Backtracking Cuts: Wall St Rallies

Navigating the Post-NFP Market Shift & Currency Playbooks

Hey guys,

I know, it’s been a while since a free report, I know…

It’s been a storming start to the year.

Forever focused. Completely aligned.

I’ve got some great news.

I want to officially welcome and introduce you all to Jingxuan, he joined the MMH research team as a macro analyst late last year after connecting and realising our aligned vision. We’ve been working closely and now I wanted to introduce you all to him and his work.

He was instrumental in the report you can see below.

Jingxuan is one of UCL’s top finance and economics undergraduates with exceptional expertise in financial plumbing and fixed-income markets. His in-depth knowledge and understanding of these critical systems within financial markets will be invaluable as we pursue some deep material with actionable investment implications.

We’re growing MMH family, and the level of reports, insights, understanding and trade ideas will only get better.

Anyways, we’ve got an NFP print to review. It’s on everyone’s lips as this reaffirms the same hawkish rhetoric Jay Powell delivered during the FOMC press conference.

So without further adieu, lend me your attention:

Walking Back Cuts

Rewind two months ago in December and we all received what was confirmed to be the Fed pivot.

This is an exert from my report reviewing the December FOMC meeting, SEP material & press conference:

“After a thorough examination of the press conference transcript and the SEP paper, it is evident that the Fed has undergone a significant shift in its stance. Instead of prioritizing concerns about persistent inflation and potential risks, the Fed now prioritizes avoiding falling behind the curve and "overdoing" policy tightening”

Jay Powell went on to say this at the December press conference:

“We will make decisions about the extent of any additional policy firming and how long policy will remain restrictive based on the totality of incoming data”

Chair Powell

The selection of words used by Jay Powell always holds weight. The word “additional” amongst many other words and answers confirmed that the Fed acknowledged that this was the end of the tightening cycle and that the market could start placing bets on when the first cut would arrive as Jay Powell also cited how “recent indicators suggest that economic activity has slowed substantially" from the outsized pace seen in the third quarter”.

However, in his recent press conference, Powell referenced the “solid” GDP growth seen in the fourth quarter coming in at 3.3%. Today NFP data showed the US added 353,000 jobs vs the 187,000 expected for January. The unemployment rate dropped 10bps to 3.7% and the average hourly earnings YoY for January ticked up 40bps to 4.5%. A strong labour market print for the U.S. Unfortunately for investors, the markets had already been pricing interest rate cuts for the Fed, expecting that growth would come in slightly cooler than forecasted.

Bolstered by a 3.3% GDP growth in Q4 ‘23, a $55 billion reduction in federal borrowing estimates and a 3.7% unemployment rate, the US economy is displaying strong signs of robust health and resilience. Summed up, the Fed have further confirmation why they don’t need to rush into a Fed cut in rates when the US economy is delivering a strong labour market with PCE at 2.6%, edging closer to the Fed’s goal of 2.4% for the year ending 2024.

Market’s NFP Reaction

Yields and the DXY caught a bid post-NPF release, with rate cuts being pushed back until May/June.

A 16-basis point rally across 10-year yields signifies a flight to risk assets by investors, driven by strong equity market performance. Investors are increasingly adopting a "strong US economy, long risk" sentiment, pushing the S&P 500 and Nasdaq towards new highs despite their already elevated valuations.

