Bracing for stagflation

After a long easter and bank holiday weekend, analysts turn their heads back to the UK as last week’s inflation print of 7% had the pound trading at new year lows of 1.2970. With the government doing very little to help UK households with the rising living costs and real earnings falling, the climate of the economy points toward one possible scenario, prolonged stagflation.

Further suffering for Eurozone

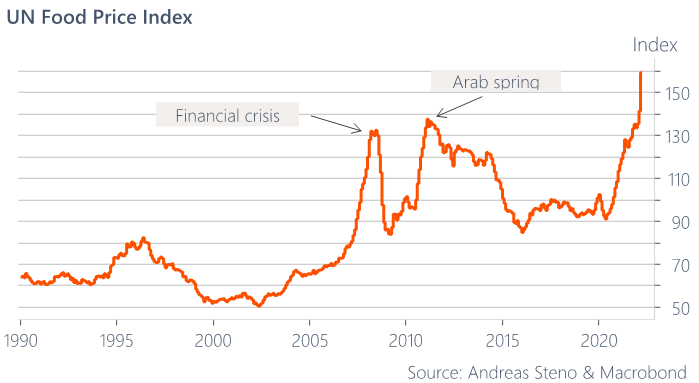

The war in Ukraine is set to destroy half of Ukraine’s harvest this year which is crucial not only to Europe but global supplies. This is set to have an unpleasant impact on the Euro zone’s inflation figures this quarter. At the time of writing the euro is trading below the 1.079 mark with little hope of a rebound.

As the ECB plans to terminate its asset purchase program this summer, Christine Lagarde is under pressure to keep the Eurozone afloat as it too faces stagflation risks which she wisely avoided mentioning at the most recent press conference. Main euro rates remain at 0% with the deposit facility rate negative 50bps. The question is, for how long?

This week Europe’s inflation figures will surface and Fed Chair Powell speaking later on Thursday. Over in the UK retail sales are set to come in negative MoM for March so analysts will be paying attention to all releases.

The US is poised to deliver its first round of 50bps hikes as traders price in a 96% chance of this happening. May 4th is the date, we expect Fed Chair Powell to speak on the tightening of monetary policy once again.