Analysing the USD/JPY & JGBs Sell Off from a Macro POV

Analysing the trade scenario for the BOJ pivot and the role the Dollar will play in the Japanese Yen

Hey Crew,

It’s been a beautiful week.

“Keep swinging the bat” —some advice I received a few weeks ago when I sat with a mentor of mine. Decades in the City & Wall St, accolades upon accolades, his secret was just that. “In the trenches, swinging the bat”.

So my words of wisdom today, is to keep swinging that bat. Keep working, keep pushing & chasing what you want.

Anyways, Hajime Takata, a BOJ policy board member, held a speech in the early hours of the morning, triggering a sell-off in JGBs and USD/JPY. So let’s break down his comments and the data supporting the policy pivot.

As always, I aim to inform and educate you to expand your area of understanding, so let’s begin by breaking down the framework governing the BOJ.

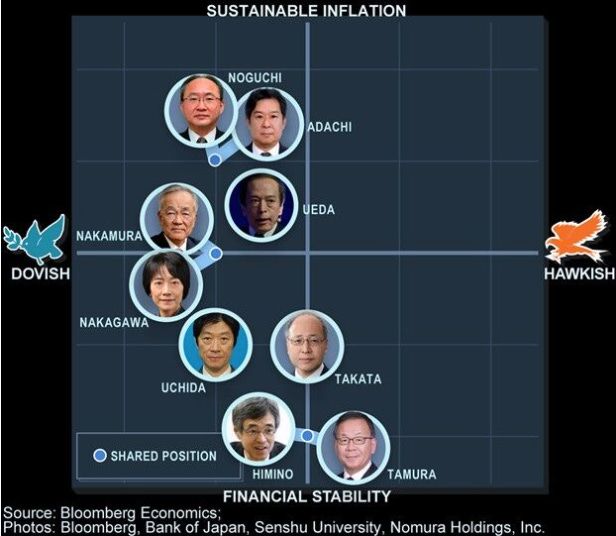

The Monetary Policy Board

The Policy Board of the BOJ, seen in Figure 1, is the main decision-making body responsible for implementing monetary policy in Japan.

The Policy Board consists of nine members, the Governor (Kazuo Ueda), his two deputies ( Himino Ryozo and Uchida Shinichi) and the remaining six members of the policy board.

I expect this visual representation of the hawk/dove scale doesn’t come as a surprise as we know the extreme dovish stance of the central bank. However, early this morning Hajime Takata held a speech saying that the bank’s price target has finally come into sight. Takata added that exit measures should include abandoning of the yield curve control mechanism, exiting negative rates and committing to overshoot inflation targets.

Why are his comments so important?

Typically, hawkish policymakers' comments are seen as reflecting their established, more hawkish view of the economy. However, when a previously neutral board member publicly acknowledges that the inflation "target is finally coming into sight," it signifies a significant shift in sentiment among BOJ policymakers, suggesting they believe the economy is now ready for higher interest rates.

The second reason, this statement nullifies the concerns over Japan tipping into a technical recession. If the BOJ were concerned in one shape or form the BOJ would cease to mention rate hikes and focus on stimulating growth and demand much like its Asian counterpart China.

Market reaction

This is how markets reacted to his comments:

The Yen gained 0.50% against the dollar as USD/JPY fell just over 100pips by the European Open open 07:00. JGBs (Japanese Government Bonds) traded heavily after the speech as investors shorted JGB futures in anticipation of higher BOJ policy rates.

The Macro View

For all technical traders aiming to incorporate macro into your strategy, or just broaden your understanding and awareness to be able to find positions this next section will be key for you. Particularly “The trade” section.

Japan’s economy, despite headlines, is not in a bad place. Yes, there could be stronger growth and underlying industrial activity, but overall the sentiment surrounding Japan’s economy is extremely bullish.

