#2 Week In Focus: FX Outlook

the pain trade in FX: long USD

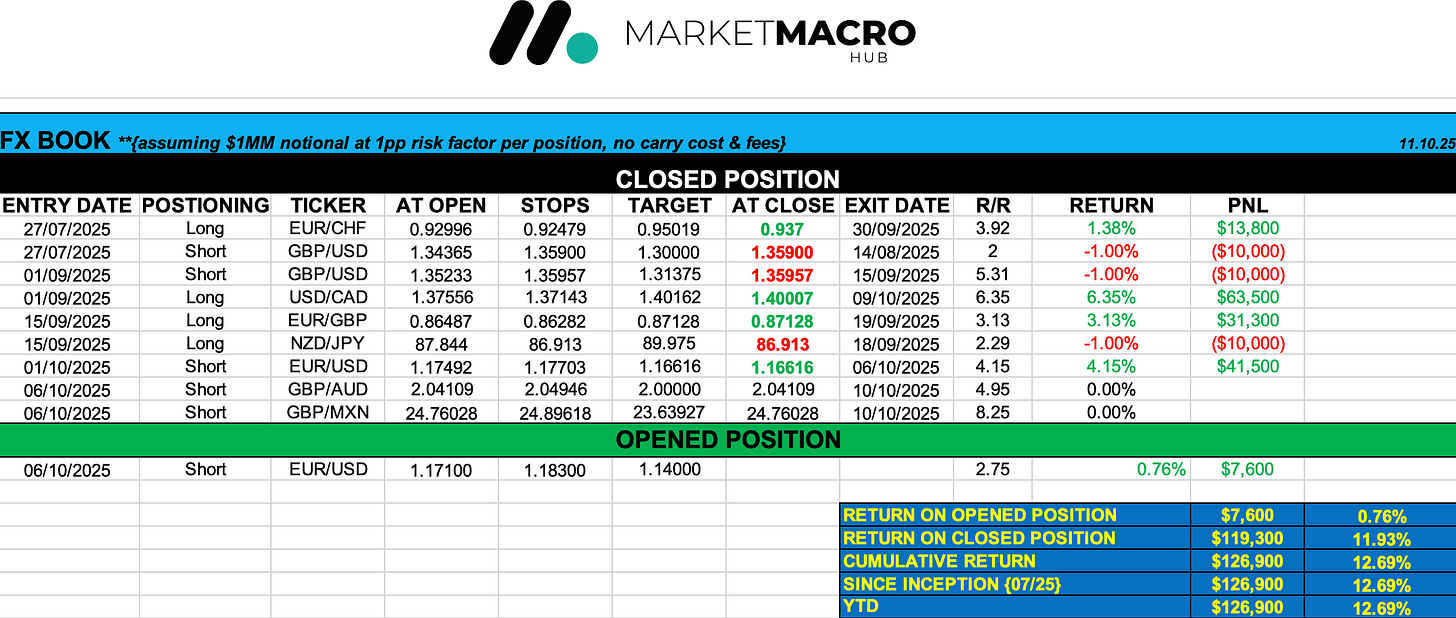

FX Portfolio

Market movers

Markets kicked off last week digesting the outcome of Japan’s LDP leadership election, which saw Sanae Takaichi emerge as the winner and de facto next prime minister.

