#3 Week In Focus: FX Outlook

FOMO meets FOMC: trick or treat?

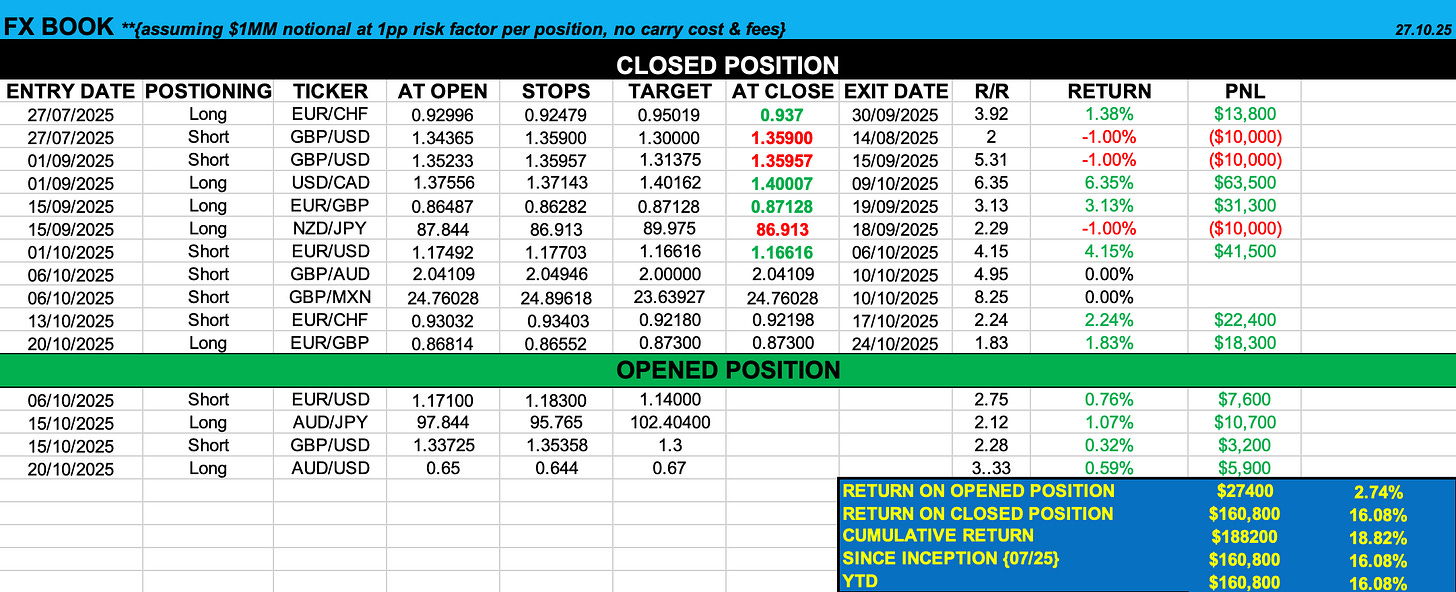

FX Book

*Since Inception, {7/25}: 16.08% || YTD:16.08%%

Market mover

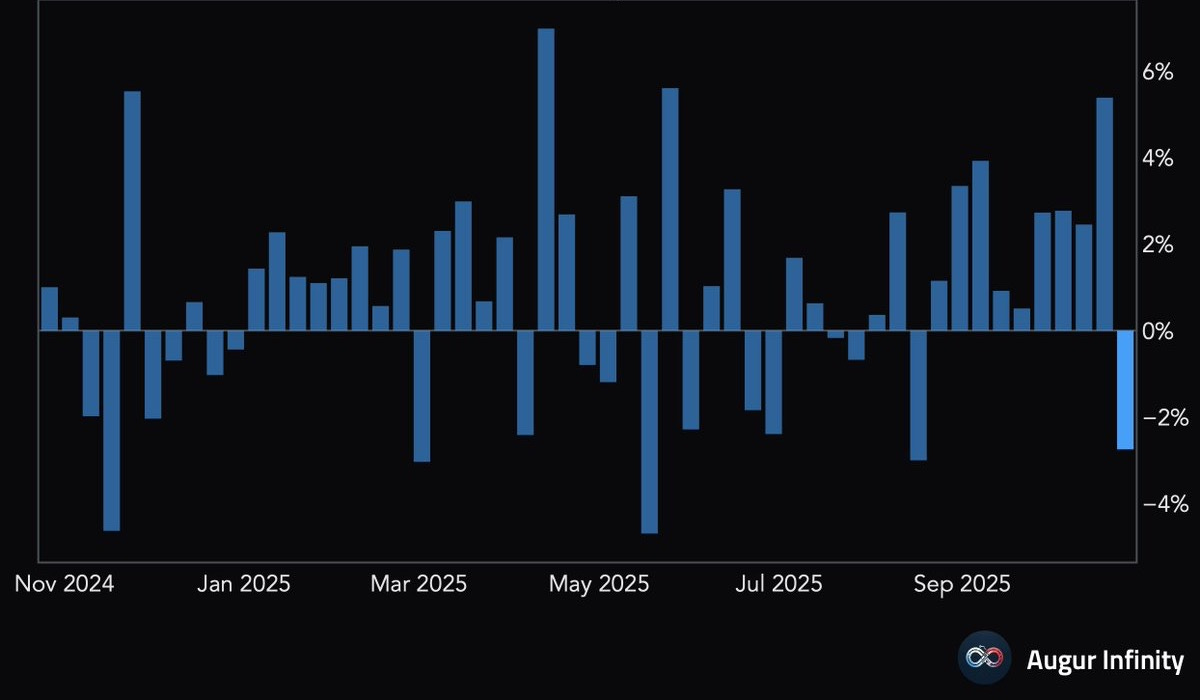

Fourth week and counting since the US government shutdown; however, that didn’t keep the pin on volatility this past week. Markets took a breather from the much-hyped “debasement trade,” now in hindsight looked more like a FOMO-driven exhaustion phase, by retail frenzy and momentum despite backed by solid unpinning forced liquidation in this year ranked #1 safe haven.

The precious metal sold off for the first time after its nine week consecutive rally.

The US narrative this past week was centered around broader US-China trade developments and geopolitics, while domestically, the inflation figures, which missed expectations across the board by 10bps, sent equities higher and cemented the fate of this week’s Fed meeting.

A different mix from broader G10 FX initial reactions sent the dollar trading lower across its peers; that was, however, short-lived, followed by a sharp recovery after robust flash PMI figures highlighted the resilience of the US economy. Pro cyclical lead the outerformers on news of tone down rhetoric on the President stance on China, which was made offical over the weekend as we look to seal its fate over the President's Asia visit.

In a surprising turn of events over in the Eurobloc, better-than-expected PMIs sniffed out hope for the zone after the previous week’s crisis in the bloc, anchored uncertainty by French politics, a region that seemed to be an outlier posting rather weak PMI figures compared to its counterpart, Germany. In the UK, softer inflation caused traders to raise bets on dovish repricing for the BoE, a trade that crawled back some modest bps by Friday’s beat in PMI figures and retail sales data.

Over in Japan, the fate of the next BoJ meeting looks now firmly sealed as PM Takaichi was officially elected into office. The yen led this week’s category in underperformers as traders piled onto the “Takaichi Stimulus” narrative, exacerbated further during her speech in the Diet, one largely focused on addressing rising food prices and talks on increasing revenue generation without raising tax. The yen’s weakness was compounded by geopolitical risk after Trump announced fresh sanctions on Russian oil majors Rosneft and Lukoil, which collectively produce around 5mb/d. As a major net importer of energy, Japan faces renewed headwinds from higher oil prices.

