2024 Macro Outlook

Reviewing the past year's tightening cycle effect on EM & where markets are headed in 2024.

Hey guys,

I’m glad to be back.

Last week I was recovering from taking a slight hit to my immune system, anyways, it proved to be necessary because I’ve been able to plot out the next several weeks of macro reports for you all covering very key and deep themes I know you’ll love going into 2024.

2023 proved to be a year of surprises for the global economy, from a weaker-than-expected Chinese manufacturing rebound, stronger growth trends across the US and banking instability forcing a temporary Fed intervention. Across Europe, the narrative at play has been in line with the market’s consensus, that of slow growth tipping raising risks of a recession in the Euro Area and cyclical low growth in the UK.

As always, lend me your focus:

A Year Of Economic Outperformance

Entering 2023, the focus was centred on major central bankers to deliver on their promises to return inflation to 2%, which is within reach for the likes of the Fed, ECB, and BoC. However, for central banks BoE, RBA and RBNZ, with headline inflation lingering above 4.7% in their respective economies, this target is further out of reach. It poses imminent risks for their economies with low growth being a structural issue for the UK. Contrary to Western monetary policy, two outliers across the Asia Pacific region, Japan & China both entered 2023 aiming to boost economic activity and sustain high inflation.

As of today, this is how far interest rates have moved across DM (developed markets) central banks this year.

Over the last 18 months, the most prominent theme across macro has been that of interest rates. Taming inflation, and returning monetary policy to a neutral run rate has led the minds of many central banks around the world. The Fed has led the path of tightening with 550bps in rate hikes, only front-run by central banks of EM (emerging markets) economies to insulate themselves from the Fed hikes. Due to my brief history working within EM sovereign debt, I always love to shed light on the interconnectedness of DM and EM monetary policy.

EM resilience during Fed tightening cycle

In previous episodes of tightening cycles led by the Fed, EM currencies fell victim. Fed hikes often resulted in destabilising currency valuations and elevating the risks of sovereign debt crises. After the inflation shock of the 70s, fueled by the first of two oil crises (1973-74) where oil prices rose from $3 per barrel to $12 per barrel, a 300% increase, the subsequent oil crises in 1979 doubled the price of oil to more than $35 per barrel resulting in inflation soaring from 8% to 14% over two years.

To combat double-digit inflation Paul A. Volcker, the Chair of the Fed from 1979-1987, hiked interest rates which had averaged 11.2% in 1979 to a peak of 20% in June of 1981. The immediate result was inflation dropped from 14% to 2.5% by 1983, this drastic ramp in the Fed funds rate pushed the US economy into a recession. That was the immediate effect, subsequent casualties globally were a basket of EM currencies, which in the face of the Fed tightening caused EM currencies to depreciate 30% against the dollar, as such the Mexican government chose to devalue the Mexican peso by 30% in February 1982.

The reason why Fed tightening hurts EM is simple yet deep. On the surface level, interest rate differentials determine the direction of capital flows, either into or out of an economy. Approximately 65% of EM sovereign debt is issued in hard currency (USD), so for EM countries issuing debt, as Mexico did in 1982, the risk of failing to finance its short-term debt becomes a high probability when the cost of debt rises due to their respective domestic currency weakening against the dollar. The flaw of denominating all EM external debt in foreign currencies was named the original sin in economics literature. Here’s a small extract from that paper.

“If a country is unable to borrow abroad in its own currency— if it suffers from the problem that we refer to as “original sin”—then when it accumulates a net debt, as developing countries are expected to do, it will have an aggregate currency mismatch on its balance sheet”

— The Original Sin, Barry Eichengreen 2003

The facts are clear. Higher Fed rates pose risks for emerging markets, both to their economy/debt management and currency performance.

