Brent Crude Short Trade Research

Weakening Demand, Ample Supply, and Reduced Geopolitical Risk Create Downward Pressure

Hey Crew,

“Feeling in flow.”

The only thought in my mind as I wrote this report last night around 02:00.

It’s been a blissful experience witnessing the progress being made.

Get up, work, get up, fail, get up, learn, get up, work, get up, win.

A continual process we’re all on, we just have to go the distance.

Anyways, crude has been in my peripheral vision. Upon researching the crude market, I see short-side opportunity for the commodity, based on three key factors affecting the current and future supply-demand balance.

Weakening demand, growing supply, and reduced geopolitical risk.

So, let’s dive into the details behind Brent crude shorts, but before I do, let me give you an update on my Dollar Yen trade idea and JGB short play.

Yen & JGBs Short Update

USD/JPY: Bearish

JGBs: Bearish

As you would know I’ve been very vocal with my short view on the Japanese economy, particularly its sovereign debt market, JGBs (Japanese Government Bonds) and its currency the Yen.

Governor Ueda has made it clear in several interviews that for the central bank to consider increasing policy rates they must first see sustainable wage growth above the 2% target. In March, we will hear more about the spring wage negotiations, named shunto, which bring together unions and management of companies with more than 1000 employees to discuss wage increases.

I first shared my short perspective on February 16th, in this article, Why GBP, JBGs and Yen Remain Shortable. USD/JPY was trading at 150.00 on February 16th ‘24 as seen in Figure 1.

Since releasing that report I followed up with a report, Analysing the USD/JPY shorts, last week doubling down on my viewpoint and shifting my perspective on the Yen from neutral/bearish, to bearish. I highlighted how a hawkish tone from a rather neutral policy board member, Hajime Takata was a real signaling point that a shift is taking place within the BOJ. If you want a recap of why I was neutral in the first place, here’s a link to that report.

As of the time of writing, USD/JPY is trading at 147.850, down 2.3% since the first published report.

I’ve got limit orders waiting to be activated on Dollar Yen, whilst I currently hold my shorts on JGB futures as seen in Figure 3. My position on JGBs looks to exploit price movements leading up to and after the Shunto wage negotiations where I expect the BOJ will hint further at their March 18th meeting the plan to remove negative rate policy.

As such, my target on JGBs is in sight with further targets set out upon completion of this position. This position falls into my ultra-short duration pocket due to its relatively short expected hold period.

As always, the aim here at MMH is to provide actionable research across FX, FI and commodities, not just informative research. So we aim to provide a balanced set of arguments supporting and going against each trade idea in order that you may build a framework of “strong opinions, weakly held”.

Chinese Growth To Drag Crude Prices

Brent Crude Outlook: Bearish

As it stands Brent crude oil futures are in backwardation, meaning that Brent spot prices are trading higher than the Brent futures price. This means that the market expects the price of Brent crude to decrease further along the curve (later date in the future). In a normal market, the Brent futures curve is in contango, meaning that the forward price of Brent is higher than. the spot price, reflecting the market’s expectation of higher prices. Doubts regarding China's ability to hit its 5% growth target for 2024 raise concerns about weakening oil demand. As the world's largest oil consumer, a lack of significant stimulus could significantly dampen Chinese demand throughout the year, putting downward pressure on oil prices.

At the time of writing, Brent crude is trading at $82.50, with technical patterns confirming that crude price’s failing to trade above the $83.72 handle. The trade is expected to fall into the short ultra-short term to short-term duration <30 days as I believe the current fair market value for Brent Crude is between $80.00- $79.00 p/b. Due to legal and regulatory purposes, I must emphasise this is not investment advice, but rather me expressing my personal market views.

Trade Outlook

Two days ago during China’s annual national conference, state planners set the target for Chinese growth at 5% for 2024. However, the lingering concern amongst markets/traders is that the CCP failed to bring to market new stimulus measures that would materially boost the Chinese economy, particularly domestic consumption. China is still amidst a property slump which the government has aimed at backstopping, but once again, investors aren’t convinced with the policies proposed by the CCP as broad Chinese indices continue to trade heavy. This negative sentiment surrounding China’s economic growth prospect will weigh heavy on crude prices.