Oil benchmarks extended gains as reports surfaced that key importers like China and India had temporarily halted seaborne Russian purchases in response to the sanctions. Brent and WTI rallied sharply on supply risks re-entered the market narrative.

Lastly, Rates weren’t spared either. What began as concern over credit quality faded after Zions Bancorporation reported strong earnings, easing pressure on financials. With little left to price heading into this week’s Fed meeting, the upside surprise in flash PMIs overshadowed Friday’s CPI miss. 2s and 10s curve closed the week flat.

Macro watch

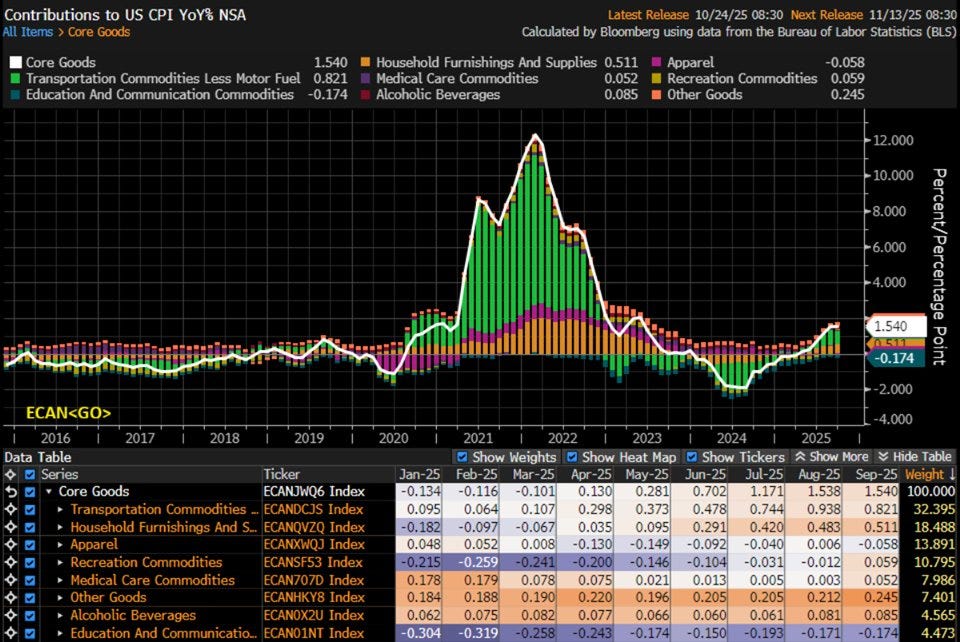

We believe the key takeaway from the past week is the misguided notion that a 10bps miss in inflation somehow marks a “win.” The narrative forming around this idea feels misplaced. It’s a convenient headline at best heading into this week policy event, and by no means are we inflationistas, but it’s worth pointing out that a “not hot print ≠ cold print.”

Much of the downside came from deceleration in shelter component (OER) and used car prices. IF we strip out these volatile sectors, the underlying trend looks far less comforting. Core CPI still advanced 0.23% on the month, equivalent to an annualized pace of roughly 2.7%. For more context the median inflation, by the Cleveland Fed’s measure, sits around 3.5%. Those are not disinflationary readings by any reasonable standard.

The broader structure of prices, core goods firming modestly, services remaining above 3%, and diffusion indices still pointing to broad upward pressure, suggests that inflation’s stickiness is intact.

The market’s impulse to read every softer CPI print as confirmation of a dovish pivot feels misplaced. The Fed may well lean toward easing but that reflects policy preference, not proof that inflation has truly normalized. Underneath the headline, price pressures are cooling unevenly: services inflation remains sticky, and smaller categories continue to show cost pass-through. Inflation is cooler, not cold. Treating it as anything else risks reviving the same complacency that policymakers can’t afford to repeat.