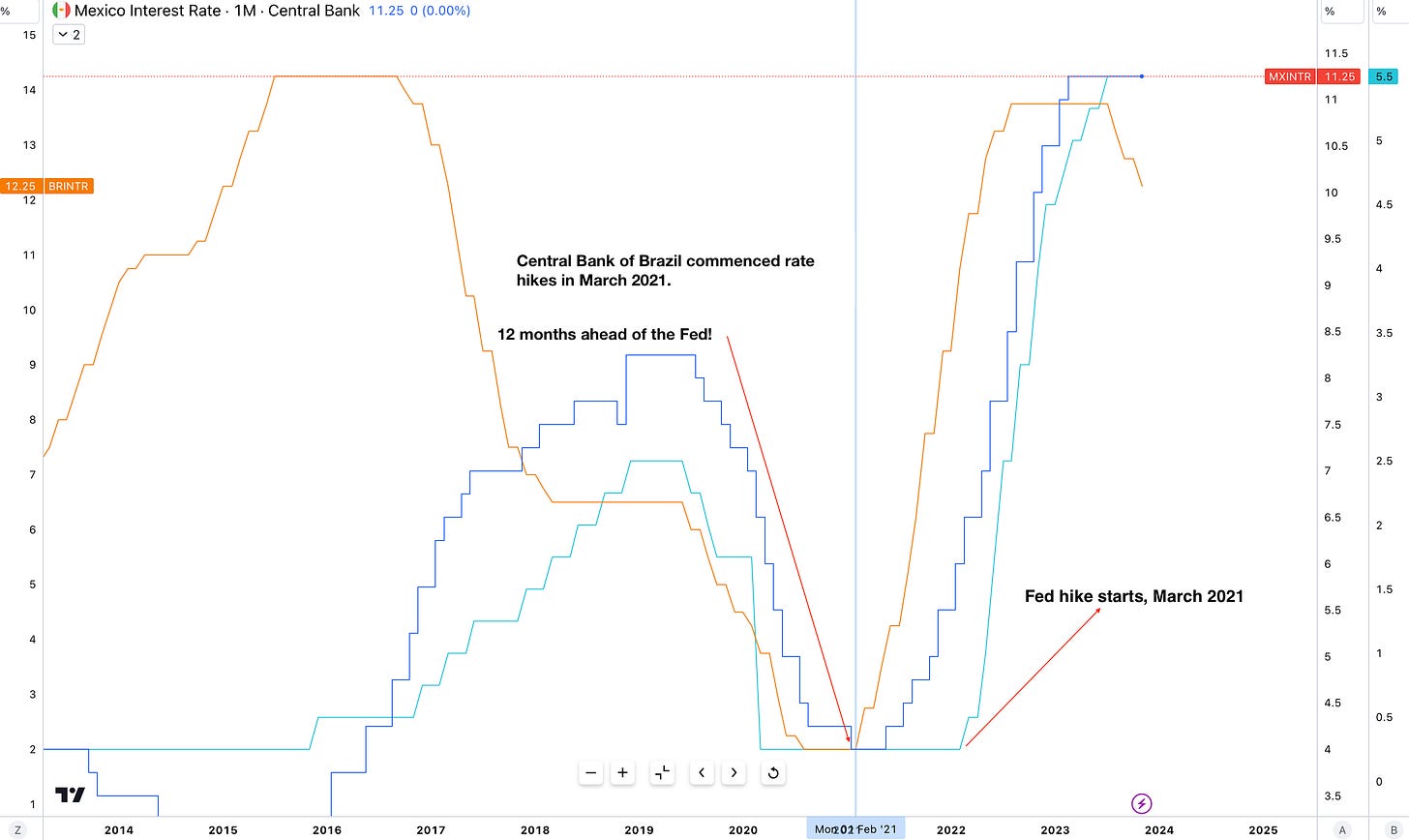

Fast forward to 2022, it seems EM has learnt the lesson by front-running the Fed tightening cycle in order to widen the interest rate differential between EM economies and DM.