Japan has been a beneficiary of the economic turbulence experienced in China over the last few years in several which encompass the points raised below:

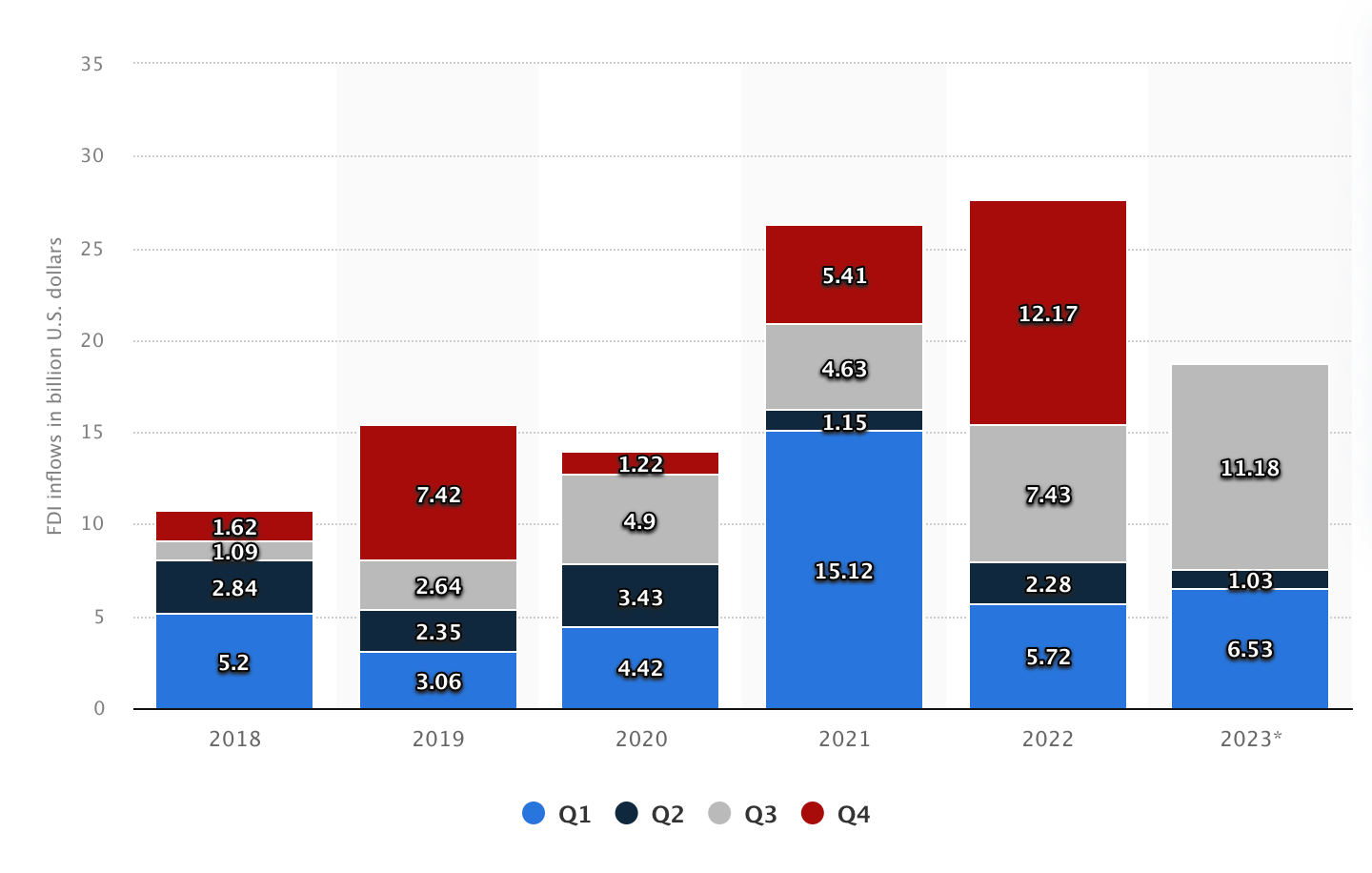

Capital Outflows: In times of uncertainty both from an economic and geopolitical standpoint, investors seek safer investment and capital destinations. Japan has maintained a prolonged political neutrality amongst the major powerhouses of the world, avoiding unnecessary tensions which has resulted in a flurry of FDI (foreign direct investment)

“As far as Japan related trade and FDI flows are concerned, there has been some diversification of production from China into the rest of Asia, to some extent into North America, and also back to Japan.”