The week is shaping up to be a busy one, with four major central banks set to deliver policy decisions. The Fed is priced for another cut, continuing its easing cycle that resumed last quarter, while the ECB is widely expected to stay on hold, maintaining its “policy is in a good place” mantra. The BoJ is also likely to remain unchanged, and the BoC stands out as the wildcard: recent upside surprises in inflation and employment have complicated expectations, though the new 10% tariffs announced over the weekend could revive bets for another go.

Away from the guys in suits, a heavy economic calendar will keep markets on edge. Q3 GDP and inflation prints from the G4 ex-US economies will give traders a clearer sense of how each region has fared as they navigate their various idiosyncrasies in the face of global fragmentation caused by Trump-led tariffs.

As is mostly the case, we expect the US to set the tone and shape the trading week, which should make for an interesting post-conference. With the shutdown still in place, that’s likely to be a challenging one for Chair Powell, with questions expected on how the Fed intends to communicate forward guidance in such a scenario.

The question now will be: will JP trick (hawk) or treat (dove) the markets?

FX Outlook

EUR

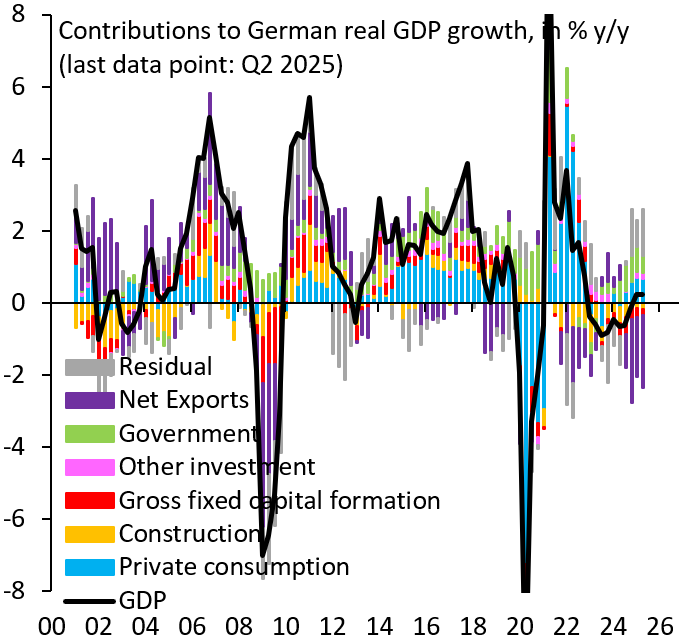

Last week’s Eurozone data gave us the same feel of that one regular lad you see everytime you go to the pub who doesn’t stop reminding everyone on how he once beat the “the famous guy“ on tv. A brief moment of glory, long since passed, now recycled as proof of relevance. Replace the pub regular with the Eurozone and the “famous guy” with the US, and the analogy writes itself.

It’s going to take more than a single beat in survey data to curb our pessimistic view of the bloc. Manufacturing figures, despite a beat, are still placed in contractionary territory.

It seems to continue to be this extended game of “when stimulus” to “if stimulus,” somewhat shifting the goalpost from a 2026 timeline to now potentially a 2027 story. No doubt the stimulus will have an impact on the domestic market, but to the tone markets and investors rallied on the EUR long/ USD short , we view that it will have a hard time materializing. This first involves defeating the bureaucratic hurdles faced in the German Bundestag, with talks about the planned investment being moved into an off-budget special fund which, if you’re not familiar with German politics, creates more uncertainty about timing, execution, granted maybe an overstated risk nevertheless dampening the “gun-blazing” theme European officials entered the year in.

Aside from these factors, the Eurobloc still faces headwinds and external shocks.

First, the latest data out of China still point to a deflationary trend a disinflationary tailwind that could weigh on the euro through softer export demand and lower goods prices. Secondly, somewhat paradoxically, renewed optimism over a potential growth pickup in the bloc has triggered capital outflows from the EUR, creating a headwind that could further constrain export capacity. And that’s before factoring in the prospect of higher oil prices following U.S. sanctions on Russian heavy producers. Since the onset of the Russia-Ukraine war, Europe’s purchases of U.S. LNG have risen roughly 20% this year, yet much of Eastern Europe countries remains reliant on refineries owned by Lukoil’s parent company not to mention the indirect Russian barrels flowing through India back into European markets.

