Betting Against Bonds: Short TLT

Rising Yields Play On Strong Growth and Inflation (for now)

Hey guys,

What a great week it was in the markets, things unfolded perfectly in line with thesis’ laid out.

I’m enjoying this calmer environment, but I’m also curious at just how long it’ll last!

Something really stuck in my head after reading this week - To get more, you must be more. Get it done, regardless of the input required.

Let’s attack next week and use the weekend to your advantage.

Portfolio update

This report will discuss the most recent trade added to the portfolio (short TLT), so read until the end!

As mentioned in the previous report, trailing stops were rolling along the flattening of the Gilt curve, leading to a stop loss in +1.12% profit.

TLT trade idea

So I want to continue from where I left off on the most recent report, regarding some yellow/orange flags popping up in the labor market. I mentioned how the revision in the NFP report alongside expectations of a rise in wages but fall in jobs (stagflation set up). The key thing to note, is that there is a distinct difference between yellow/orange flags and red. Red flags mark the reversal of the regime while yellow/orange mark the end coming.

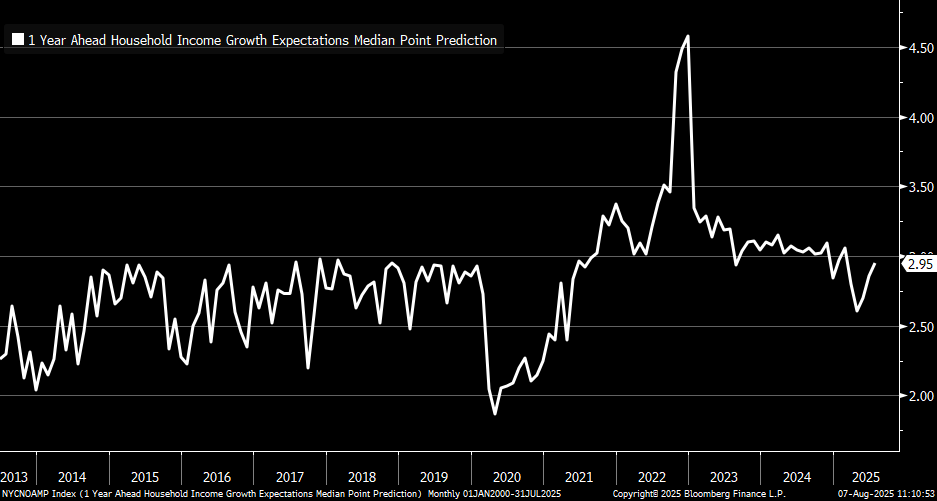

Wage expectations:

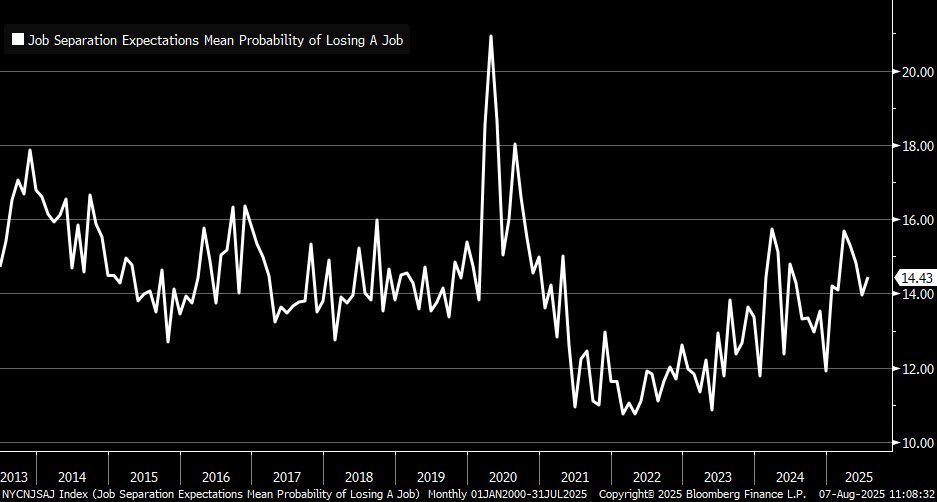

Jobs expectations:

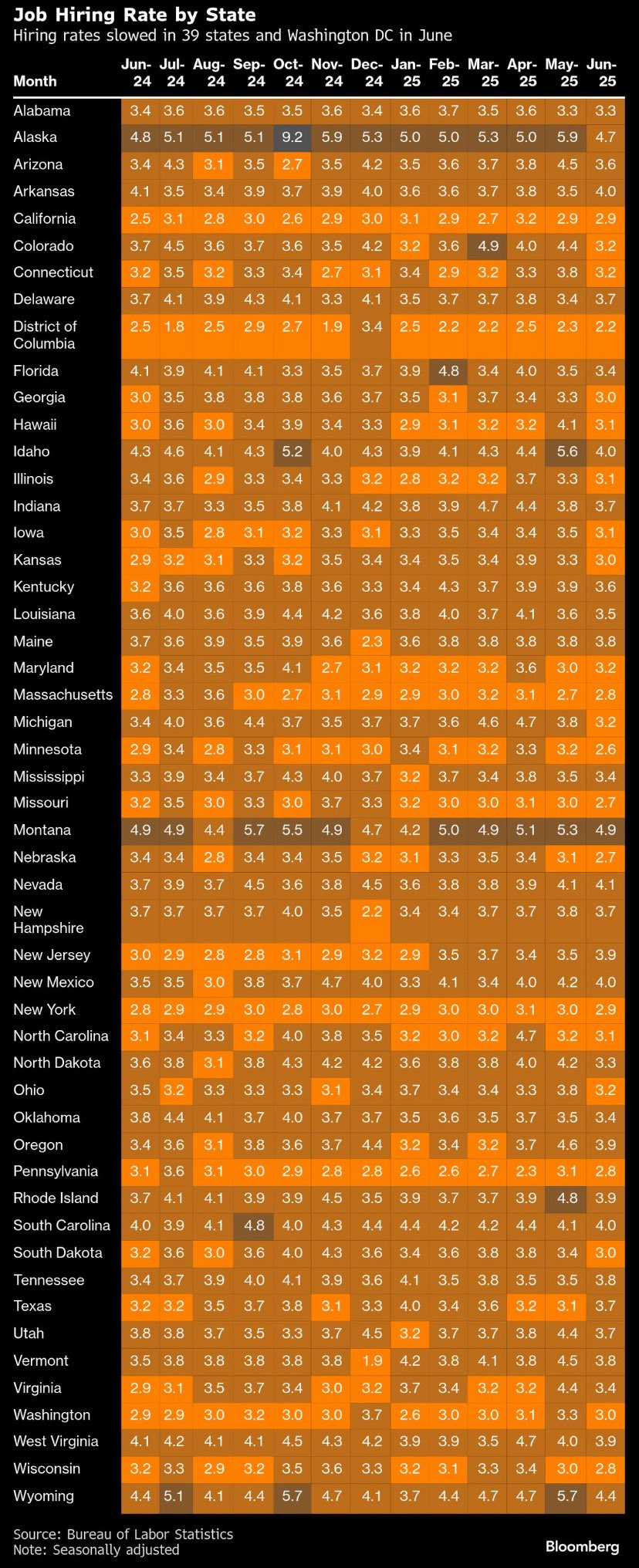

We need to see more of a persistent trend in slowing jobs to really feed into a stagflation regime, which will flip the direction of equities and create an even tougher job for the Fed. This week, another early sign of an ending to the current regime was that the hiring rate fell in 80% of US states in June, meaning that June was one of the worst performing months in the labor market, I’d want to see this until at least September to be sure that this isn’t some transitory effect of the current monetary and fiscal policies in place.