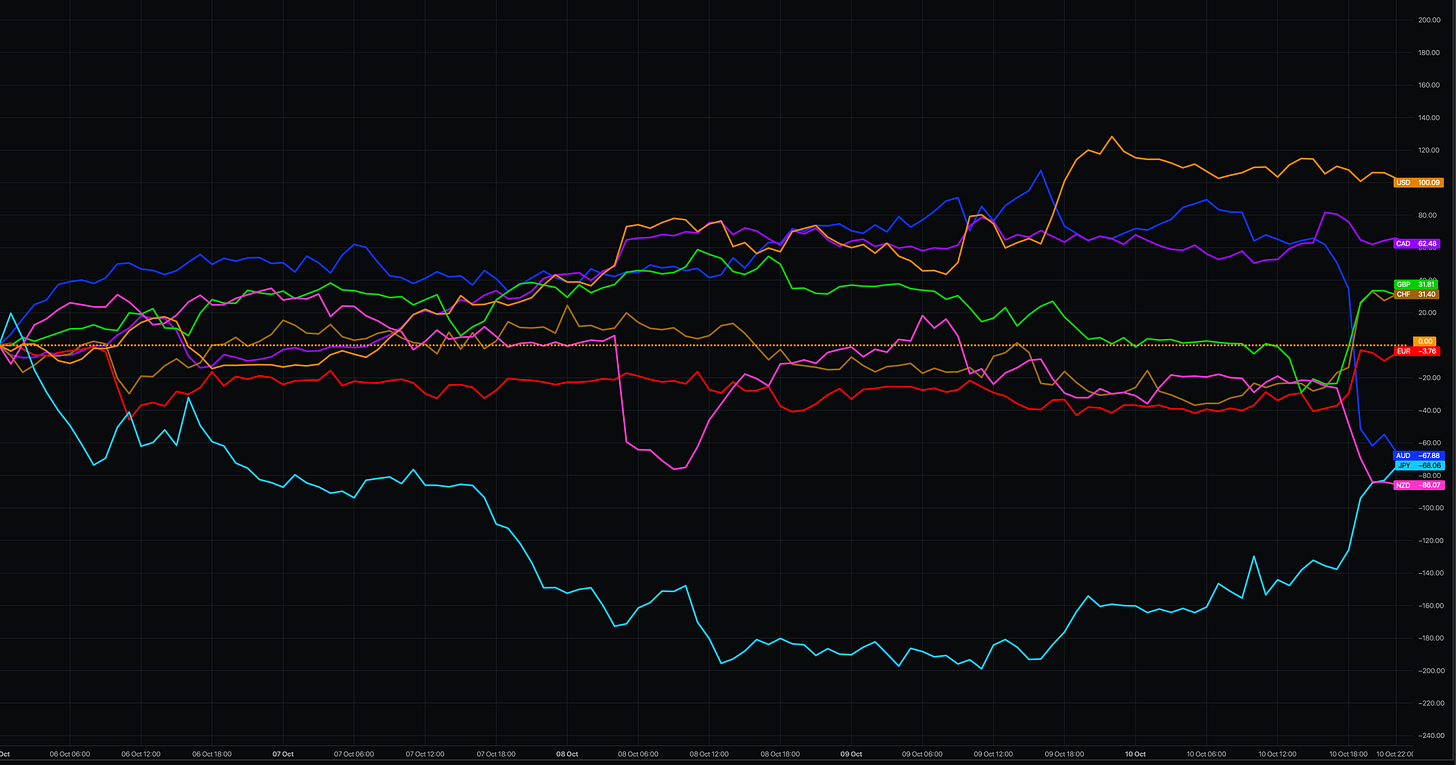

This unleashed sharp moves in the yen, bringing back the carry trade as investors priced in potential delays to the BoJ’s normalisation path. The yen ended the week as the worst-performing currency across both G10 and EM, while the U.S. dollar posted its strongest weekly gain since the start of the year.

Elsewhere, idiosyncratic risk dominated, leaving most currencies to trade defensively against a stronger greenback.

In central bank governance, there was a rare divergence in monetary policies shaping both Antipodes (AUD & NZD). Governor Bullock of the RBA is taking a more cautious stance, holding rates steady and signalling that inflation, while easing, remains too sticky. In contrast, the RBNZ delivered a surprise 50bps cut, prioritising the weakening growth outlook over stubborn inflation still hovering at the upper band of its 1–3% range. Across the continent, the messaging from these bankers has followed the same script, a familiar policy trade-off where even modest deterioration in growth is enough to trigger easing, irrespective of inflation trends.

In Canada, data has taken a turn for the positive. Job gains surged for the first time in months, and unemployment rate beat estimates. The meeting between PM Carney and Trump, however, failed to offer much optimism, so the question remains whether this is enough to warrant a pause on the cutting cycle for the BoC.

OIS markets stake a 40% chance of a 25bps cut at the end of the month BoC meeting.

Across Europe, a flurry of ECB speakers offered a cautiously optimistic tone on the outlook, yet the rhetoric was quickly undermined by fresh manufacturing data, the weakest reading since January. In politics, France, which appointed yet another prime minister after the very short-lived Lecornu tenure, now faces the next hurdle—presenting a budget to parliament aimed at reducing the fiscal deficit in accordance with the bloc.

The UK calendar was light, leaving sterling to drift with broader risk sentiment.

Lastly, Friday starred the main event as Trump proposed a 100% additional tariff package set to take effect from November 1st, targeting China on his claims of rogue restriction of their rare earth metals.