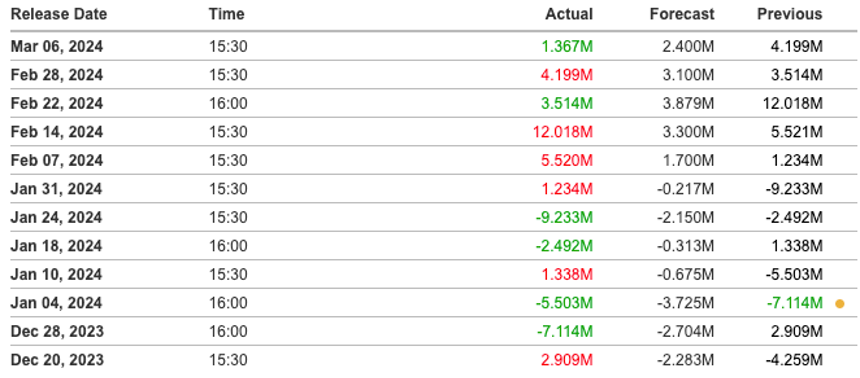

U.S crude oil inventories have generally surpassed forecasts, except for January 24th, 2024, which saw a draw of 9.223 million barrels. February 14th marked the largest positive surprise, exceeding expectations by 8.7 million barrels.

Despite OPEC's production cuts in Q3 2023, led by Russia and Saudi Arabia, crude prices remain subdued. This is primarily due to the market's awareness of ample global oil reserves, which could be quickly tapped if demand increases. The lacklustre growth outlook for economies outside the United States further weakens the potential impact of further production cuts on Brent crude prices.

Factoring geopolitics into discretionary positions in 2024 has become somewhat of a norm; whilst tensions in the Middle East persist, the oil markets have settled and had ample time for volatility to subdue. In the peak of the October 7th attack, OVXCLS (Crude Oil Volatility Index) sharply peaked at 40.00 and continued its rise peaking on the 27th of October at 46.5, right after the Israel Defence Forces announced that it is “expanding ground operations” in the Gaza Strip and “operating forcefully” on all fronts against the militant group.

The 27th of October 2023 also marked the date when two drone missiles were fired in a northerly direction from the southern Red Sea (Houthis), aimed at Israel but failed to strike the target and instead injured half a dozen citizens in Egypt, which further reiterated the contagion risk the Israel-Hamas conflict presents.

Fast forward to today and the OVXCLS index is trading near ’23 lows showing the minimal focus on geopolitical factors as opposed to global growth.

Risk Factors

Data released this morning shows a 5.1% increase in Chinese crude oil imports for the first two months of 2024 compared to the same period last year. This rise in imports suggests stockpiling by refiners in anticipation of increased fuel demand during the Lunar New Year holidays in February.

The Lunar New Year typically brings a seasonal surge in fuel consumption due to nationwide travel for family gatherings. As a matter of fact, our very own Macro Analyst Jingxuan Niu travelled back for the holidays reiterating my point! However, a 30.6% decline in refined oil exports raises concerns about broader Asian demand. China's significant crude oil imports, for both domestic use and strategic reserves, are likely a contributing factor to this decline.

With economies like Japan experiencing recessions resulting in a drop in demand for refined petroleum products, China's refined oil exports are expected to remain sluggish.

In conclusion, weakening demand from China, ample global oil reserves, and reduced geopolitical risk are all expected to exert downward pressure on crude prices which is why I expect Brent prices to trade south. Recognising the potential risks associated with unexpected demand surges from mainland China, inventory drawdowns, and unforeseen geopolitical events. This report aims to equip you with the necessary information to make informed decisions, emphasising the importance of understanding both potential rewards and risks.

As always, strong ideas, weakly held. Remain adaptable.

I hope you all took a point or two away from this report guys; always good to hear from you so let me know your thoughts!

Until next time