The ECB meeting, likely to be a non-event; however, it will be interesting to hear Lagarde parse the developments in France with the overall fiscal stance of the bloc, acknowledging the tariff impact on the bloc as export activity to the US is now down 15% this year alone, treading that fine line between resilience and structural weakness.

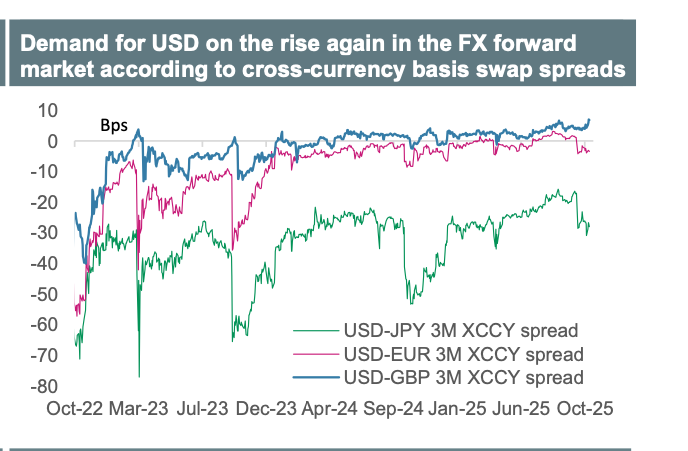

In contrast to the USD, which this past week, despite the shutdown, saw the dollar index closing c.0.5% higher last week, as we noted last in this series, bringing back its safe-haven demand amid geopolitical risk and trade tension as other technical factors such as hedging costs are now increasing for the currency.

The Fed is expected to ease by another 25bps, which markets pairs with a throw-in-the-towel moment from JP considering the lack of data. we disagree and likely see a rerun of the September meeting: JP gives with one hand and takes with the other, a hawkish cut if you will, stressing the data-dependent path while staying away from fully committing to December, as we got a glimpse of this in his October 14th speech, a view, by the way, shared by Gov. Waller highlighting the divergence between the growth outlook (GDP) and labor market weakness, stressing the need to move with caution.

This outcome and divergence of market view should give EUR/USD clearance to trade lower.