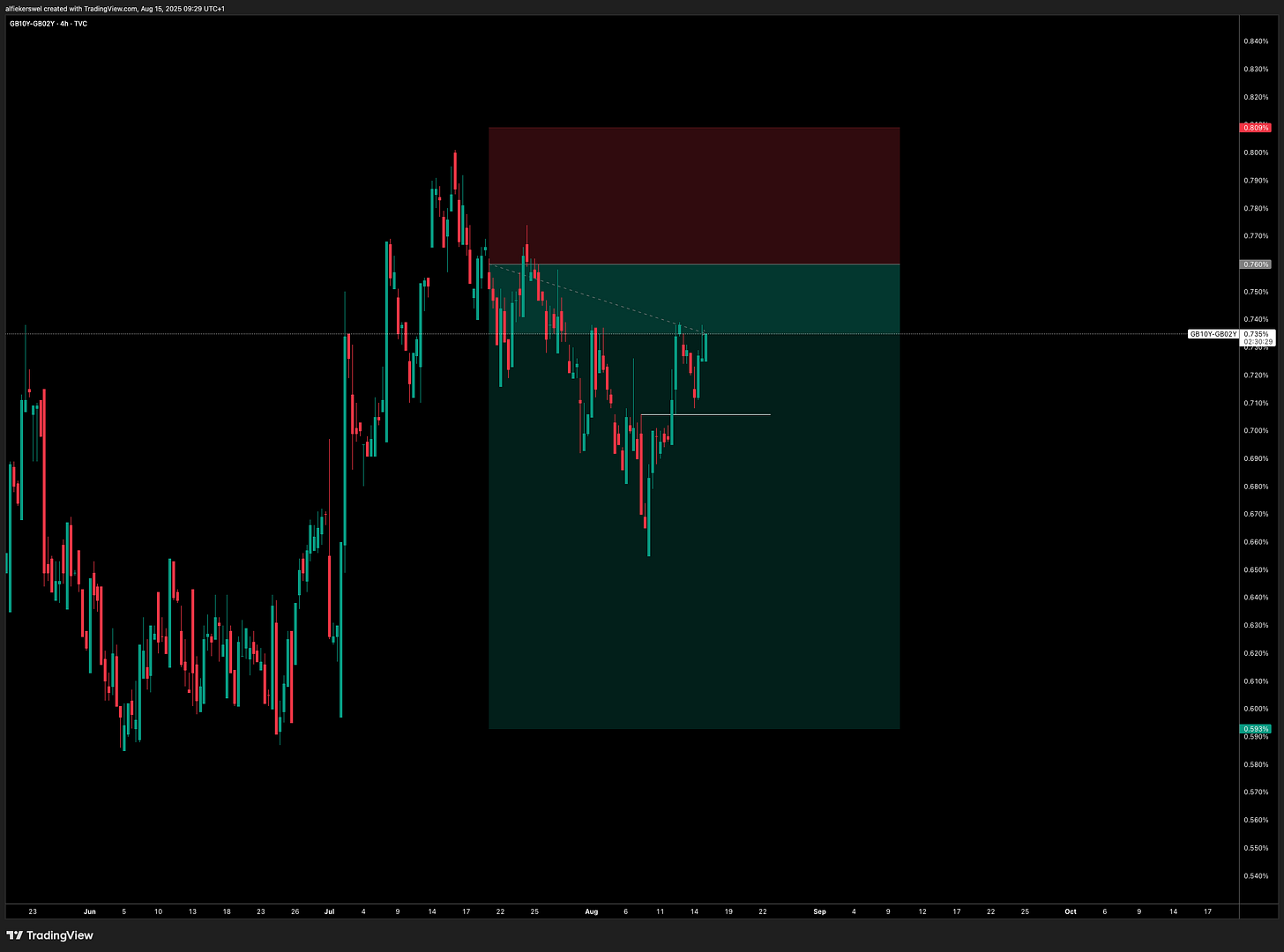

However, just because we are near the end of a cycle, it doesn’t mean we can’t monetise it. So in the meantime, we can play not only the regime in hand (strong growth and inflation), but also the uncertainty in the tail-risk of stagflation. This will be most effective in the long end which is why I think TLT is the best way to capture the highest RR in this theme. The 2s10s is continuing to steepen, there is strong underlying growth in the economy for now.

This is how I’m viewing the TLT short position:

So growth aside, there is now a near guarantee that the Fed will cut into inflationary pressure, which will likely give equities a bid and some heavy selling pressure on ZN and TLT. If growth were slow right now, we wouldn’t be seeing this bull steepening in the curve, especially for such a persistent amount of time.

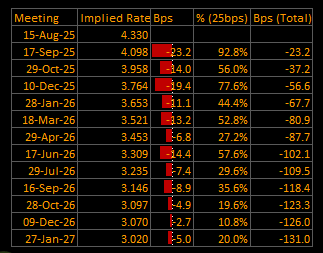

There’s now a 92.8% chnace of a cut in September of 25bp, this is truly overcooked for the inflation and growth present. Chart below form Capital Flows (Substack).

Oh, and liquidity is of easy. The GS US Financial Conditions Index has moved to the loosest since April 2022, and the Fed hasn’t cut rates in nearly 12 months…

TLT is a high conviction play for me in the regime we’re dealing with, however, the tail-risk I am exposed to is a further crack in the labor market in August & September. Also, we know that the market is heavily pricing a cut (almost fully priced) meaning that the tone of Powell will be more important for bonds and equities than the cut itself. Some scenario analysis:

Labor market cracks in August and September, Fed cut 25bp and point to this being the beginning of many consecutive cuts to come - Neutral TLT, long ZT, neutral equities

Labor market cracks in August and September, Fed cut 25bp but remain very cautious on growth and inflation. Long ZN, ZT, short equities

Labor market reignites strength in August and September data, Fed cut 25bp but remain very cautious on growth and inflation - Short TLT (current trade), short ZT, long equities.

Labor market reignites strength in August and September data, Fed cut 25bp and point to this being the beginning of many consecutive cuts to come - Mega short TLT, mega short ZTN, long equities

As simple as possible, that’s the scenario we have at hand.

Enjoy your weekend guys, see you next week.