Betting Against The CAD: House Keeping & Portfolio Structure

The Case for a Stronger USD/CAD

Hello Crew!

In global macro, one of the most overlooked skills is clarity of thought. Independent, disciplined thinking that filters out the noise from key drivers.

Too often, we are taught to lean on the biases of the “big players.”

Case in point: while several major desks continue to forecast near-term dollar weakness, our research since July has consistently taken the other side, building a long USD thesis. Broadly against G10, but today among other high convictions we forecast an asymmetric opportunity in the Loonie CAD.

Let’s break it down.

I’ll admit it’s not the best case to make for long USDCAD this week on the back of rather out of consensus miss for ISM figures and secondary jobs data surveys (JOLTS, ADP, claims) so far. From our read, and judging by recent price action, the market still remains laser-focused on the payrolls report in under 24 hours. That release may confirm or challenge the view that slack is developing in the U.S. labour market. Payrolls between both economies this Friday will help set expectations for relative policy paths between the Fed and the BoC, shaping the USD/CAD rate spread.

But the more compelling story lies on the Canadian side of the equation.

The CAD faces a confluence of headwinds at present, in our view, makes a compelling case for USD/CAD near- and longer-term appreciation. For us, whilst markets remain over-fixated on the Fed policy outlook, we view a greater underestimated structural tail risk facing the Canadian economy, warranting a more dovish stance for the BoC or at least markets perception thereof.

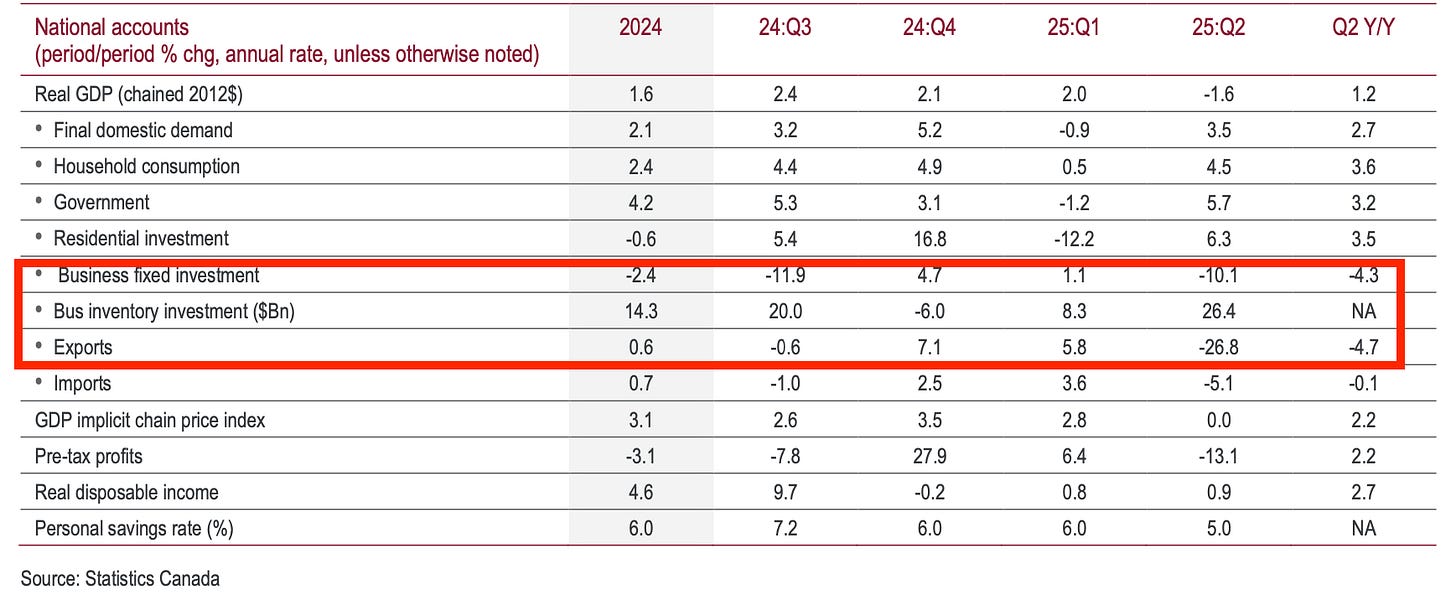

On the macro front, the BoC finds itself in an uncomfortable position mix of deteriorating labour market with UR at 6.9% and GDP figures contracting 1.6% annualised in Q2 against the -0.7% expected. As tariff policies get cemented and global uncertainty trades off its peak, we are seeing the ‘strength’ from Q1 figures fade off.

