$11.7 Trillion Ticking Time Bomb...

BOJ Interest rate decision shook FX markets early this morning followed by U.S PCE figures, reviewing the elevating risks across macro

Hey crew,

I’m sitting in my room. Bought a new desk chair which has probably been my best purchase yet. Simple things, the beauty of life I guess.

A very interesting week in markets to say the least.

Home sales in the U.S, a few ECB speeches, AUD CPI, and today the BOJ interest rate decision which we’ll look at alongside the PCE figure from the U.S.

Without further adieu, lend me your attention:

The Time Bomb Within The BOJ’s Policy

For over a decade now we’ve watched the Bank of Japan stimulate markets, pin yields globally down and keep borrowing costs ultra-cheap amidst different market regimes and cycles.

Whether that be at the mercy of their currency or the mercy of their monetary policy.

It’s often said that betting against the BOJ, in this case betting on a hike in interest rates or an abandonment is a “widow maker” trade, which for the most part is true. Many hedge funds, PMs, and traders have fallen victim to this accurate statement, it’s simple, by the time the BOJ pivot, you’ll be all out of capital.

So does that mean we can’t bet on a move away from YCC or a hike in interest rates?

Not exactly, you see since 2016 the BOJ has adopted the policy of capping the yield of their 10-year JGBs at +/-50bps to help disinflationary pressures their economy has faced for decades.

The trade numerous hedge funds have taken has been shorting JGBs in hopes the yields would soar above the 0.5 peg put in place by the BOJ, but the BOJ has been resilient, and merciless, purchasing an unlimited amount of JGBs to protect the yield curve control policy putting many funds in the red, i.e turning these funds into widows.

The caveat?

Huge depreciation on the Yen.

This is the Yen’s movement overnight after the BOJ held rates negative and Ueda removed forward guidance regarding the BOJ’s policy. From previous reports you will all know interest rate spreads/differentials are key drivers behind currencies. ‘Hot money’ flows to destinations with the most attractive money market yields, and the Yen is bottom of that list making it an economy where investment flows outside of the four walls rather than inwards.

Here’s what I was reading today, a look into the BOJ’s outlook or economic activity and prices released today:

