Bonds: The Glue of Financial Markets

Demystifying the world of fixed income assets and exploring it's key role within financial markets.

Hey crew,

One message.

Take that step.

Yesterday I attended the global fund centre event hosted by the Luxembourg fund.

Excellence personified.

Discussions on alpha generation, regulatory developments within the asset management space and of course, private markets with a focus on private debt.

You ever felt at home in a completely foreign environment?

That was me.

Listening, typing, listening, typing.

Sometimes you just have to make moves towards your goal that your future self will thank you for.

Macro focus.

Anyways, today’s report will be a deep dive into the world of fixed income and why bonds truly are the glue of financial markets.

To the free community I know I missed you with an article last week so I’ve added you to this week’s private MMH report, enjoy!

What Are Bonds And Their Use In Markets?

Many of you will be familiar with the world of fixed income (FI), I myself spent some time covering emerging market (EM) sovereign debt at my previous firm (on the sales side), which was my first real dive into the world of fixed income. Even with the fundamental knowledge of bonds, some of you may not be entirely sure how the entire plumbing of the financial system revolves around the bond market.

Let’s first answer the question, what is a bond?

A bond is an IOU agreement between the borrower (issuer) and lender (creditor). Now these “IOU” agreements can range over different maturities from a few months or less than a year (T-bills) to 10, 20 and 30-year maturities. Your next question may be, who issues these instruments? Governments, corporations and municipalities (local/town governments). Now, these entities will issue bonds to fund projects and expansions. Here’s an extension of the big players within FI:

Banks

Corporations

Governments

Insurance firms

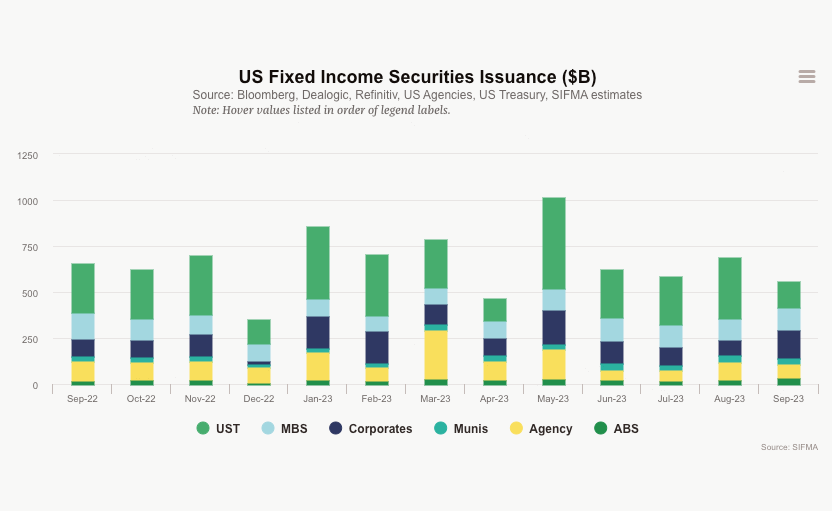

Now broadly speaking, government bonds and corporate bonds remain both the largest issuers and sectors of the bond market. Here’s a visual representation of the composition of the US bond market by issuers.

As expected, UST (treasuries) take the top rank for issuance of FI securities with agency debt and corporates following behind UST issuance. Before I explain what agency debt is, it’s important to understand that the macrocycle plays a huge part in the increased issuance or lack of issuance of corporate debt.

During periods of rising rates, corporations tend to avoid/reduce their issuance of debt due to the high-interest fees they’ll be forced to pay. Whereas, rewinding the clock to 2021 when borrowing costs were practically non-existent you would have seen a huge rush to issuance from corporates resulting in Figure 1 showing corporations with a larger share of US fixed income issuance.

Referring back to Figure 1, agency debt, aka, agency securities are debt securities issued by government-sponsored enterprises (GSEs) in the US. These GSEs are private companies that were created by the US government to provide funding and liquidity to specific areas of the economy such as mortgages and student loans/business loans. You might be familiar with Fannie Mae and Freddie Mac, both agency debt issued to provide liquidity to the US mortgage market.