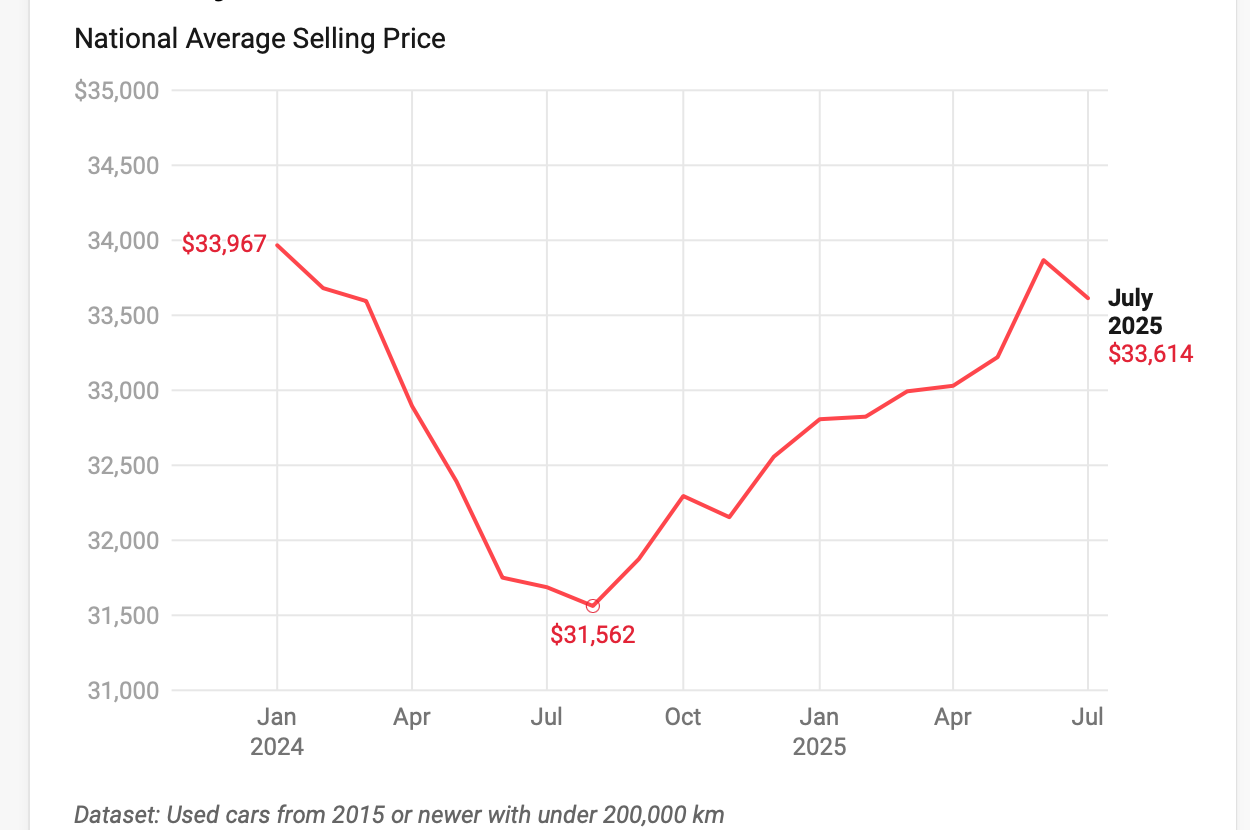

Few standouts to the recent GDP figures is the drag from business fixed investment, likewise the unwinding of Q1 tariffs front-running. As devious as these figures are, in comparison to the July BoC MPR, it’s almost in line with forecast as GDP only disappointed 10bps by the bank estimate. At face value, this offers somewhat of a mixed read. Household consumption and final domestic demand beat, however not because consumers are flushed; rather we are now seeing the upward effect of tariffs on prices add particularly in autos with household saving falling to 4% (1pp reduction from previous) leaving us to believe that room for growth is questionable here on out.

More so, the inflation timeline has developed to be an interesting one. As is the current state of affairs of other developed markets like the US and UK, where inflation isn’t giving the clear go-ahead for further policy easing, the July report released showed 20bps reduction from the previous 1.9% reading, a development that would be very much welcomed by the bank. However, one thing we struggle with could be Macklem commitment to resume easing. A total of 225bps in easing over the last year has been conducted. Given the fiscal impulse and its lag thereof will pose to a great hurdle warranting more cuts from our perspective, considering for the most part some of these appear to be supply shocks with academic reference pointing to little effect of monetary policies in easing demand here compared to a more fiscal approach.