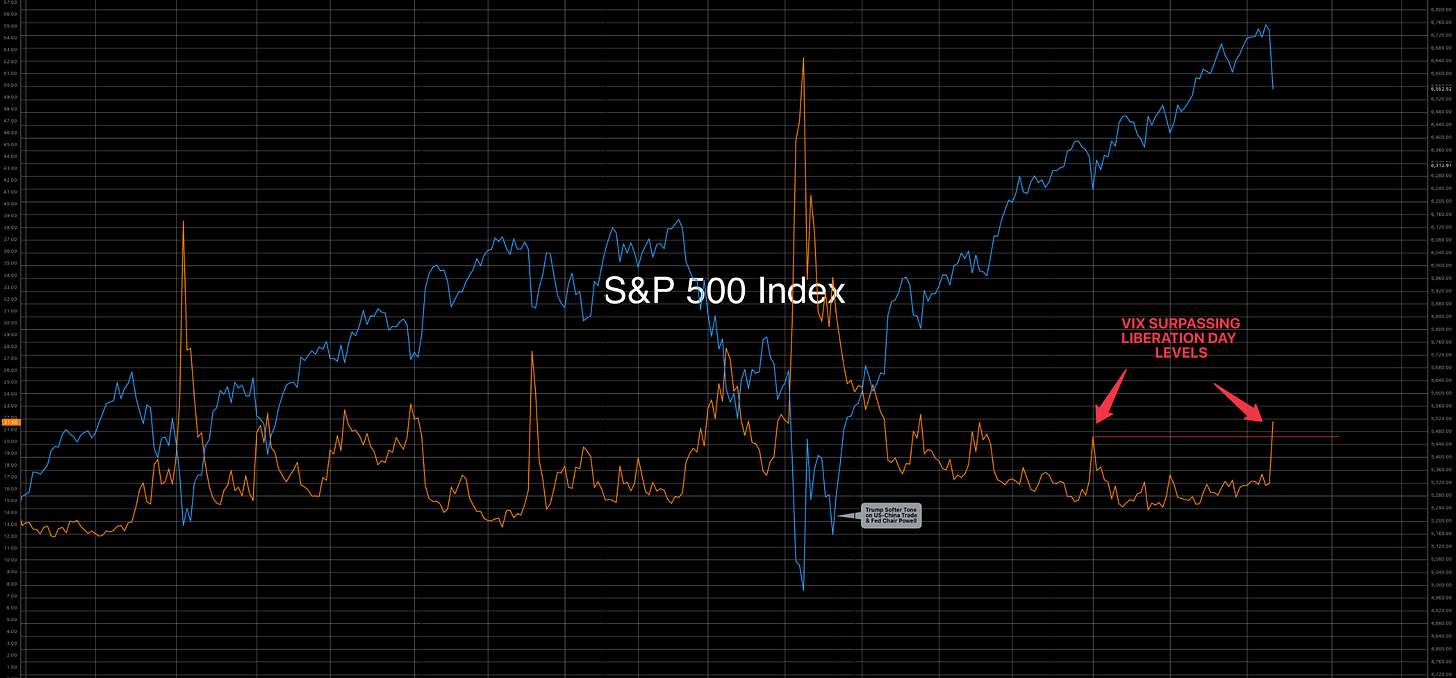

Equities fell, coinciding with the surge in VIX, and bonds caught a bid. The dollar surrendered some of its earlier gains to safe havens and alternatives alike, while higher-beta currencies like AUD and NZD underperformed sharply.

Rate markets are now pricing c.118bps of cumulative easing by the end of 2026, up about 5bps on the week, overshadowing the optimistic tone from the UoM sentiment survey.

Macro watch

The U.S. remains in a limbo with no news on its government reopening while trump once again resumes flaunting his tariff wand over his adversaries. With the chinese back agin in the spot light we recommend revisiting our recent piece offering a tailored deep dive into their economy

with little time to digest the tariff news market for this week will be watching closely for signs of development between both relations where renewed restrictions could ripple through gloabl supply chain.

Away from the political cascade, the Fed’s Beige Book this week will offer an updated read on the regional growth profile and labour dynamics. This was, among others, a key input in JP’s assessment of the economy, squaring his rationale to make a pivot at Wyoming.

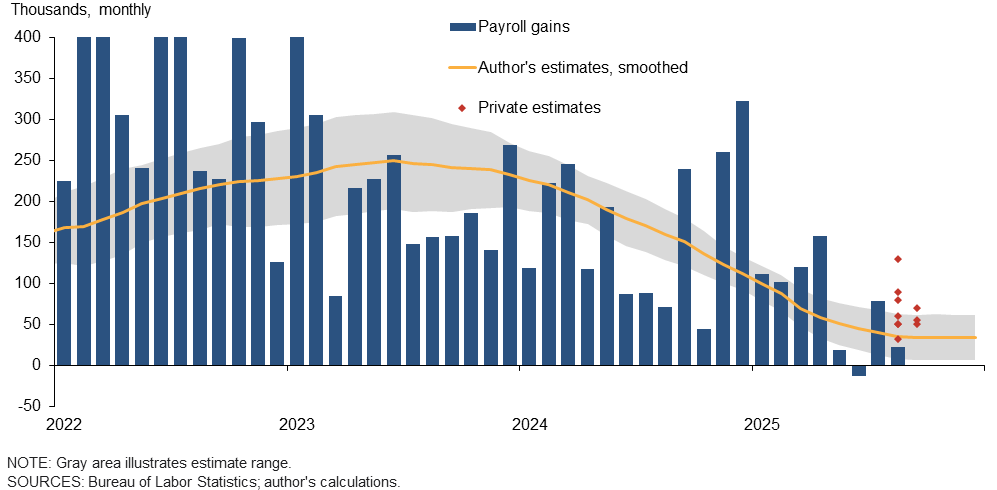

The lack of payroll data for the past month adds a layer of uncertainty to market expectations, but as we’ve discussed before, the weaker figures are not a signal of imminent recession. Rather, they reflect an economy adjusting to the complex policy mix that has defined this year.