Gov Ueda at the Jackson Hole Economic Forum August 29, 2023

Figures 5 and 6 emphasise the movement and diversification of FDI flows away from China.

Regardless of the motivation for diversifying into Japan – whether geopolitical concerns or portfolio strategy – the outcome is the same: increased capital flowing into Japan.

YTD the Nikkei 225, Japan’s equity markets are up 17%, with returns last year just shy of 30%. Last year, the Nikkei posted returns that outperformed the S&P 500’s 24% ROI. So it’s clear to see where a portion of the FDI flows are going to, Japanese capital markets.

The Cause for Hikes

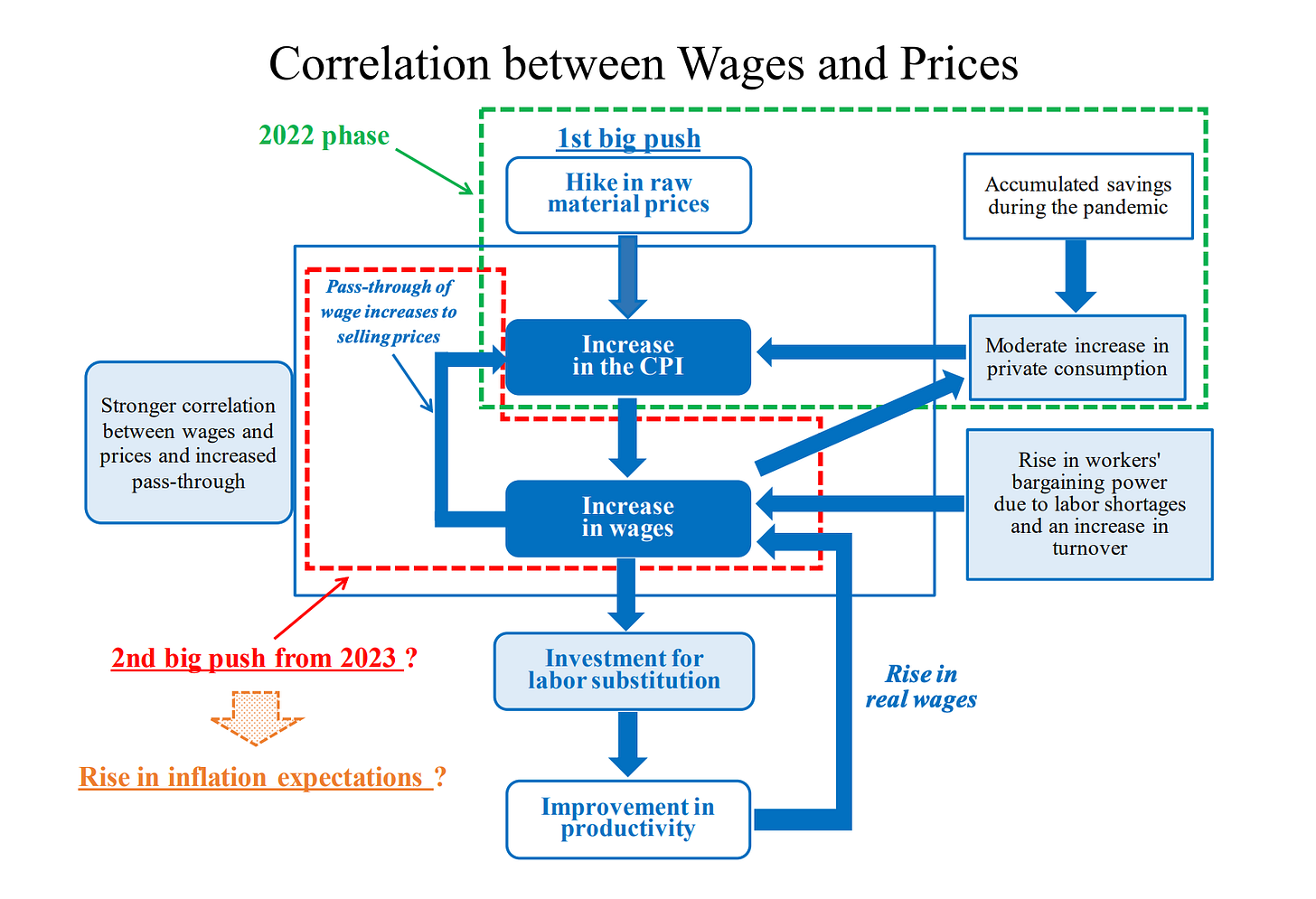

Circling back to Takata’s comments on the bank reaching its’ price target it’s vital we understand the transmission of inflation through wage increases as that’s what Gov Ueda has made clear he wants to see before pivoting. Wage growth.

This cycle starts with the "1st big push," which can be triggered by various factors like rising energy prices or supply chain disruptions. This initial push leads to higher inflation. As the cost of living increases, workers often demand higher wages to maintain their purchasing power. These higher wages can then feed back into further increases in the CPI, perpetuating the cycle.

