A New Era For The BOJ

Reviewing the BoJ's fundamental position in global financial markets & the future for the YCC

Hey guys,

It’s currently 8:28 pm and I’m deep in my thoughts.

This is usually when I overload myself with macro research until the early hours of the morning.

I’m confident you’ll take away some new info and understanding from this report.

So let’s dive in.

A New Chapter In Global Macro

After a decade in leadership, Governor Kuroda stepped down as head of the BOJ and was replaced by Kazuo Ueda. This could be monumental for markets, I’ll explain why below.

But before we get into all of that, it’s worth explaining the power and importance of the BOJ as many seem to overlook this central bank.

Japan owns the U.S treasury market, essentially.

If you weren’t aware, Japan is the single largest holder of U.S debt in the world, holding roughly 17% of all U.S treasury bonds available, now let me put that into context for you. The U.S treasury market is roughly an $11.2 trillion dollar marketplace; so owning just under 1/5th of that market shows how important the Bank of Japan is to the U.S market.

Now you’re probably thinking, “Ok, so they’ve got deep pockets, but how does owning Treasuries affect asset prices within macro?”. Well, let me explain.

Tech companies are widely known to rely on cheap, low borrowing costs in order to fund their day-to-day activities, get the highest valuations and all around perform well in attracting investors’ money. The next question is, what creates an environment where the cost of borrowing is cheap?

Low-interest rates, which translates into lower yields on US10Y. Why?

Simple, the 10y as we know is the risk-free interest rate, and this instrument is used as a benchmark for all banks, and financial institutions providing lending facilities such as your non-bank mortgage lender (aka your shadow banks).

So, for Tech stocks in the Nasdaq to perform well, borrowing costs have to be relatively low, what would happen if the BOJ would stop purchasing bonds?

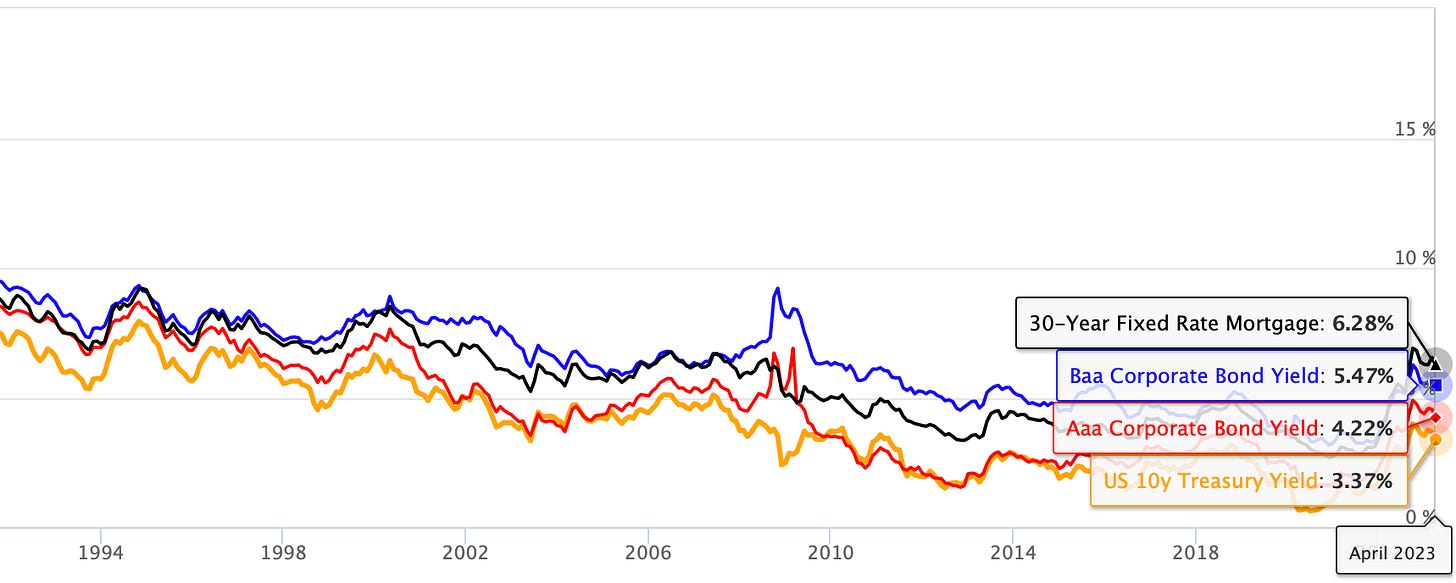

It’s very clear the direct relationship between bond prices and bond yields, if the BOJ were to stop buying treasuries and invest domestically we would see a massive rally in yields as the price of the risk-free instrument dumps. You can see from Figure 1 how closely interest rates follow the direction of the 10y, whether that be corporate bonds, or your 30-year mortgage for your family in the U.S, your bank, or mortgage lender would use the U10Y as a benchmark and add on a risk premium in the form of additional interest rates onto your loan making the loan profitable for the institution before lending out. That risk premium is the reason 30y fixed mortgages and corporate bonds pay more interest.