The Dallas Fed’s latest breakeven report supports that interpretation. In our view, the U.S. economy has now largely moved through its structural correction phase from the policy mix and is now positioned for a more cyclical acceleration, or at the very least, a repricing of excessive recession fears. With the UR still near historic lows, the data continue to point to stability rather than strain.

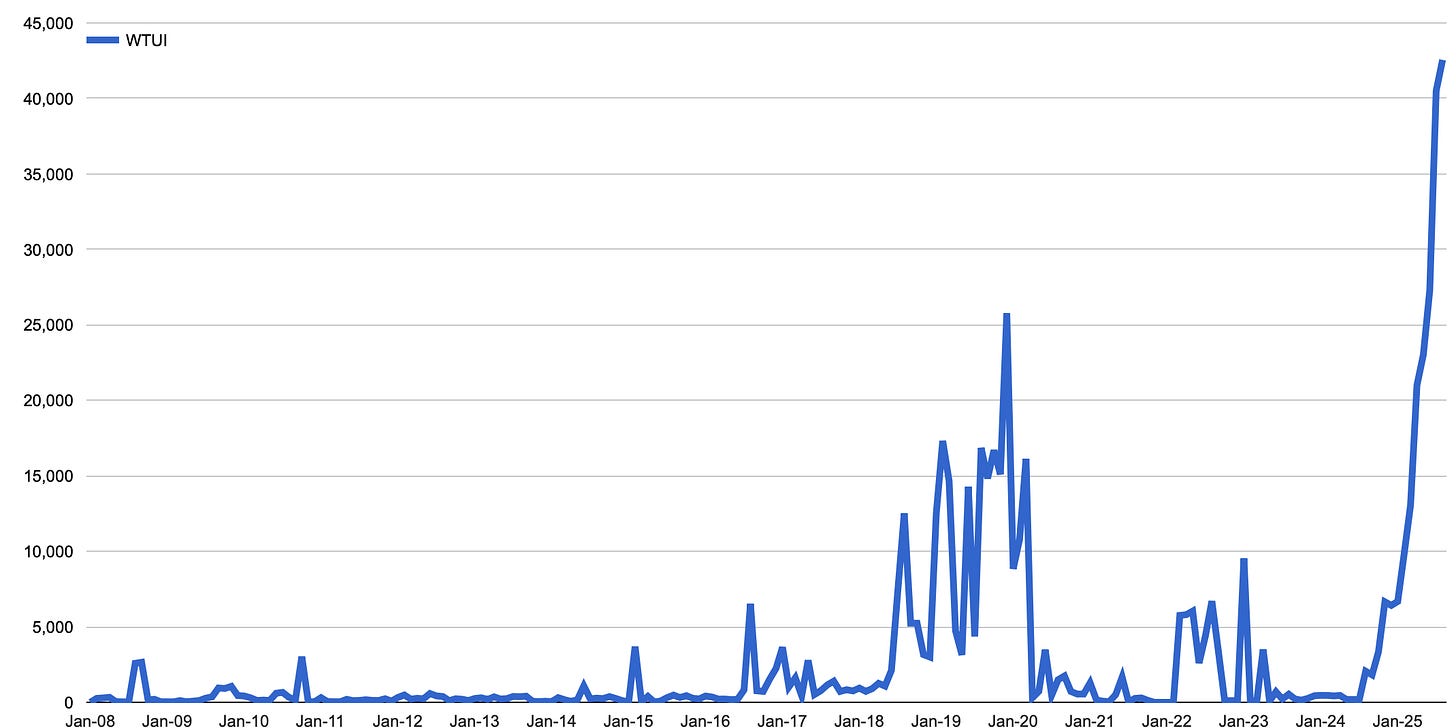

The crème de la crème of it all is the star trade of the year—gold—which still has structurally embedded risk to the upside. The world trade uncertainty index has surged to a record high, for more context, double the levels seen during the pandemic. That backdrop has fuelled the gold rally, which we think still has room to run.

In our opinion as the rally reflects deepening policy fragmentation and geopolitical uncertainty, a quest for seeking other alternatives and safe haven then by proxy extensuion the Swiss Franc should continue to benefit as a portfolio hedge muting the ‘carry‘ flavour from its haven appeal and residual inflows from underperforming carry trades.

FX Outlook & Trade Recommendations

EUR: Winter Is Coming

What? Too soon?…

Across the street, we could almost count on one hand how many sell-side research desks entered Q4 with a near-term bullish dollar view

We’ll say this though, the move over the past week has not been due to any meaningful dollar positives domestically, but rather largely sponsored by risk across the euro bloc. Dismal growth metrics and ongoing political strain in France have only deepened investor caution.