Governor Ueda has made it clear in several interviews that for the central bank to consider increasing policy rates they must first see sustainable wage growth above the 2% target. In March, we will hear more about the spring wage negotiations, named shunto, which bring together unions and management of companies with more than 1000 employees to discuss wage increases. The negotiations involve the country’s largest employers such as Toyota, Sony and Nissan, as well as other companies with <1000 employees.

Figure 9 shows the large increase sighted in 2023, of 3.6%, as the base pay increase showed a 1.5% increase from CY 2022. Provided the shunto negotiations fully convince the BOJ to hike we will experience huge shifts in markets.

The Trade

A policy shift will have a monumental impact on asset markets, especially risk-free rates.

While shifting policy rates from negative to slightly positive (e.g., 0.00% - 0.10%) may seem like a minor adjustment, its significance lies in the signal it sends to markets. This move can trigger a substantial repatriation of capital from overseas back into Japan, as the world's largest capital exporter seeks domestic investment opportunities

The policy shift conveys a message of confidence and policy normalization. By raising rates, policymakers signal their commitment to sustainable inflation and gradual removal of extraordinary support measures like Quantitative Easing (QE). This signals a shift towards a more normalized market environment.

It’s imperative to note that rates in Japan don’t have to rise to 2-3% before a large amount of capital returns to the JGB and Nikkei market. I’ll explain why, FX hedging.