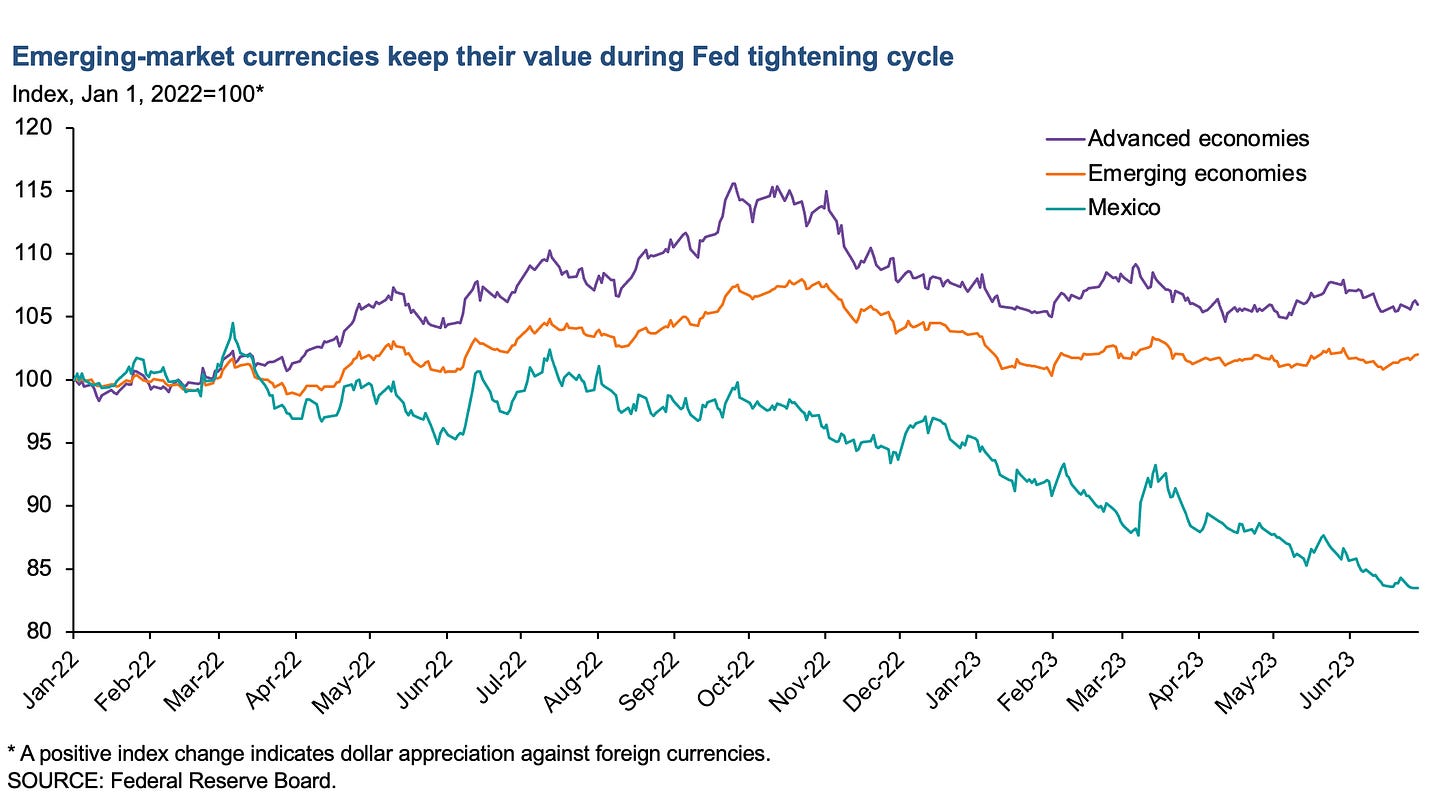

Figure 3 highlights the result of EM central banks hiking ahead of advanced economies, their currencies faired well, depreciating only by a few percentage points against the dollar whilst still outperforming DM currencies during the tightening cycle of 2022. A positive index change indicates the dollar appreciated against foreign currencies, whilst a downward index change indicates the dollar depreciated against foreign currencies. Standing out, the Mexican peso closed out a 15% gain against the greenback showing a substantial turnaround vs the 1982 peso performance. The majority of EM central banks, particularly in LatAm (Latin America) began their hiking cycle 9-13 months before the Fed began theirs.