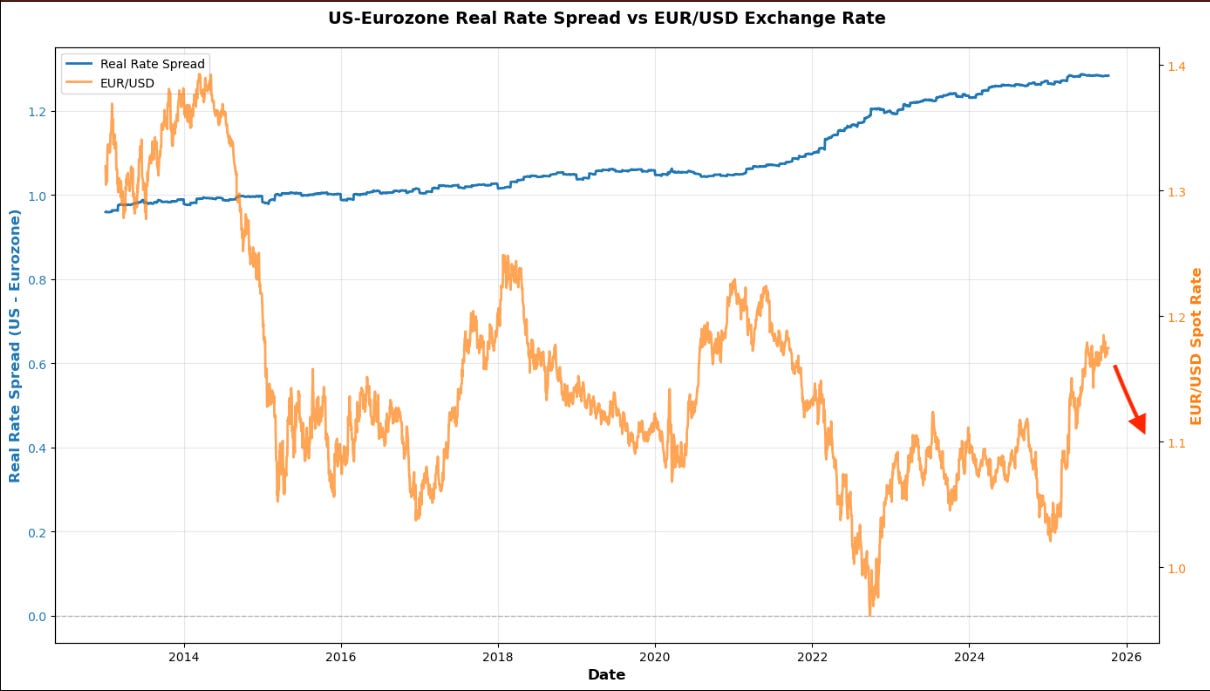

For once, it feels good for the dollar to be on the receiving end of offsetting risk, considering the string of events unfolded this year. Ironically, the wait-and-see mode for data in the U.S. has shifted the lens toward Europe, amplifying our bearish view on the EUR.

Away from politics, the macro backdrop still doesn’t cut the euro any slack. Industrial production saw its largest decline since ‘22, with the same fate suffered in Italy, where production contracted by 2.4% for the month.

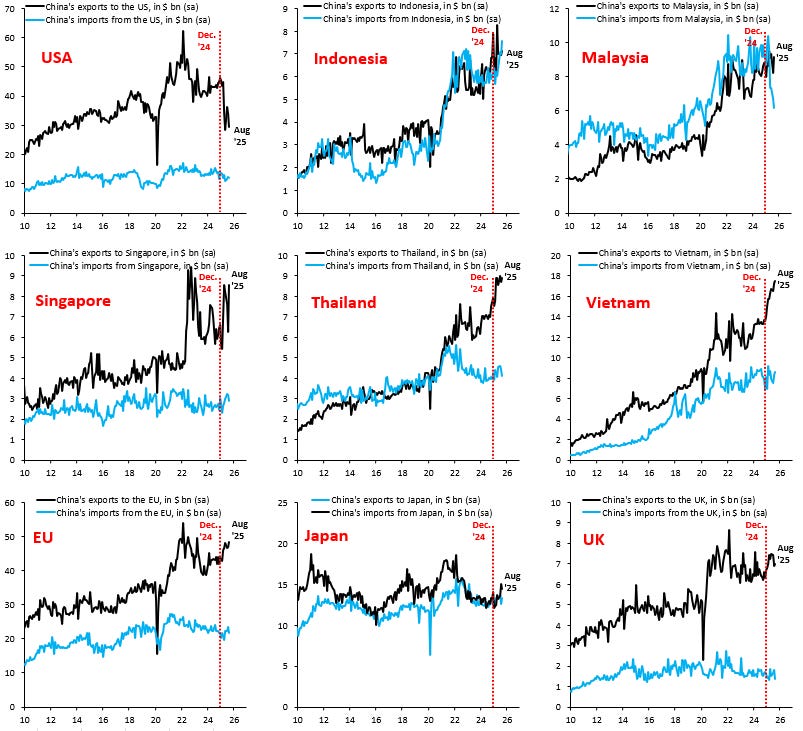

We think moving forward, a stark distinction here on out is the new risk factor with fiscal stimulus in Europe still elusive and tariffs on China exports to the U.S. running the risk of hitting triple digits (150%)—the same privilege offered to its currency since the start of the year on tariff policies seeking capital flight is now over.