In our base case, we remain biased towards a September cut to close the output gap, but data will be the ultimate decider given only c.14bps priced in, a worse than expected surprise in macro release favour more CAD downside however the primary risk to this view is a sudden improvement in U.S.–Canada trade relations, which could lend temporary support to CAD. But, given the historical asymmetry in U.S. trade negotiations, any “deal” is likely to be tilted towards U.S. interests, providing only limited and temporary relief for Canadian exporters. Despite having the lowest tariff amongst countries, the 50% sectoral Section 232 on industries like aluminium and steel will continue to put downward pressure considering the option of Canadian markets that depend on US demand.

Based on these factors, we see the risk skewed to the USD/CAD trading at 1.40 handle over 1.35 with the next event risk being the jobs data the payrolls release this Friday, but with growth in such conditions and less commitment from business to CAPEX spend, it is indicative of reluctancy to hiring, we like the odds here!

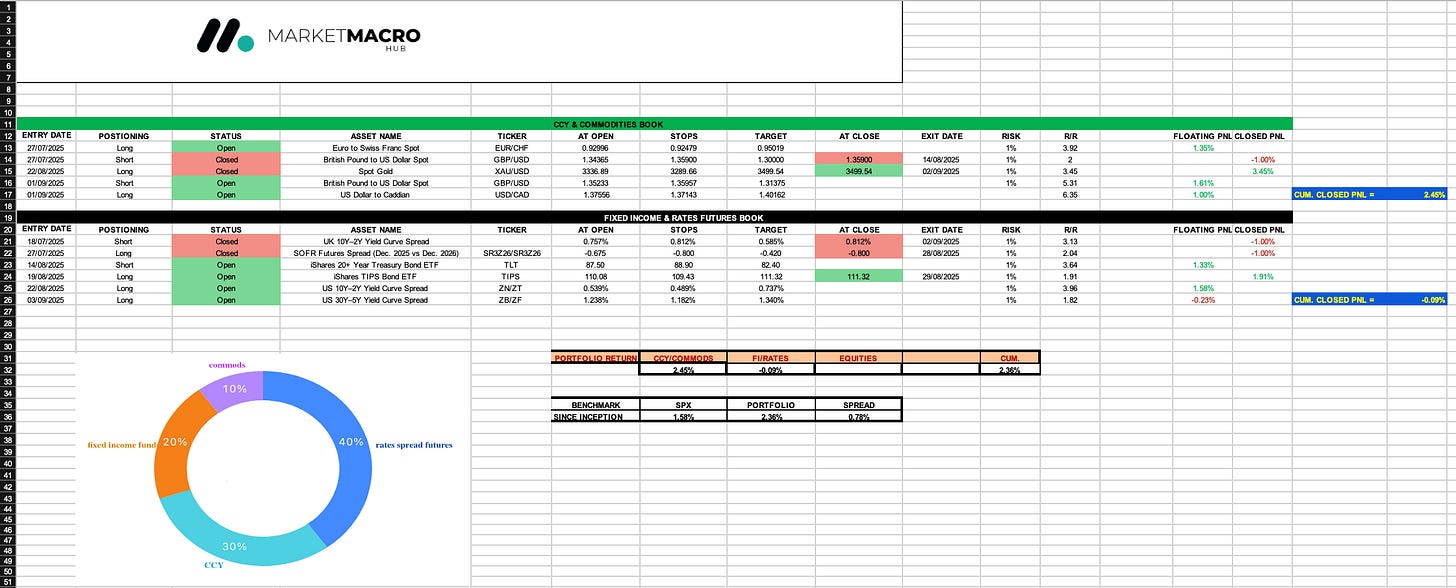

Housekeeping & Portfolio Structure

Trade Update

Following last weeks teaser on CAD (after GBP short recommendation) we begain adding exposure moday london open. So far encouraging PA to the upside with little DD. On a technical setup, pullback in both markets remain a selling (GBPUSD)/buying (USDCAD) opportunity.

Now, rather more technical announcement on the structure of things going forward. Due to the schedule of our publication in order for readers to get the most value in terms of our real-time positioning going forward we will utilise the Substack function to share interim positioning and trade updates across our holding so we encourage everyone to get familiar with the app.

Here’s the downlaod link: IOS || Android

Make sure to enable notifications to stay aligned with our setups.

Portfolio Allocations

Thank you for your attention!

MMH

I found this really insightful! The tail-risk concerns around CAD make sense, especially if oil prices dip further. Still, it’s hard to ignore the strong USD sentiment heading into the Fed’s announcement…