue to compound. With the BoE forecasted to hold rates steady we expect markets’ attention to shift towards communication on the likely pace of quantitative tightening (QT) for now. Markets lean toward a slowdown in gilt sales closer to passive roll-off, but if the BoE sticks to the current £100bn pace, the impact could be disruptive.

An unchanged QT trajectory risks pushing gilt yields higher just as fiscal concerns intensify. Historically, sterling trades poorly when gilt yields spike—the market reads it less as a “higher carry” story and more as a constraint shock from fiscal debt increases.

The November budget is the next major risk event for sterling. The pattern here is still likewise familiar: whenever fiscal discipline is in doubt, the pound sells off and gilts bear the adjustment. Markets will be quick to punish any sign of slippage. But here’s the caveat—even if Reeves leans on higher taxes to project discipline, the “credibility premium” is unlikely to save GBP, in our opinion. Tax hikes may steady gilts in the short run, but they deepen the growth drag in an economy already defined by weak productivity and fragile demand.

Bondholders might find some comfort, but FX won’t.

For sterling, in our view, growth trumps credibility. The structural bias remains lower, and the delay in BoE easing only makes the eventual adjustment sharper.

Hold the line!!

FX Trade Idea: Long EUR/GBP

ENTRY: 0.86468

SL: 0.86321

TP: 0.87128

Bank of Japan

The yen remains under pressure, caught between US rate cut expectations and Japan’s own domestic uncertainties. The resignation of PM Ishiba has injected fresh political noise, complicating the BoJ’s already cautious stance. For now, the BoJ is expected to hold rates steady at 0.50%, but markets will scrutinize its guidance for any hint that a hike could come as soon as October once political dust settles.

On paper, the yen should be strengthening. The Fed is gearing up for back-to-back cuts into year-end, US yields have already rolled over. In textbook divergence terms, that mix argues for USD/JPY to move lower.

Yet politics is getting in the way, evident in recent price action. If Sanae Takaichi emergences as the winner in the LDP leadership race, this changes the equation. In our view, markets might be underpricing the implications of a Takaichi victory: her platform of a revival of Abenomics, and political pressure to keep monetary tightening at bay, creates a ceiling on yen strength as JGB yield soar higher even with a symbolic BoJ hike.

FX Trade Idea: Long NZD/JPY

BUY LIMIT: 87.844

SL: 86.914

TP: 89.962

That flips the divergence story on its head. Instead of chasing USD/JPY higher, we look elsewhere. NZD/JPY stands out. The kiwi has already recovered the losses it suffered after the RBNZ’s dovish pivot last month, buoyed by narrowing rate differentials as Fed easing gets priced in and by a robust “risk-on” global environment that favours cyclical currencies. However near-term risks remain, Q2 GDP is expected to show a 0.4% contraction, and a weaker print could reinforce easing expectations, but the improving tone in recent labour market surveys pointing to labour demand pickup, increase in new orders PMI data and terms of trade data leaves room for an upside surprise here on out. Should that occur, NZD would be quick to benefit, particularly on the crosses.

Thank you all for your attention & see you in the next one!

MMH