The spillover of tariffs placed by the U.S. on China is by de facto inflationary for the U.S. and deflationary for the RoW. That mix of weak industrial complex and external drag should, at the very least, open the door to more conversations on policy easing from the ECB.

Markets are currently sat at <2.0% implied pr (cut) at the next ECB meeting scheduled for month end, we’ll take the over considering the sharp policy divergence between the Fed & ECB any pivot should offer meaningful fuel for the pair to trade lower.

Positioning data show that bearish dollar bets among both RM & HF (real money and hedge funds) have eased but remain elevated. The pain trade, for now, still points to a stronger dollar.

We maintain our near-term call for EURUSD to trade toward the 1.14 handle.

JPY: Takaichi Same Path Different Travel

It was a week of mixed fortunes for the yen. Politics initially pushed USDJPY above the 150 level, but the rally gave up some gains as safe-haven demand took centre stage. The fallout between the LDP and its long-time coalition partner, New Komeito, unsettled sentiment briefly, though we do not believe it will derail Takaichi’s prospects in the upcoming election later this month.

Political desks, including HSBC, outline several potential outcomes, viewing the first two as the most likely paths forward:

The LDP concedes to New Komeito’s demands on party funding reforms, reviving the coalition and bringing the DPP in to secure a working majority.

The LDP governs as a minority with informal backing from New Komeito and smaller parties.

The LDP forms a new coalition with Ishin and the DPP to achieve a majority.

The CDPJ unites opposition parties behind its own prime ministerial candidate and governs through broad informal agreements.

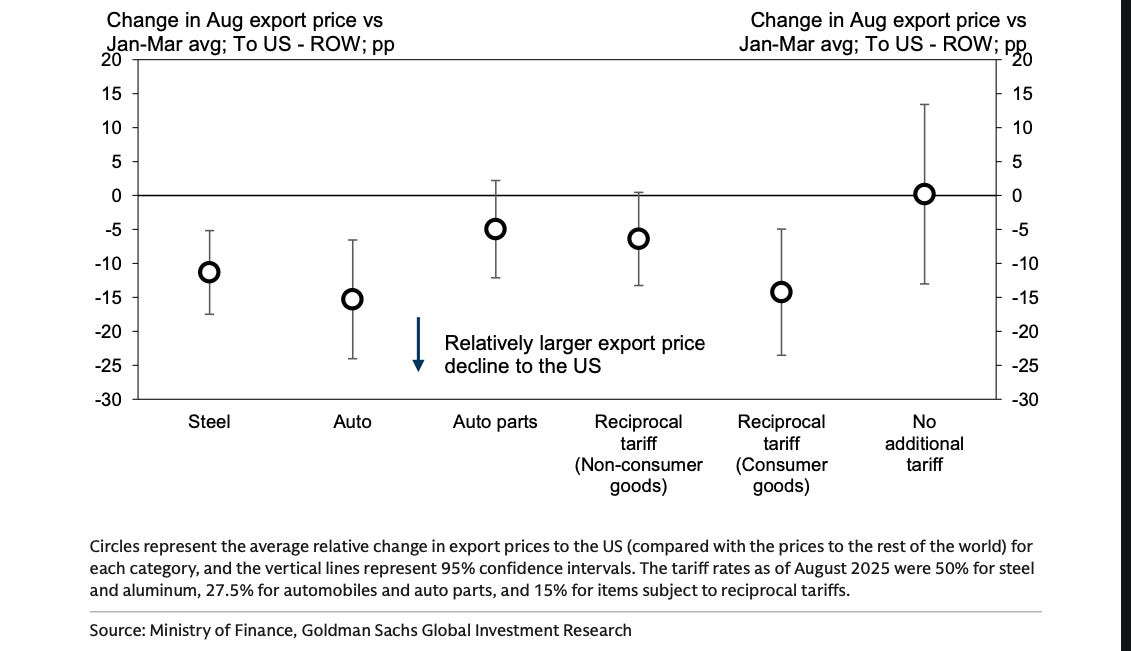

With U.S. tariffs back in play, it is worth revisiting Japan’s export dynamics. The traditional transmission channel is usually straightforward: tariff costs move through the chain from exporters to importers and, ultimately, to end users. Yet for Japan’s major automakers, this pass-through has broken down. Firms have been absorbing tariff costs to protect U.S. market share, compressing margins and weakening corporate balance sheets