By front-running DM central banks EM countries effectively insulated themselves against heavy capital flow volatility as interest rates across EM countries became increasingly attractive as the risk premia proved substantial. I’ll save more detail for a note focused on EM, as for now let’s evaluate the outlook for growth in 2024 and the key risks surrounding the year ahead.

Growth To Stagger in 2024

When it comes to forecasting no one firm has the crystal ball, it all falls to predictions and models, which aren’t always accurate, but to get a consensus view of where institutions see growth positioned in 2024 here are the growth forecasts from GS.

After being revised higher, global growth forecasts sit at 2.7%. Outperforming most expectations at the start of 2023, where if you recall a recession was on the lips of analysts expecting the US to fall sometime in Q3/Q4 2023. The U.S has proved its resiliency, a combination of fiscal spending from the Biden administration and robust consumer spending. This dynamic has propelled a tight labor market, with the unemployment rate down to 3.9%, below pre-pandemic levels.

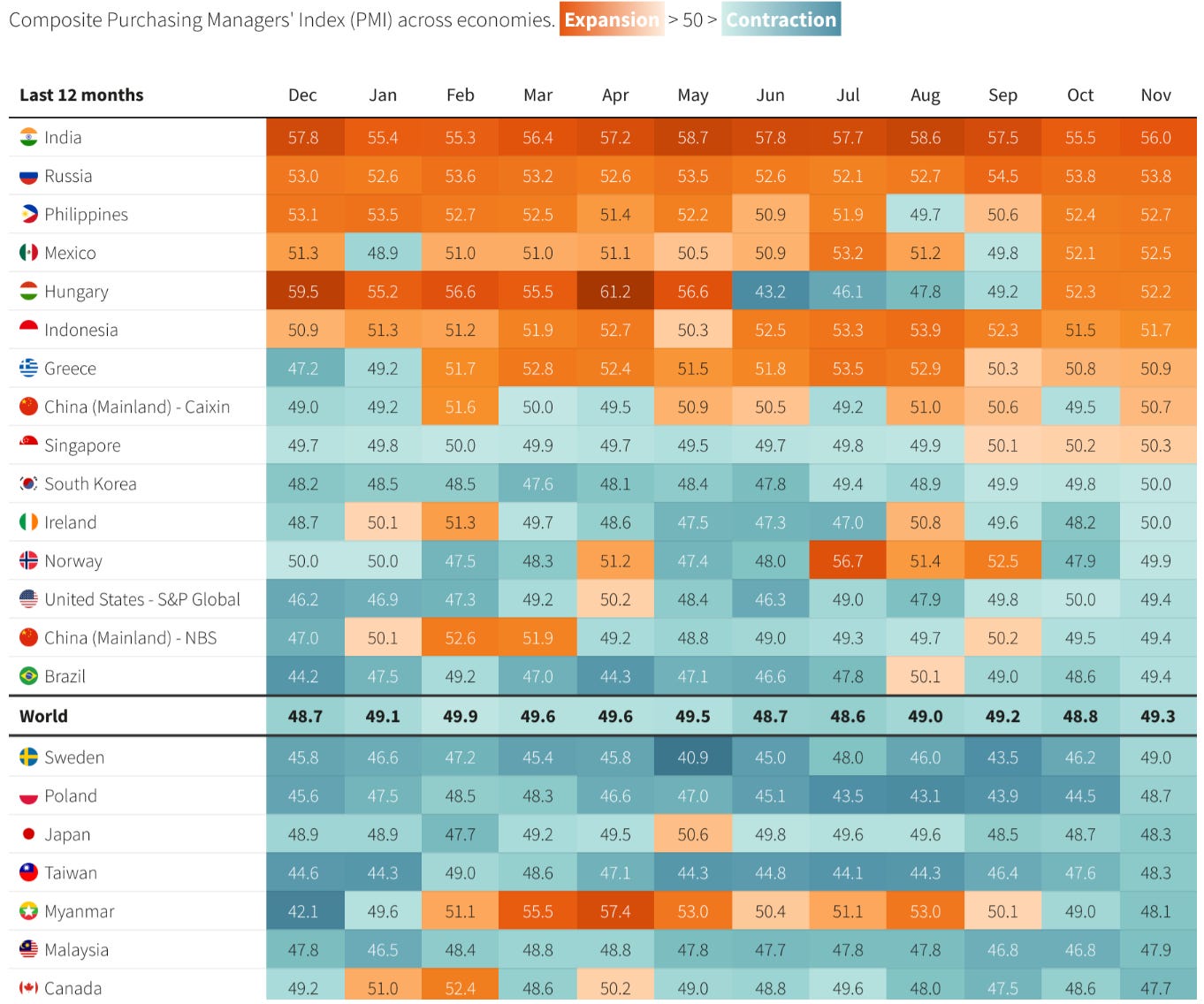

After observing the resiliency of the US economy a recession is not on the table for 2024, PMI data across the board has been healthy despite the recent manufacturing PMI reading dropping to 49.4. Services PMI remains in expansionary territory and the US consumer is still driving the economy forward.