So indirectly, the BOJ has capped U.S treasury yields through their extremely loose monetary policy and purchases of gov bonds.

What Happened To FX On Monday?

If you’re an FX trader, or just a market enthusiast actively following you would have noticed that on a bank holiday where volume is usually dead, we had dollar strength causing shorts on dollar crosses followed by a sharp rebound later this week post-CPI, which I’ll cover in tomorrow’s free report.

The below is for MMH Pro members, consider subscribing.

As mentioned I’m back with a free report tomorrow, so be on the lookout ;)

Here’s what went down, it was the BOJ.

Sunday was Governor Ueda’s first day in office and Monday 7:15pm Japanese Time he held his first press conference.

It’s rarely ever what happened but more so what was said, remember that. Governor Ueda triggered dollar strength and immediate weakness in the Yen after his comments where he said:

“Judging from the current economic and price conditions, it is appropriate to maintain the yield curve control,”

— BOJ Governor Ueda

His comments dampened markets expectations of a monetary policy shift away from yield curve control which has dominated the central bank’s economy for more than 20 years as cited by Gov Ueda’s predecessor Kuroda below:

“A powerful monetary easing policy has continued for more than 20 years,”

— Former BOJ Gov Haruhiko Kuroda

This was across all xxx-USD whilst, USD-xxx pairs saw a temporary uplift early in the week before markets recovered from dollar gains.

Yield Curve Control, What Most Traders Missed…

If YCC is a new term to you I’ll quickly explain its function.

Yield curve control is the process where a central bank of a country aims to control both short-term and long-term policy interest rates. This creates a framework where the central bank can effectively cap borrowing costs regardless of what shape the economy is in, in order to stimulate inflation within the economy.

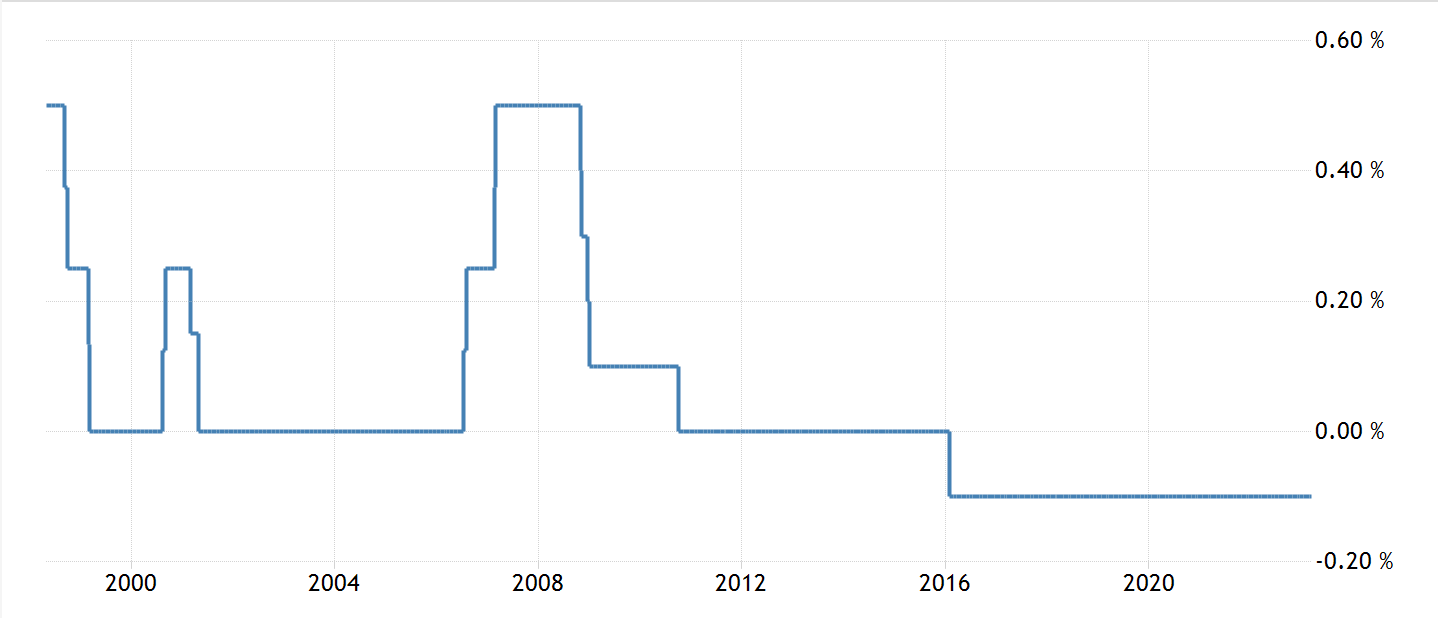

The BOJ has been implementing this policy since 2016, but the underlying issue of slow growth, disinflation and an economy with no young rising working demographic still remains an issue at present.

Rates in Japan are stuck at -0.1%, yes, negative 0.1% whilst the Fed, BoE and ECB are all hiking north 4.50% in order to get inflation under control.