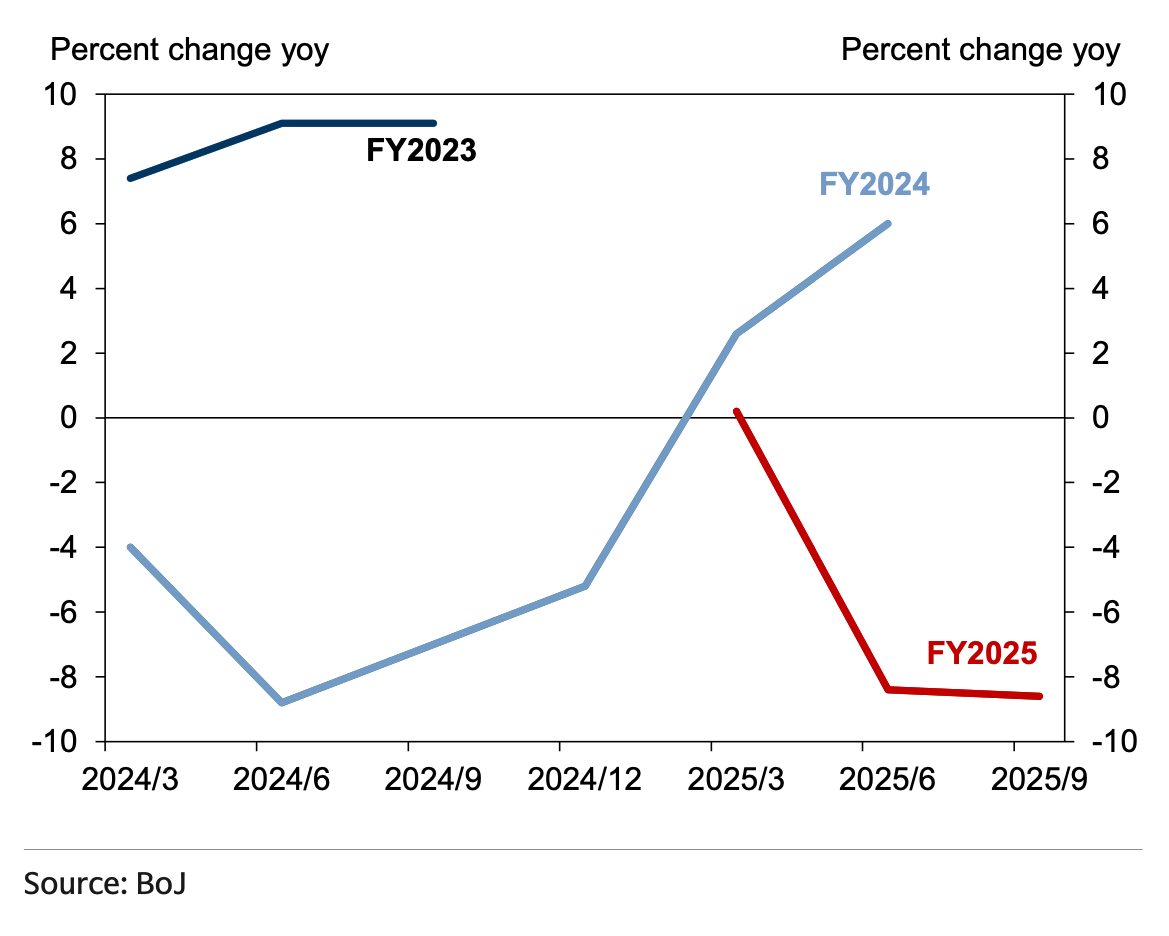

This pressure is already evident in the BoJ’s latest Tankan survey, where large manufacturers reported a deterioration in profit expectations and declining sentiment across export-heavy sectors.

We think the margin squeeze lands precisely where the BoJ least wants it which are the wage negotiations, one of the drriving force at the start of year with projections encouraging the BoJ to stay on course before being derail from external tariff shock of april liberation day.

The math goes like this: when exporters’ profits fall, wage-setting capacity weakens. Large manufacturers typically anchor shuntō negotiations, and their profit margins determine how much room they have to raise pay. A c.1% drop in operating margins across major exporters translates to roughly a ¥1.5 trillion reduction in corporate cash flow, enough to shave c.0.2–0.3% off potential annual wage growth. If that happens, wage momentum now running near 5% could slip closer to 3%, slowing the income-driven inflation cycle the BOJ needs to entrench. In short, slimmer profits mean smaller pay hikes, softer consumption, and a harder path to durable 2% inflation.

The next autumn Diet meeting is expected to have a longer discusion on the budget which should lean on fiscal expansion to support domestic demand such as gasoline tax cut, direct cash handout to household and wage targetting. The government’s approach aligns with the coordination framework outlined under Article 4 of the BOJ Act, which calls for communication and cooperation between fiscal and monetary authorities.

In layman’s terms, this means the government will drive fiscal stimulus while the BOJ keeps policy anchored, fiscal activism paired with monetary patience, if you will

In our opinion if Japan is to hold its path toward eventual normalization, it must first secure wage-led inflation. On this backdrop we expect the BoJ to maintains its stance towards hiking as cautious on the back of slowing inflation and global uncertainity, prioritizing stability over premature tightening

GBP: Wait and See mode

What a way to end the week (writer narrates scaracstically).

The absence of domestic data here in the UK has subjected the pound to broader global risk, overshadowing its quiet domestic calendar.