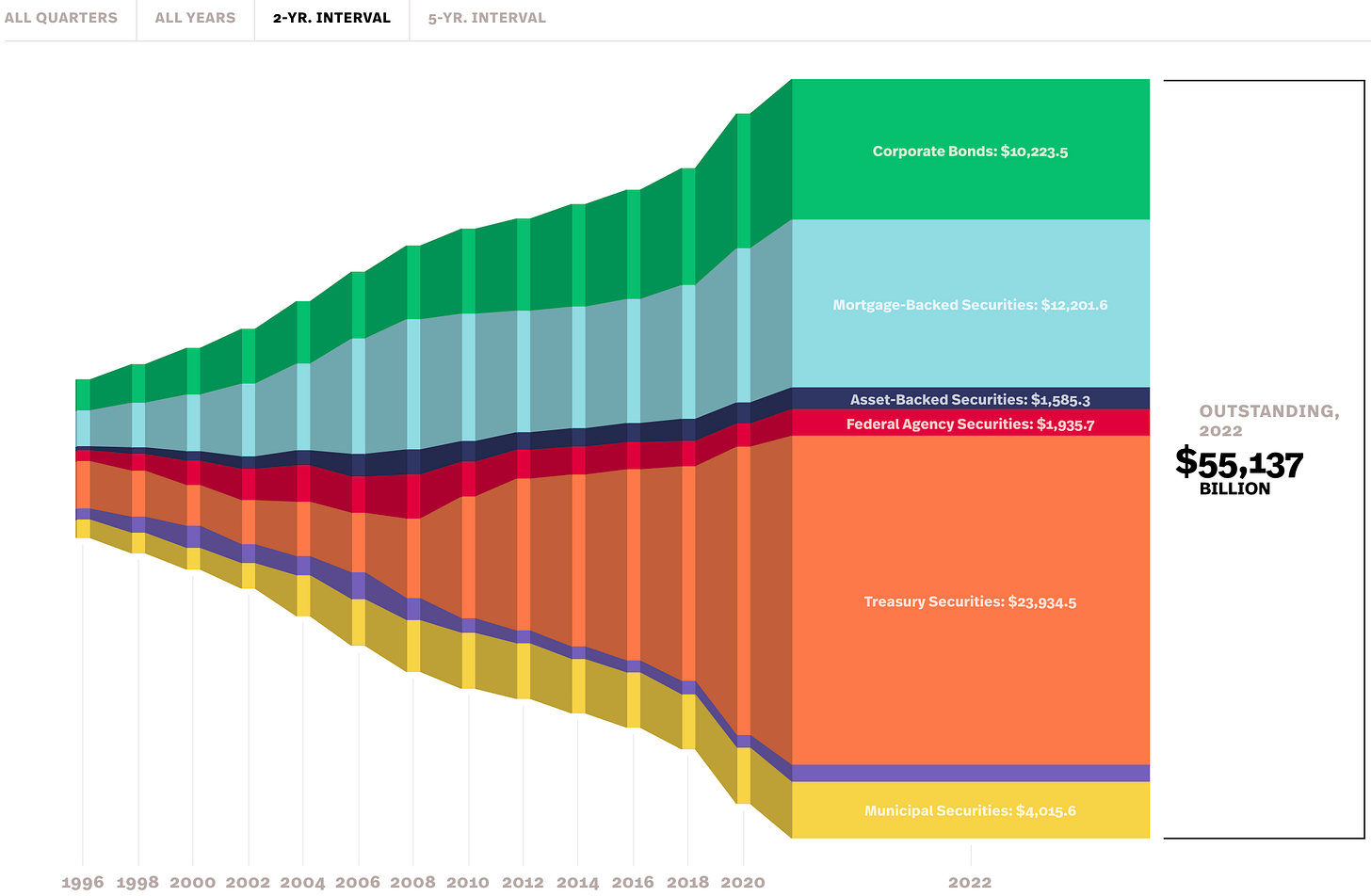

As it stands this is a representation of the US fixed income market by outstanding securities.

This should give you a better picture of which bonds make up the DNA of the US fixed-income market.

I know what you’re thinking.

How does the entire financial system revolve around bonds?

The answer? Liquidity.

Liquidity was a key theme that emerged throughout the panel discussions at the Synergies in Asset Management Conference yesterday.l

The Global Head of Digital Assets Strategy from HSBC made this simple yet fundamental remark when asked about the reason behind the digitalisation of assets:

“This is all about liquidity”

— John O’Neil, HSBC

John is responsible for CBDC development at HSBC, and although that’s completely different from bonds, the principle behind it remains the same.

When you think of the basic use of bonds outside of governments, and corporations raising financing, you realise the bond market is what keeps the global economy together.

Monetary policy needs bonds in order to function efficiently. Central banks use bonds in order to influence the available money supply within the economy, and therefore influence short-term interest rates.

With this understanding, it’s a fair assumption that:

Bonds = liquidity

You may wonder, what channel central banks use bonds to implement their monetary policy, and that’s money markets.

To re-jog your memory, money markets are the market for short-term lending between banks/institutions, from which activity within this interbank market provides the basis for growth and increased liquidity in the broader market.

But why such a focus on liquidity?

At the heart of nearly every financial crisis, you’ll find that a lack of liquidity is almost always present. The withdrawal of liquidity from markets makes it difficult and costly to enter and exit financial securities; this lack of liquidity results in a credit crunch as the cost of short-term capital increases.

The best way to measure a lack of liquidity is to measure bond volatility. When bond volatility is elevated, as it was during the run-up to Lehman Brothers’ collapse, investors become more reluctant to trade bonds due to the uncertainty about financial conditions resulting in a reduced volume of bond trading activity. It doesn’t take a genius to realise that low-volume bond trading results in wider bid-ask spreads which increases the cost of trading these instruments.

I hope this simple intro into bonds has helped clear certain concepts on the role bonds play within financial markets.

This is the first of the bond deep dive series where we’ll uncover the true importance of bonds within the financial system.

In my next report, we’ll break down the different components of the interbank market, the different Fed financing facilities and how bonds play a crucial role in both markets.

I enjoyed it.... 👍

Insightful !