JPY

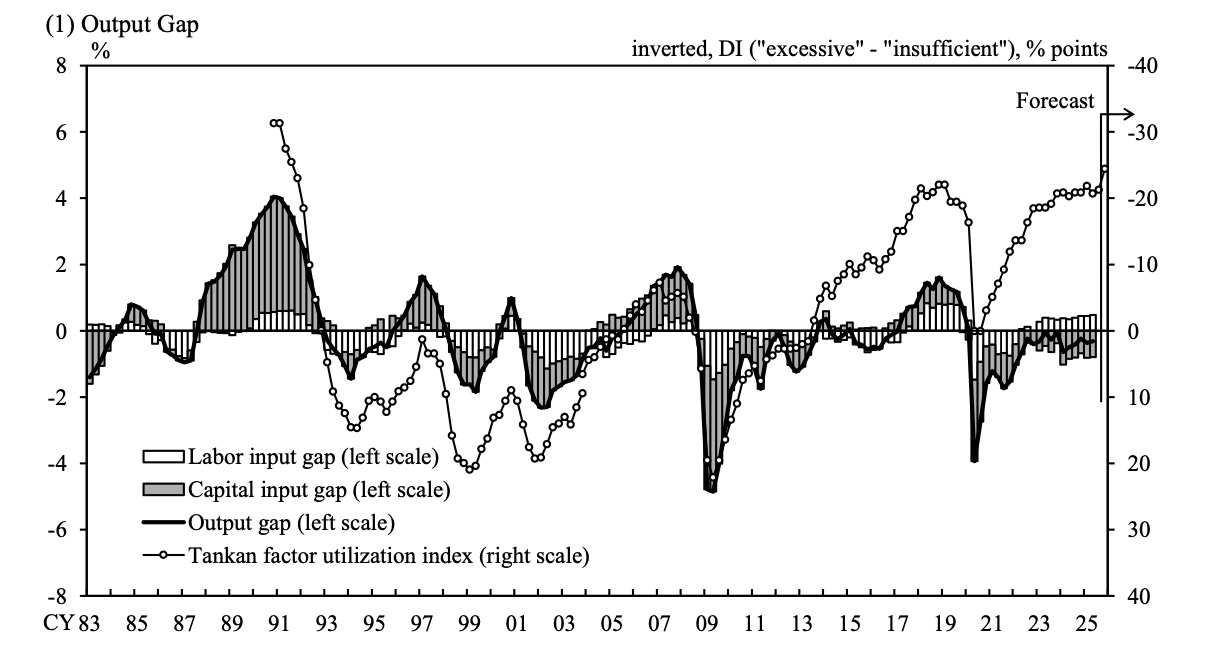

Our view on the yen remains largely unchanged, although we are approaching a more constructive tone. The recent confirmation of Takaichi as Prime Minister only reinforces our base case for near-term yen weakness. Her early policy blueprint towards a more growth-led Japanese economy is seeking supplementary spending estimated at 2-3% of GDP to revive the economy, moving it into a “high-pressure economy,” a term coined by the FX desk at CA CIB, which places focus on the economy output gap.

The output gap shows whether the economy is operating above or below its potential, esentially whether demand exceeds supply capacity.

Output gap > 0 → economy running hot (demand > supply)

Output gap < 0 → economy running below potential (slack in the system)

For us, this should be the mission Takaichi-nomics should focus on: moving the money away from saving back into broader circulation.