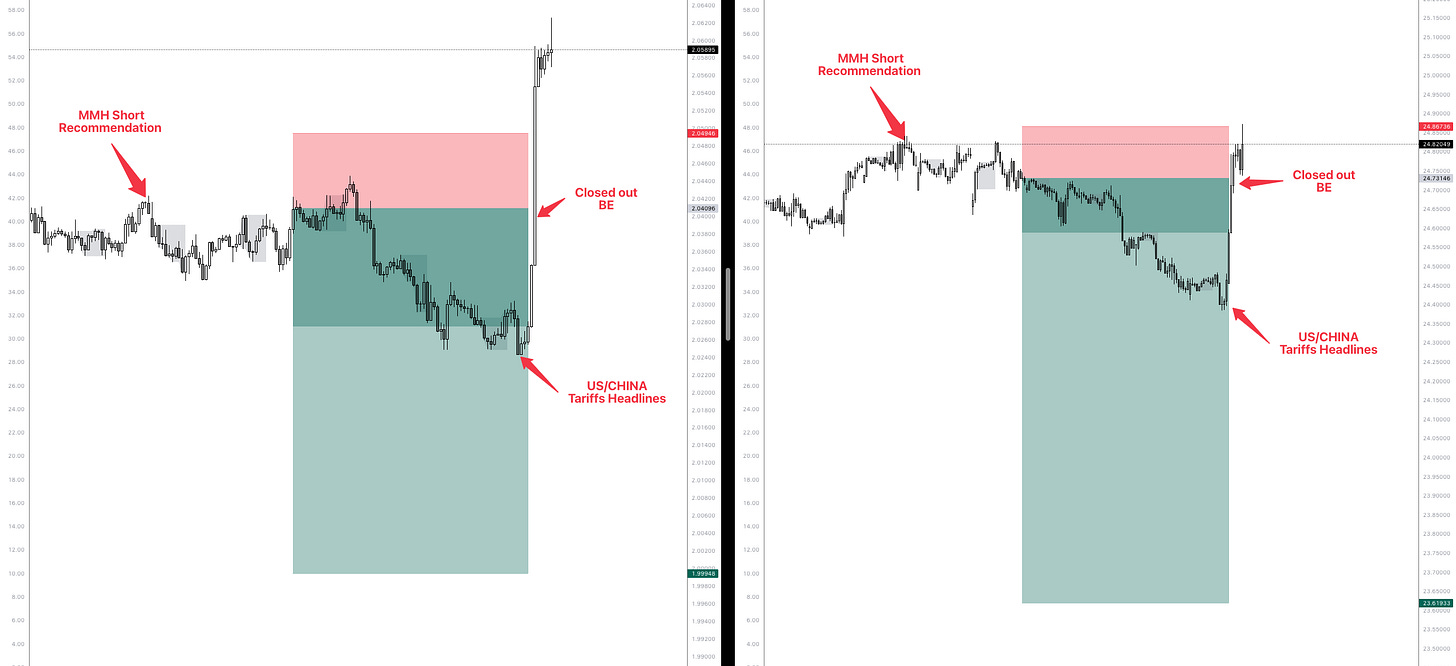

Our GBP expression against the AUD and MXN performed in line with expectations following 4 days of gains wiped off via the tariff announcement, which shifted sentiment and forced us to manage risk by closing the position at entry.

The direction of travel for the Aussie will largely hinge on developments in the U.S.–China tariff situation. Before Friday’s announcement, the market was buoyed by fiscal exuberance and supported by pro-cyclical beta flows, with investors leaning into growth exposure amid a broadly global easing cycle. The tariff shock threatens that optimism. Any escalation that dampens China’s export or domestic momentum would likely weigh on Aussie terms of trade, tempering AUD gains and re-anchoring the currency to global risk sentiment rather than domestic resilience

While our broader view on GBP/MXN remains intact, the nature of carry trades means that when momentum becomes crowded and positioning is heavy, any unwind tends to be sharp and unforgiving. we will monitor currrent PA for possible re-entry

With merely <2bps priced for the next novermber BoE meeting this week labour market report along side GDP figures could turn out to be a live event in shaping the BoE’s near-term policy path. Private payrolls has been wobbly enough to kick off the easing cycle yet when paired together with the inflation mix, not bad enough to justify another cut as early as Novermber

Our view remains that short-term volatility around tariff news does not alter the underlying macro path for the UK. The next key risk events heading into autumn budget will determine whether the BoE can maintain its cautious stance heading into year-end.

Trade Recommendation:

Long AUDJPY || BUY LIMIT 97.844 || SL 95.765 || TP 102.404

Short GBPUSD || SELL LIMIT 1.33725 || SL 1.35358 || TP 1.3

Short EURCHF || SELL LIMIT 0.93032 || SL 0.93403 || TP 0.92180

MMH!

Keep up the good work Emmanuel 🤝

Appreciate the kind words Nyric, thanks for the support!