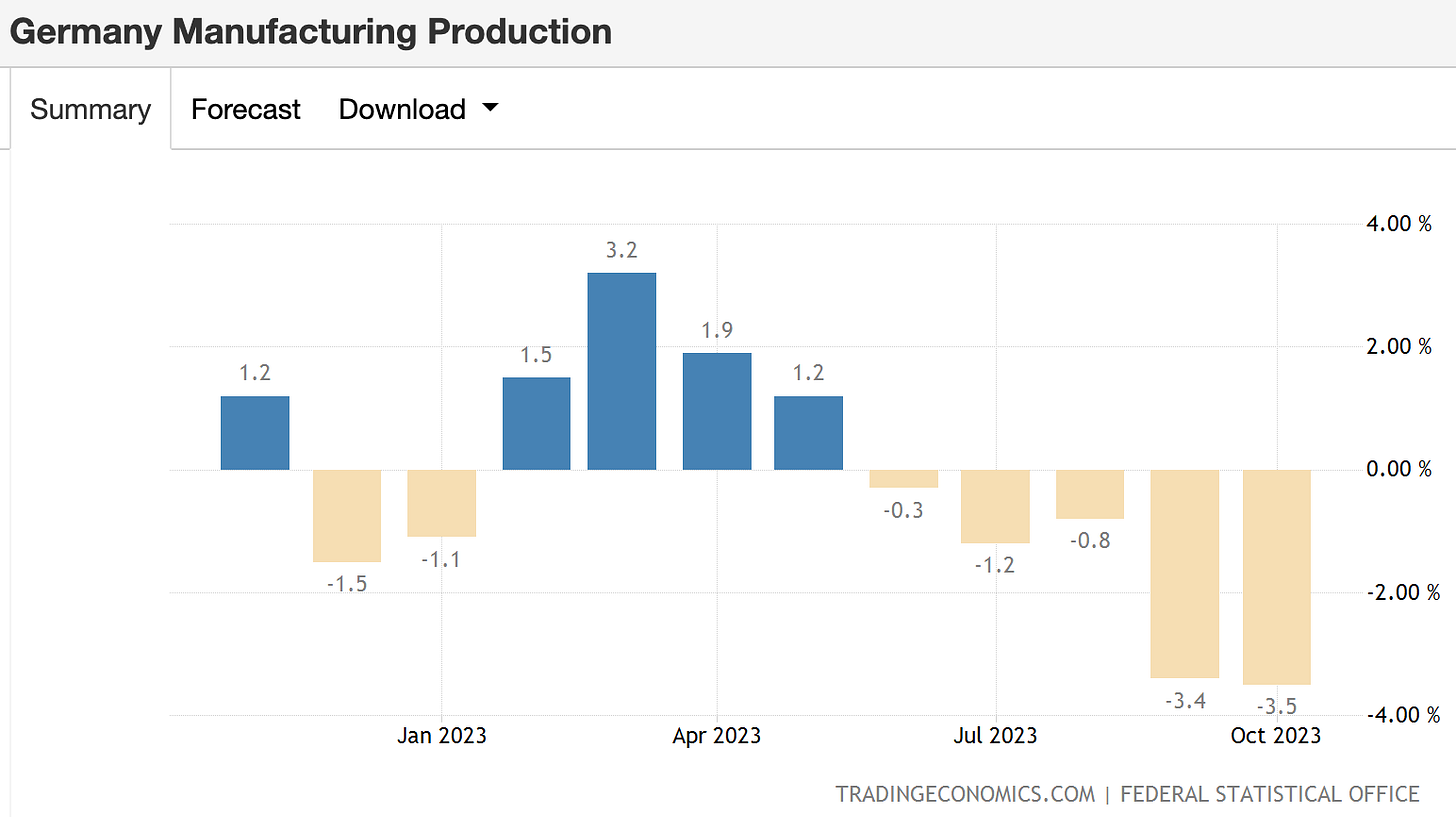

Europe is expected to grow 0.9% in 2024, a positive uplift compared to its 2023 forecast and current trajectory to fall anywhere between 0.5-0.6% growth this year. With inflation not yet in the rearview mirror tightening policy remains a bottleneck for European growth. The impact of the energy crisis has had prolonged effects on the union’s top consuming countries, Germany, Italy, France, Netherlands, Spain, Belgium and Poland. Whilst entry prices have reverted to their long-term averages, Germany’s manufacturing production is in deep waters struggling to grow production.

Germany’s PMI data backs the lacklustre performance of the manufacturing and broader industrial sectors. Going into 2024 I expect to see some relief in industrial production, as greater fiscal support from the Chinese government boosts economic activity within manufacturing and demand for German factory goods. It’s not enough to hope for China to pull Germany’s manufacturing industry out of the mud, as chief economist at Hang Seng Bank China Dan Wang said:

“The domestic market cannot make up for losses in Europe and the US”

— Dan Wang, chief economiest, Hang Seng Bank China

Globally the manufacturing and industrial sector is weak across major export giants and export-reliant economies such as Taiwan, Japan, Malaysia and China.

President Lagarde has emphasised the ECB will not be cutting for “several quarters”, however, the markets are pricing in a 50bps rate cut as early as April 2024, followed by another 100bps of cuts throughout the year.

From 2021 to 2022, the Euro lost 7.45%, resuming its long-term bearish trend against the dollar and in 2022 extended its losses peaking at a 17% loss before reversing early losses to close the year down 7.74%.

Looking at the Euro chart you’ll notice a sharp rebound and recovery from late September. As broken down in previous reports, this inflection point in macro was synonymous across all markets. Global liquidity resumed its flow into the financial system following the British Gilt crisis, which had posed potential contagion risks for the US. This influx of liquidity contributed to a loosening of financial conditions.

This rally in the Euro, driven by dollar weakness, was short-lived as since January the Euro has consolidated in a 700 pip range from 1.04500 - 1.1200.

Without covering too much of my next report which will be my currency outlook for 2024, my premise for the Euro is predicated on my view of the dollar and its strength over ‘24. With the Fed poised to cut in late 2024 and other DM central banks set to grow slower than the U.S and cut earlier than the US, an environment where the dollar weakens is less probable.

Instead, I believe we’ll see a slight weakness in the dollar as rates become less of an incentive moving forward for both investors and market yields.

I’ll be doing a report next week solely focused on my FX outlook for the upcoming year so be sure to watch out for that.

I appreciate you getting to the end, let me know your thoughts!