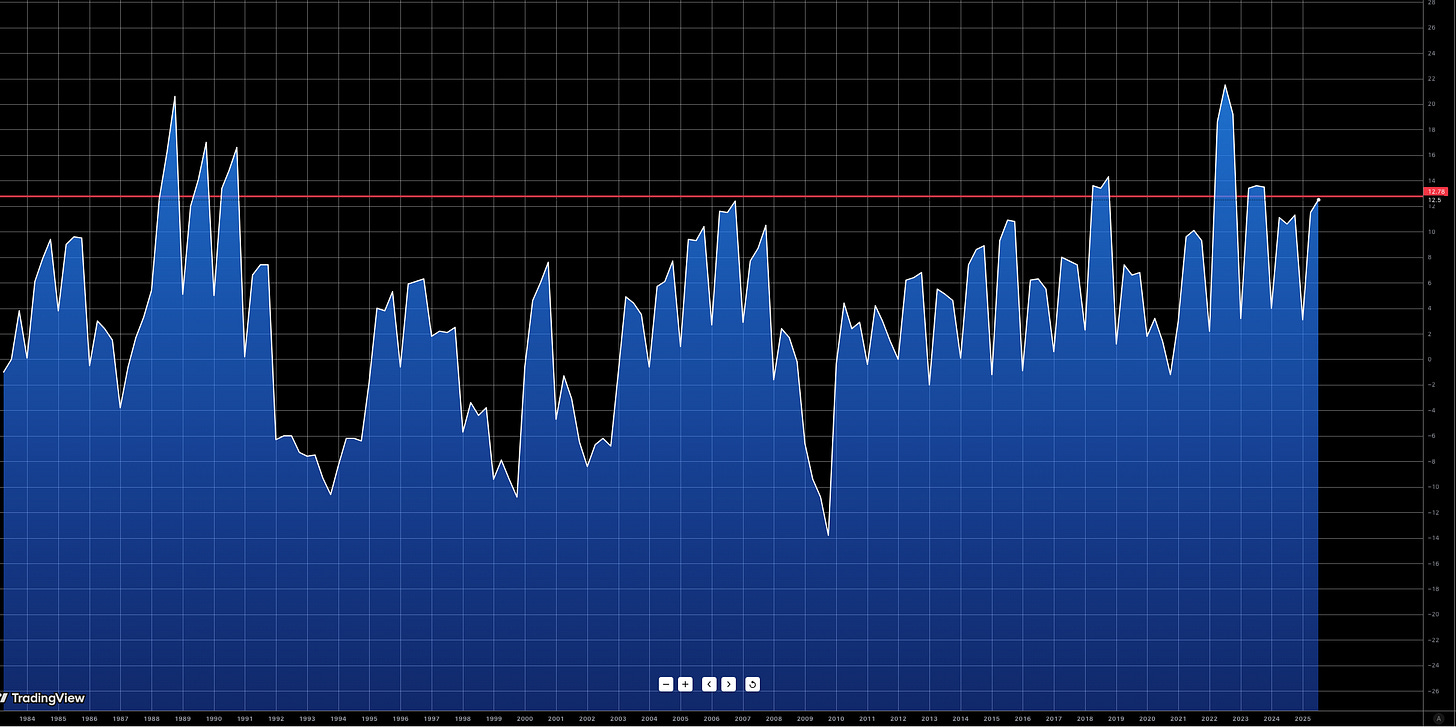

Looking at Japanese capex spending commitments, interestingly, they have edged higher. However, despite a robust corporate balance sheet, the dilemma remains that, the recent surge in capex isn’t materializing into profits for the manufacturing sector, most firms continue to bear tariff costs we noted in the previous report.

Heading into the BoJ policy meeting, these are areas of uncertainty alike we expect the committee to highlight as Ueda offers a balanced yet cautious tone on the policy outlook going into year-end. The composition of this and the US shutdown should offer enough cover not to signal total capitulation to the doves. As tightening is likely to be delayed until fiscal measures gain traction, this leaves room for the yield spread between the US and Japan to widen, keeping the yen under pressure. We view 155 for USD/JPY as in sight for the near term.

On inflation, this is the number one issue for voters. It is basically what modern-day elections are won on, as President Trump won his 2nd term on higher grocery prices, and PM Takaichi clearly understands this. This places the approach to fiscal accommodation, considerably more difficult. Core CPI has eased from mid-year peaks, reflecting past shocks rather than strong domestic demand. As temporary factors such as energy subsidies fade, inflation may dip before gradually rising with sustained fiscal support. A perfect execution of Takaichi-nomics would convert liquidity from government support and both corporate and household savings into productive spending, which could eventually lay the groundwork for a yen recovery in 2026.

GBP

Heading into Q4, the UK economy sits in an uneasy balance between improving inflation optics and a murky growth outlook, forcing markets to reassess the “stagflation” narrative that has shadowed the cycle. The latest CPI print surprised modestly to the downside, around 20bps below consensus, but remained flat at 4.0% versus the prior month. The headline relief does little to change the broader picture: inflation is easing, but not fast enough to justify an imminent dovish pivot.

Earlier in the month, we outlined the idea of a “credibility premium,” that the UK’s fiscal and policy path would ultimately dictate sterling’s direction. Since then, GBP has indeed drifted lower, particularly against the dollar, validating that framework. Yet, despite softer data, markets remain cautious in pricing more cuts. The earliest meaningful action is seen in December, with only 36% odds of a cut, hardly a sign of conviction.

Part of this restraint be belive stems from timing. The Autumn Budget lands weeks after the next Monetary Policy Committee meeting, leaving policymakers reluctant to pre-empt fiscal guidance. The fiscal signal will frame monetary tone. The market’s “credibility premium” lens implies that Chancellor Reeves now holds the pivotal role. If she signals credible fiscal tightening, it could strengthen the BoE’s confidence that inflation has peaked, allowing for a more deliberate easing path into 2026.

MMH!