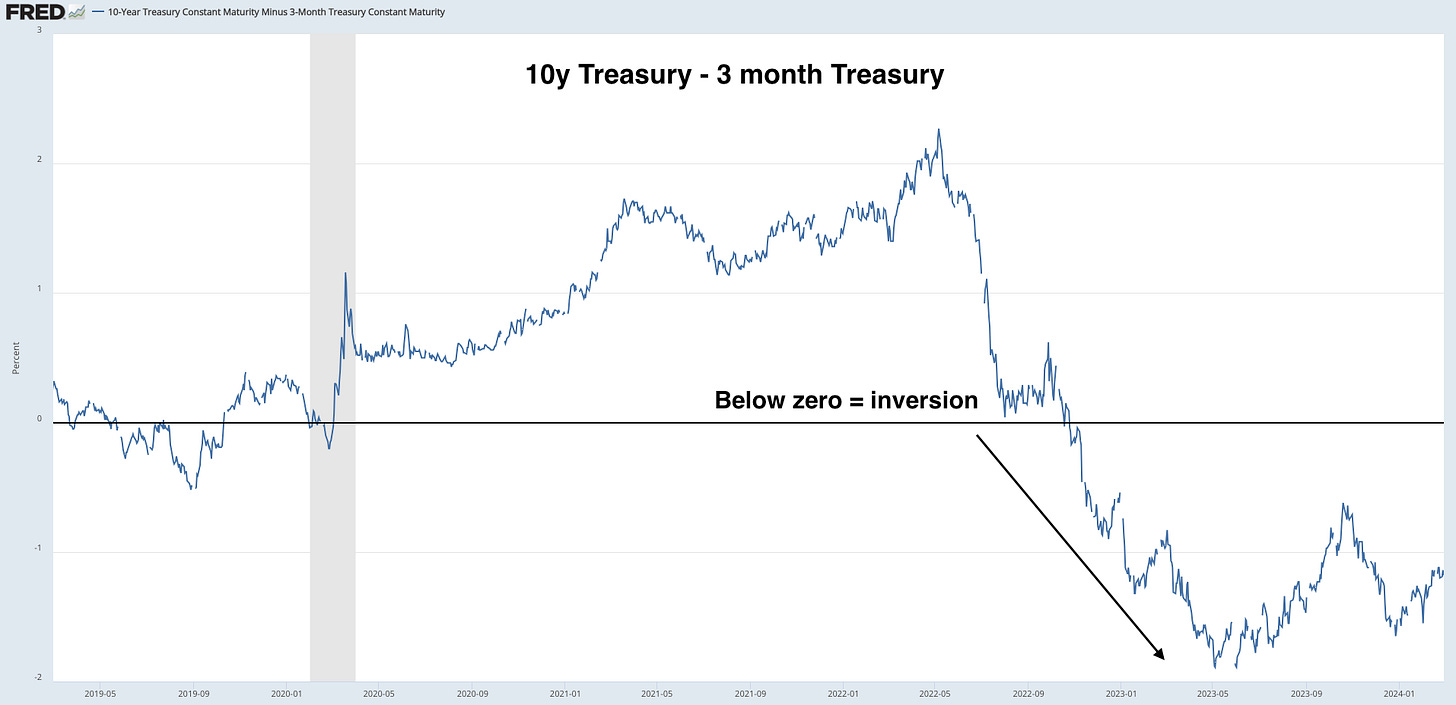

If you’re unfamiliar with the costs involved with FX hedging here’s an insight. Cross-border asset purchases come with exchange rate risks. As the Fed raised front-end rates, the dollar's appreciation against the yen and other currencies increased the costs of hedging.

For example, Japanese investors, pension funds, and asset management firms must first convert yen to dollars to purchase Treasuries. They then must convert their USD back into JPY when repatriating returns back to Japan. During this process, they are exposed to major volatility and swings in the FX rate so investors would hedge their risk by borrowing dollars at a fixed rate against the yen to protect their investment from dollar depreciation or appreciation.

Take note. The fixed rate that Japanese and other foreign investors must pay is determined by short-term borrowing costs (USD Libor) between the two currencies, known as the cross-currency swap rate.

The Fed's aggressive front-end rate hikes have created a yield curve inversion, where short-term yields are higher than long-term yields. This makes US Treasuries less attractive to Japanese investors seeking longer-term investments (e.g., 10-year, 20-year bonds). Since they must hedge their currency exposure by borrowing at higher short-term rates, it erodes the potential returns from those longer-dated bonds.

There’s a saying when it comes to banks, which also applies to how many institutional investors in Japan operate, they borrow short (front end of the curve) and lend long (purchase longer-dated bonds).

Consequently, even a moderate rise in JGB yields could incentivize significant capital repatriation back to Japan. This influx of funds could potentially push US Treasury yields, particularly the risk-free 10-year note, as investors seek domestic investment solutions.

Trade Conclusion

Yen: Underweight

JGBs: Underweight

Currently, my preferred execution strategy focuses on long positions in the Japanese Yen (JPY) and short opportunities on JGBs. As highlighted in my February report, I anticipated that JGBs offer the most attractive potential for alpha generation but after reviewing recent inflation data from the U.S I know propose both trades present equal opportunities. This view is driven by expectations of continued downward pressure on US inflation, which could prompt the Fed to move towards rate cuts sooner than anticipated as seen by today’s PCE data which came in line with expectations of a 2.4% rise YoY (Jan).

That’s it for today crew, I hope you enjoyed this one!

Let me know any questions and what you want to see going forward!