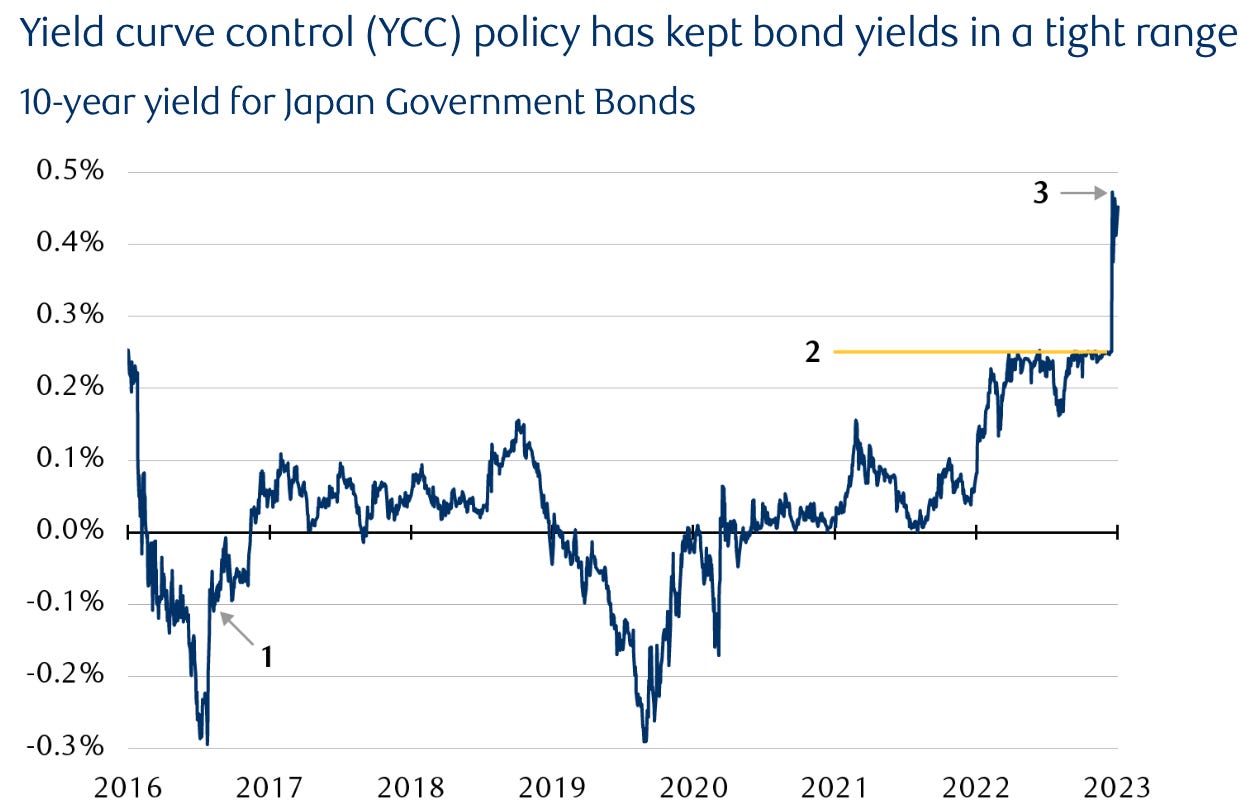

Through yield curve control the BoJ has capped 10y JGBs (Japanese Government Bonds) at +/-0.50%. If JGB yields are pinned at 0.50% then Japanese investors are forced to seek yield overseas by purchasing U.S bonds as one of the only alternatives to realising real yields on their investments.

As one can see from the above, YCC does a great job at keeping yields within the range, which at first in 2016 was +/- 25bps from zero, but as you can see by no.2, this became increasingly difficult due to the inflation rate globally which also affected Japan forcing the eventual move seen as point no.3 in December 2022 where the BOJ increased their YCC band to 50bps above or below 0%.

Here’s what most traders missed as a hint on what future monetary policy looks like.

The new Deputy Governor of Japan Uchida said during the confirmation hearings late in February this year that if the BOJ were to move and abandon YCC, this would have to be “a surprise” to markets.

“Due to the nature of the yield curve control, it’s hard to get markets price in a change beforehand,”

— Deputy Gov Uchida

The reason for this is simple if the BOJ provide what we know as forward guidance to markets, the existing bonds yielding close to 0% would see heavy selling pressure from investors forcing the BOJ to intervene and keep the JGB market intact.

So, looking towards the BOJ meeting on April 28th, will we see a policy change? No, but does that mean it’s ruled out? Far from that. The BOJ has already signalled that they will move in silence so we’ll never really know until we see the Yen gain massive value against the dollar and US10Y yields increase even further.

So to end, it’s important knowledge to know:

The influence the BOJ have on capital markets, particularly how they influence the US10y

What a deviation from YCC could mean for the global economy and rates

How the JPY influences major FX pairs & moves.

It’s currently 11:48 pm as I finish this macro report.

This was more of an in-depth educational insight into how the BOJ has been functioning and the importance they play.

I hope you learned a thing or two!

I appreciate you guys for being a part of this journey, would love to hear from more of you in the discord as well! You’ve got a group of macro addicts on the same journey, it’s a no-brainer ;)

Back tomorrow for a free report

Catch up soon!

Joe