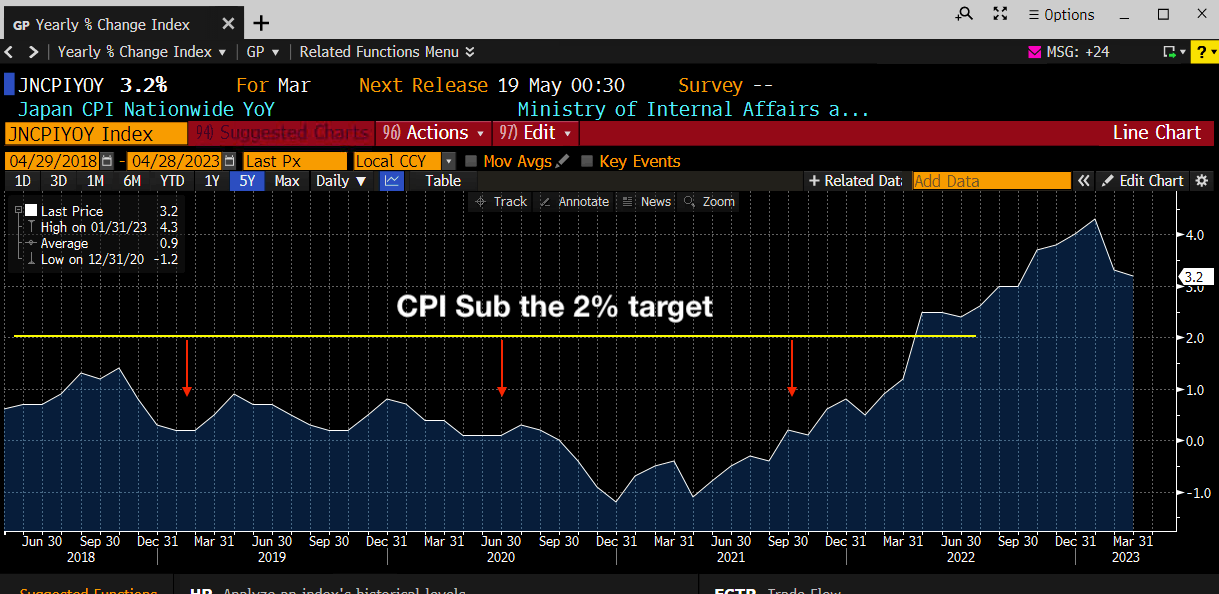

Inflation in Japan is and has always been a struggle to prop up, everything from an ageing working demographic, something that has severe effects on an economy, mainly because as the working demographic continues to grow older and eventually retires the working population shrinks. That leads to lower productivity within the economy, a lower output gap, and decreased consumer consumption which depletes the economy of inflationary pressures.

A bit gloomy?

Yup.

But, my view still stands, the BOJ’s policy is a ticking time bomb, with new leadership in the form of Gov Ueda, I’m constructive on the view that upon reviewal of the current BOJ policy, he will outline a roadmap to normality, first within the JGB market, as the yields have been manipulated to serve the purpose of lower borrowing costs.

Ideally for Japan to become an active country producing goods, seeing inflationary pressures, a lot will have to be done, and that’s a structural reform which can’t be done overnight, but monetary policy is the starting point for how the BOJ move forward and get a grip of their currency.

Over the period of 2022 a carry trade involving the dollar and the yen would have been a very wise position, of course, easier said looking backwards than acting in the immediate right?

There’s a lesson we can learn from this and one which can help you identify opportunities in today’s price. 2022 the Fed accelerated monetary policy tightening at the fastest pace ever seen, during this period the BOJ remained dovish. The spread in rates at the start of ‘22 was 0.35% between the Fed and BOJ. That spread now stands at 5.10%.

A carry trade is in the money when the currency you’re borrowing capital from (the Yen) to invest in the currency with a higher interest rate (the dollar) has a positive interest rate differential where the currency being borrowed yields a lower rate than the currency where your capital is invested in. Of course, a carry trade is usually over a long-term horizon of 6-12months+, so for those intraday and swing traders here a simple long position on USD/JPY would be a proxy position which backs your narrative of a weaker Yen and a stronger dollar. As always, this is just an exemplary trade, not investment advice, since the large majority of my audience is retail.

U.S PCE, Stick, Sticky & Stickier

For the second month running Core PCE rose by 0.3%, at this point, the only thing this is instilling is a further conviction for the Fed to go ahead and hike rates further than the upcoming May meeting.

YoY PCE rose to 4.6%!!

Now for starters, this goes to prove a very important detail when dealing with inflation. Once inflation enters the sticky parts within an economy as seen here in the labour/wage market it’s virtually impossible to shake it off as easily as supply chain bottlenecks.

If you’re wondering why on Earth equities are soaring higher, are we risk on after today’s PCE?

No, we’re not, the gains seen in equities are idiosyncratic, strong corporate earnings pulled equities into the green— side note if you’re wondering whether we’re in a total risk on/risk off market environment I’d recommend checking all high beta assets be that commodities, crypto, high beta currencies like the Aussie and the dollar as a benchmark to see whether it’s indeed risk on/off or whether it’s separate to only one asset class.

PCE is going to be a hard battle for the Fed. It’s said so often but not properly acknowledged that the Fed’s tools are extremely inaccurate and blunt having little to no effect on the part of the economy which needs to be attended to but rather affecting the whole playing field.

The Fed meet in 5 days, May 3rd. It’s clear to say the market is set on 25bps, I personally expect to see some softness in the dollar post the Fed hike as this has been priced in since early/mid-March post the SVB collapse and banking frenzy.

I’ve opened Substack chat for all members, I’m curious to hear your thoughts on markets and where you think we’re headed!

Join the free chat group below ;)

I’ll be with you guys next week.

I’ve got some time off. Well, that’s if I actually take time to rest…

Stay vigilant in the markets and thanks for being part of the MMH crew ;)

For MMH Pro guys, I’ll be in touch on the discord channel this weekend for Sunday’s market recap!

Appreciate ya!

I reckon the dollar gon' break the floor soon.