Repricing

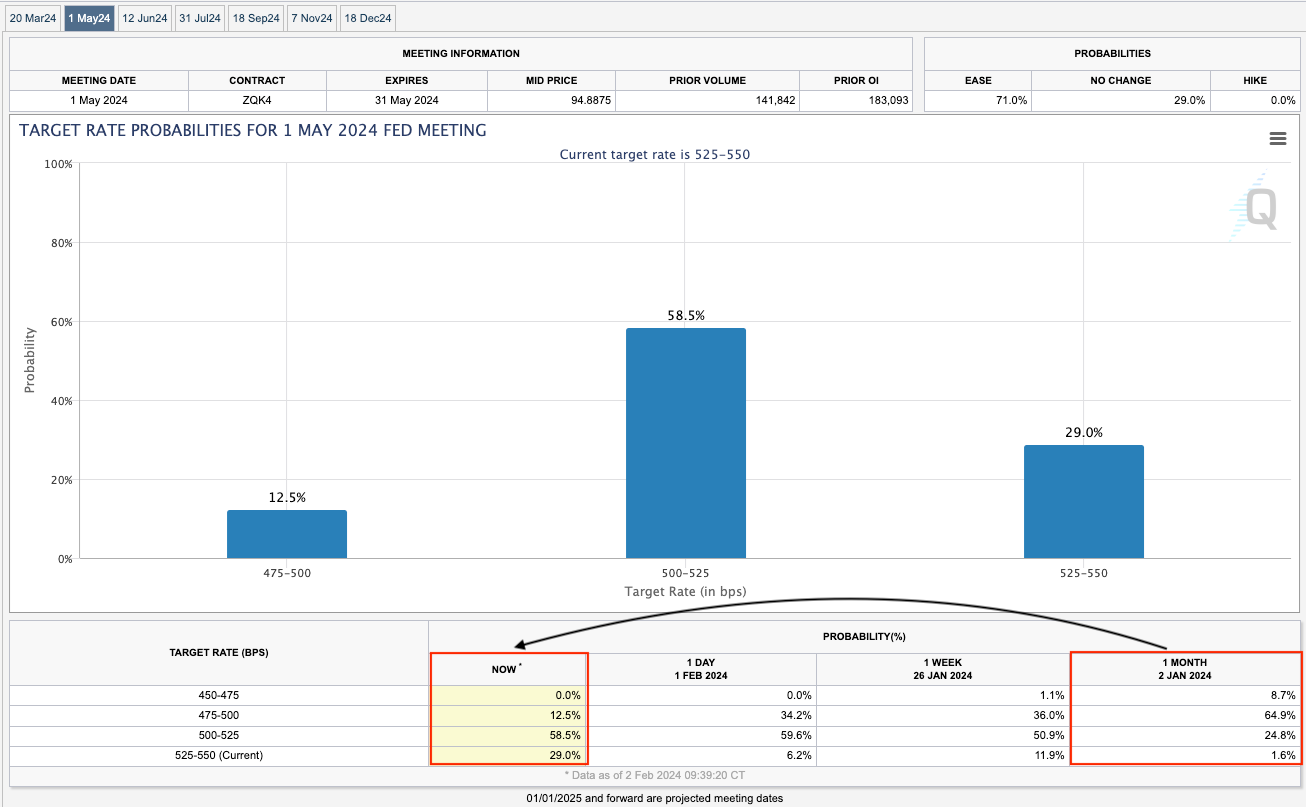

Figure 3 is the target rate probability for the FOMC’s March meeting.

What I want you to focus on is the highlighted section at the bottom. When we say the market “priced in” a move, this is what we’re referring to. 1 month ago, on January 2nd the market put the probability of a 25bps cut at 70%, with only a 21% probability that the Fed would keep rates unchanged. Fast forward to today and the two have completely reversed, there’s a 78.5% probability the Fed hold rates in March with a 21.5% chance of a 25bps cut.

Recent market movements illustrate excessive optimism regarding potential Fed rate cuts. Investors are aggressively front-running expectations of multiple cuts beginning in March.

Beyond March, the situation remains similar. Looking at the FOMC meeting in May, market pricing a month ago indicated a 65% chance of a 50bps cut. This probability has now plummeted to just 12.5%, with the broader consensus favouring a 25bps cut with a 58.5% probability.

Currency Playbook

Ahead of the FOMC meeting on March 20th, two key factors shape our currency playbook:

Robust US Economy: The US economy exhibits significant strength compared to its G7 counterparts, laying the foundation for continued expansion. This positive momentum suggests an appetite for risk.

Dollar Strength: Optimism towards the US economy and the dollar suggests positioning against Dollar currency crosses. We anticipate a stronger dollar to appreciate against G7 currencies.

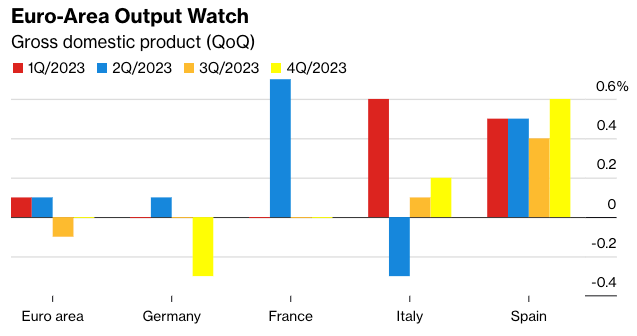

While the Eurozone narrowly avoided recession, stagnating in the fourth quarter of 2023, thanks to firmer growth in Spain and Italy, Germany’s economic woes and the region’s reliance on growing Chinese demand remain its Achilles heel. Euro downside potential exists.

The story is similar across the UK with growth stagnating and core inflation stuck at 5.1% both currencies present downside opportunities so I remain bearish both on the Euro and Cable.

That’s it for today crew.

I hope you enjoyed this brief snapshot report, simple, direct and informative, that’s my goal for delivering research to you all.

Next week we’ll be diving into something very significant within the current macro landscape so be sure to add my email to your VIP list! (it makes sure you’ll never miss a report)